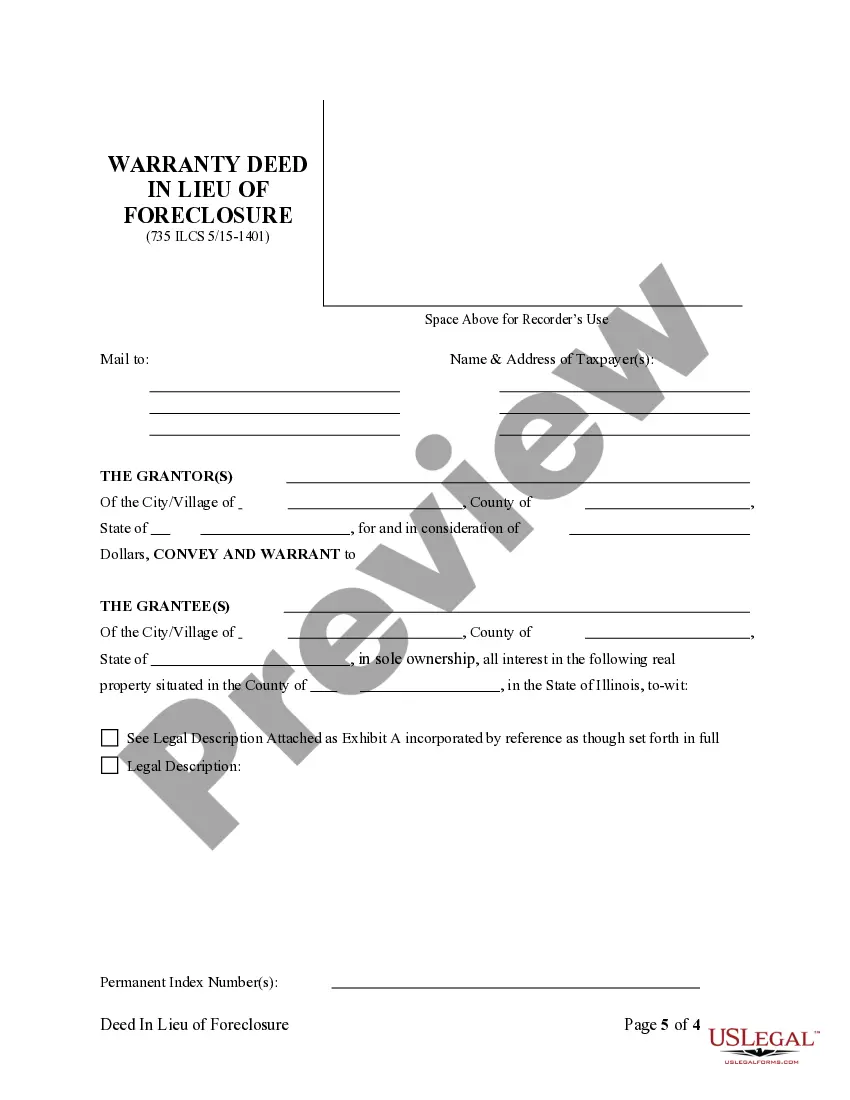

This form is a Warranty Deed where the grantor(s) transfer all interest in the real property to the grantee(s) in lieu or in place of foreclosure. This deed complies with all state statutory laws.

Chicago Illinois Warranty Deed in Lieu of Foreclosure

Description

How to fill out Illinois Warranty Deed In Lieu Of Foreclosure?

Capitalize on the US Legal Forms and gain instant access to any form template you require.

Our user-friendly website, featuring a vast array of document templates, makes it easy to locate and acquire nearly any document you desire.

You can store, fill out, and sign the Chicago Illinois Warranty Deed in Lieu of Foreclosure in merely a few minutes instead of spending hours browsing the internet for a suitable template.

Leveraging our collection is a great approach to enhance the security of your document submissions.

If you haven’t created an account yet, follow the instructions below.

US Legal Forms stands as one of the largest and most trustworthy template repositories online. We are always prepared to assist you in any legal matter, even if it involves only downloading the Chicago Illinois Warranty Deed in Lieu of Foreclosure.

- Our knowledgeable legal experts frequently review all documents to guarantee that the forms are applicable for a specific state and comply with updated laws and regulations.

- How can you acquire the Chicago Illinois Warranty Deed in Lieu of Foreclosure.

- If you possess a subscription, simply Log In to your account.

- The Download feature will be activated on all documents you view.

- Additionally, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure? It is an adverse element in the borrower's credit history. The lender takes the real estate subject to all junior liens. The process is lengthy and involves a lawsuit.

Drawbacks Of A Deed In Lieu Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop. You also won't be able to easily get another mortgage if you have a deed in lieu on your credit report.

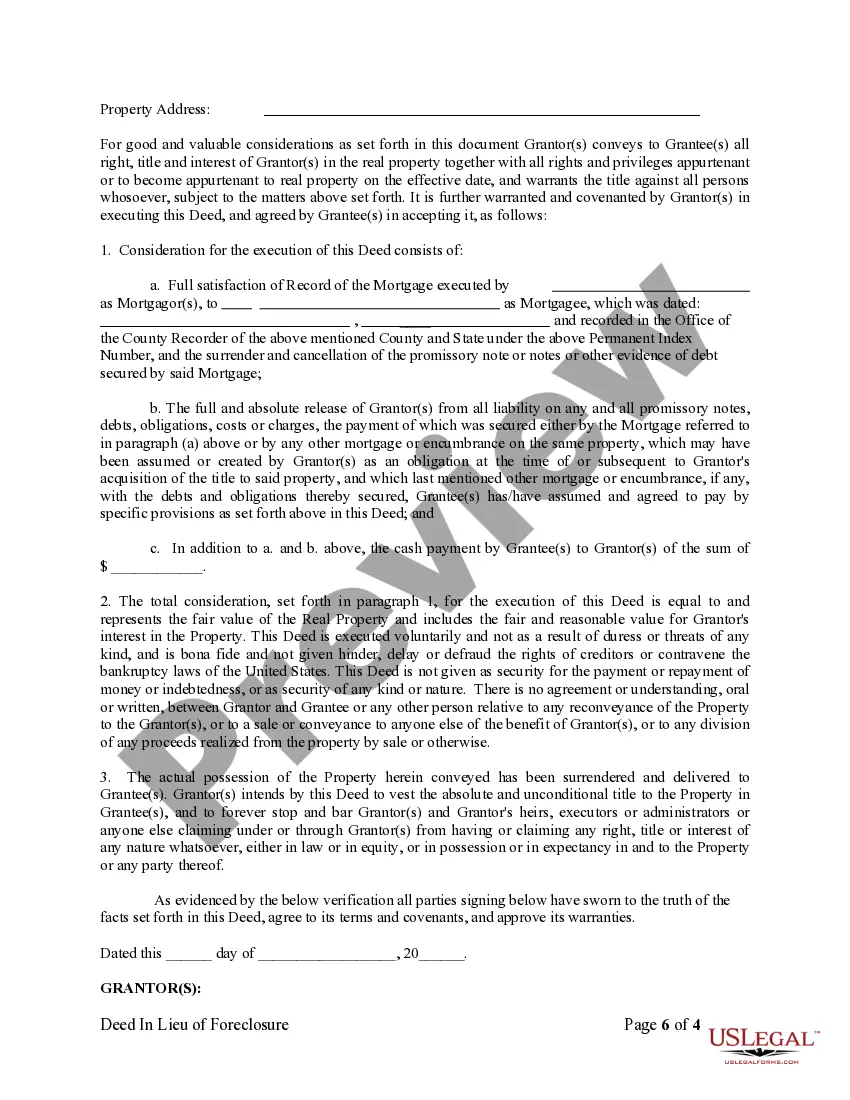

This deed instrument allows homeowners to satisfy a mortgage loan that's at risk of defaulting, and, most importantly, avoid foreclosure proceedings. A deed in lieu can benefit both the borrower and lender, specifically by sparing both parties from an expensive and time-consuming foreclosure process.

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process. inlieu of foreclosure may help you avoid being personally liable for any amount remaining on the mortgage.

What is the most likely disadvantage to a lender in accepting Deed in Lieu of Foreclosure? Rationale: The liability for existing liens on the property is the most likely disadvantage.

There's less negative impact on your credit score. With a deed in lieu of foreclosure, the drop might be anywhere from 50 to 125 points or higher. With a foreclosure, the drop is anywhere from 85 to more than 160 points, which means that it could take significant time to rebuild your credit.

Less damage to your credit: A deed in lieu agreement stays on your credit report for 4 years while a foreclosure sticks around for 7 years. Taking a deed in lieu agreement can allow you to buy a new home sooner than if you go through a foreclosure.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.