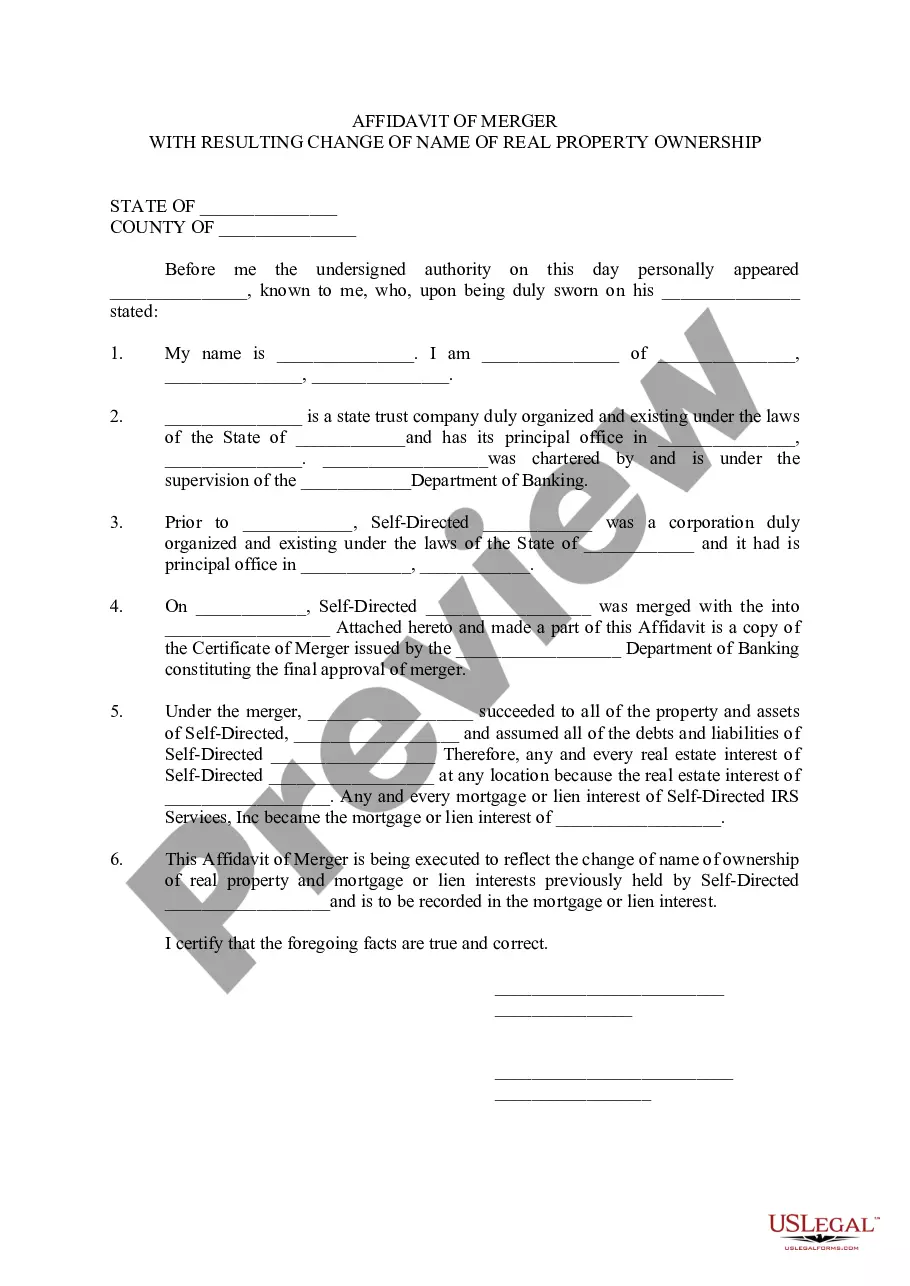

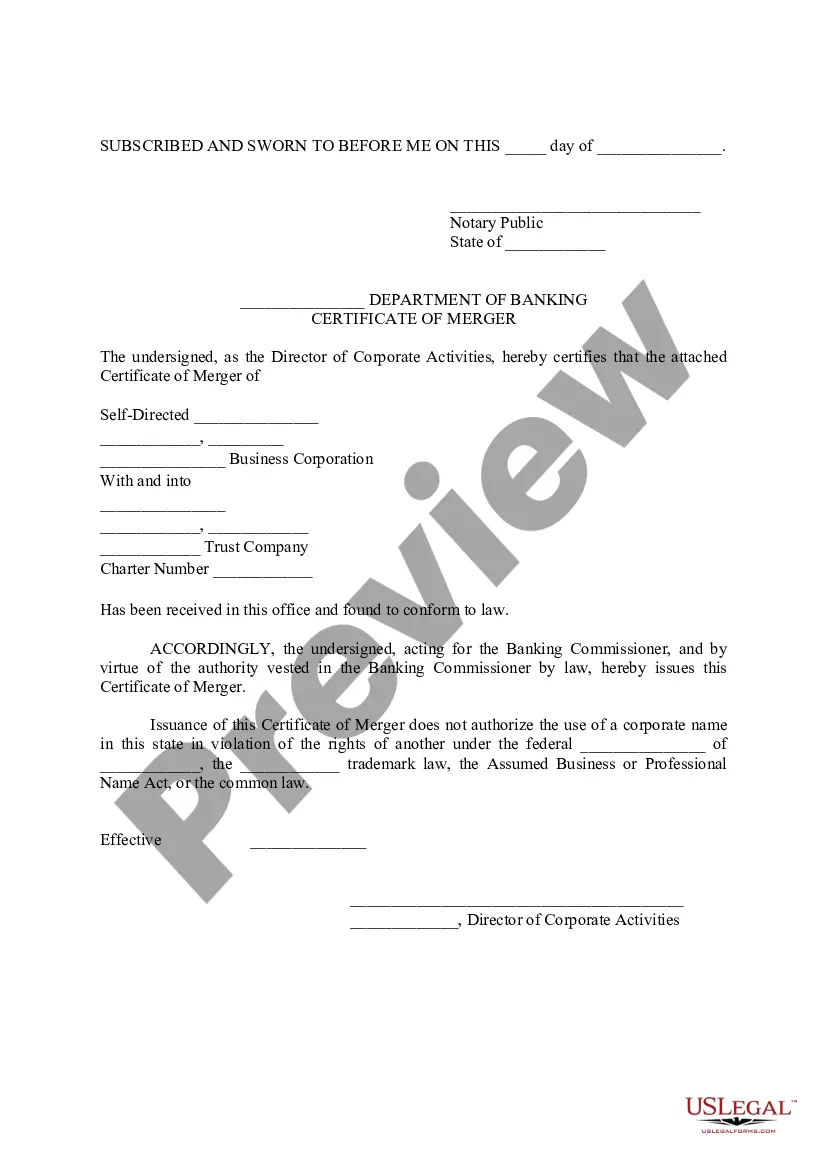

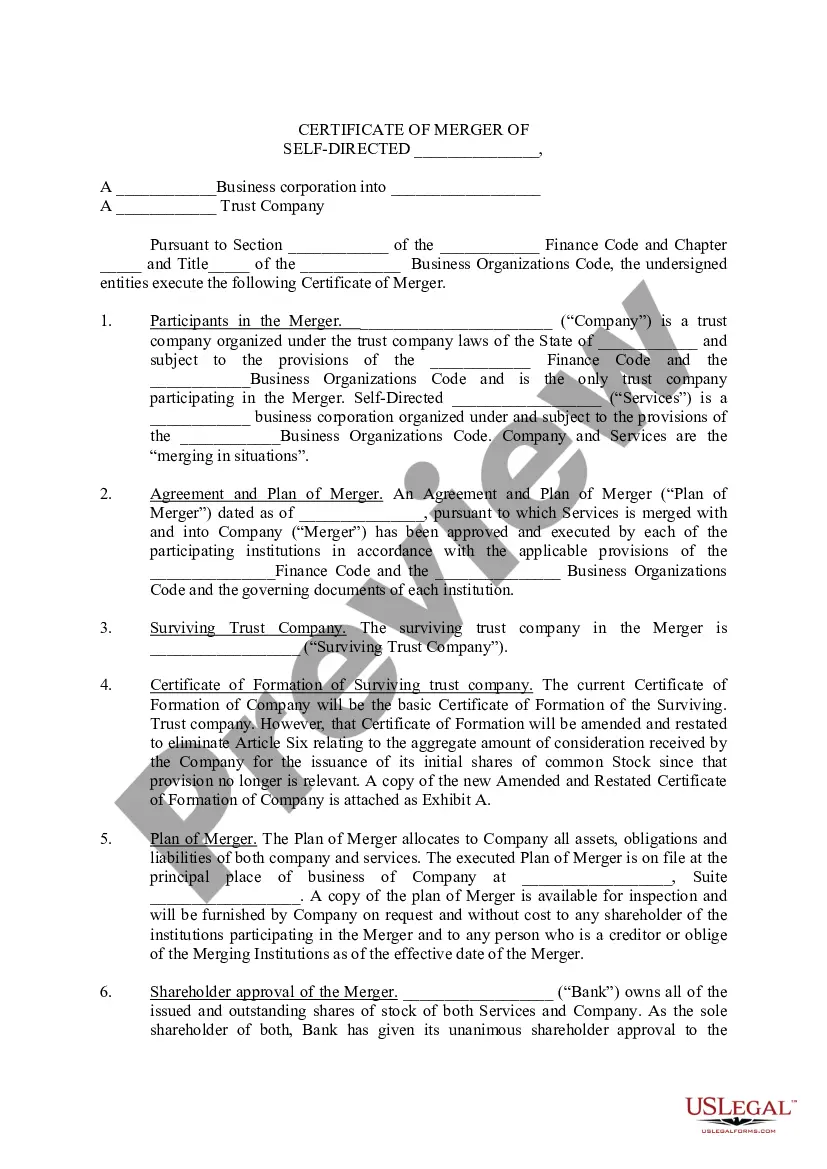

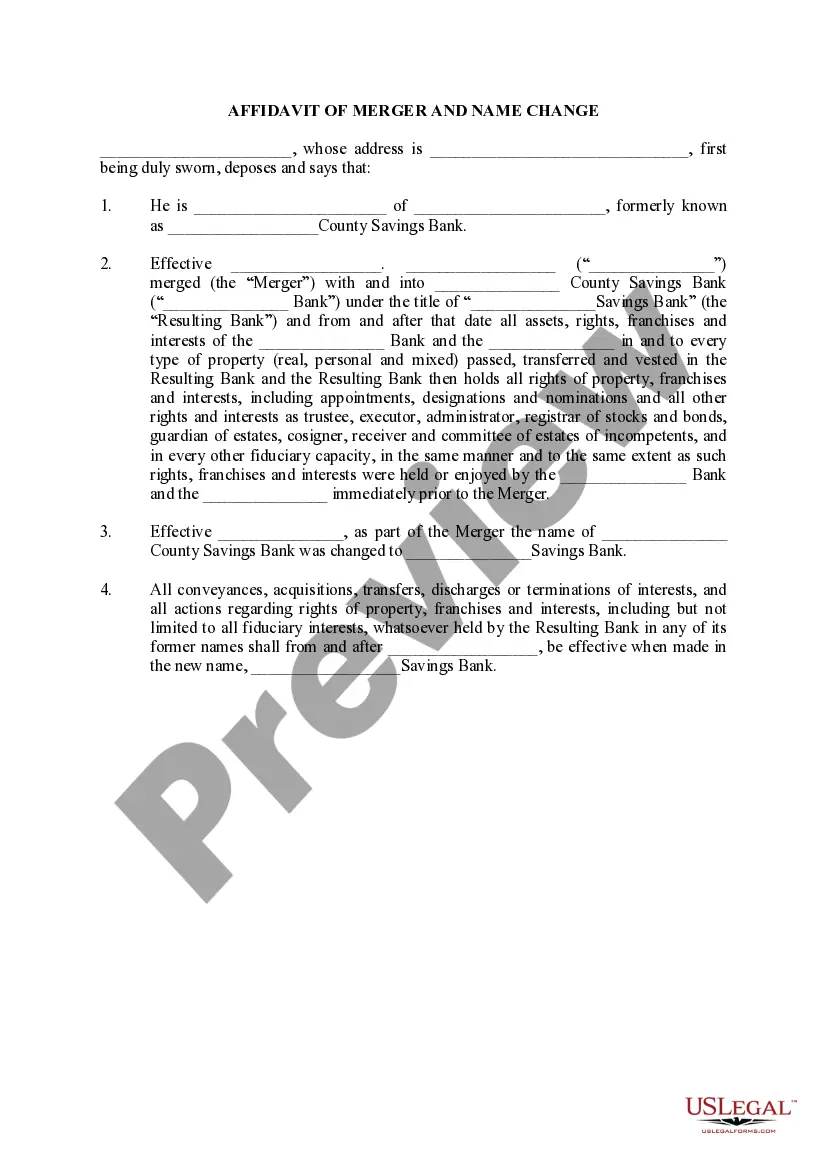

Chicago Illinois Affidavit of Merger With Resulting Change of Name Of Real Property Ownership

Description

How to fill out Illinois Affidavit Of Merger With Resulting Change Of Name Of Real Property Ownership?

Regardless of your social or professional standing, completing legal documents is an unfortunate requirement in the current professional landscape.

Frequently, it’s nearly impossible for someone without any legal background to construct such documents from scratch, primarily due to the intricate language and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Verify that the form you have located is tailored to your locality as the laws of one state or county may not apply to another.

Examine the document and review a brief overview (if available) of situations the document can be utilized for.

- Our platform boasts an extensive collection of over 85,000 ready-to-use state-specific templates suitable for almost any legal situation.

- US Legal Forms is also an excellent resource for associates or legal advisors aiming to save time by utilizing our DIY forms.

- Whether you need the Chicago Illinois Affidavit of Merger With Resulting Change of Name Of Real Property Ownership or any other paperwork pertinent to your state or county, everything is conveniently accessible through US Legal Forms.

- Here's how you can obtain the Chicago Illinois Affidavit of Merger With Resulting Change of Name Of Real Property Ownership quickly using our dependable platform.

- If you are already a subscriber, simply Log In to your account to access the necessary form.

- However, if you are new to our platform, please follow these instructions before downloading the Chicago Illinois Affidavit of Merger With Resulting Change of Name Of Real Property Ownership.

Form popularity

FAQ

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

Some transactions are exempt from Transfer Tax. Some examples would be conveyances between husband and wife, parents and child, grandparent and grandchild, brothers and sisters. A one-time transfer is allowed between former spouses. Other exemptions are allowed in certain situations.

Illinois Real Estate Transfer Tax Payment. Document (non recorded transfers)

The transfer of the property is usually in the form of a donation (a gift) or the sale of the property to the child. A written contract must be entered into between the parent and child. The following should be carefully considered and the advice of an expert should be obtained.

Step 1. Determine and prepare the needed requirements for a title transfer. Deed of Conveyance.Photocopies of valid IDs of all signatories in the deed.The Notary Public's official receipt for the deed's notarization. Certified True Copy of the Title (3 copies)Certified True Copy of the latest Tax Declaration.

If you want to transfer real estate in Illinois to a relative or a friend, you might consider doing this yourself by using a quitclaim deed. A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.

Property Tax E-Services State of Illinois Forms PTAX-203, 203-A, and 203-B. City of Chicago Form 7551 ? Real Property Transfer Tax Declaration. Real Property Transfer Tax Declarations for participating counties.

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.