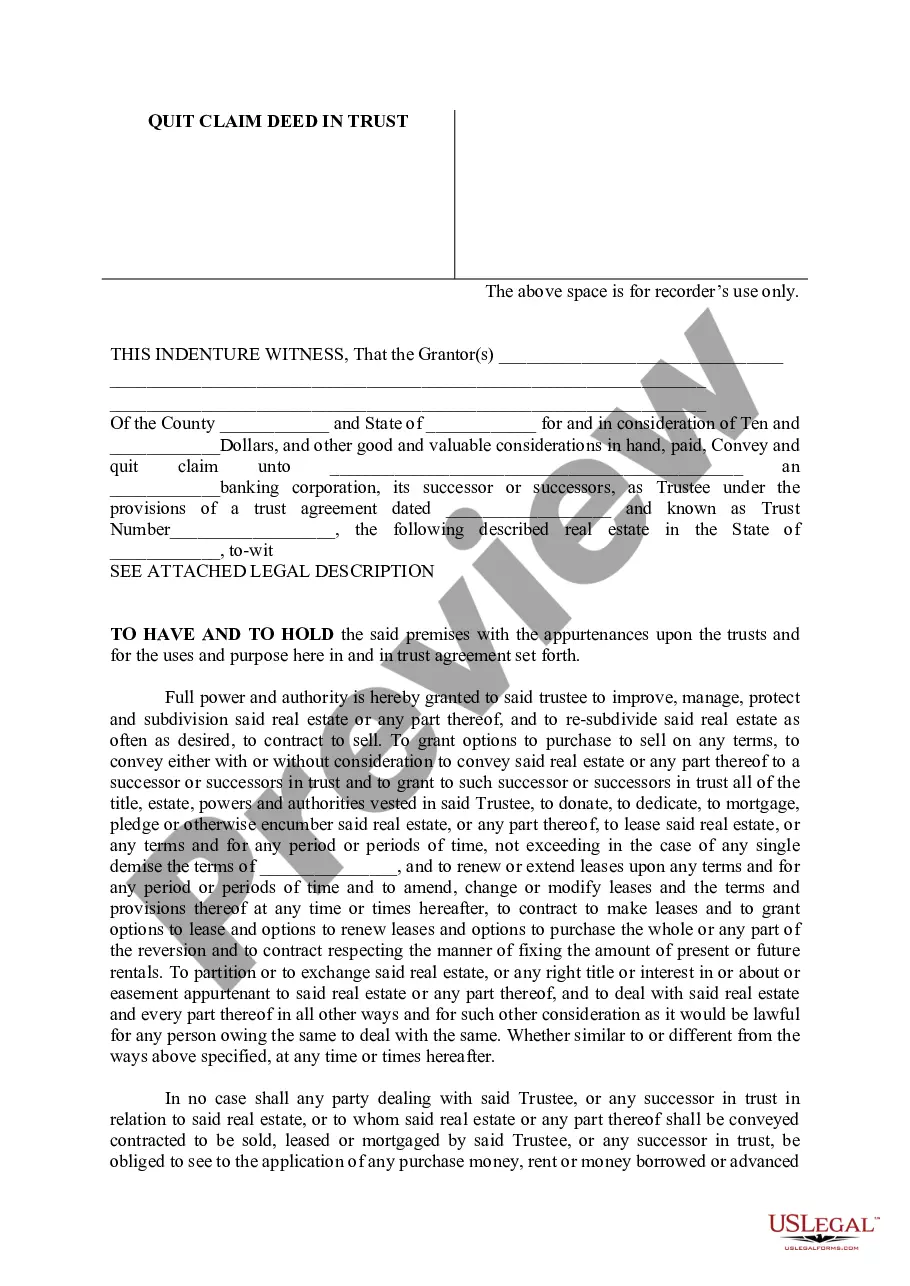

Elgin Illinois Quit Claim Deed in Trust

Description

How to fill out Illinois Quit Claim Deed In Trust?

If you are looking for a pertinent document, it’s impossible to select a more suitable service than the US Legal Forms site – likely the most extensive repositories on the web.

Here you can obtain thousands of template examples for business and personal use by categories and jurisdictions, or keywords.

With the excellent search functionality, finding the latest Elgin Illinois Quit Claim Deed in Trust is as simple as 1-2-3.

Finalize the transaction. Use your credit card or PayPal account to finish the registration process.

Receive the document. Select the file format and download it to your device. Edit it. Complete, alter, print, and sign the acquired Elgin Illinois Quit Claim Deed in Trust.

- Additionally, the relevance of each document is confirmed by a group of experienced attorneys who routinely review the templates on our platform and refresh them according to the latest state and county regulations.

- If you are already acquainted with our platform and possess an account, all you need to acquire the Elgin Illinois Quit Claim Deed in Trust is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the directions below.

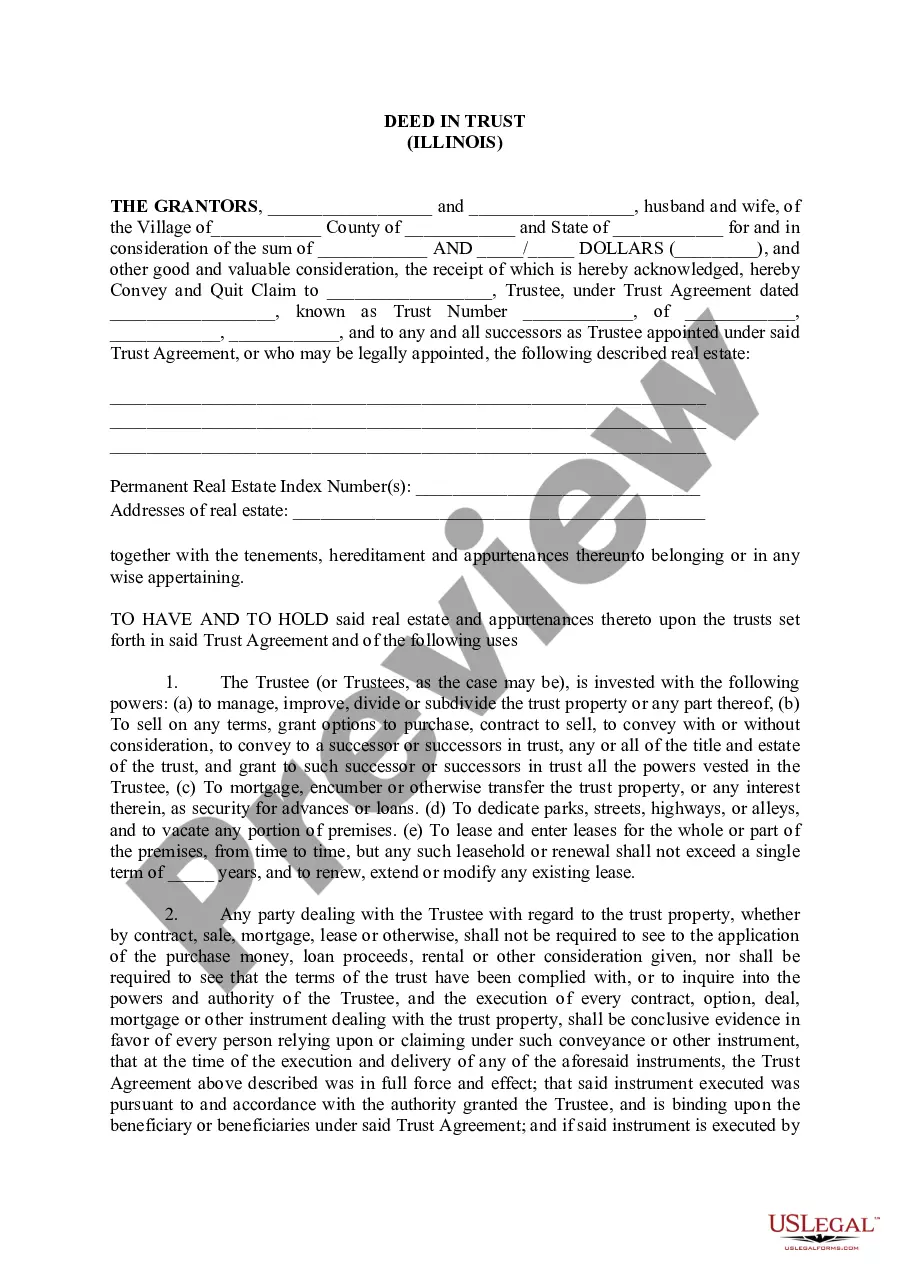

- Ensure you have opened the document you need. Verify its details and use the Preview option (if available) to examine its contents. If it doesn’t fulfill your requirements, utilize the Search feature at the top of the page to find the desired record.

- Confirm your choice. Select the Buy now option. Then, choose your desired subscription plan and provide details to register an account.

Form popularity

FAQ

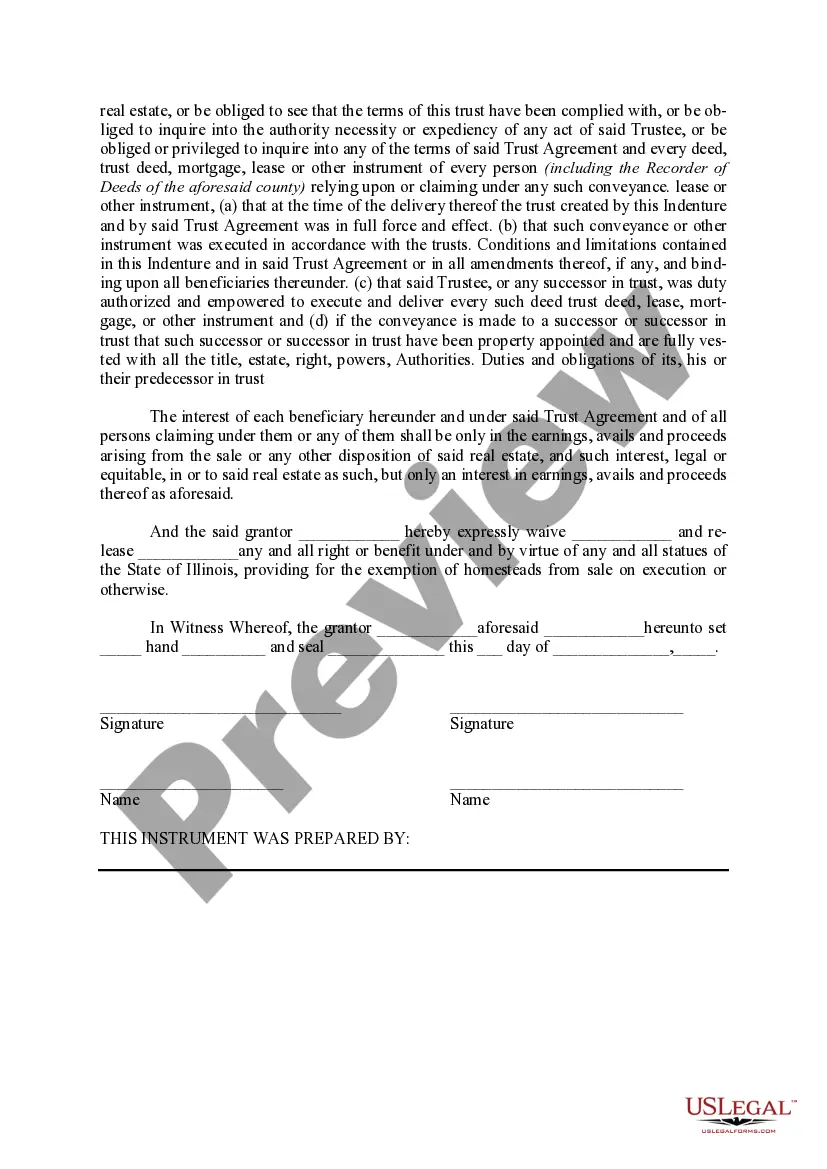

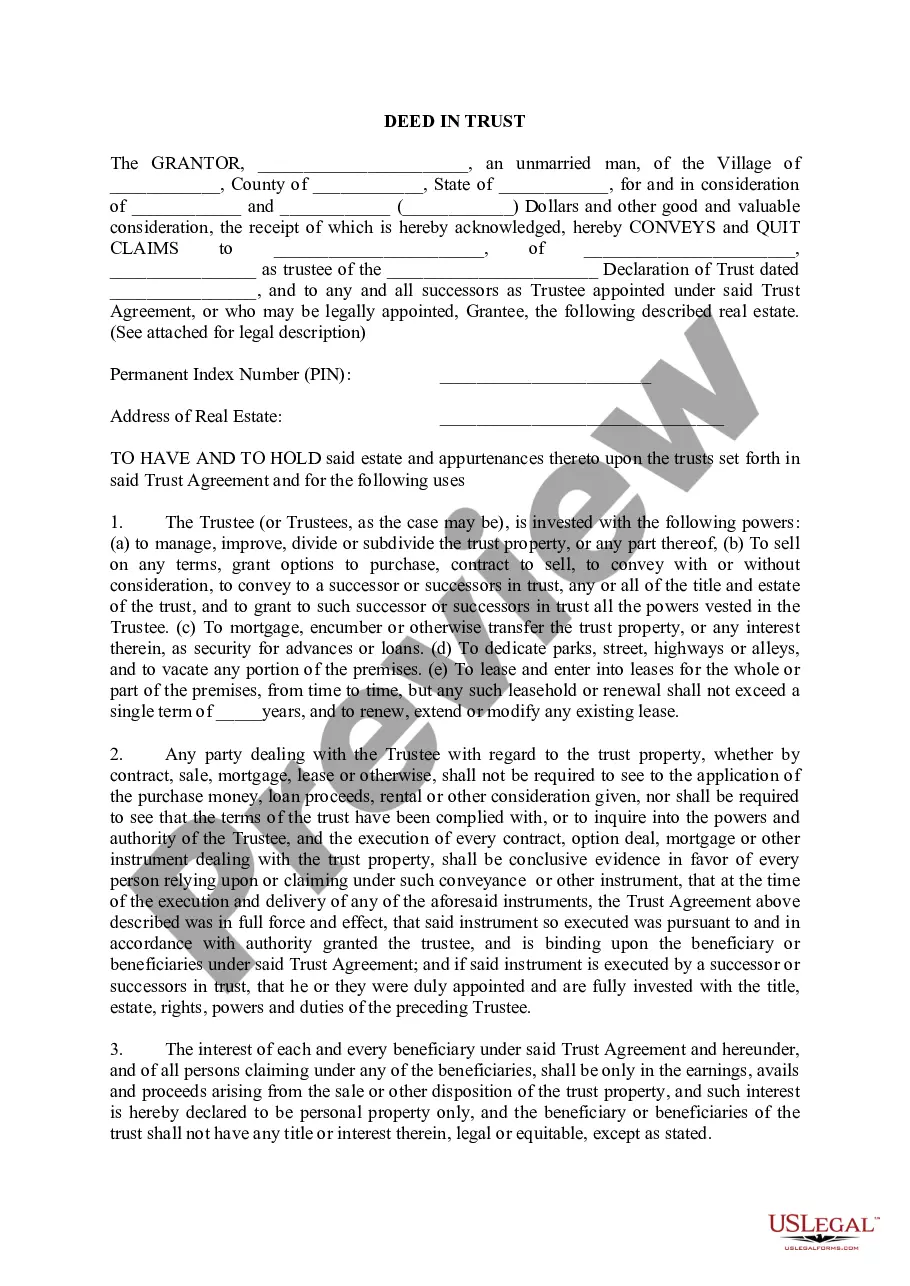

To quit claim a deed to a trust, start by preparing a quit claim deed form that specifies the trust as the new owner. Fill out the necessary details, including property description and trustees' names. After signing, file the deed with your local county recorder’s office to finalize the process and ensure that the transfer is legally documented.

You can obtain a copy of an Elgin Illinois Quit Claim Deed in Trust from the county recorder’s office in the area where the property is located. Many counties also have online databases that allow you to search for and request copies digitally. Alternatively, platforms like uslegalforms can provide templates and guidance to help you understand the process better.

To transfer a deed to a trust in Illinois, you must first create the trust document. Next, execute an Elgin Illinois Quit Claim Deed in Trust, clearly stating the trust as the grantee. Finally, record the deed with the appropriate county recorder’s office to ensure the transfer is legally recognized.

You do not need a lawyer to file an Elgin Illinois Quit Claim Deed in Trust, but having legal guidance can simplify the process. A lawyer can help ensure that the deed meets all legal requirements, preventing potential issues later on. However, many individuals successfully file the deed without legal assistance by using clear instructions and forms available online.

Once a quitclaim deed is filed, it generally conveys ownership permanently unless challenged in court. It effectively transfers interest in the property immediately upon execution. This immediate transfer is a key benefit of the Elgin Illinois Quit Claim Deed in Trust, as it simplifies property transactions.

A quitclaim deed cannot be used in situations involving financing, where lenders require more assurance about the property title. Additionally, it is typically not appropriate for transferring property in a divorce settlement or in cases where a warranty deed is necessary for legal protection. Evaluating your circumstance can guide your choice of using the Elgin Illinois Quit Claim Deed in Trust legally and effectively.

The primary disadvantage of a quit claim deed is that it provides no guarantees about the property title. This means you could inherit unresolved claims or liens on the property. Users should carefully consider these risks when deciding to use an Elgin Illinois Quit Claim Deed in Trust.

The choice between a trust deed and a quit claim deed depends on your specific situation. If you want to ensure that property is managed for you, a trust deed may be preferable. However, if you seek a quick transfer of property without the need for warranties, an Elgin Illinois Quit Claim Deed in Trust may suit your goals better.

You do not necessarily need a lawyer to file a quit claim deed in Illinois; however, consulting one can be beneficial. They can guide you through the process, ensuring that everything is completed correctly. Additionally, a lawyer can help you understand the implications of using an Elgin Illinois Quit Claim Deed in Trust.

While placing your house in a trust offers many advantages, there are some potential disadvantages to consider. For example, creating a trust may require legal fees and ongoing administrative costs. Additionally, the Elgin Illinois Quit Claim Deed in Trust does not shield your property from creditors, which can be a concern. It is important to weigh these factors against the benefits and consult with a professional to make the best decision for your situation.