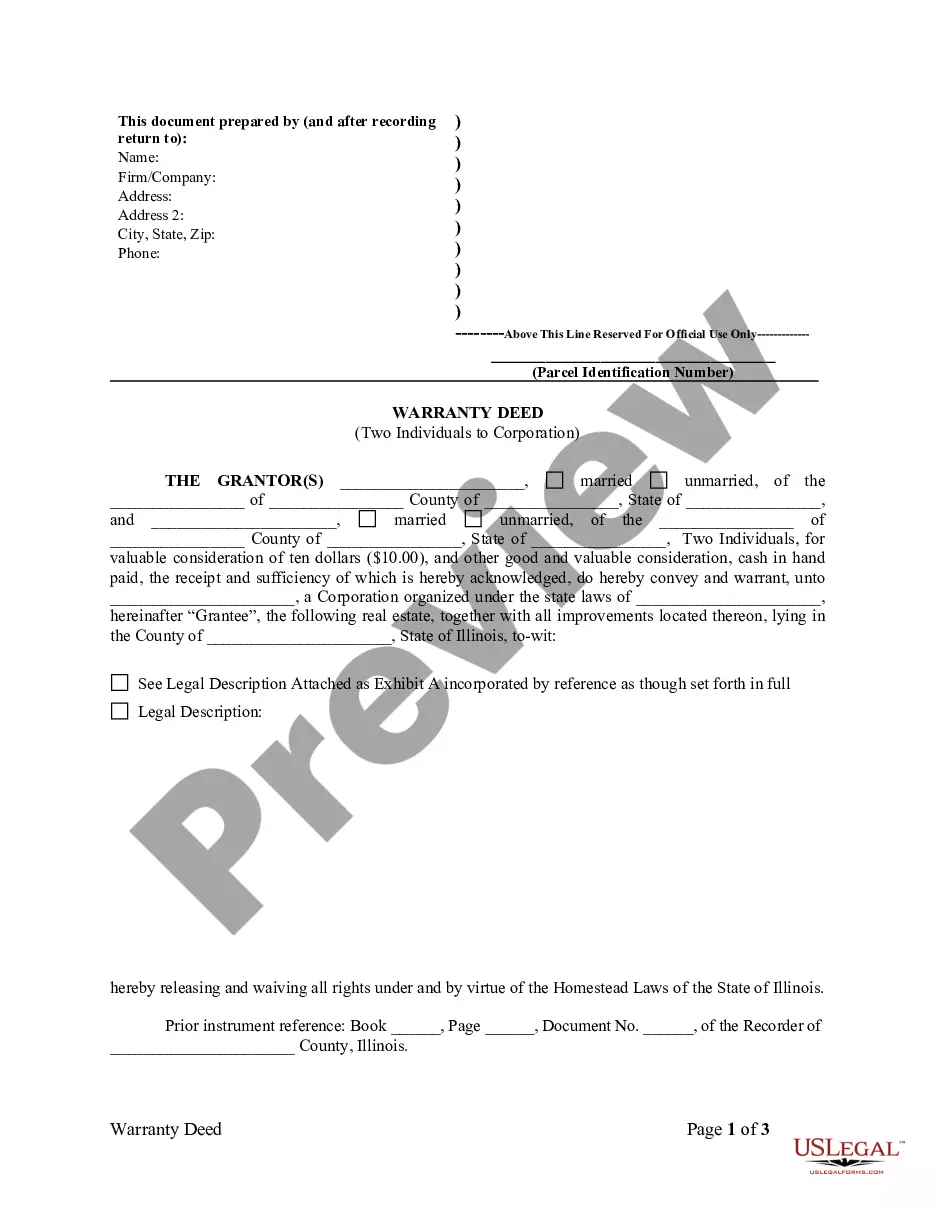

Chicago Illinois Warranty Deed from two Individuals to Corporation

Description

How to fill out Illinois Warranty Deed From Two Individuals To Corporation?

If you are searching for an authentic document, it's impossible to discover a more user-friendly platform than the US Legal Forms website – likely the most comprehensive libraries on the internet.

With this collection, you can locate numerous document samples for business and personal needs categorized by type and location, or keywords.

Utilizing our sophisticated search functionality, finding the most current Chicago Illinois Warranty Deed from two Individuals to Corporation is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration procedure.

Obtain the document. Choose the format and save it on your device.

- Moreover, the applicability of every document is guaranteed by a team of qualified attorneys who routinely review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Chicago Illinois Warranty Deed from two Individuals to Corporation is to Log In to your account and select the Download option.

- If you are utilizing US Legal Forms for the first time, just refer to the guidance outlined below.

- Ensure you have located the form you require. Review its details and utilize the Preview feature (if available) to view its contents. If it does not satisfy your requirements, use the Search option at the top of the page to locate the suitable document.

- Confirm your choice. Select the Buy now option. Then, pick your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

General warranty deeds give the grantee the most protection, special warranty deeds give the grantee more limited protection, and a quitclaim deed gives the grantee the least protection under the law.

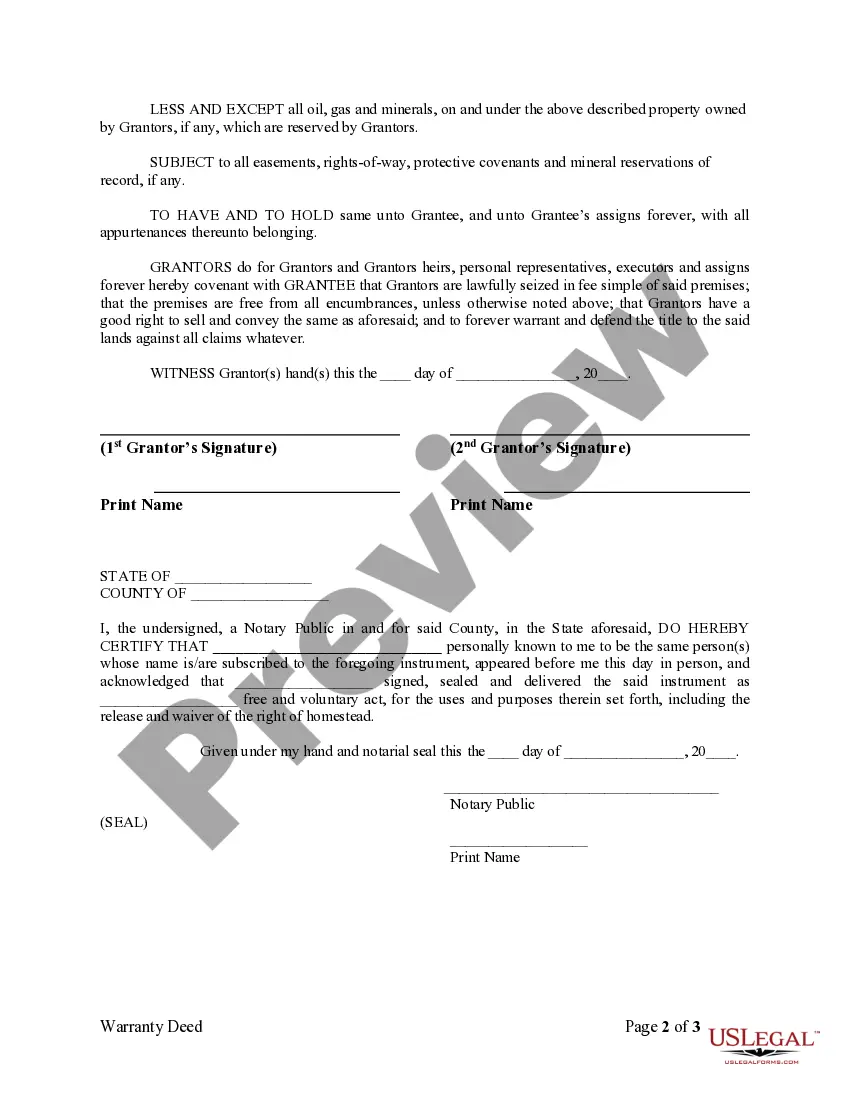

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

For the purpose of recording the document, your document must meet all of the recording requirements (the document has to have the property tax number, address, legal description and preparer's name and address, with signatures/notary. For recording you must provide the original plus one copy.

If you want to transfer real estate in Illinois to a relative or a friend, you might consider doing this yourself by using a quitclaim deed. A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.

A general warranty deed is used to transfer real property from one person to another. This type of deed offers the greatest protection for the buyer and has specific requirements for what must be included in the document.

12. Who benefits the most from recording a warranty deed? D. Explanation: The grantee is the one who has acquired an interest in the land, and she is the one who benefits the most from recording the deed to provide constructive (legal) notice of that interest.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

Clouds on the title are resolved by initiating a quitclaim deed, which releases a person's interest in a property without stating the nature of the person's interests.

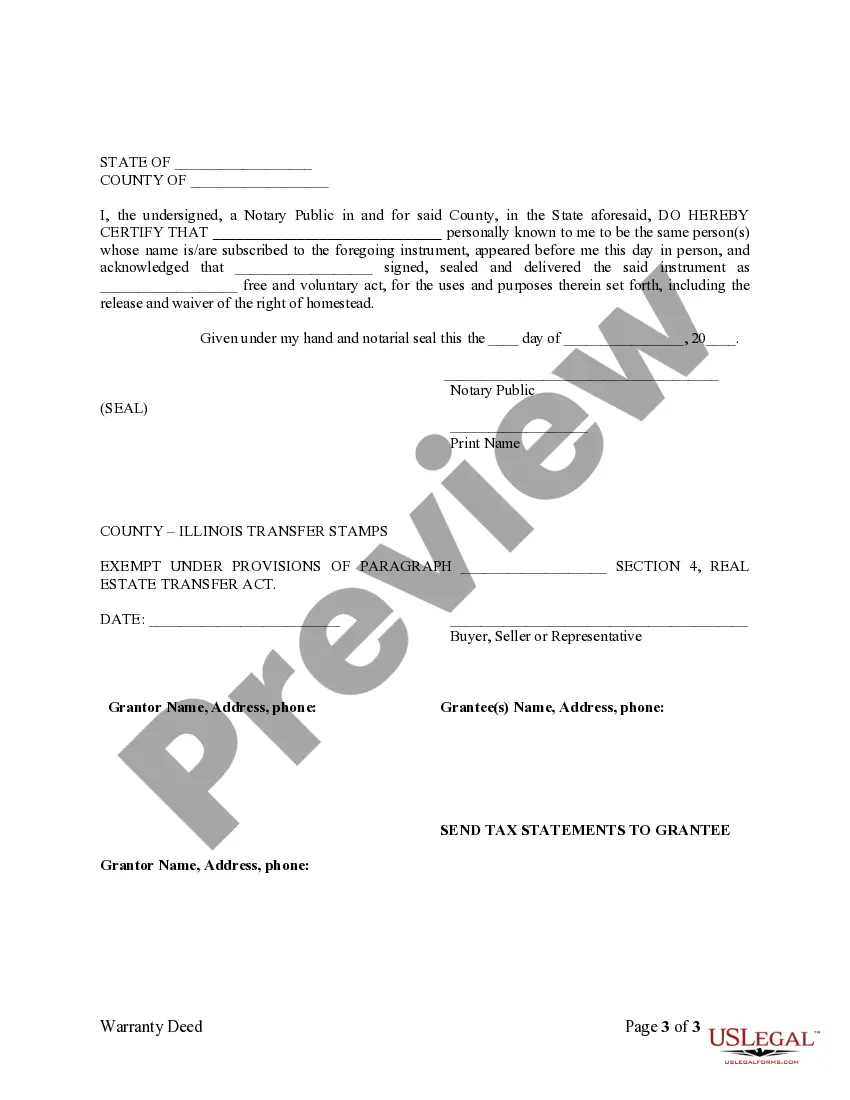

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.