Cook Illinois Closing Statement

Description

How to fill out Illinois Closing Statement?

Do you require a trustworthy and cost-effective legal forms provider to purchase the Cook Illinois Closing Statement? US Legal Forms is your ideal option.

Whether you need a simple contract to establish rules for living with your partner or a collection of documents to process your separation or divorce through the court, we've got you covered. Our website offers over 85,000 current legal document templates for personal and business purposes. All templates that we provide are not generic and are tailored based on the requirements of particular states and regions.

To acquire the form, you must Log In to your account, locate the desired form, and click the Download button adjacent to it. Please remember that you can download your previously purchased document templates at any time from the My documents tab.

Are you new to our platform? No need to worry. You can set up an account with great ease, but first, ensure you do the following.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Cook Illinois Closing Statement in any available format. You can revisit the website at any time and redownload the form without any additional costs.

Finding current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time searching for legal papers online for good.

- Verify if the Cook Illinois Closing Statement adheres to the rules of your state and locality.

- Review the form’s description (if accessible) to determine who and what the form is suitable for.

- Restart the search if the form is not appropriate for your legal circumstance.

Form popularity

FAQ

To claim your Illinois property tax refund, start by gathering your closing statement from Cook Illinois, which outlines your property tax details. Next, fill out the necessary forms to initiate your refund claim. After completing the forms, submit them to the appropriate Illinois tax authority along with your documentation. Utilizing platforms like US Legal Forms can simplify this process, providing guidance and essential forms needed for your claim.

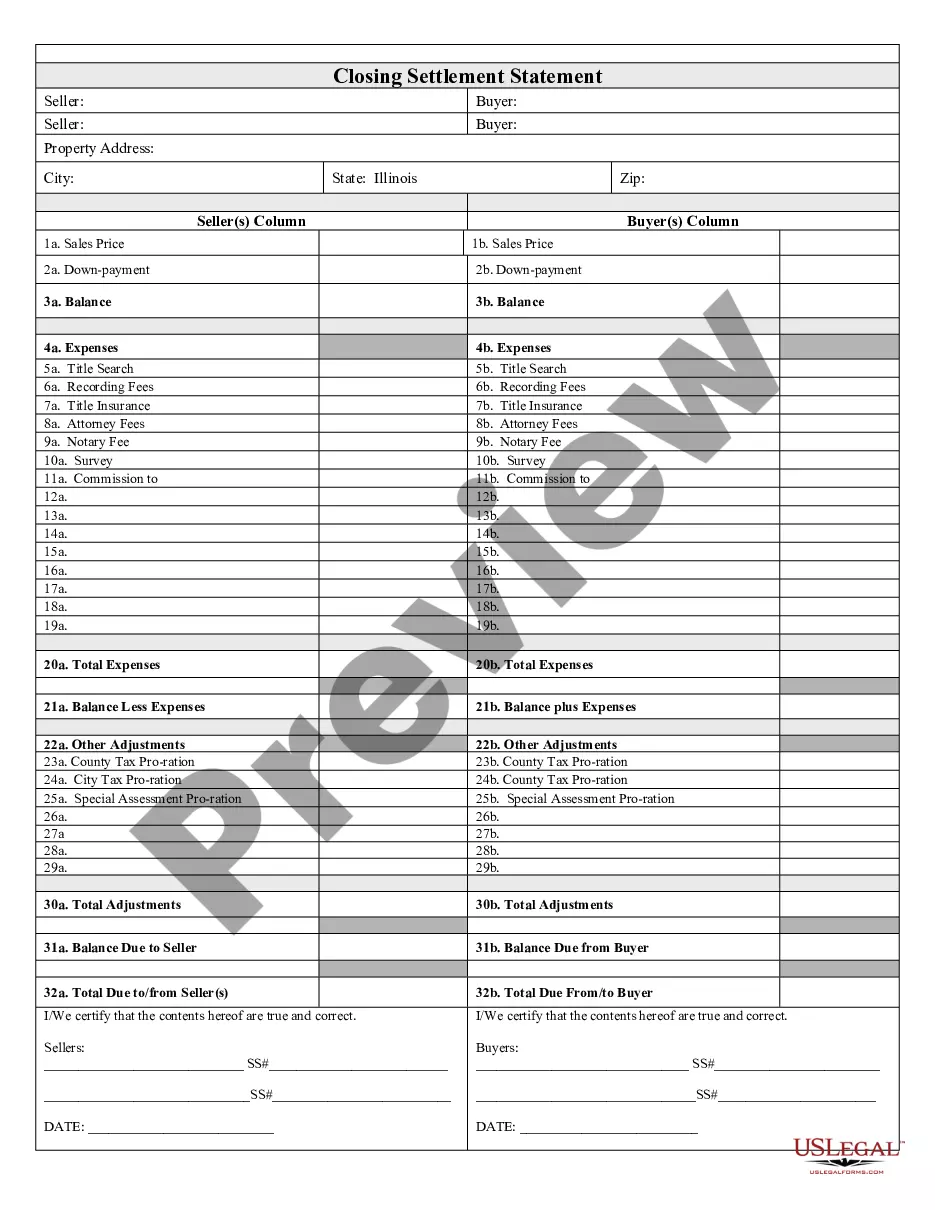

A seller's closing statement is a document that provides a detailed account of the seller's financial obligations and proceeds from the sale of a property. It outlines any deductions, such as closing costs or commissions, that will affect the final amount the seller receives. Familiarizing yourself with the Cook Illinois Closing Statement can ensure you understand all elements impacting your sale.

A closing statement summarizes all financial details involved in a real estate transaction. It details credits and debits for both the buyer and seller, ensuring all parties understand their financial position. When you review the Cook Illinois Closing Statement, you will find a comprehensive outline of what you owe and what you will receive at closing.

A seller's closing certificate certifies that the seller has met all obligations during the sale process. It typically confirms that all necessary documents are in place and accurately reflect the transaction. When considering the Cook Illinois Closing Statement, this certificate serves as a crucial part of ensuring transparency and legal compliance.

You can find your closing statement typically through your real estate attorney or title company. After the closing process, the Cook Illinois Closing Statement is usually provided to both the buyer and seller for review. If you need assistance obtaining this document, platforms like uslegalforms can simplify the process and clarify any confusion.

The closing process in Illinois includes several steps: preparing documents, conducting a title search, negotiating closing costs, and finally, signing the Cook Illinois Closing Statement. Each step is crucial for ensuring that the transaction proceeds smoothly. Communication with your real estate agent and attorney can also help clarify each phase.

Typically, closing on a house in Illinois can take anywhere from 30 to 60 days from the time an offer is accepted. Factors such as property inspections and financing can influence this timeline. By staying informed about the Cook Illinois Closing Statement and all related documentation, you can help expedite the process.

To obtain a copy of your Cook County property tax bill, visit the Cook County Treasurer's website. You can search for your property using your address or property index number. Once you locate your property, you can download or print your tax bill directly from the site. Keeping track of your Cook Illinois Closing Statement is essential, as it may include relevant tax information.