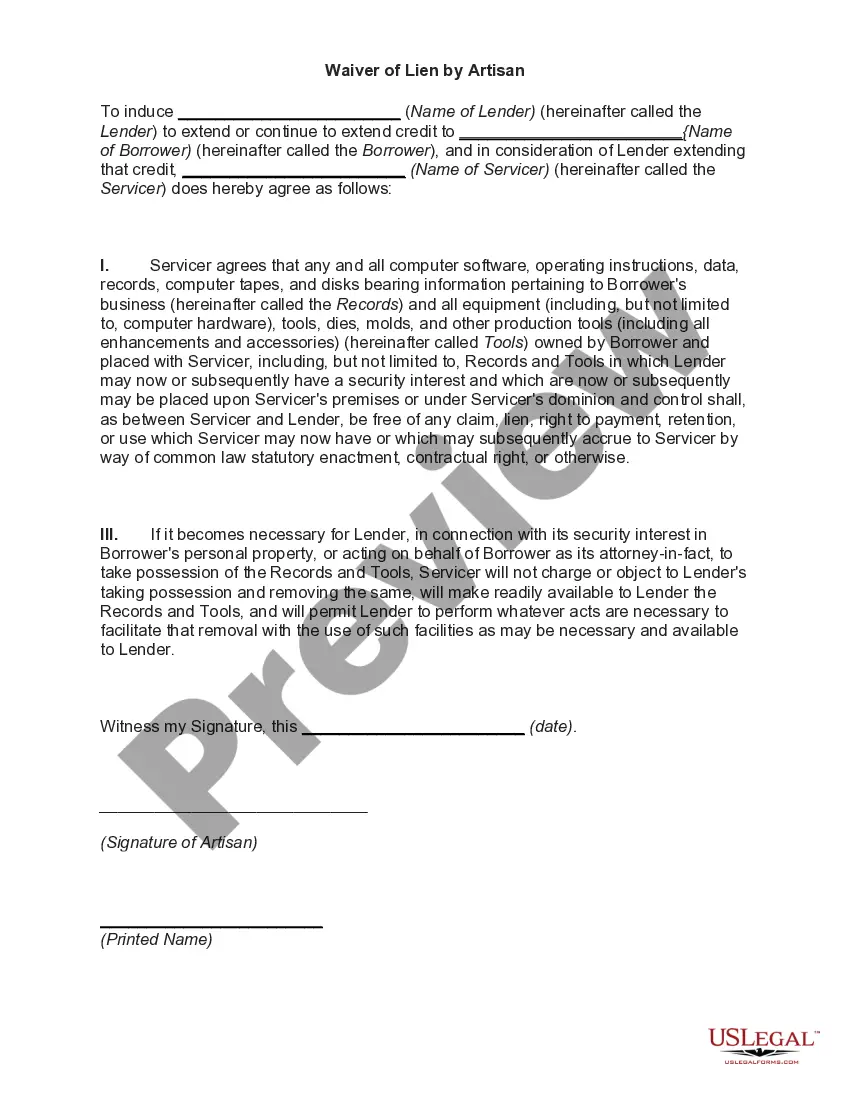

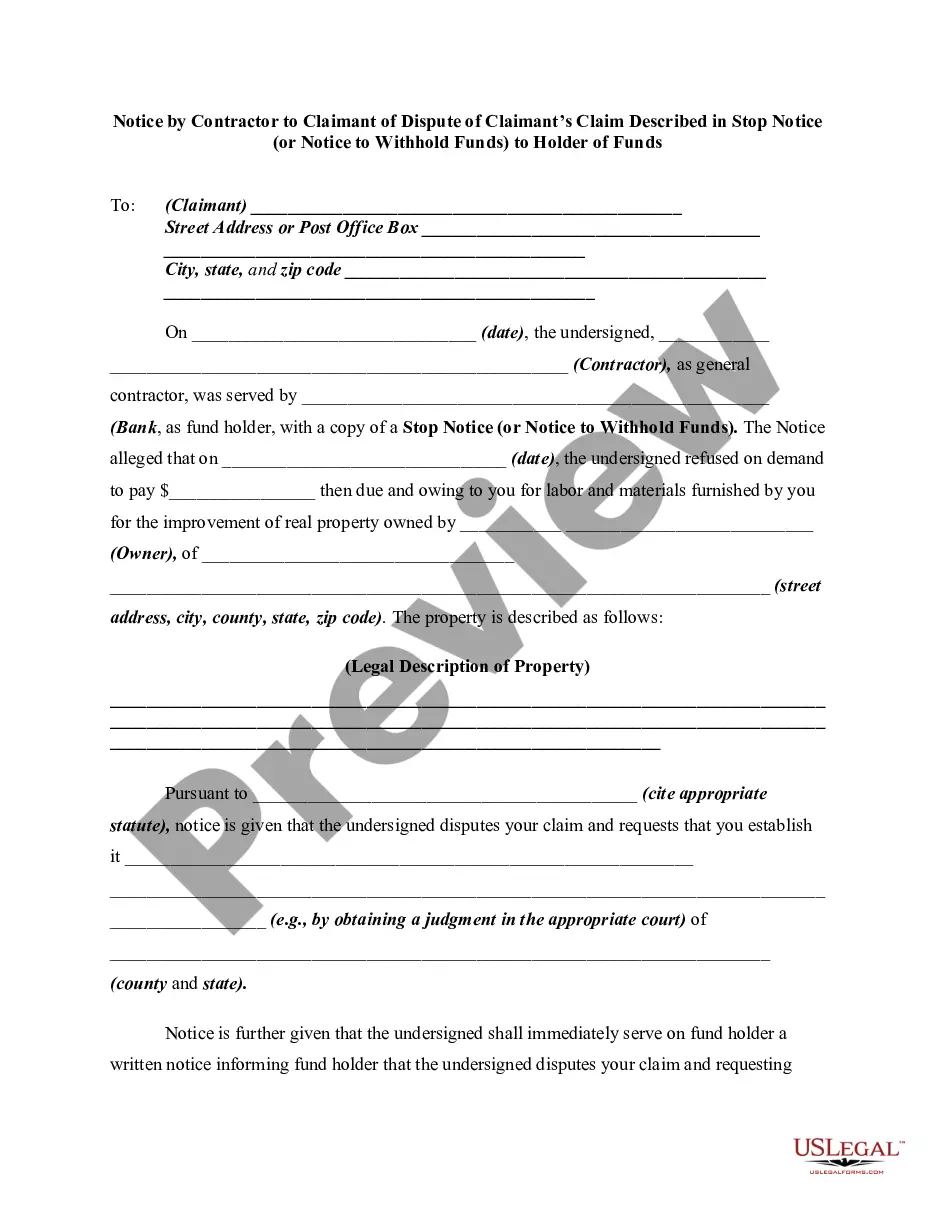

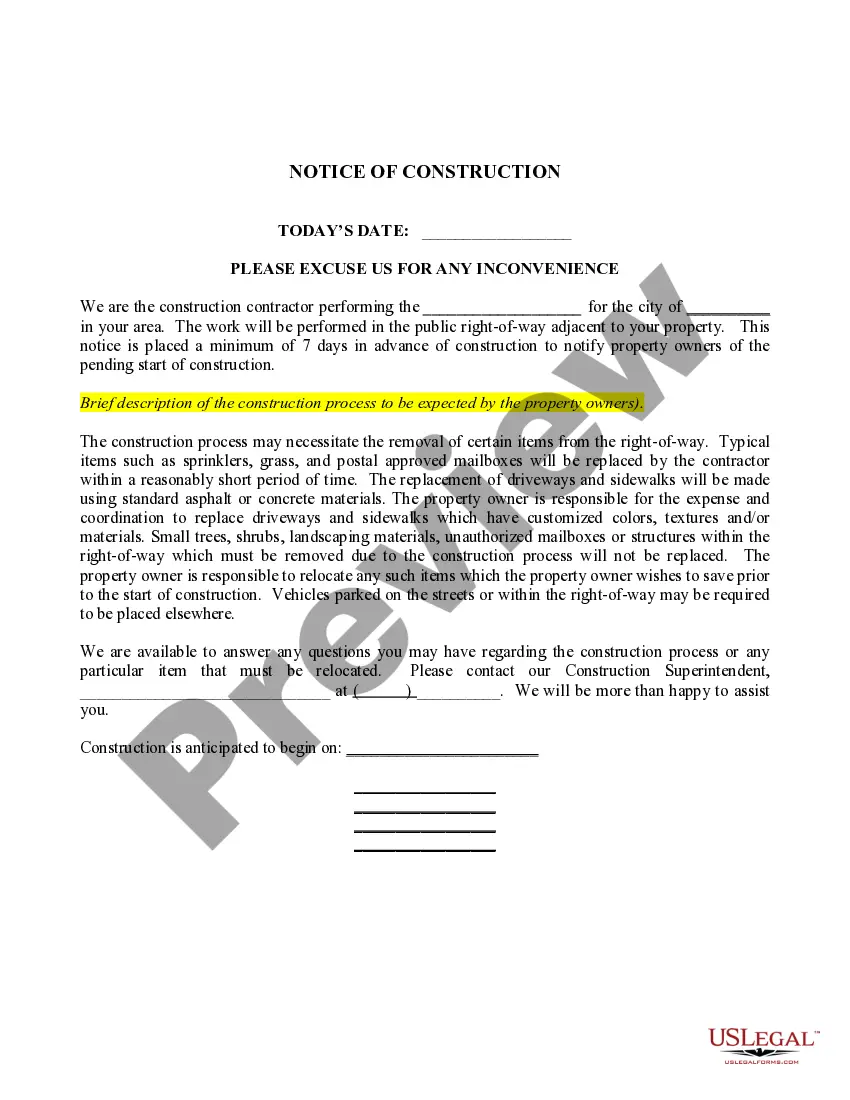

Kansas law provides a form with which a subcontractor may claim a lien for labor and/or materials provided to new residential property. This Notice of Intent to Provide is filed in the office of the clerk of the district court of the county where the property is located. After the lien claimant is paid in full, the lien claimant is required to also file a form releasing the previous Notice and waiving any lien.

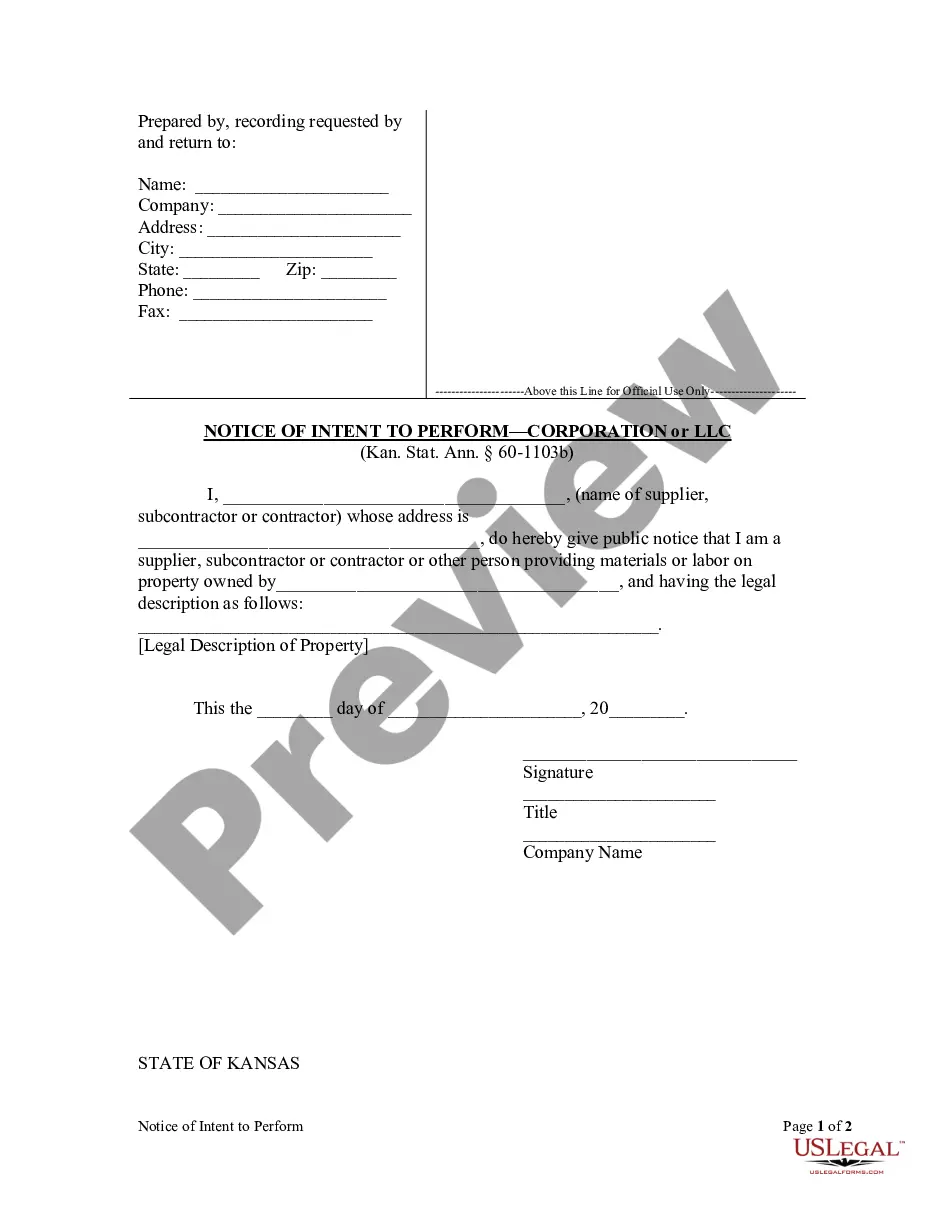

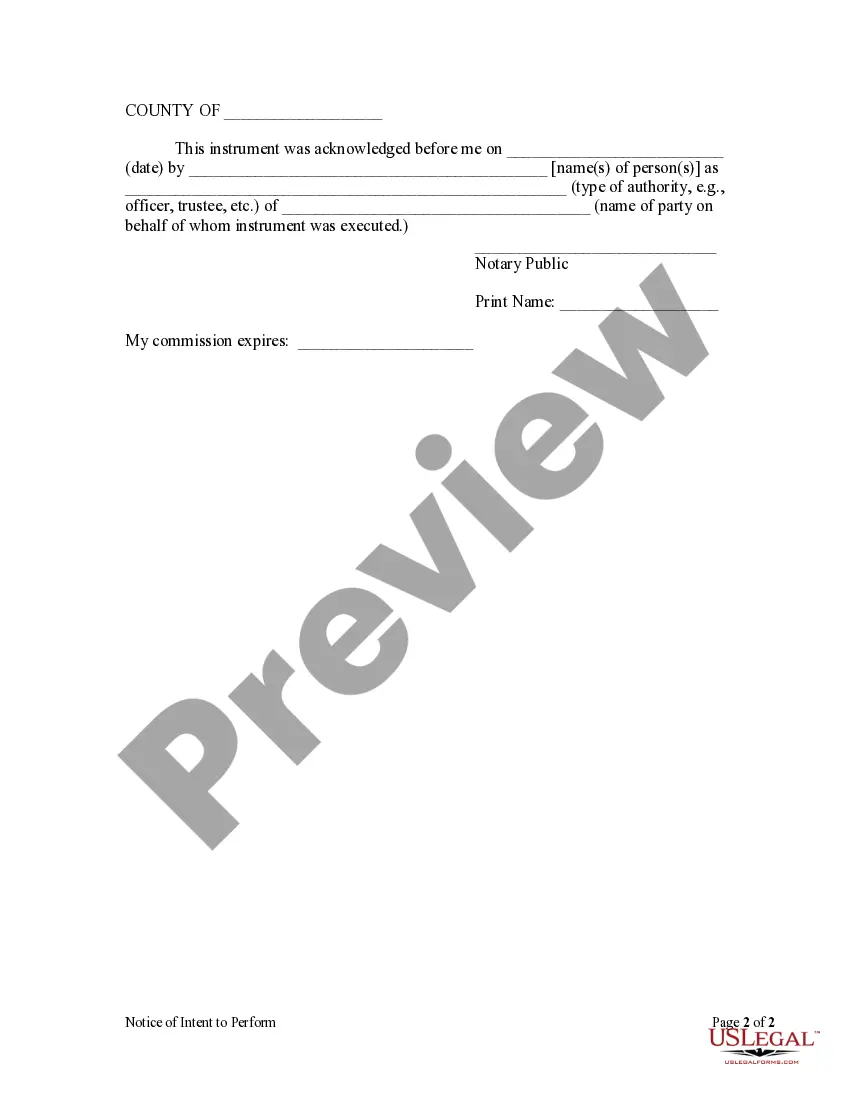

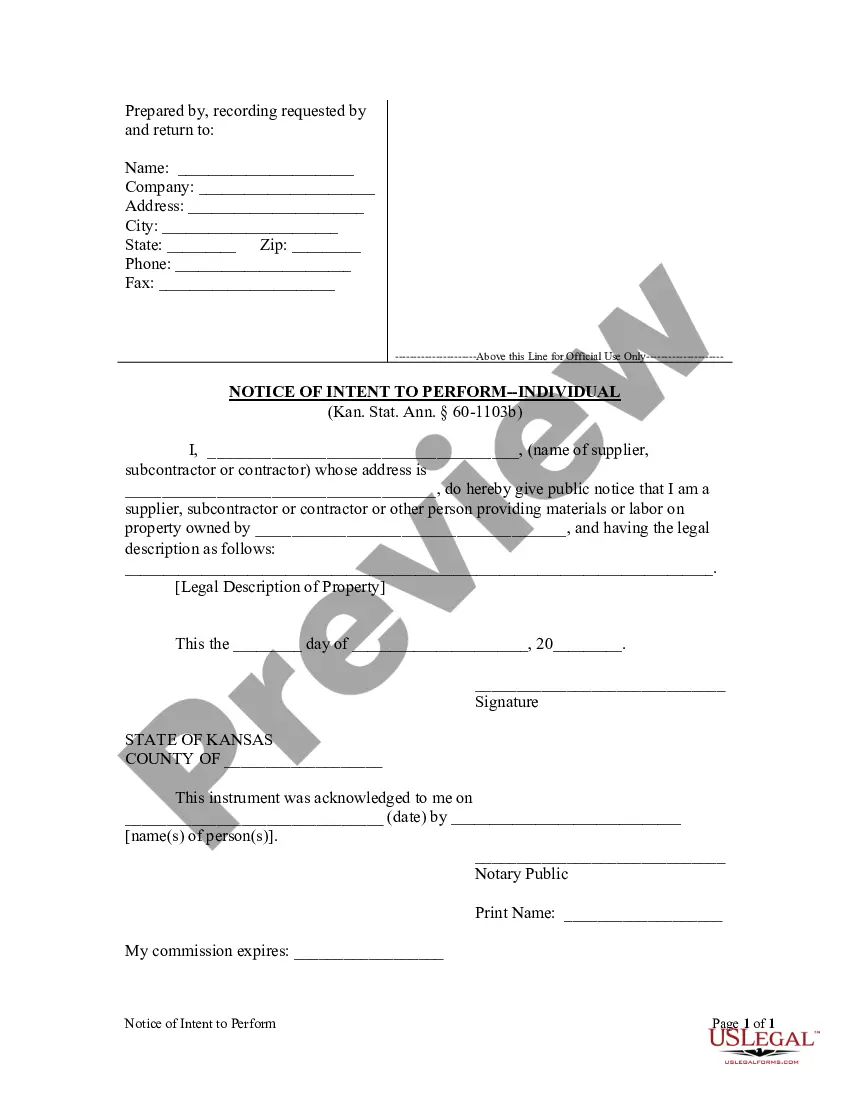

Wichita Kansas Notice of Intent to Perform by Corporation or LLC

Description

How to fill out Kansas Notice Of Intent To Perform By Corporation Or LLC?

Utilize the US Legal Forms and gain instant access to any form template you require.

Our helpful website with a vast collection of templates enables you to locate and acquire nearly any document sample you need.

You can download, complete, and authenticate the Wichita Kansas Notice of Intent to Perform by Corporation or LLC in just a few minutes instead of spending hours searching online for a suitable template.

Employing our repository is an excellent method to enhance the security of your form submissions. Our expert legal advisors routinely review all the documents to ensure that the forms are suitable for a specific state and adhere to current laws and regulations.

US Legal Forms is one of the largest and most dependable form repositories available online. We are always prepared to assist you with virtually any legal process, even if it is merely downloading the Wichita Kansas Notice of Intent to Perform by Corporation or LLC.

Feel free to take advantage of our platform and make your document experience as seamless as possible!

- How can you access the Wichita Kansas Notice of Intent to Perform by Corporation or LLC.

- If you possess a subscription, simply Log In to your account. The Download button will be visible on all the documents you review. Additionally, you can retrieve all previously saved files in the My documents section.

- If you haven’t created an account yet, follow the instructions below.

- Locate the template you need. Confirm that it is the template you were searching for: check its title and description, and make use of the Preview option if it is available. Otherwise, use the Search field to find the correct one.

- Initiate the saving process. Click Buy Now and select the pricing plan you prefer. Then, register for an account and pay for your order using a credit card or PayPal.

- Download the file. Choose the format to obtain the Wichita Kansas Notice of Intent to Perform by Corporation or LLC and modify and complete, or sign it as per your requirements.

Form popularity

FAQ

How much does it cost to form an LLC in Kansas? The Kansas Secretary of State charges $165 to file the Articles of Organization. You can reserve your LLC name with the Kansas Secretary of State for $30 when filing online or $35 when filing by mail.

The cost to form a Kansas corporation is $85 online or $90 by paper. A Kansas LLC costs $165 by paper or $160 online. Kansas corporations and LLCs must file the Kansas Annual Report every year after incorporation. The report is due the 15th day of the fourth month following your tax closing month.

All for-profit entities with a tax period other than a calendar year must file an annual report no later than the 15th day of the fourth month following the end of the entity's tax period. Not-for-profit entities with a calendar year tax period may file an annual report any time after the end of the tax period.

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.

Corporations which elect under subchapter S of the Internal Revenue Code not to be taxed as a corporation must file a Kansas Small Business Corporation return. S corporations are generally exempt from tax.

How do you form an S-corporation? To form a new S-corporation, you must first file Articles of Incorporation for an LLC or a C-corporation. Once the Articles of Incorporation are on file with the state in which the business operates, Form 2553 must be filed with the IRS in order to elect S-corporation tax status.

Here is a brief overview of the tax forms a typical S corporation needs to file with the IRS. Form 2553 ? S Corporation Election.Form 1120S ? S Corporation Tax Return.Schedule B ? Other Return Information.Schedule K ? Summary of Shareholder Information.Schedule K-1 ? Individual Shareholder Information.

Save time and money by filing your articles of incorporation online at . There, you can also stay up-to-date on your organization's status, annual report due date, and contact addresses.

You can form an S corp by filing Form 2553 with the Internal Revenue Service (IRS).

Save time and money by filing your articles of organization online at . There, you can also stay up-to-date on your organization's status, annual report due date, and contact addresses. The filing fee for this document is $165.