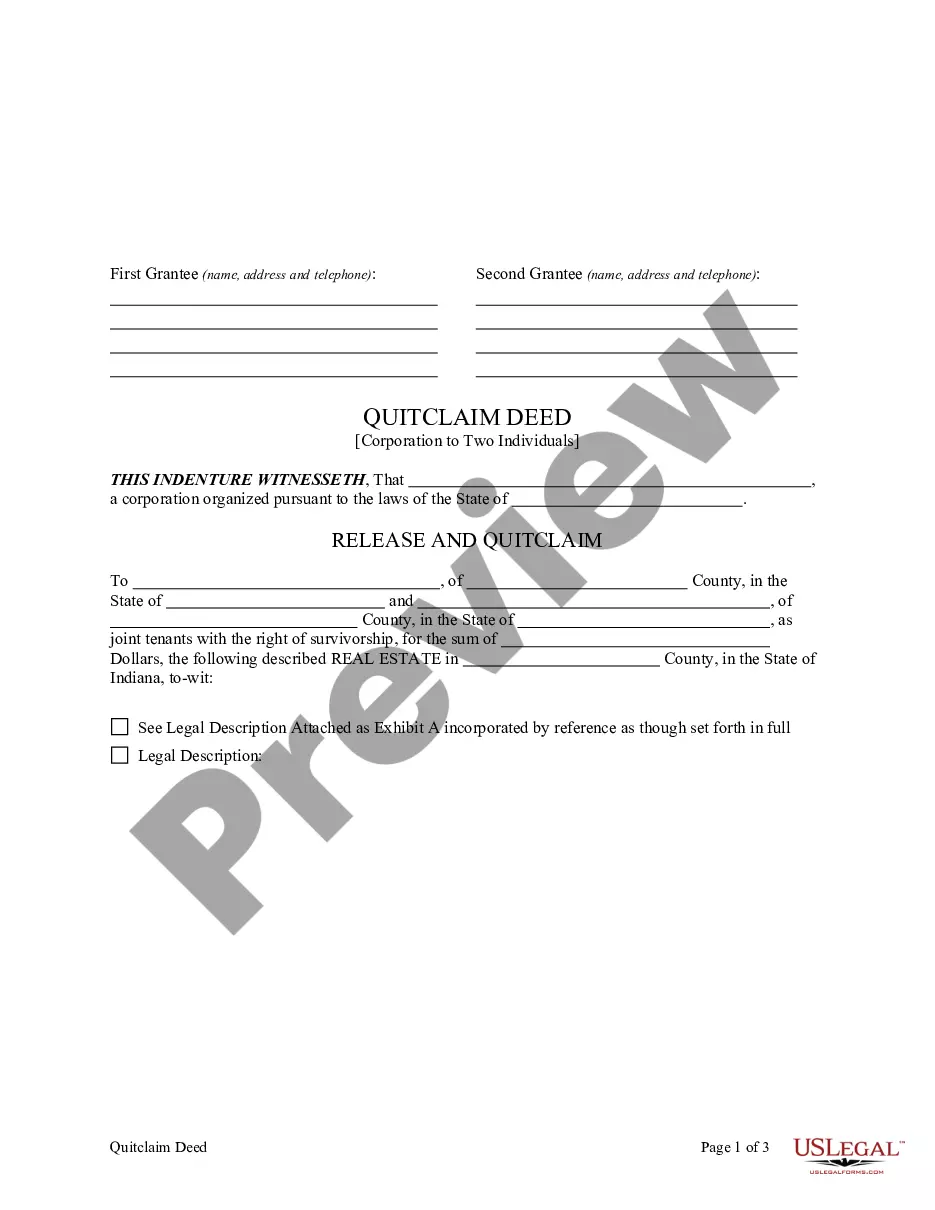

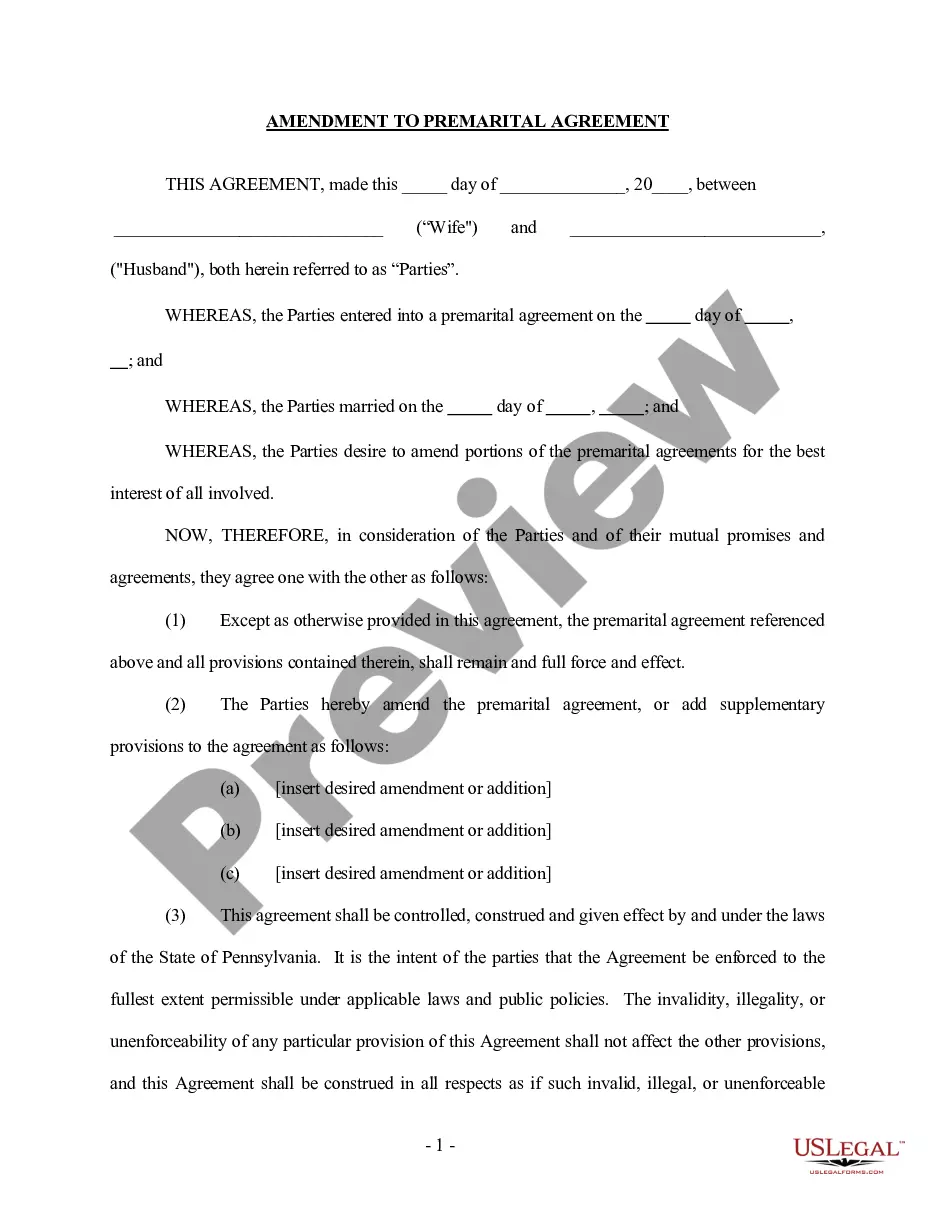

This form is a Quitclaim Deed where the grantor is a corporation and the grantees are two individuals. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Indianapolis Indiana Quitclaim Deed from Corporation to Two Individuals

Description

How to fill out Indiana Quitclaim Deed From Corporation To Two Individuals?

Utilize the US Legal Forms and gain instant access to any document you need.

Our convenient website with a vast array of templates simplifies the process of locating and obtaining nearly any document sample you seek.

You can export, complete, and validate the Indianapolis Indiana Quitclaim Deed from Corporation to Two Individuals within minutes rather than spending hours searching the Internet for a suitable template.

Leveraging our collection is a superb method to enhance the security of your document submissions. Our knowledgeable legal experts routinely review all forms to ensure that the documents are applicable for a specific state and compliant with current laws and regulations.

If you haven’t created an account yet, follow the steps below.

Feel free to take advantage of our services and make your documentation experience as seamless as possible!

- How can you acquire the Indianapolis Indiana Quitclaim Deed from Corporation to Two Individuals.

- If you hold a subscription, simply Log In to your account. The Download feature will be activated for all the documents you review.

- Additionally, you can access all previously stored documents in the My documents section.

Form popularity

FAQ

Indiana Quit Claim Deed Form ? Summary The Indiana quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

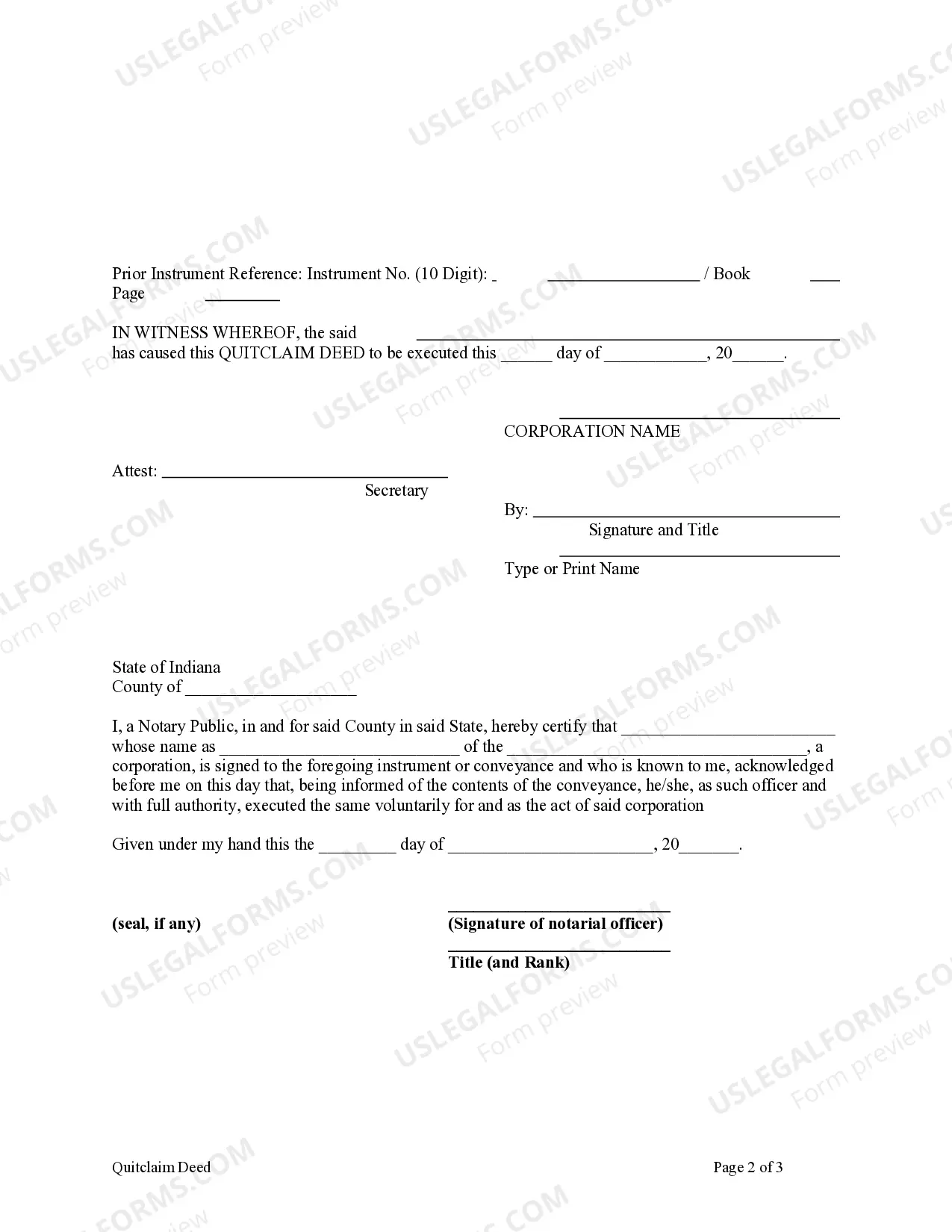

Transfer on Death Deed Form ? A popular deed form that is specifically authorized by Indiana law to transfer property to designated beneficiaries upon the death of an owner....How to Transfer Indiana Real Estate Locate the prior deed to the property.Create the new deed.Sign the new deed.Record the original deed.

?Adding someone to a deed? means transferring ownership to that person. The transfer of ownership can occur during life (with a regular quitclaim deed, for example) or at death (using a lady bird deed, transfer-on-death-deed, or life estate deed).

As a homeowner, you have the ability to execute a quitclaim deed to change ownership, and you don't need to refinance the mortgage loan to file a quitclaim deed. Filing a quitclaim deed will change only the property's ownership and title, not anything regarding the loan.

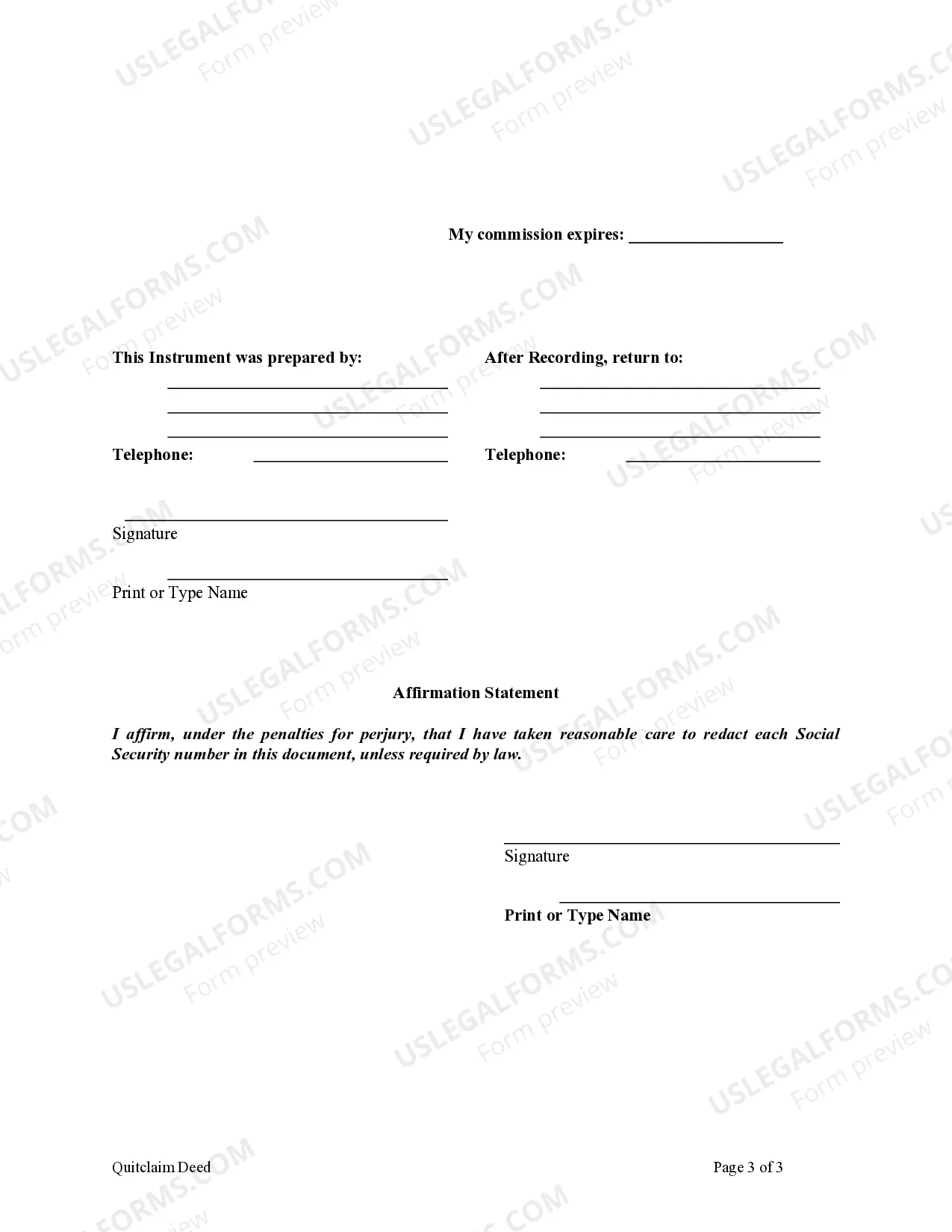

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

A quitclaim deed transfers the title of a property from one person to another, with little to no buyer protection. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The title is transferred without any amendments or additions.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

A Quitclaim Deed transfers only whatever ownership in property the person doing the Quitclaim Deed has. For example, if someone has no legal ownership in a house, and that person signs a Quitclaim Deed saying you now have ownership, you have nothing.

Yes you can. This is called a transfer of equity but you will need the permission of your lender.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.