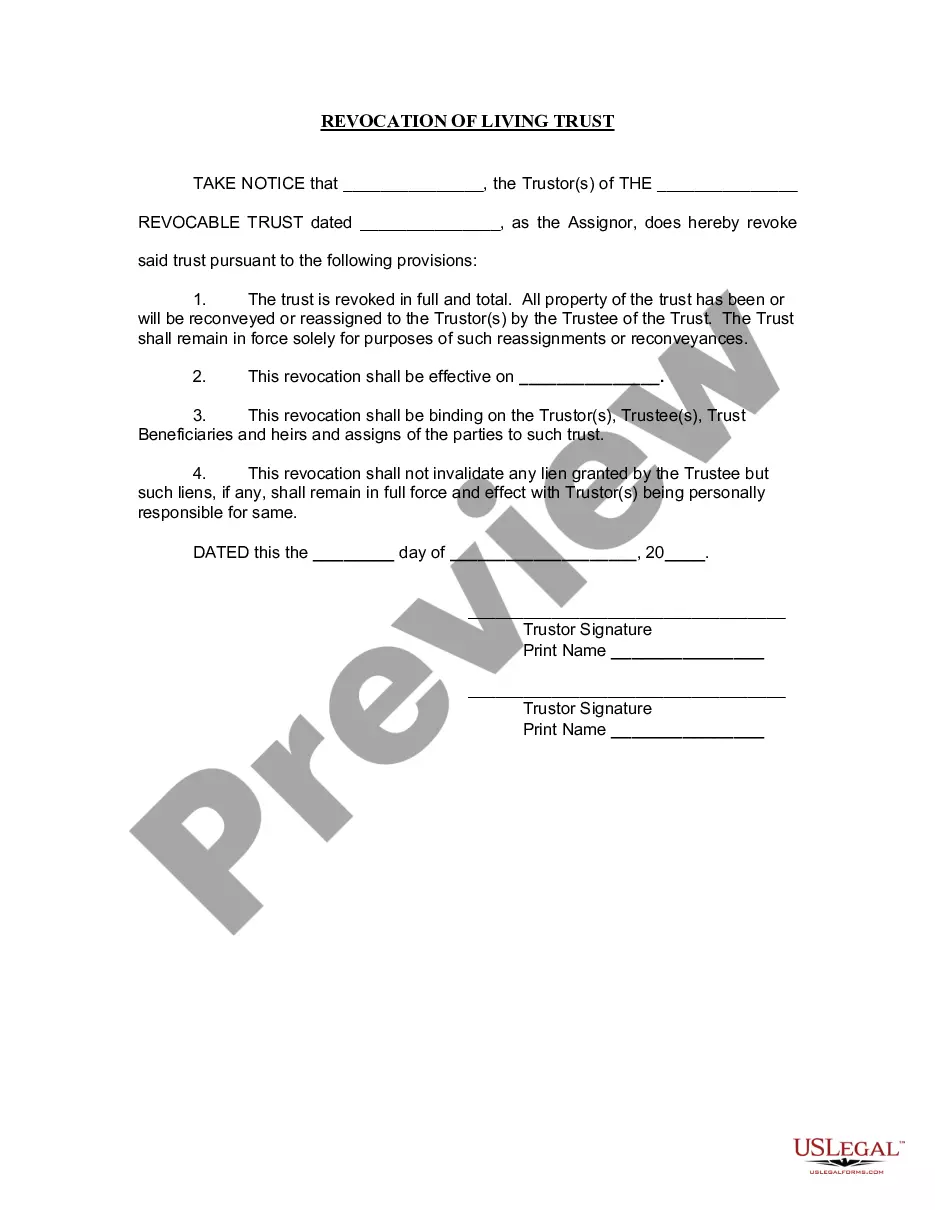

Chicago Illinois Revocation of Living Trust

Description

How to fill out Illinois Revocation Of Living Trust?

Regardless of one’s social or professional position, completing legal documents is a regrettable requirement in today’s workplace.

It is frequently nearly impossible for an individual lacking legal education to generate such paperwork from scratch, primarily due to the complex language and legal subtleties they involve.

This is where US Legal Forms steps in to assist.

Confirm that the template you have located is appropriate for your region, taking into account that the laws of one state or county may not apply to another.

Examine the document and review a brief description (if available) of situations for which the document can be utilized.

- Our service boasts a vast library of over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms serves as an excellent tool for legal associates or advisers seeking to enhance their efficiency with our DIY forms.

- Whether you require the Chicago Illinois Revocation of Living Trust or any other legal documents applicable in your state or county, US Legal Forms makes everything accessible.

- Here’s the method to quickly acquire the Chicago Illinois Revocation of Living Trust using our reliable service.

- If you are already a member, you can proceed to Log In to your account to retrieve the necessary form.

- If you are unfamiliar with our platform, make sure to follow these steps before acquiring the Chicago Illinois Revocation of Living Trust.

Form popularity

FAQ

A settlor can revoke a trust, if the original trust document allows this action. The trust is fully valid. It only comes to an end when the settlor fully revokes it. mistake.

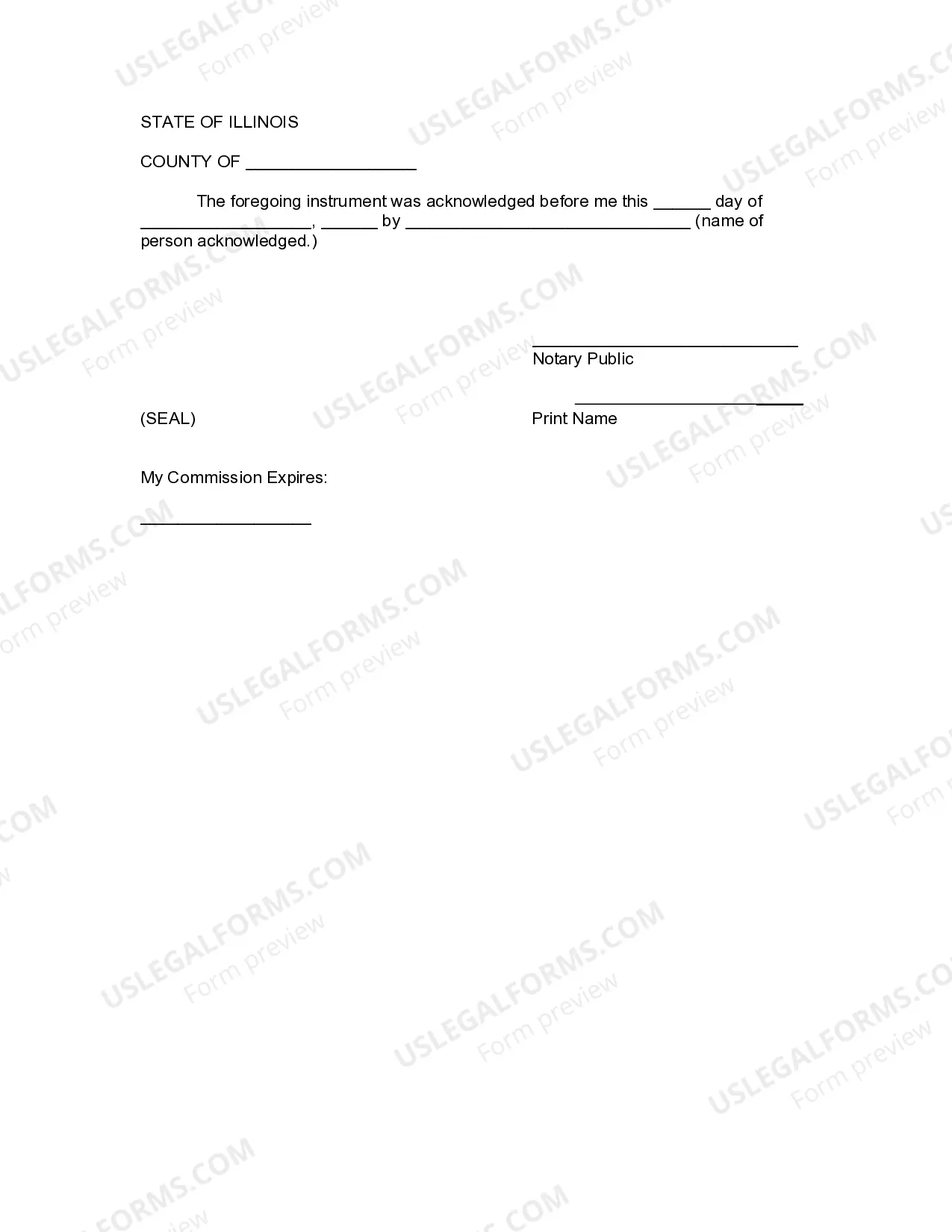

Here are the steps you can take when revoking a trust in Illinois: Remove All Property from the Trust.Fill out a Revocation Declaration.Review your Revocation.Finalize the Declaration with a Notary as Witness.Submit or Store your Declaration.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.

By definition and design, an irrevocable trust is just that?irrevocable. It can't be amended, modified, or revoked after it's formed.

How do you terminate a trust in Illinois? Even if a trust is considered ?irrevocable,? Illinois court still has the authority to modify or revoke an irrevocable trust. Trustees and beneficiaries of an irrevocable trust can petition to have the trust modified or even terminated with a judge's approval.

With an irrevocable trust, the transfer of assets is permanent. So once the trust is created and assets are transferred, they generally can't be taken out again. You can still act as the trustee but you'd be limited to withdrawing money only on an as-needed basis to cover necessary expenses.

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.

Most states allow all the beneficiaries to agree in writing to dissolve the trust. This requires unanimity and there may be additional requirements such as statements explaining the legal and tax effects to the beneficiaries on termination. Each state is different. You should consult a professional on this.