Chicago Illinois Assignment to Living Trust

Description

How to fill out Illinois Assignment To Living Trust?

If you have previously utilized our service, Log In to your account and retrieve the Chicago Illinois Assignment to Living Trust on your device by selecting the Download button. Make sure your subscription is active. If it isn't, renew it according to your billing plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have acquired: you can locate it in your profile under the My documents section whenever you wish to reuse it. Make use of the US Legal Forms service to swiftly find and save any template for your individual or professional requirements!

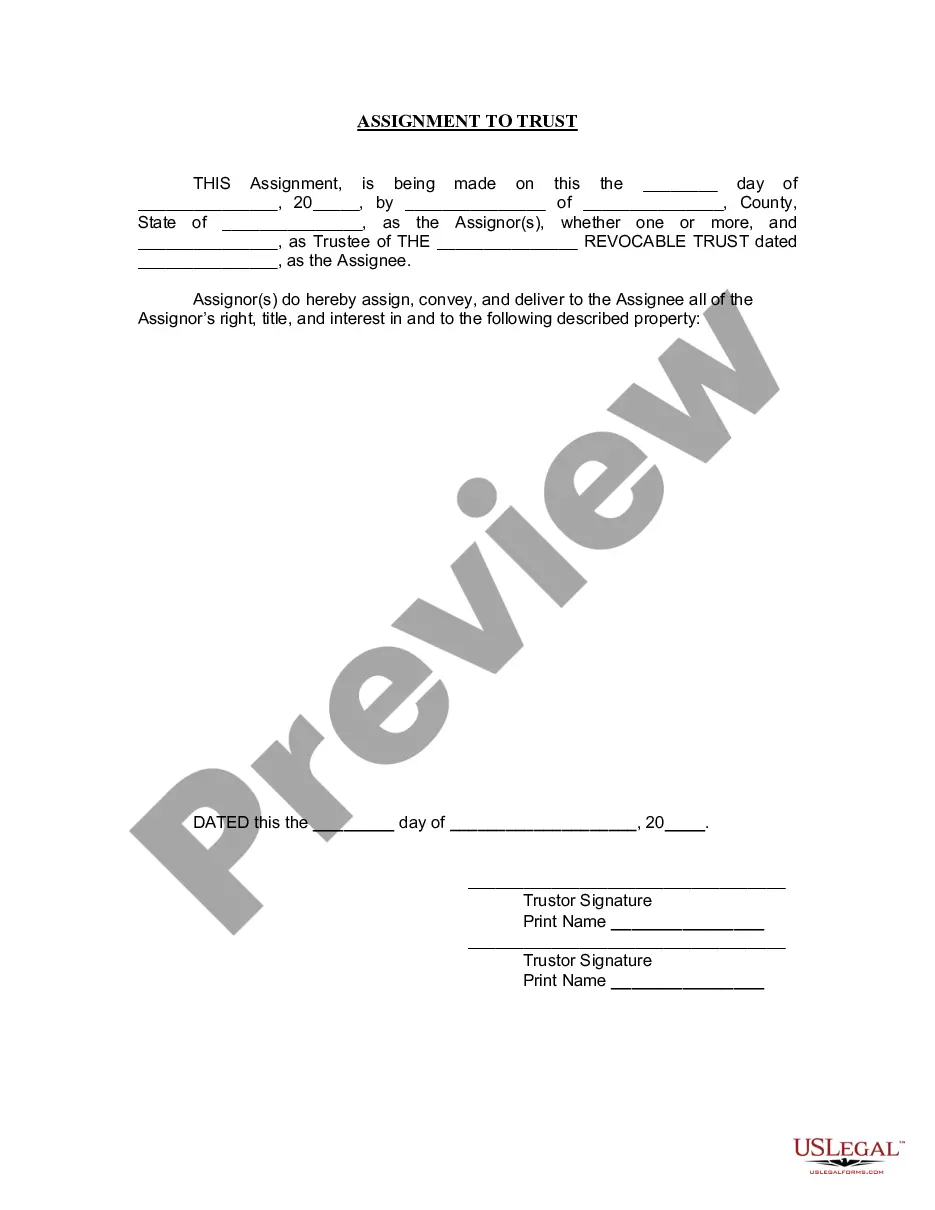

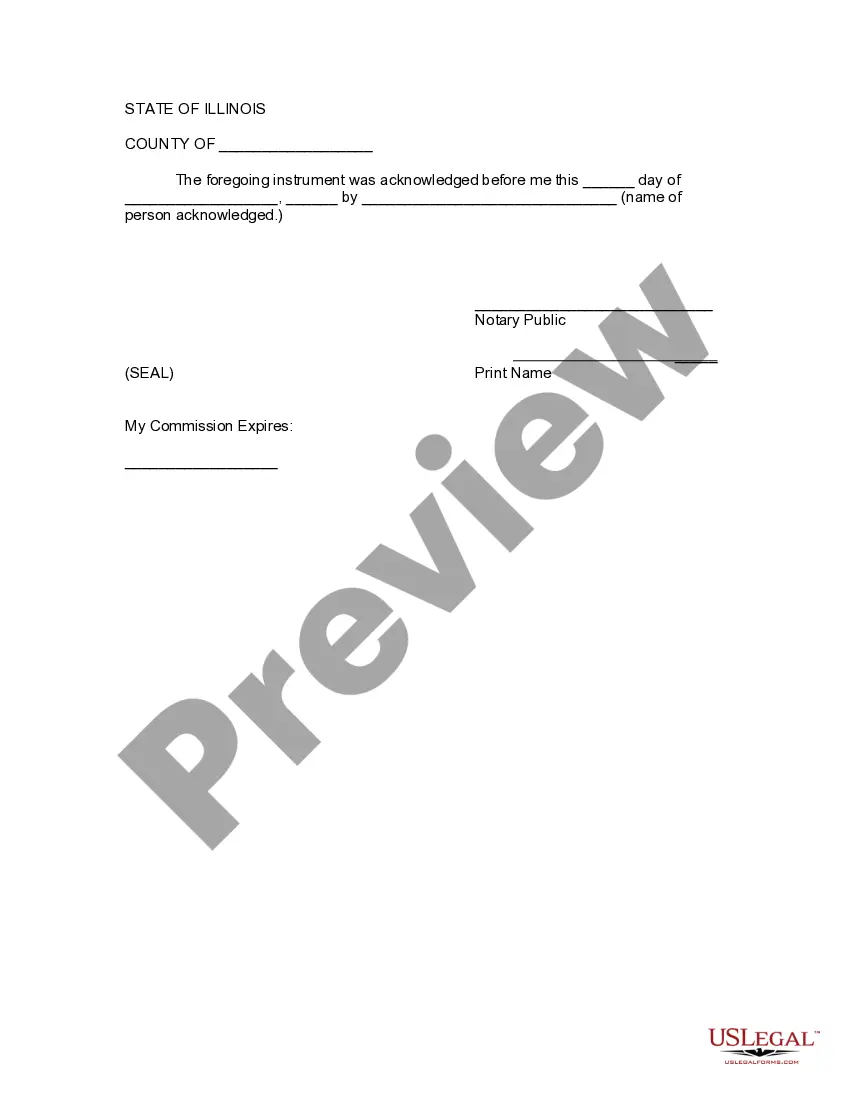

- Confirm you have located the correct document. Review the description and use the Preview option, if available, to verify if it fulfills your needs. If it does not satisfy you, use the Search feature above to find the suitable one.

- Buy the template. Hit the Buy Now button and choose a monthly or yearly subscription option.

- Create an account and finalize your payment. Enter your credit card information or select the PayPal option to complete the transaction.

- Access your Chicago Illinois Assignment to Living Trust. Choose the file format for your document and save it to your device.

- Complete your template. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

What Types of Assets are Not Subject to Probate in Illinois? Retirement accounts (such as 401Ks or IRAs) or life insurance policies, as long as a beneficiary has been named; Property held in a living trust; U.S. savings bonds that are co-owned or registered in pay-upon-death (POD) form. Pension plan distribution;

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

The settlor establishes the trust by transferring the property. The trustee is the person in charge of managing the trust. The beneficiary is the one who will benefit from the trust. As the new legal owner of the property, the trustee manages it according to the settlor's wishes outlined in the deed.

Every estate does not have to go through probate. Probate is the legal process to make sure that a deceased person's debts and taxes are paid. In Illinois, a lawyer is required for probate unless the estate is valued at or less than $100,000 and does not have real estate.

To make a living trust in Illinois, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Mechanism of Transfer Real estate is transferred through the execution of the appropriate deed transferring the real estate property to the Trust. You or your attorney must then record the deed with the Recorder of Deeds for your county.

A living trust is a legal framework that you can place assets and property in. The trust is established by a document. A trust has a trustee who is in charge of managing the trust and distributing the property to the trust's beneficiaries according to its instructions.

Living Trusts In Illinois, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

To make a living trust in Illinois, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.