Chicago Illinois Irrevocable Pot Trust Agreement

Description

A Pot Trust is a trust set up for more than one beneficiary, typically children. The purpose of a Pot Trust is to keep the funds in one pot until a later event. For example, at the death of the parents, the assets may be kept in one pot until all the children have graduated from college or reached age 21.

How to fill out Irrevocable Pot Trust Agreement?

How long does it typically take you to create a legal document.

Considering each state has its own laws and regulations for various life circumstances, finding a Chicago Irrevocable Pot Trust Agreement that meets all local standards can be overwhelming, and obtaining it from a legal professional is frequently expensive.

Numerous online platforms provide the most prevalent state-specific documents for download; however, utilizing the US Legal Forms library is the most advantageous.

Create an account on the platform or Log In to move on to payment methods. Pay through PayPal or a credit card. Modify the file format if necessary. Click Download to save your Chicago Irrevocable Pot Trust Agreement. Print the document or utilize any preferred online editor to complete it digitally. Regardless of how many times you need to utilize the purchased template, you can find all the samples you have ever downloaded in your profile by accessing the My documents tab. Give it a try!

- US Legal Forms is the largest online directory of templates, organized by states and areas of application.

- In addition to the Chicago Irrevocable Pot Trust Agreement, you can access any particular document to manage your business or personal activities, adhering to your regional standards.

- Experts validate all samples for their accuracy, ensuring you can prepare your paperwork appropriately.

- Using the service is quite straightforward.

- If you already possess an account on the platform and your subscription is active, you simply need to Log In, select the needed form, and download it.

- You can retrieve the file in your profile at any time later.

- Conversely, if you are unfamiliar with the website, there will be a few additional steps to follow before obtaining your Chicago Irrevocable Pot Trust Agreement.

- Review the content of the page you are on.

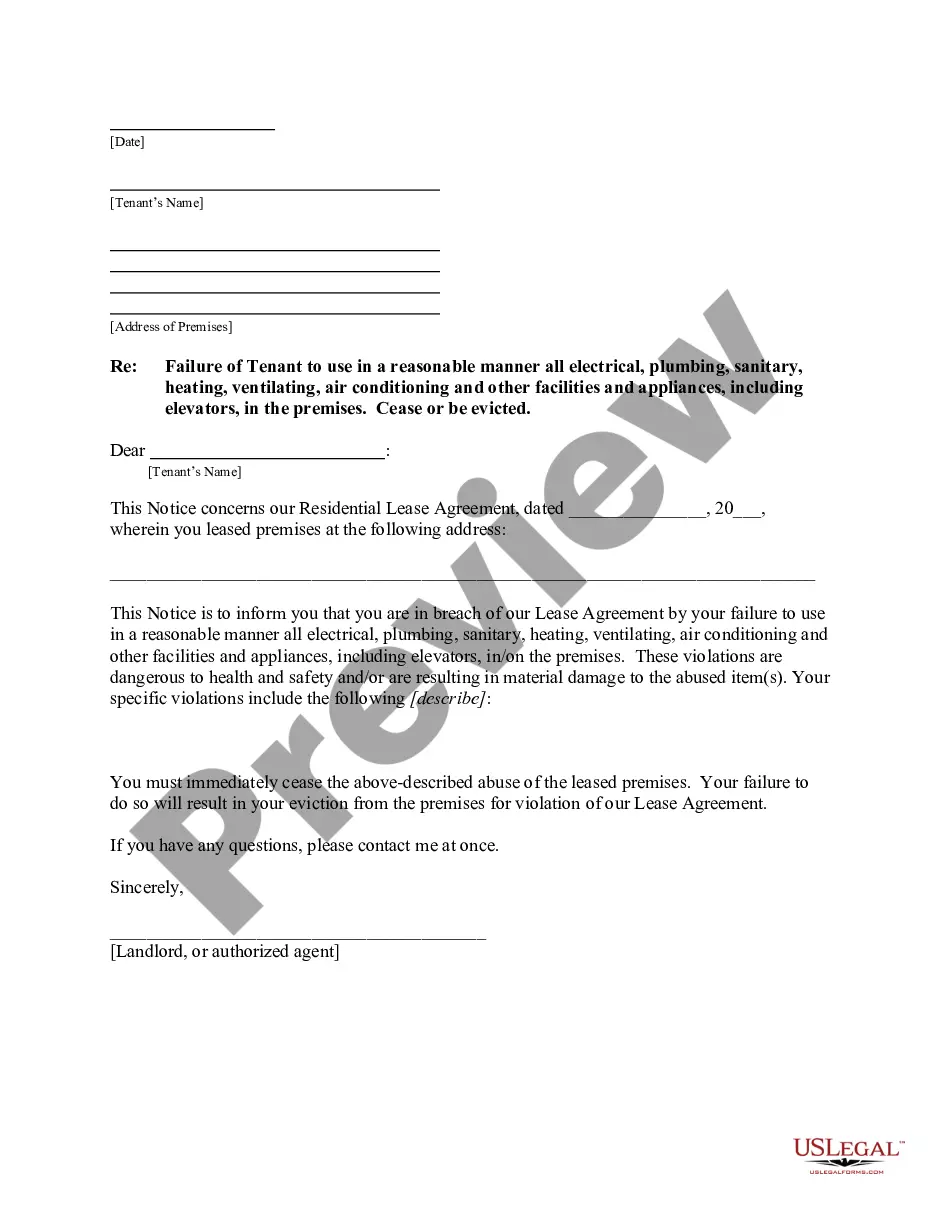

- Examine the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you are confident in your selected file.

- Select the subscription plan that best fits your needs.

Form popularity

FAQ

The lookback period for an irrevocable trust is primarily set at five years. This means that any gifts or transfers made to a Chicago Illinois Irrevocable Pot Trust Agreement must be accounted for if you apply for certain government benefits. Understanding this lookback period is crucial for individuals aiming to protect their assets while planning for future healthcare needs, ensuring they meet the required criteria without complications.

Avoiding the 5-year lookback rule can be complex; however, strategic planning can help. One approach is utilizing a Chicago Illinois Irrevocable Pot Trust Agreement to structure your assets effectively from the beginning, or potentially establish spending plans that comply with Medicaid requirements. Furthermore, consulting with an estate planning attorney can provide personalized strategies to safeguard your interests without triggering the lookback period.

The 5 year rule for an irrevocable trust dictates that any assets transferred into such a trust may be subject to a waiting period before they are completely protected from creditors and government claims. Specifically, if you create a Chicago Illinois Irrevocable Pot Trust Agreement, any asset transferred into the trust must be held for five years to ensure that it is not included in your estate for Medicaid qualification. This rule is essential for long-term planning, as it helps in calculating eligibility for certain types of benefits.

Yes, you can establish an irrevocable trust for yourself, as long as it is drafted correctly and complies with Illinois laws. A Chicago Illinois Irrevocable Pot Trust Agreement can provide significant advantages, such as asset protection and tax benefits. However, it's essential to understand that once created, you typically relinquish control over the assets in the trust. Consulting an attorney can provide clarity and assist you in establishing the trust you need.

In most cases, a trust does not need to be filed with the court in Illinois. However, certain circumstances, such as probate or real estate transactions, may require filing specific documents. Ensuring compliance with legal requirements related to your Chicago Illinois Irrevocable Pot Trust Agreement is crucial to maintain its benefits. Legal guidance can clarify any necessary steps for your trust.

Yes, a trust can hold up in court if it complies with state laws and reflects the grantor's intentions. Courts generally uphold valid trusts, such as a Chicago Illinois Irrevocable Pot Trust Agreement, unless there's evidence of fraud or undue influence. It’s essential to ensure that your trust is drafted properly to withstand potential legal challenges. Working with a knowledgeable attorney can strengthen your trust's integrity.

In Illinois, trusts are not typically recorded in a public registry. However, specific documents, like a Chicago Illinois Irrevocable Pot Trust Agreement, may need to be filed with relevant authorities if they involve real estate. Recording can add a level of legal protection, so review your situation with an expert. This helps you understand any necessary steps for your unique trust arrangement.

To make a trust enforceable in Illinois, you should ensure it meets specific legal requirements, such as being in writing and having a clear intent to create the trust. Additionally, the trust must have identifiable beneficiaries and a designated trustee responsible for managing the assets. A properly drafted Chicago Illinois Irrevocable Pot Trust Agreement can help secure enforceability, so consider working with a legal professional to guide you.

In Illinois, beneficiaries do have the right to request access to the terms of a trust, including a Chicago Illinois Irrevocable Pot Trust Agreement. This access allows beneficiaries to understand their rights and obligations under the trust. However, the level of access can depend on the specific terms set forth by the trust creator. To ensure proper management, consult an expert in trust law.

To write an irrevocable trust document, begin by identifying the assets to be placed in the trust and defining the beneficiaries. Clearly outline the terms governing the distribution and usage of the assets. Using a Chicago Illinois Irrevocable Pot Trust Agreement template can streamline this process while ensuring your intentions and the legal requirements are met.