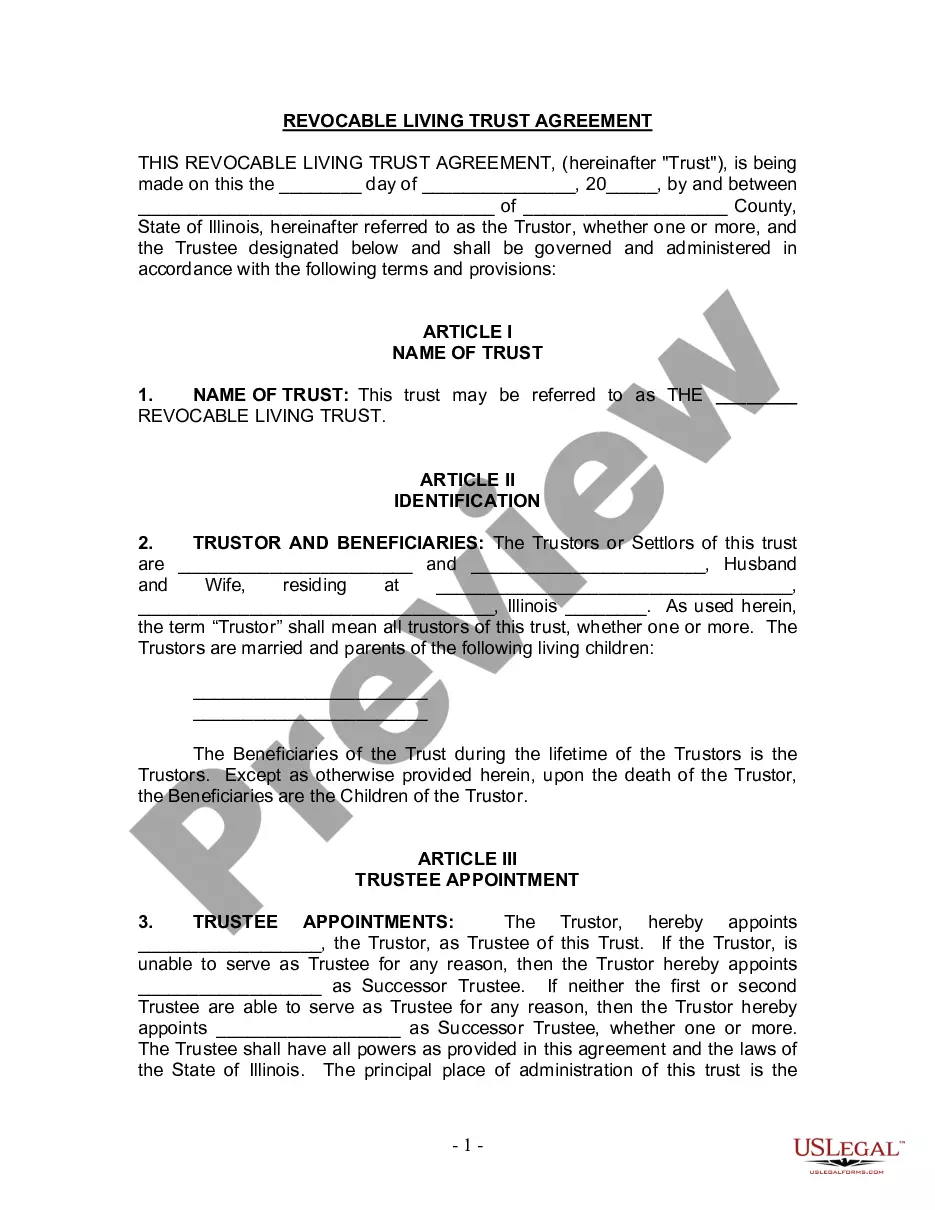

Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Illinois Living Trust For Husband And Wife With Minor And Or Adult Children?

If you have already utilized our service previously, Log In to your account and store the Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children on your device by clicking the Download button. Ensure that your subscription is active. If it isn’t, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to refer to it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Confirm you’ve found the correct document. Review the description and employ the Preview option, if available, to determine if it meets your requirements. If it falls short, use the Search tab above to find the appropriate one.

- Purchase the template. Hit the Buy Now button and choose a monthly or yearly subscription option.

- Establish an account and process a payment. Enter your credit card information or utilize the PayPal option to finalize the purchase.

- Receive your Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children. Select the file format for your document and save it to your device.

- Complete your form. Print it out or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Yes, placing your house in a trust can be beneficial in Illinois. By creating an Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children, you can avoid probate, which simplifies asset distribution for your loved ones. This arrangement also provides privacy regarding your estate plans, as trusts typically do not undergo public record scrutiny. Overall, it’s a smart move for many couples with children.

Yes, you can make your own living trust in Illinois, and many people successfully do so. To create an Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children, you can use online resources or legal forms that help streamline the process. Remember, it's important to follow all necessary legal requirements to ensure that your trust is valid and enforceable.

You can create your own living trust in Illinois if you feel confident in navigating the requirements. Utilizing templates and resources, such as those offered by US Legal Forms, can simplify this process, especially for an Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children. However, double-checking your work is essential to ensure your trust meets all legal standards.

Yes, you can set up a trust without an attorney in Illinois, but it requires careful attention to detail. Using resources like US Legal Forms can guide you through the process of creating an Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children. Ensure you understand all legal requirements to avoid mistakes in the trust's formation.

It depends on your specific family situation and financial goals. Many couples choose to create a joint Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children, simplifying management and distribution of assets. However, some may benefit from separate trusts, especially if they have different financial contributions or unique assets that they want to protect individually.

One of the biggest mistakes parents often make is not properly funding the trust. Without adequate assets placed in the trust, it cannot serve its purpose, especially when it comes to an Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children. It's crucial to ensure that all eligible assets are transferred into the trust to effectively protect your family's financial interests.

In Illinois, you do not file a trust with the court unless necessary under certain circumstances. Instead, ensure you have a properly drafted trust document and that your assets are titled in the name of the trust. For creating your Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children, consider using US Legal Forms, which can provide you with the necessary resources to complete this process accurately and efficiently.

A trust generally does not have to be filed with the court in Illinois, which adds a level of privacy to your estate planning. For your Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children, keeping the trust private can be a significant benefit. However, if the trust becomes irrevocable or if it needs to be validated, you may need to involve the court. Consulting a legal expert can clarify your specific circumstances.

To establish a living trust in Illinois, you first need to draft the trust document detailing your wishes. Next, you transfer ownership of your assets to the trust. This process is crucial for your Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children, as it ensures that the trust is funded correctly. If you need assistance, platforms like US Legal Forms offer templates and guides to help you through this process effectively.

In Illinois, a trust does not need to be recorded as part of public records. However, keeping a detailed trust document is essential for the effective management of your Elgin Illinois Living Trust for Husband and Wife with Minor and or Adult Children. This record will help you ensure clarity and facilitate the distribution of your assets according to your wishes. It is advisable to consult with a legal professional to ensure your trust aligns with state laws.