Chicago Illinois Complaint For Declaratory Judgment regarding Uninsured Motorist Coverage Determination for Rental Car is a legal document filed in the state of Illinois when an individual or entity seeks a court's declaration on matters pertaining to uninsured motorist coverage for a rental car. Keywords: Chicago, Illinois, complaint, declaratory judgment, uninsured motorist coverage, determination, rental car. Different Types of Chicago Illinois Complaint For Declaratory Judgment regarding Uninsured Motorist Coverage Determination for Rental Car: 1. Individual's Complaint: An individual may file this type of complaint when they have been involved in an accident with an uninsured motorist while driving a rental car. They seek a declaratory judgment to determine the extent of their uninsured motorist coverage and the applicable limits. 2. Rental Car Agency's Complaint: Rental car agencies may file this type of complaint to seek a court's declaratory judgment on uninsured motorist coverage for their fleet of rental cars. The agency may want clarity on whether their insurance policy covers instances when a renter is involved in an accident with an uninsured motorist. 3. Insurance Company's Complaint: Insurance companies that provide coverage for rental car agencies or individuals may also file a complaint for declaratory judgment. They may seek clarification on the extent of their liability and obligations concerning uninsured motorist coverage for rental cars. 4. Dispute Resolution Complaint: In some cases, when there is a dispute between the involved parties regarding uninsured motorist coverage for a rental car, one of the parties may file a complaint for declaratory judgment. This type of complaint aims to resolve any disagreements and secure a court's declaration on the matter. In all these potential types of complaints, the plaintiff will present a detailed account of the incident involving the rental car and the uninsured motorist. They will outline their insurance policy terms and provisions related to uninsured motorist coverage. The complaint will highlight any ambiguities or conflicting interpretations of the insurance contract. The plaintiff will also request the court to clarify the rights, obligations, and liabilities of the involved parties regarding uninsured motorist coverage for the rental car under the specific circumstances.

Chicago Illinois Complaint For Declaratory Judgment regarding Uninsured Motorist Coverage Determination for Rental Car

Description

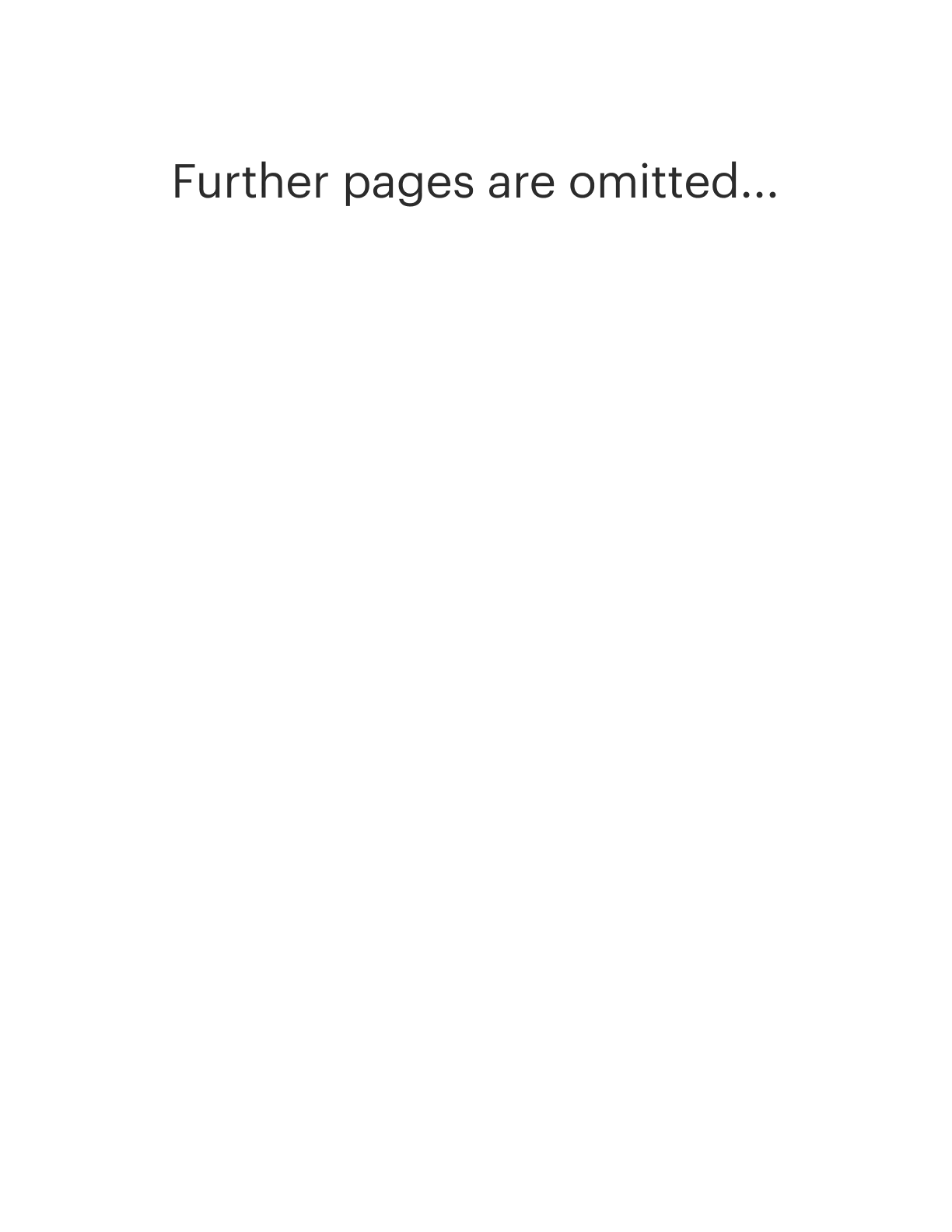

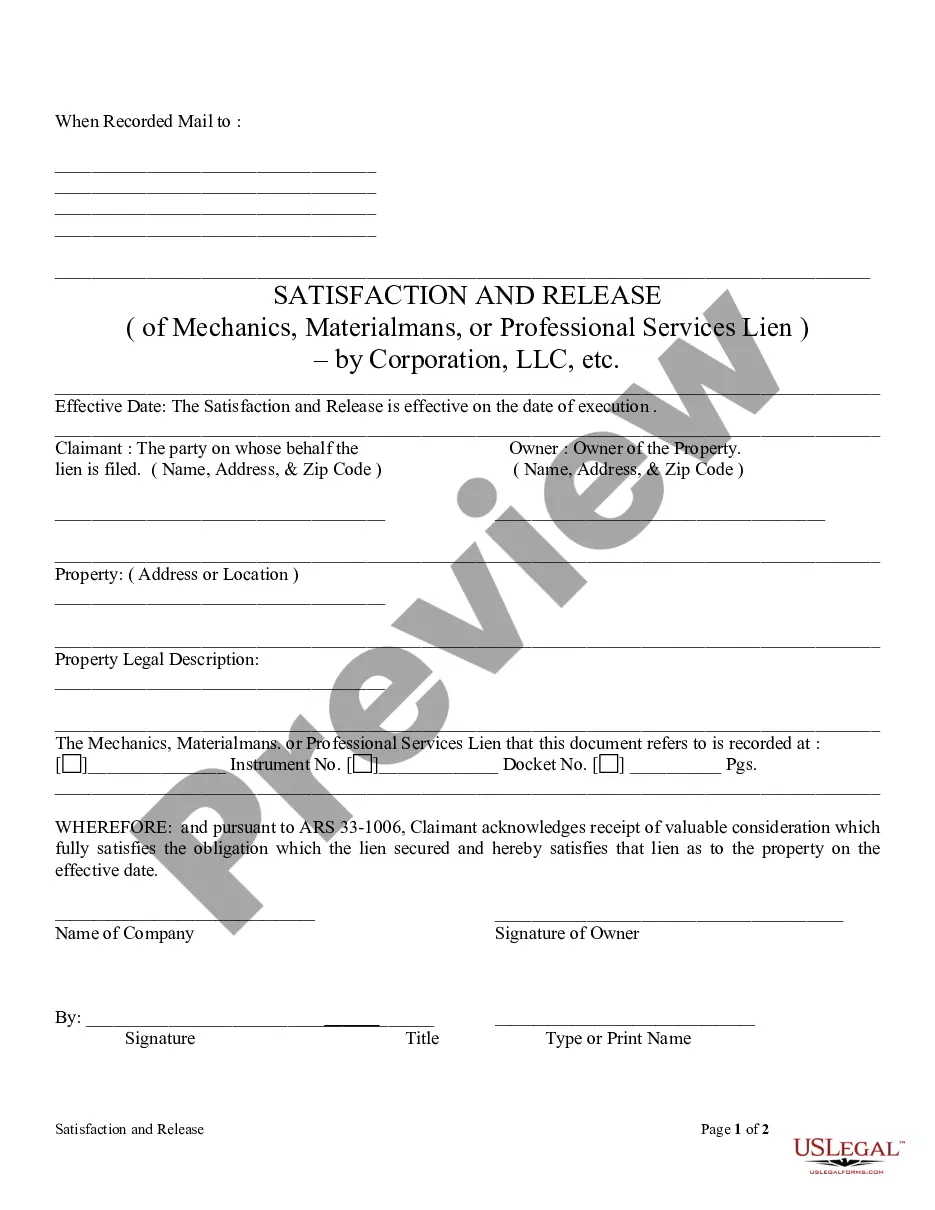

How to fill out Chicago Illinois Complaint For Declaratory Judgment Regarding Uninsured Motorist Coverage Determination For Rental Car?

If you are in search of a pertinent form template, it’s incredibly challenging to select a more user-friendly platform than the US Legal Forms website – likely the most exhaustive online repositories.

Here, you can discover a vast array of templates for business and individual use categorized by sectors and regions, or by keywords.

With our top-notch search capability, locating the latest Chicago Illinois Complaint For Declaratory Judgment concerning Uninsured Motorist Coverage Determination for Rental Car is as simple as 1-2-3.

Obtain the form. Specify the format and download it to your device.

Edit as necessary. Complete, modify, print, and sign the obtained Chicago Illinois Complaint For Declaratory Judgment regarding Uninsured Motorist Coverage Determination for Rental Car.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Chicago Illinois Complaint For Declaratory Judgment regarding Uninsured Motorist Coverage Determination for Rental Car is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have selected the template you require. Read its description and use the Preview option (if accessible) to view its contents. If it doesn’t meet your requirements, use the Search function located at the top of the screen to find the correct file.

- Confirm your selection. Choose the Buy now option. After that, choose your preferred payment plan and fill out your credentials to create an account.

- Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

They can result in a fine between $501-$1,000 and a license suspension of up to three months. You'll have to pay a reinstatement fee of $100. At the third or subsequent offense, you still have a license suspension of three months and will have to pay the reinstatement fee.

Illinois public policy prohibits direct actions against an insurance company because of the negligence of its insured prior to obtaining a judgment against the insured.

Also, Illinois drivers must carry Uninsured Motorists coverage with the same minimum limits. Failure to carry adequate insurance is considered a petty offense, which means it is punishable by a fine only ? no jail time. If you're caught driving uninsured, you could face up to a $1,000 fine.

If you have been unfortunate enough to be involved in an accident with an uninsured driver, can you claim compensation? Thankfully, yes you can.

Illinois requires that all drivers have minimum liability coverage of 25/50/20 and uninsured and underinsured motorist coverage. This includes $50,000 in bodily injury coverage per accident with a $25,000 limit per person, which helps drivers pay for any third-party injuries sustained in an accident.

1) Submit an Illinois Crash Report to the Illinois Department of Transportation to confirm that the at-fault party was uninsured, then request that the Secretary of State suspend the uninsured motorist's license for failure to have insurance. 2) File a lawsuit and obtain a judgment against the uninsured motorist.

Uninsured Motorist Bodily Injury Coverage (UM) ? Covers you for your bodily injury caused by a hit-and-run driver or an at-fault driver who has no auto liability insurance. Currently, Illinois uninsured motorist bodily injury minimum limits are $25,000 per person and $50,000 per accident.

If you are hurt by an uninsured driver, your liability policy will pay for your personal injuries, including medical expenses, pain, and lost wages. However, it does not cover the damage to your car or other property. You may have to pay to repair your car or buy a new one out of your own pocket.

Suing the Uninsured Driver Technically, you can sue the other driver even if he or she does not have insurance, but these cases are extremely difficult to bring about and if you win, you may have trouble collecting from the driver.

More info

Case No. 16CV054, USDA, District of Columbia, District of Columbia, Civil Action No. 02-18096; 03-1146; 06-1014; 03-1149; 06-1019. (This case was listed in 2016, a settlement was announced, see below.) Defendant had filed a Certificate of Insurance in the amount of 100, claiming the insured was insured on the vehicle under insurance policy from the State of Illinois of 100, Defendant issued insurance with a claim amount of 100, and the driver is covered under that insurance for the amount of 100, A person injured in a vehicle accident must be entitled to an insurance policy sufficient to pay for medical expenses. The defendant had received more than 90% of its insurance premium for medical expenses. Defendant was entitled to more than 90% reimbursement under the contract of indemnity. The defendant was not insured under the agreement signed by the insured, the policy contract was not executed.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.