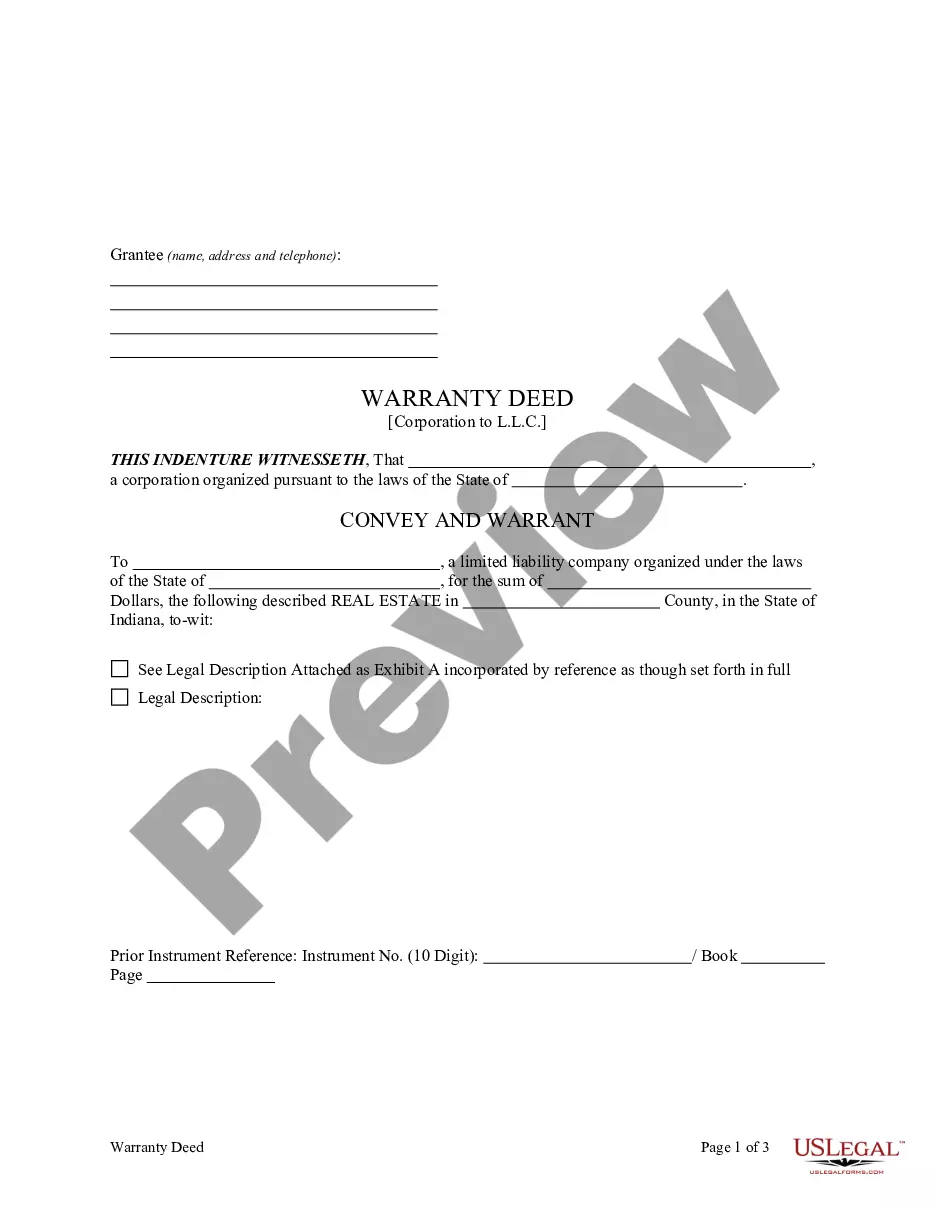

This form is a Warranty Deed where the Grantor is a Corporation and the Grantee is also a Limited Liability Company. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Indianapolis Indiana Warranty Deed - Corporation to Limited Liability Company

Description

How to fill out Indiana Warranty Deed - Corporation To Limited Liability Company?

If you have previously utilized our service, Log In to your account and store the Indianapolis Indiana Warranty Deed - Corporation to Limited Liability Company on your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it according to your billing plan.

If this is your first time using our service, follow these easy steps to obtain your document.

You have ongoing access to all the documents you have purchased: you can find them in your profile under the My documents section anytime you need to access them again. Leverage the US Legal Forms service to quickly find and store any template for your personal or business needs!

- Ensure you’ve located an appropriate document. Review the description and use the Preview feature, if available, to confirm it meets your needs. If it’s not suitable, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription option.

- Establish an account and finalize a payment. Use your credit card information or the PayPal method to complete the transaction.

- Receive your Indianapolis Indiana Warranty Deed - Corporation to Limited Liability Company. Select the file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Updated . An Indiana special warranty deed is similar to a warranty deed in that it guarantees a seller has a title to sell to a buyer, though it only provides a limited guarantee. The guarantee is limited to the grantor's ownership of the property and not any previous ownership.

You can get a copy of your deed or mortgage release/satisfaction from the Recorder's office, and our staff can help you with your search. However, we cannot conduct searches for you. Companies may contact you and offer to send a copy of your deed for $60 or more.

Benefits of starting an Indiana LLC Easily file your taxes and discover potential advantages for tax treatment. Easy creation, management, regulation, administration and compliance. Protect your personal assets from your business liability and debts. Low cost to file ($100)

To amend your initial Articles of Organization for an Indiana LLC, you'll need to file Articles of Amendment with the Indiana Secretary of State, Business Services Division. In addition, you must pay the $30 paper filing fee or $20 online filing fee, depending on how you choose to submit your form.

The buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.

Professional services businesses Indiana allows professionals, such as accountants, attorneys, and physicians, to form an LLC. Indiana's statutes do not provide for a professional limited liability company (PLLC).

The Indiana special warranty deed form provides a limited warranty of title. With a special warranty deed, the person transferring the property guarantees that he or she has done nothing that would cause title problems, but makes no guarantees about what might have happened before he or she acquired the property.

A special warranty deed guarantees two things: The grantor owns, and can sell, the property; and the property incurred no encumbrances during his ownership. A special warranty deed is more limited than the more common general warranty deed, which covers the entire history of the property.

The process of adding a member to an Indiana LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

To form an Indiana LLC you'll need to file the Articles of Organization with the Indiana Secretary of State Business Services Division, which costs $95-$100. You can apply online or by mail. The Articles of Organization is the legal document that officially creates your Indiana Limited Liability Company.