Rockford Illinois Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Illinois Financial Statements Only In Connection With Prenuptial Premarital Agreement?

If you have previously employed our service, sign in to your account and store the Rockford Illinois Financial Statements solely in relation to the Prenuptial Premarital Agreement on your device by selecting the Download button. Ensure that your subscription remains active. If not, renew it in accordance with your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have ongoing access to all documents you have purchased: you can find it in your profile within the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to efficiently discover and store any template for your personal or professional purposes!

- Confirm that you’ve located an appropriate document. Review the description and utilize the Preview feature, if available, to verify if it satisfies your requirements. If it does not suit you, make use of the Search tab above to find the correct one.

- Procure the template. Click the Buy Now option and select a monthly or yearly subscription plan.

- Create an account and make a payment. Employ your credit card information or the PayPal option to finalize the purchase.

- Acquire your Rockford Illinois Financial Statements solely in connection with the Prenuptial Premarital Agreement. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it or make use of online editing professionals to complete it and sign it electronically.

Form popularity

FAQ

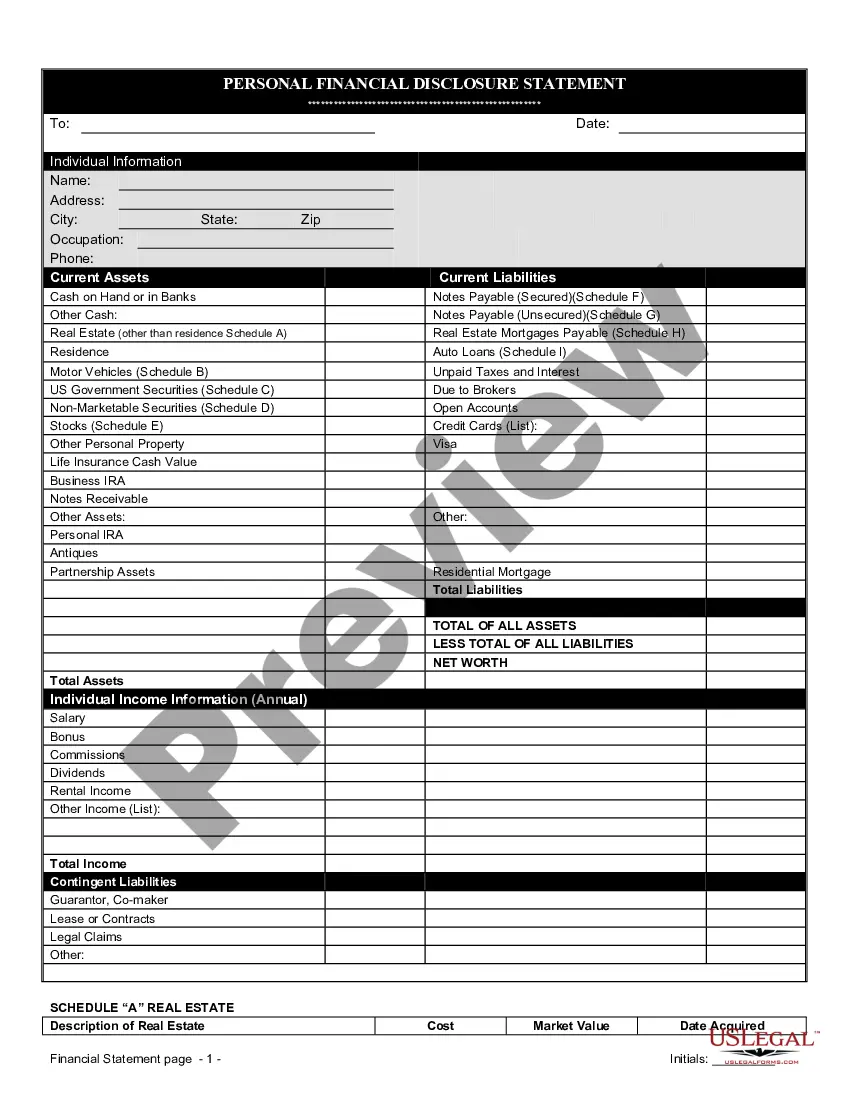

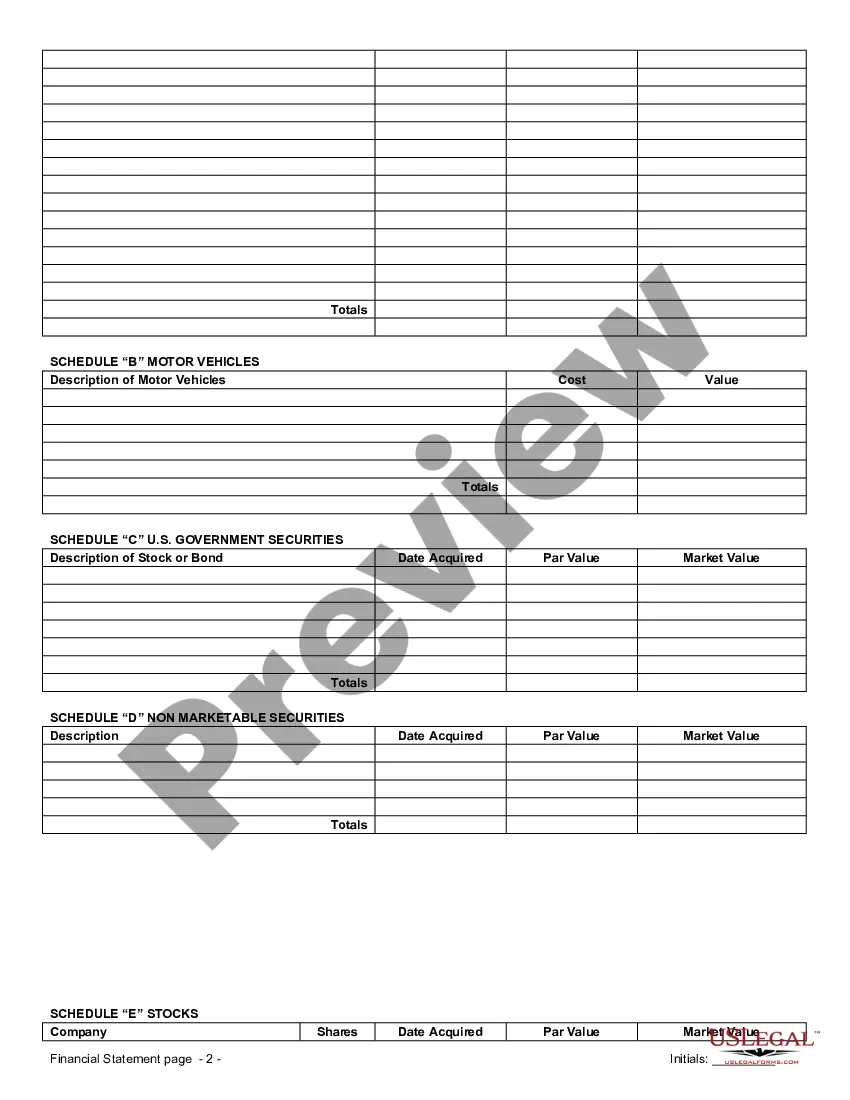

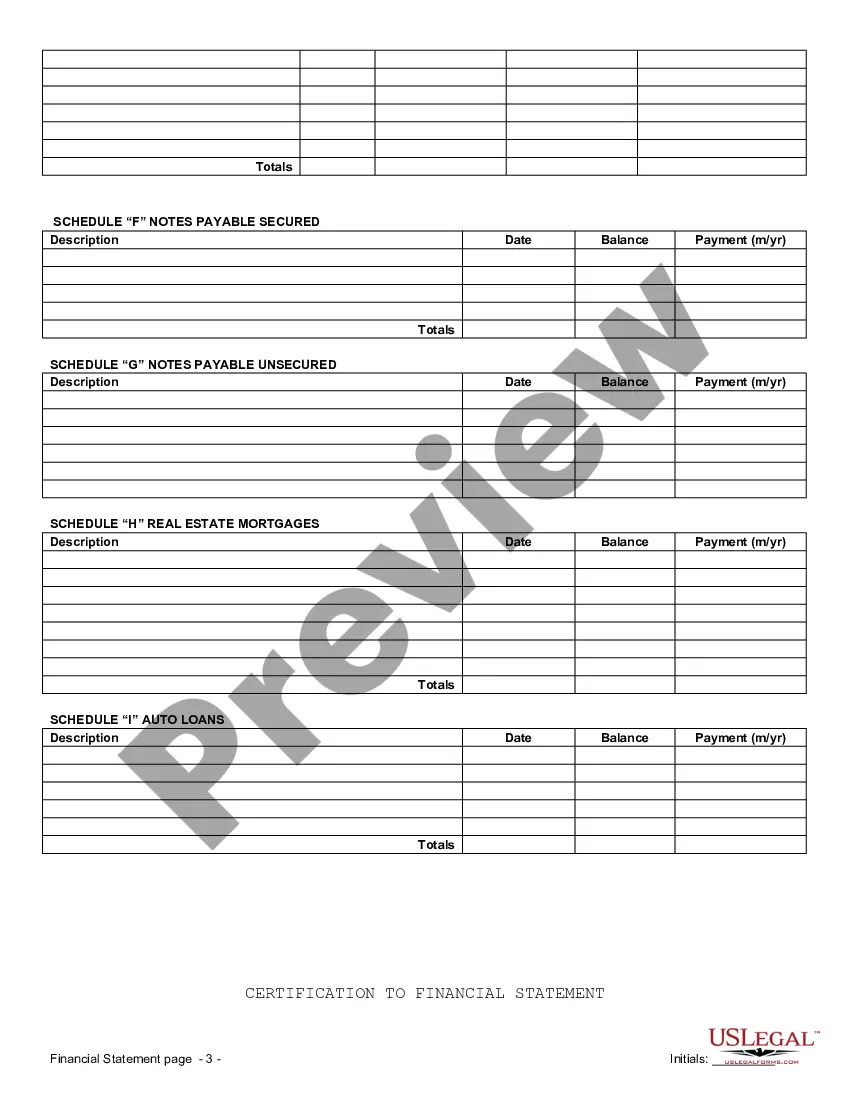

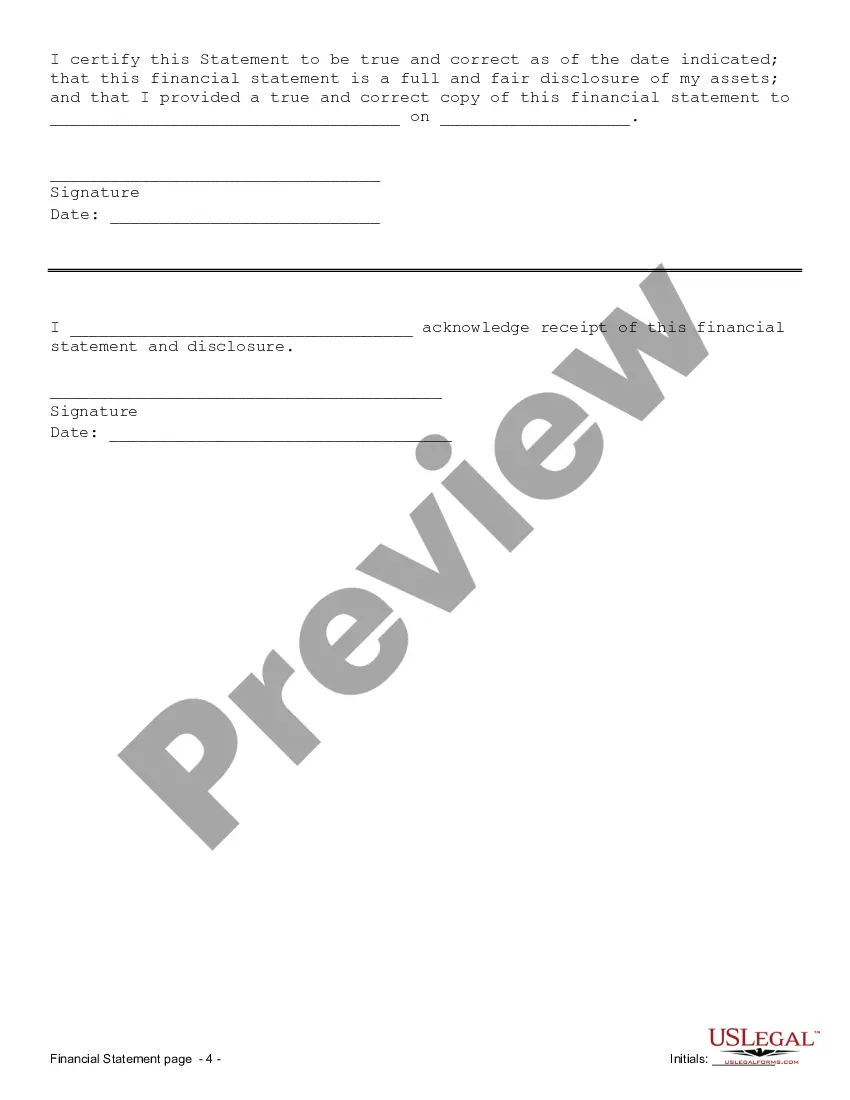

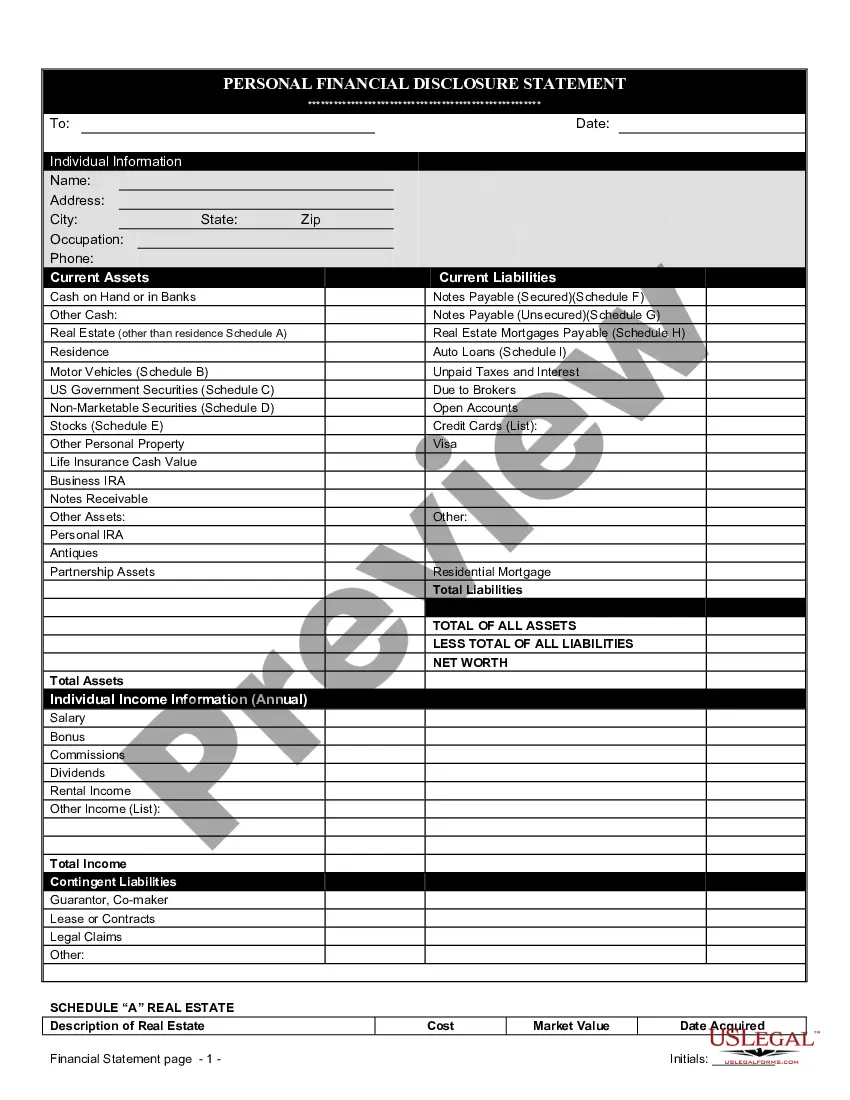

A financial agreement before getting married is typically a prenuptial agreement. This legal document outlines how financial matters will be managed during and after the marriage. When considering your options, make sure to gather Rockford Illinois financial statements only in connection with prenuptial premarital agreements, as they provide critical insight into each partner's financial health and intentions.

A postnuptial agreement, or postnup, can be just as effective as a prenup, depending on your situation. While a prenup is established before marriage, a postnup is signed after the wedding, allowing couples to address their financial matters formally. In Rockford Illinois, financial statements only in connection with prenuptial premarital agreements remain pertinent to both documents, affirming each partner's commitment to financial clarity.

The financial document before marriage is typically a prenuptial agreement, or prenup. This legal contract covers how assets will be handled if the marriage ends. In Rockford Illinois, you will need to include financial statements only in connection with prenuptial premarital agreements to create a comprehensive understanding of each partner's financial landscape.

You can write your own prenup in Illinois, but it is highly recommended to consult a legal professional. A lawyer can help ensure that the document meets all legal requirements and protects both parties effectively. Using our platform, uslegalforms, simplifies this process, especially in gathering Rockford Illinois financial statements only in connection with prenuptial premarital agreements.

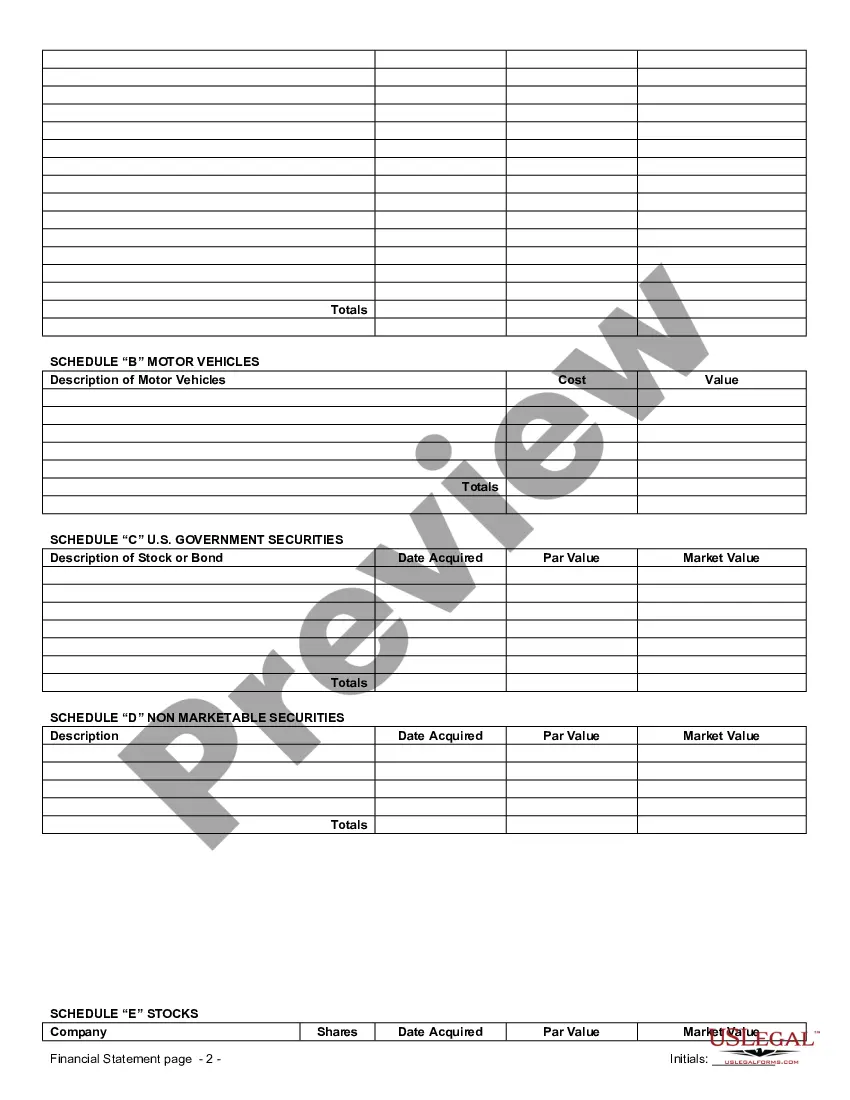

Yes, providing bank statements for a prenup is often necessary. This documentation helps validate your financial claims and offers a clearer picture of each partner's financial status. In Rockford Illinois, financial statements only in connection with prenuptial premarital agreements include bank statements to facilitate open communication and trust during the preparation process.

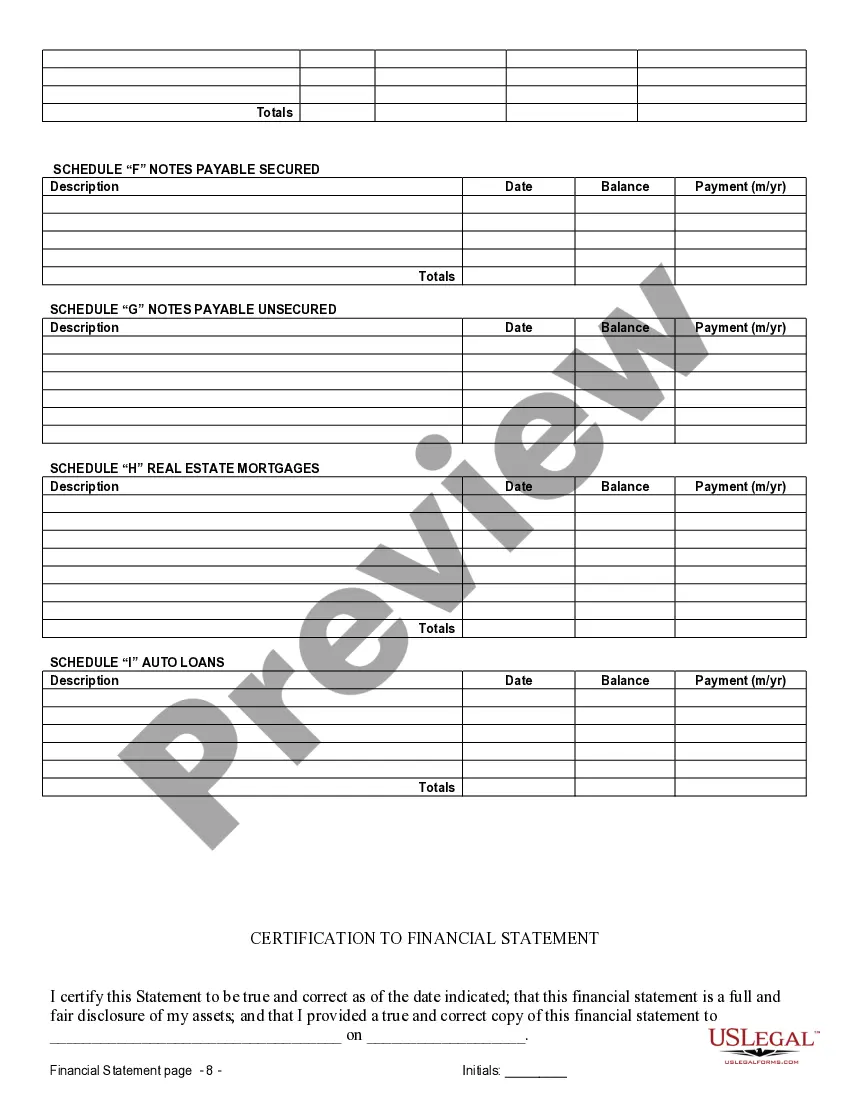

A financial statement for a prenuptial agreement outlines your assets, liabilities, and income. This document provides transparency between partners and ensures both parties understand each other's financial situations. In Rockford Illinois, financial statements only in connection with prenuptial premarital agreements serve as a vital tool in negotiating terms and protecting assets.

To invalidate a prenup in Illinois, you must provide evidence for your claim, such as lack of disclosure or proof of coercion. A thorough review of Rockford Illinois Financial Statements only in Connection with Prenuptial Premarital Agreement can assist in determining any inaccuracies or omissions. Consulting with a legal professional can guide you through the process and enhance your chances of successfully invalidating the agreement.

In Illinois, a prenup can be canceled if both parties explicitly agree to its dissolution or if the terms have been integrated into a divorce settlement. Additionally, if there is proof of coercion or illegality, a court may consider the prenup unenforceable. Updating your Rockford Illinois Financial Statements only in Connection with Prenuptial Premarital Agreement can help reflect any significant changes in your financial situation.

A prenup in Illinois can be voided under certain conditions, such as lack of legal representation for one party or if the agreement was created under duress. If either party did not understand their rights or the terms were deemed unconscionable, the prenup can also be challenged. To ensure compliance, consider using Rockford Illinois Financial Statements only in Connection with Prenuptial Premarital Agreement and consult a legal expert.

Several factors can render a prenup invalid in Illinois. If one party did not enter the agreement voluntarily, or if there was fraud involved in the financial disclosures, the prenup may not hold. It is crucial to present accurate Rockford Illinois Financial Statements only in Connection with Prenuptial Premarital Agreement to avoid potential issues in the future.