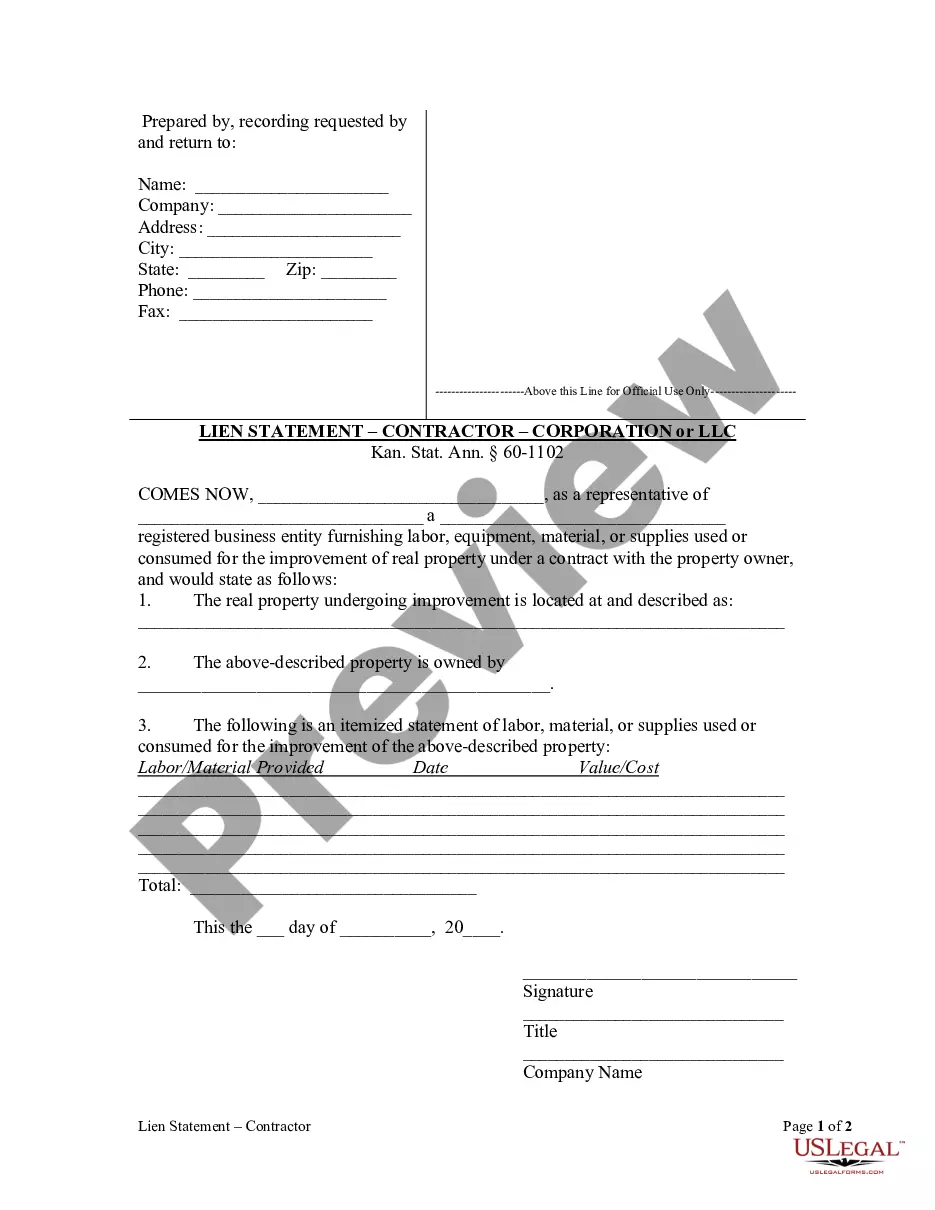

Kansas law makes a distinction between the lien statement to be filed by a contractor and a subcontractor. Both lien statements serve to inform the property owner that a lien is being claimed against his property for labor or materials provided. A contractor must file his lien statement within four months after the date the last labor was performed or material furnished.

Topeka Kansas Lien Statement by Contractor as Corporation or LLC

Description

How to fill out Kansas Lien Statement By Contractor As Corporation Or LLC?

We consistently endeavor to minimize or avert legal consequences when handling intricate legal or financial issues.

To achieve this, we seek legal solutions that are generally quite costly.

Nevertheless, not all legal situations are equally intricate; many can be managed independently.

US Legal Forms is an online repository of current DIY legal forms that encompass a range of documents, from wills and powers of attorney to articles of incorporation and petitions for dissolution.

If you happen to lose the form, you can effortlessly re-download it in the My documents section. The process remains equally simple for new users; you can set up your account in a matter of minutes. Ensure to verify that the Topeka Kansas Lien Statement by Contractor as Corporation or LLC adheres to the laws and regulations of your state and locality. Additionally, it's vital to review the form's outline (if available), and if you observe any inconsistencies with your initial requirements, look for an alternative template. Once you confirm that the Topeka Kansas Lien Statement by Contractor as Corporation or LLC is appropriate for you, you may select a subscription plan and continue to the payment process. Afterwards, you can download the form in any compatible format. Over the past 24 years, we've assisted millions by offering customizable and current legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Our collection empowers you to handle your affairs without the necessity of consulting a lawyer.

- We provide access to legal form templates that are not always made available to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Leverage US Legal Forms whenever you require to find and download the Topeka Kansas Lien Statement by Contractor as Corporation or LLC or any other form swiftly and securely.

Form popularity

FAQ

Yes, in certain circumstances, anyone can put a lien on your car, typically as a result of an unpaid debt or services rendered. If a creditor files a Topeka Kansas Lien Statement by Contractor as Corporation or LLC against your vehicle, it becomes a public record. This can limit your ability to sell or transfer ownership until the lien is resolved. Staying informed about your financial obligations can help you avoid unexpected liens.

In Kansas, you typically have six months to file a lien after the last work was performed or materials were supplied. For a Topeka Kansas Lien Statement by Contractor as Corporation or LLC, this timeframe is crucial to ensure your claim remains valid. If you miss this deadline, you may lose the right to pursue your lien. Staying organized and aware of your timeline can help you navigate this process smoothly.

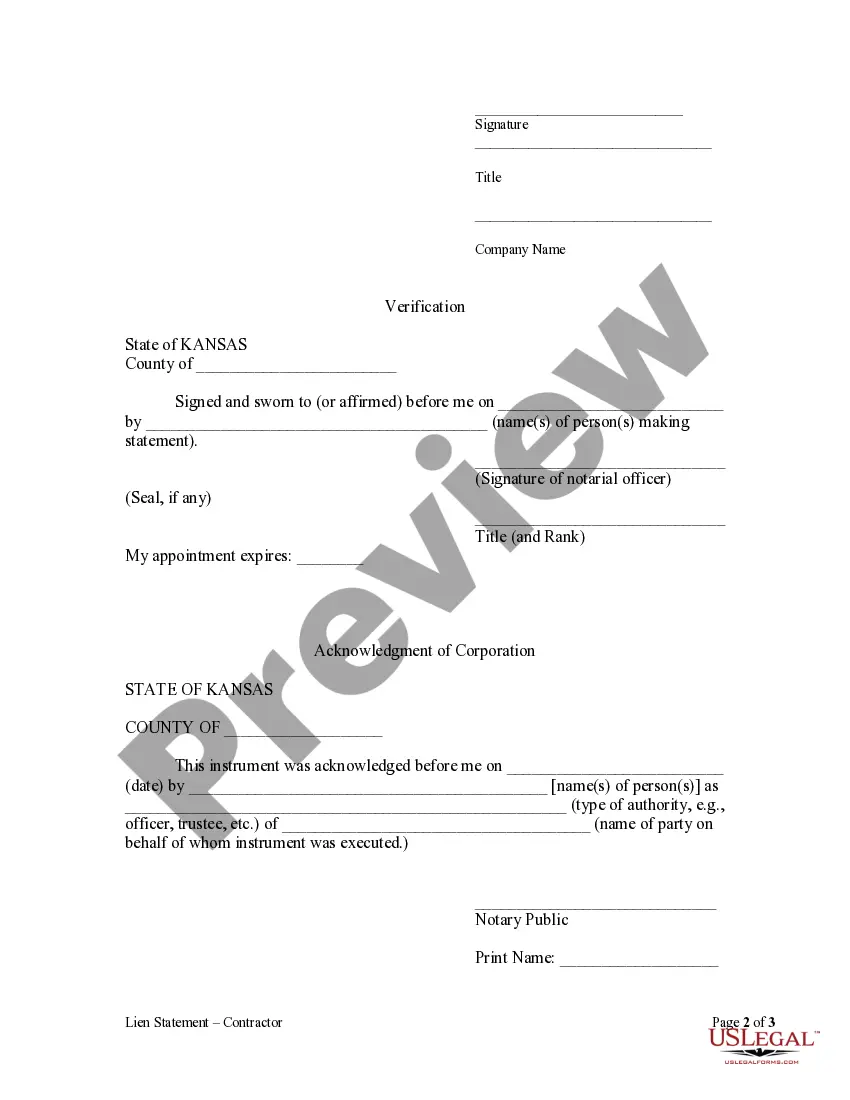

To put a lien on a property in Kansas, you must file a Topeka Kansas Lien Statement by Contractor as Corporation or LLC with the appropriate county office. First, ensure you have the proper documentation and details regarding the debt owed. After completing the lien statement form, submit it along with any necessary fees to the local register of deeds. This process legally protects your claim against the property.

Yes, contractors can place a lien on a business if they are owed payment for services rendered. It is important to file the proper documentation, including the Topeka Kansas Lien Statement by Contractor as Corporation or LLC, to ensure the claim is valid. This legal framework protects contractors in their business transactions.

A lien is a legal claim against a property for debt payment, while a mechanic's lien specifically pertains to construction-related debts. Mechanic's liens arise from unpaid work for improvements or repairs. Understanding the distinction can help when filing your Topeka Kansas Lien Statement by Contractor as Corporation or LLC.

Typically, contractors, suppliers, and others involved in providing goods or services can place a lien on a business for unpaid debts. It is crucial that the party filing the lien files the correct documentation, like the Topeka Kansas Lien Statement by Contractor as Corporation or LLC. This step makes their claim legally recognized.

In Kansas, a contractor can file a lien without a formal contract if they can demonstrate that services were provided. However, proving the agreement through other forms of communication or documentation is essential. Using the Topeka Kansas Lien Statement by Contractor as Corporation or LLC effectively documents the claim.

Placing a lien on a corporation involves filing a Topeka Kansas Lien Statement by Contractor as Corporation or LLC that includes specific information about the debt and the corporation. You will also need to ensure that the necessary legal requirements are met, which can differ from personal liens. Consulting with a legal expert may also help streamline the process.

To file a lien in Kansas, you need to prepare a Topeka Kansas Lien Statement by Contractor as Corporation or LLC. This document must outline the details of the debt, including the nature of the work and the amount owed. After completing the statement, it should be filed in the appropriate county office to make it legally binding.

In order to file a lien, certain conditions must be met. The claimant must provide proof of the debt owed and demonstrate that the work was completed satisfactorily. Additionally, the lien must be filed within a specific timeframe established by Kansas law. Lastly, filing the Topeka Kansas Lien Statement by Contractor as Corporation or LLC correctly ensures compliance.