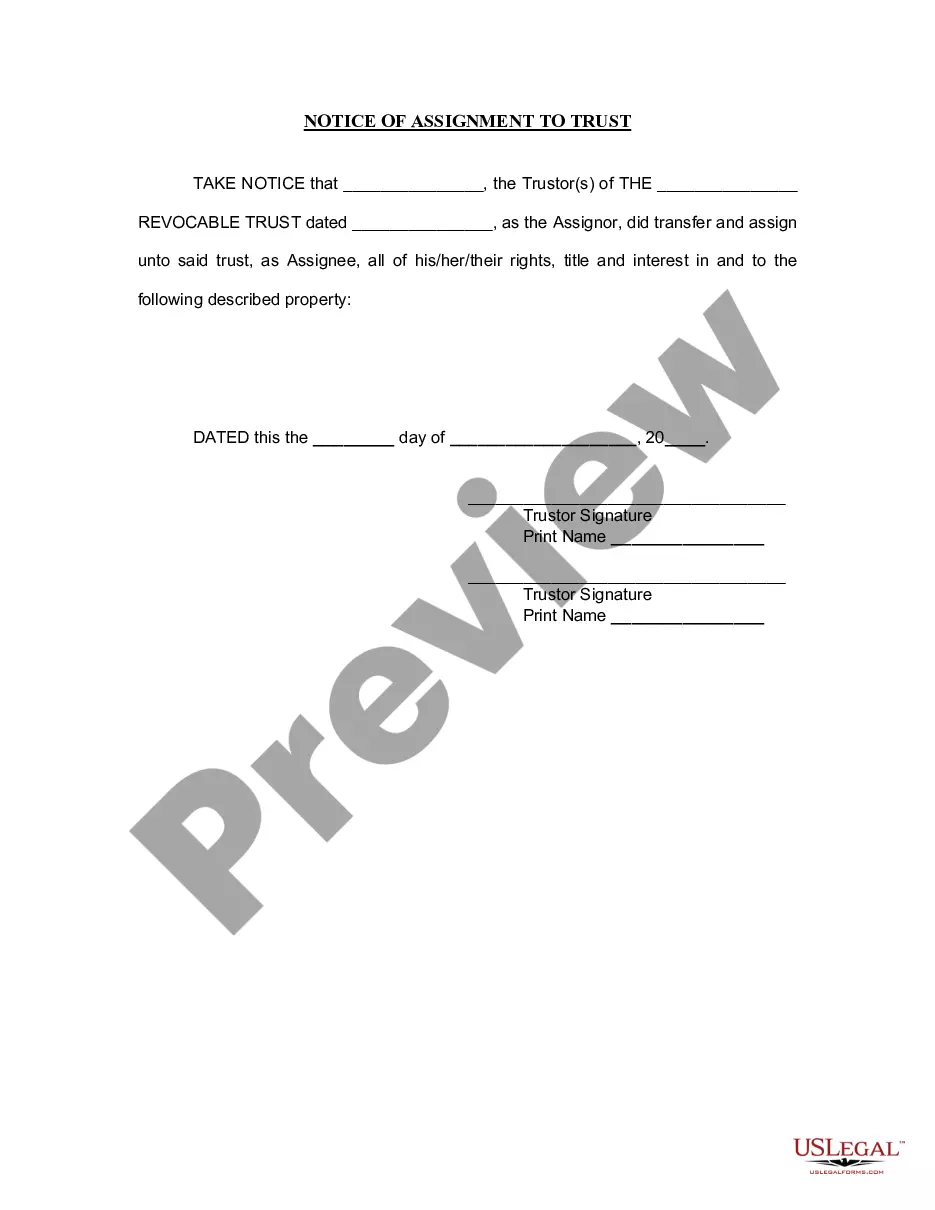

Cook Illinois Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out Illinois Notice Of Assignment To Living Trust?

Capitalize on the US Legal Forms and gain immediate access to any form you need.

Our user-friendly site with an extensive array of templates makes it easy to locate and acquire nearly any document sample you require.

You can download, complete, and endorse the Cook Illinois Notice of Assignment to Living Trust in just a few moments instead of spending hours online searching for the appropriate template.

Utilizing our collection is an excellent approach to enhance the security of your form submissions.

If you haven't created an account yet, follow the steps outlined below.

Navigate to the page with the template you need. Verify that it is the document you were searching for: check its title and description, and utilize the Preview feature when available. Alternatively, use the Search box to find the required one.

- Our experienced attorneys routinely review all the documents to ensure that the forms are suitable for a specific state and adherent to new laws and regulations.

- How can you obtain the Cook Illinois Notice of Assignment to Living Trust.

- If you already hold a subscription, simply Log In to your account.

- The Download option will be available on all the samples you view.

- Furthermore, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

Determining whether your parents should place their assets in a trust depends on their financial goals and family dynamics. A trust can provide benefits like avoidance of probate, but it’s essential to carefully evaluate its suitability. If they are considering a Cook Illinois Notice of Assignment to Living Trust, exploring resources such as USLegalForms can help clarify the benefits and set up a trust that aligns with their needs.

A key downside of placing assets in a trust involves the loss of direct control over those assets. Once you transfer assets into a trust, you must adhere to the trust's terms, which may limit your flexibility. For individuals considering a Cook Illinois Notice of Assignment to Living Trust, it's important to understand these implications and consult with legal professionals to navigate potential challenges.

Trust funds can sometimes create dependency among beneficiaries, discouraging them from becoming financially independent. Furthermore, if not set up correctly, a trust fund may not provide the intended benefits. For those looking at a Cook Illinois Notice of Assignment to Living Trust, it’s crucial to ensure that the trust is structured to support rather than hinder beneficiaries’ financial growth.

One disadvantage of a family trust is the potential for increased administrative costs. Maintaining a family trust may require ongoing legal assistance, which can add up over time. Additionally, if a Cook Illinois Notice of Assignment to Living Trust is not handled properly, it can create confusion among beneficiaries. It's essential to weigh these factors when considering a family trust.

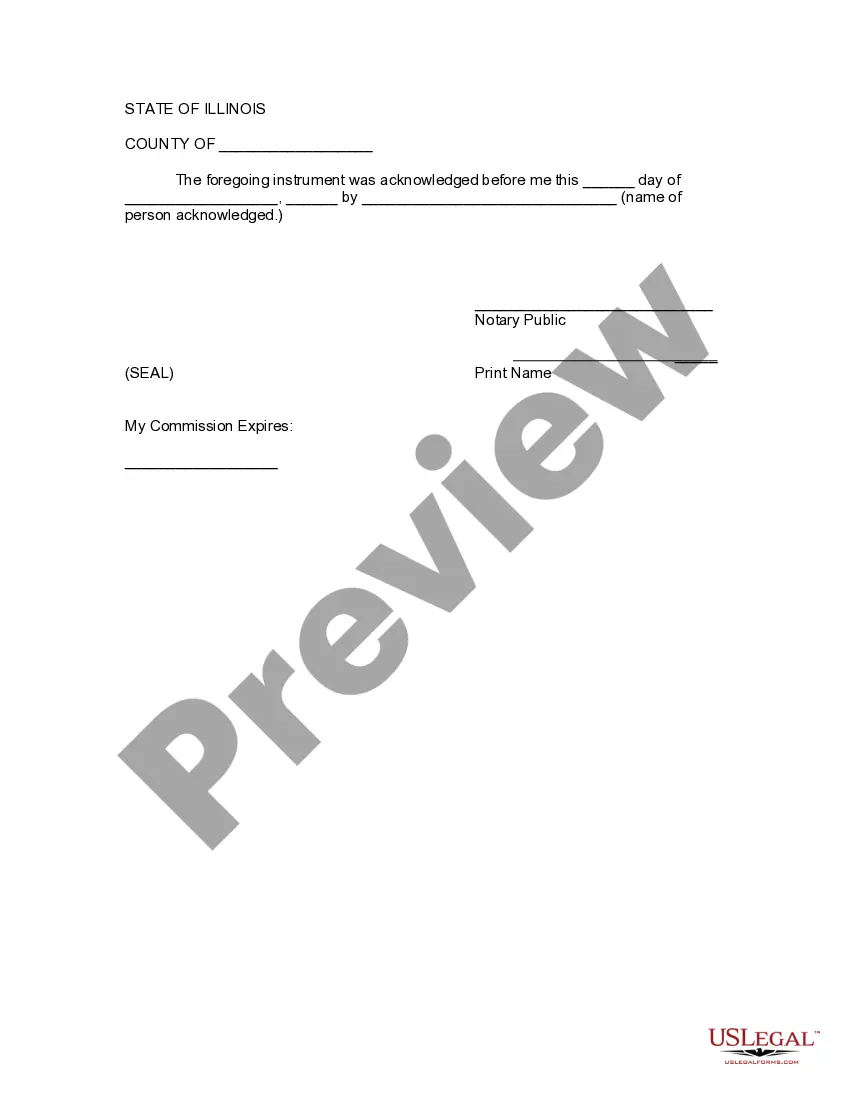

Transferring your property into a trust in Illinois involves filing a Cook Illinois Notice of Assignment to Living Trust. Begin by drafting this document, which should describe the property and the trust's terms. After you sign the document, it is essential to notarize it and then file it with the county recorder. This process not only clarifies your intentions, but also protects your assets effectively.

To transfer property to a trust in Illinois, you need to create a Cook Illinois Notice of Assignment to Living Trust. This document clearly outlines the property being transferred and the details of the trust. Once you have completed the notice, you should sign it in front of a notary public. Finally, you must record the assignment with the county recorder to ensure the transfer is legally recognized.

In Illinois, a trust does not need to be filed with the court to be valid. However, when creating a Cook Illinois Notice of Assignment to Living Trust, it's important to ensure that all necessary documents are properly prepared and executed to establish the trust's authority. While you may not file the trust itself, some related documents might require court involvement, such as when disputes arise or in cases of asset transfer. Using resources like US Legal Forms can help you navigate these requirements effectively.

While putting property in a trust can offer benefits, it also has disadvantages. One common issue is the potential for loss of control; once property goes into a trust, the trustee manages it, which can limit your access. Furthermore, using a Cook Illinois Notice of Assignment to Living Trust involves costs, such as fees for setting up and maintaining the trust. Understanding these drawbacks is key to making an informed decision.

One of the biggest mistakes parents make when setting up a trust fund is failing to properly fund the trust. Without transferring assets into the trust, it cannot function as intended. Additionally, many overlook the importance of using a Cook Illinois Notice of Assignment to Living Trust document to ensure clarity and legality in the process. Remember, a well-funded trust can provide strong protection and benefits for your heirs.