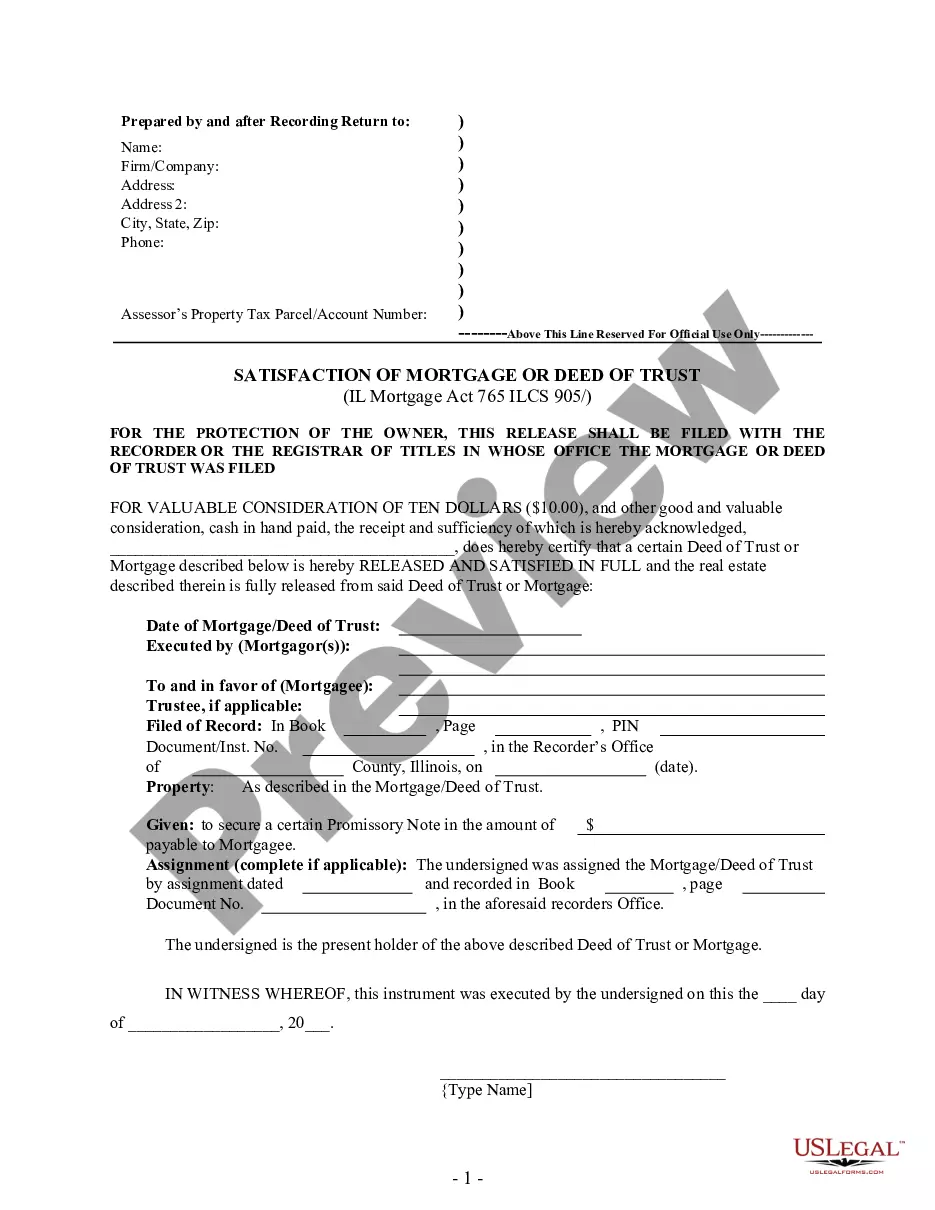

Cook Illinois Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Illinois Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Utilize the US Legal Forms to gain immediate access to any form sample you need.

Our helpful website, which boasts a vast array of templates, simplifies the process of locating and acquiring almost any document sample you seek.

You can download, fill out, and sign the Cook Illinois Satisfaction, Release or Cancellation of Mortgage by Individual in just a few minutes instead of spending hours online searching for a suitable template.

Using our library is an excellent method to enhance the security of your record submissions.

Locate the template you require. Ensure it is the document you were searching for: confirm its title and description, and use the Preview function when available. If not, use the Search box to find the correct one.

Initiate the downloading process. Choose Buy Now and select the pricing option you prefer. Afterward, create an account and pay for your purchase using a credit card or PayPal.

- Our qualified attorneys frequently review all the documents to ensure that the forms are suitable for a specific area and adhere to new laws and regulations.

- How can you secure the Cook Illinois Satisfaction, Release or Cancellation of Mortgage by Individual.

- If you possess an account, simply Log In to the profile. The Download button will be activated on all the samples you examine.

- Moreover, you can find all your previously saved documents in the My documents section.

- If you have not yet established an account, follow the instructions below.

Form popularity

FAQ

Obtaining a mortgage satisfaction letter usually takes a few days after your final payment is processed by your lender. However, this timeframe can differ based on the lender's internal procedures. Once you secure the letter, remember to file it promptly to ensure your records are accurate. You can rely on uslegalforms to provide the tools needed for Cook Illinois Satisfaction, Release or Cancellation of Mortgage by Individual.

The time it takes to receive a satisfaction of a mortgage can vary based on your lender's policies. Typically, once you have made the final payment, lenders may take a few days to process your request. After receiving the satisfaction letter, you will then file it at your local land records office. Thus, expect a timeline of a few weeks for complete processing related to Cook Illinois Satisfaction, Release or Cancellation of Mortgage by Individual.

To obtain a satisfaction of a mortgage, start by contacting your lender. Request a satisfaction letter that indicates your mortgage balance is zero. Once you have this document, you will need to file it with your local land records office for official recognition. Using platforms like uslegalforms can simplify the process of obtaining necessary documentation for Cook Illinois Satisfaction, Release or Cancellation of Mortgage by Individual.

The terms release and satisfaction of mortgage are often used interchangeably, but they can have different implications. A release specifically refers to the legal process of removing the mortgage lien, while satisfaction may encompass broader contexts of fulfilling all obligations under the mortgage. In Cook, Illinois, it’s important to understand both terms when discussing the release or cancellation of mortgage by an individual.

Satisfaction, or release of mortgage, signifies the conclusion of a mortgage agreement when a borrower repays their debt in full. This process frees the property from the lender's claim, restoring full ownership to the borrower. Knowing how to correctly execute the satisfaction process in Illinois is essential, and USLegalForms can provide useful resources to navigate these procedures.

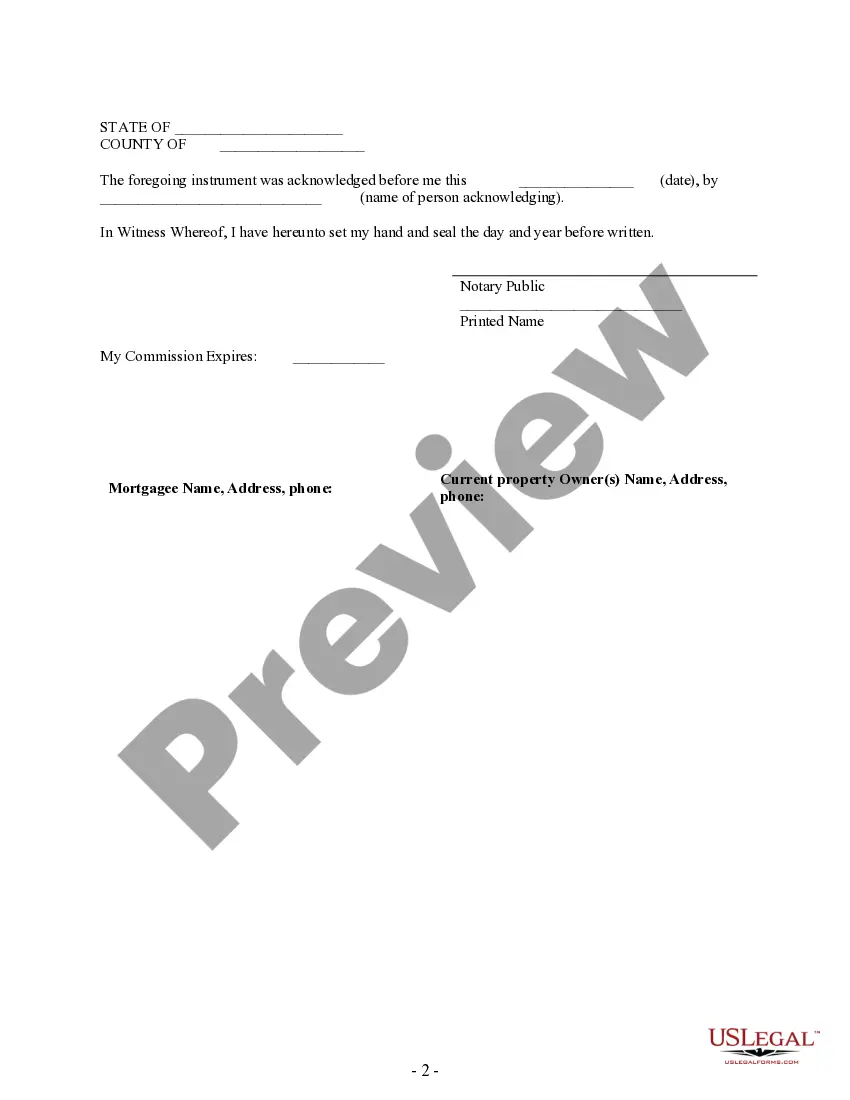

To record a release of your mortgage in Cook, Illinois, you first need to obtain a release document from your lender. Once you have the signed release, you can take it to your county Recorder’s Office. It's essential to submit the document alongside any required fees. This process ensures that your mortgage is officially removed from public records.

A mortgage release form is a legal document that confirms the repayment of a mortgage, effectively cancelling the lender’s claim on the property. It provides assurance to property owners that there are no outstanding obligations. Once completed, this form can be recorded with local authorities, ensuring clarity in property ownership in accordance with the Cook Illinois Satisfaction, Release or Cancellation of Mortgage by Individual.

To record a release of a mortgage in Cook, Illinois, you must first obtain the mortgage release document from your lender. After securing the document, visit your county recorder's office to submit it for recording. This process officially updates public records to show that the mortgage has been satisfied and canceled, providing you peace of mind about your property ownership.