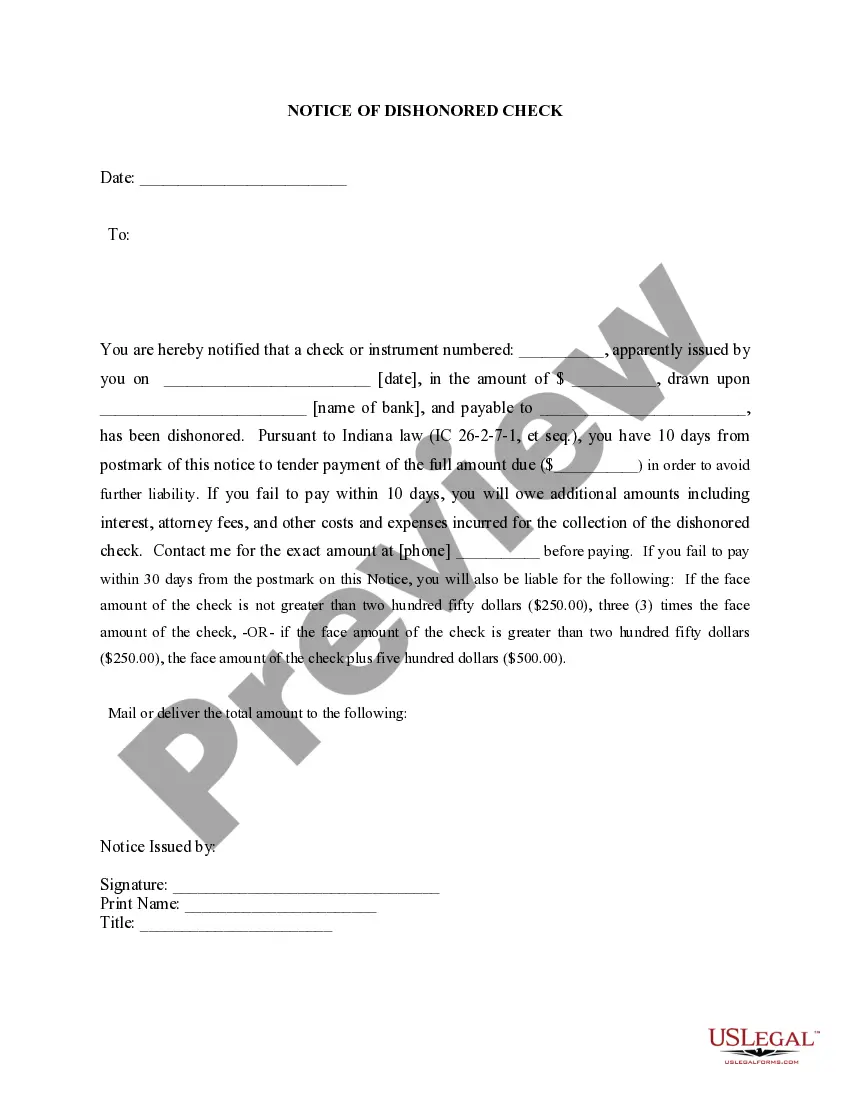

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Fort Wayne Indiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Indiana Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

If you are in search of an appropriate form, it’s incredibly challenging to select a superior platform compared to the US Legal Forms site – one of the largest repositories on the web.

Here, you can discover countless document examples for business and personal use by type and region, or keywords.

With our sophisticated search feature, locating the latest Fort Wayne Indiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is as simple as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the format and download it to your device.

- Furthermore, the accuracy of each entry is confirmed by a group of experienced attorneys who routinely review the templates on our site and refresh them according to the most recent state and local laws.

- If you are already familiar with our platform and have an account, all you need to do to obtain the Fort Wayne Indiana Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is to Log In to your profile and select the Download option.

- If this is your first time using US Legal Forms, just adhere to the instructions below.

- Ensure you have located the sample you desire. Review its details and utilize the Preview feature (if available) to examine its contents. If it doesn’t meet your requirements, use the Search feature at the top of the page to find the suitable document.

- Verify your selection. Click on the Buy now button. Subsequently, pick the preferred pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

To recover a bad check, start by reaching out to the person who issued it and request payment. If that doesn't work, you can initiate a Fort Wayne Indiana Notice of Dishonored Check - Civil process. Utilizing the USLegalForms platform can simplify this process, providing you with the necessary forms and guidance to successfully recover your funds from a bounced check.

A check might be returned or dishonored for several reasons, including insufficient funds in the issuer's account, a closed account, or a stop payment request. Understanding these reasons is crucial if you are facing a Fort Wayne Indiana Notice of Dishonored Check - Civil situation. Being aware of this can prepare you for the next steps, such as filing legal action if necessary.

When someone gives you a bad check, you can first contact the issuer to resolve the issue directly. It may be an oversight, and they could arrange payment quickly. If this approach fails, you may need to consider pursuing a Fort Wayne Indiana Notice of Dishonored Check - Civil suit. This legal action can help you recover the funds you lost due to the bounced check.

Indiana law defines bad checks, or dishonored checks, primarily under certain circumstances such as insufficient funds or account closures. Issuing a bad check can be treated as a criminal offense, which can lead to both civil and criminal penalties. It's important to recognize that the Fort Wayne Indiana Notice of Dishonored Check provides specific guidelines on handling these situations. For comprehensive assistance, consider using US Legal Forms to ensure you are informed and protected under Indiana law.

Yes, you can face trouble if someone writes you a bad check, particularly if you deposit it and it bounces. You may be held responsible for any fees from your bank, and the situation could lead to complications in your personal finances. Involving local authorities for advice is often a good step, as well as navigating through resources provided by US Legal Forms to understand your rights and next steps.

Writing a bad check over $500 can have serious consequences, including criminal charges. In Indiana, this can be classified as a felony, resulting in heavier fines and possible jail time. Additionally, it can harm your credit score and lead to difficulties in future banking. To avoid these complications, it's essential to understand the laws surrounding bounced checks, specifically the Fort Wayne Indiana Notice of Dishonored Check.

Disputing a bounced check starts with gathering evidence, such as the check itself and any correspondence with the issuer. Next, you may want to contact the issuer directly to resolve the issue amicably. If that fails, you could consider sending a demand letter before taking legal action. Furthermore, utilizing resources from US Legal Forms can guide you through the dispute process effectively.

A legal letter for a bounced check, often referred to as a demand letter, formally requests payment from the issuer of the bad check. When you receive notice that a check has bounced, this letter serves as proof that you have attempted to collect the funds. It can also outline the next steps if the payment is not made. Using a service like US Legal Forms can help you create this letter to ensure it meets legal standards.

Yes, you can face legal issues for a bounced check. A bounced check is often viewed as a bad check, which can lead to penalties. Depending on the circumstances, you may face fines, civil suits, or even criminal charges. In Fort Wayne Indiana, a Notice of Dishonored Check - Civil can help you understand your options if you encounter this situation.

To write a letter notifying someone that their check has bounced, begin with a formal greeting followed by the specific details of their check, including the amount. Clearly explain that the bank returned the check and list any necessary steps for them to take. Ending the letter with a pleasant reminder that you appreciate their attention to this matter can help maintain a good relationship. US Legal Forms can provide templates to ensure you cover all important points.