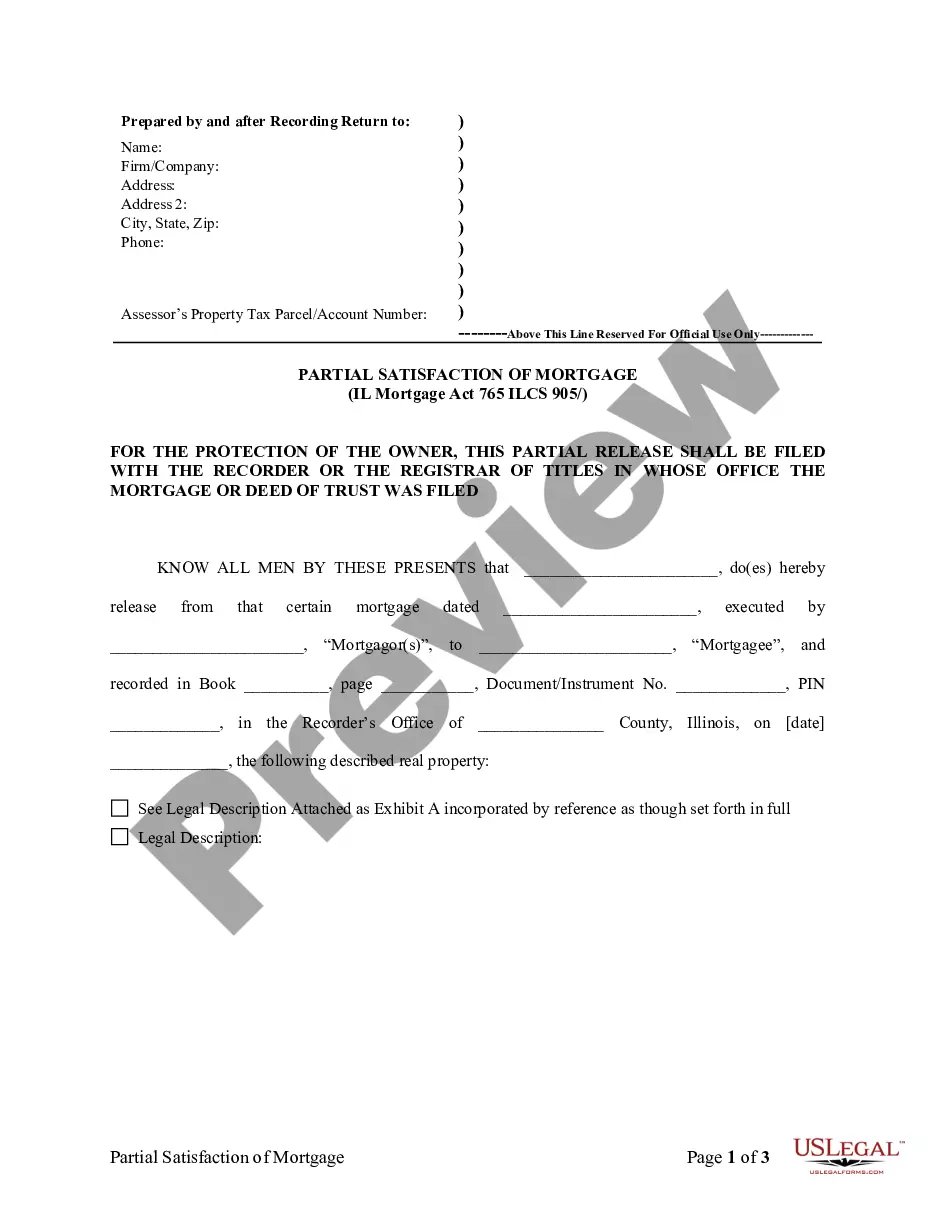

Chicago Illinois Partial Release of Property From Mortgage by Individual Holder

Description

How to fill out Illinois Partial Release Of Property From Mortgage By Individual Holder?

If you are looking for a pertinent form, it’s exceedingly challenging to discover a superior service than the US Legal Forms site – one of the most extensive online repositories.

With this repository, you can obtain a vast number of templates for organizational and personal purposes categorized by types and areas, or keywords.

Employing our advanced search functionality, acquiring the latest Chicago Illinois Partial Release of Property From Mortgage by Individual Holder is as straightforward as 1-2-3.

Execute the financial transaction. Use your credit card or PayPal account to complete the registration process.

Obtain the form. Select the format and download it onto your device.

- Moreover, the relevance of each document is verified by a group of professional attorneys who routinely examine the templates on our platform and refresh them according to the latest state and county regulations.

- If you are already acquainted with our system and possess an account, all you need to do to acquire the Chicago Illinois Partial Release of Property From Mortgage by Individual Holder is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have located the template you need. Review its description and utilize the Preview feature to examine its content. If it does not meet your requirements, use the Search field at the top of the page to find the correct document.

- Confirm your selection. Click the Buy now button. Next, choose your desired pricing plan and provide your details to register for an account.

Form popularity

FAQ

What to do after paying off your mortgage Stop any automatic payments to your mortgage lender.Close out the escrow account, and redirect any related billings.Budget for property taxes and homeowners insurance.Pay off remaining debts.Increase your savings.

A partial reconveyance is to reconvey a portion of the land subject to a deed of trust, not the loan amount. In this case ? like the great majority of cases ? we are not dealing with a subdivided parcel of land, so the customer won't be able to split up the land subject to the deed of trust.

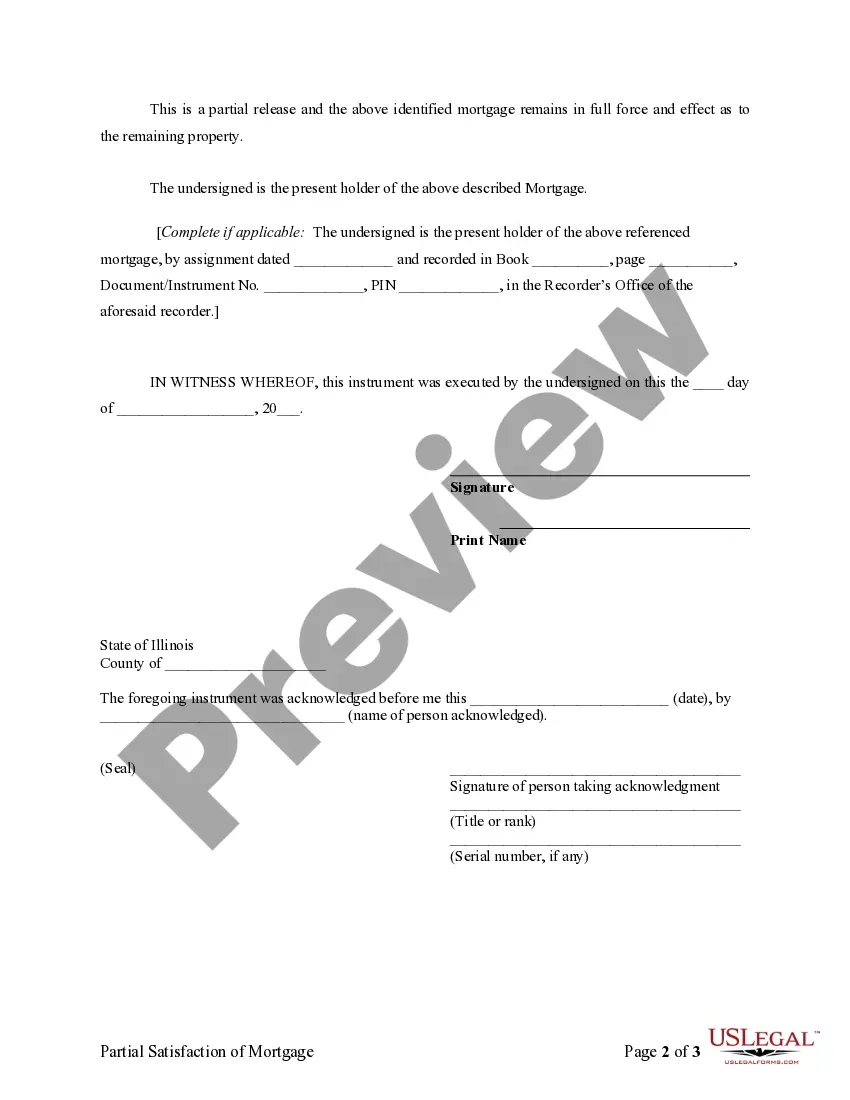

When you pay off a mortgage, the original deed of trust is sent back to you by the mortgage holder marked ?paid? or ?cancelled.? This process usually takes up to 60 days, but because deeds are public records, you can check on the progress with your county registrar.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.

Step-by-step process Speak to your lender. Let them know about your intention to discharge your mortgage, and confirm the fees and how long it will take. Contact a broker or conveyancer.Fill in a Discharge Authority form.Your bank registers the discharge of mortgage.The discharge is finalised.

A release clause is a term that refers to a provision within a mortgage contract. The release clause allows for the freeing of all or part of a property from a claim by the creditor after a proportional amount of the mortgage has been paid.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

A release deed would typically be executed at a time when your home loan provider grants you a legal certificate that you have fully paid your loan and the lender is freeing the collateral submitted as a security against the loan. An individual can also give up his right in a property through this instrument.

A partial lien release is a legal contract that enables your lender to release their lien on a part of your mortgaged property. Under the typical terms of a partial release, if you pay down a certain amount of your mortgage principal, your lender will agree to release some of your property from the loan contract.