Cook Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

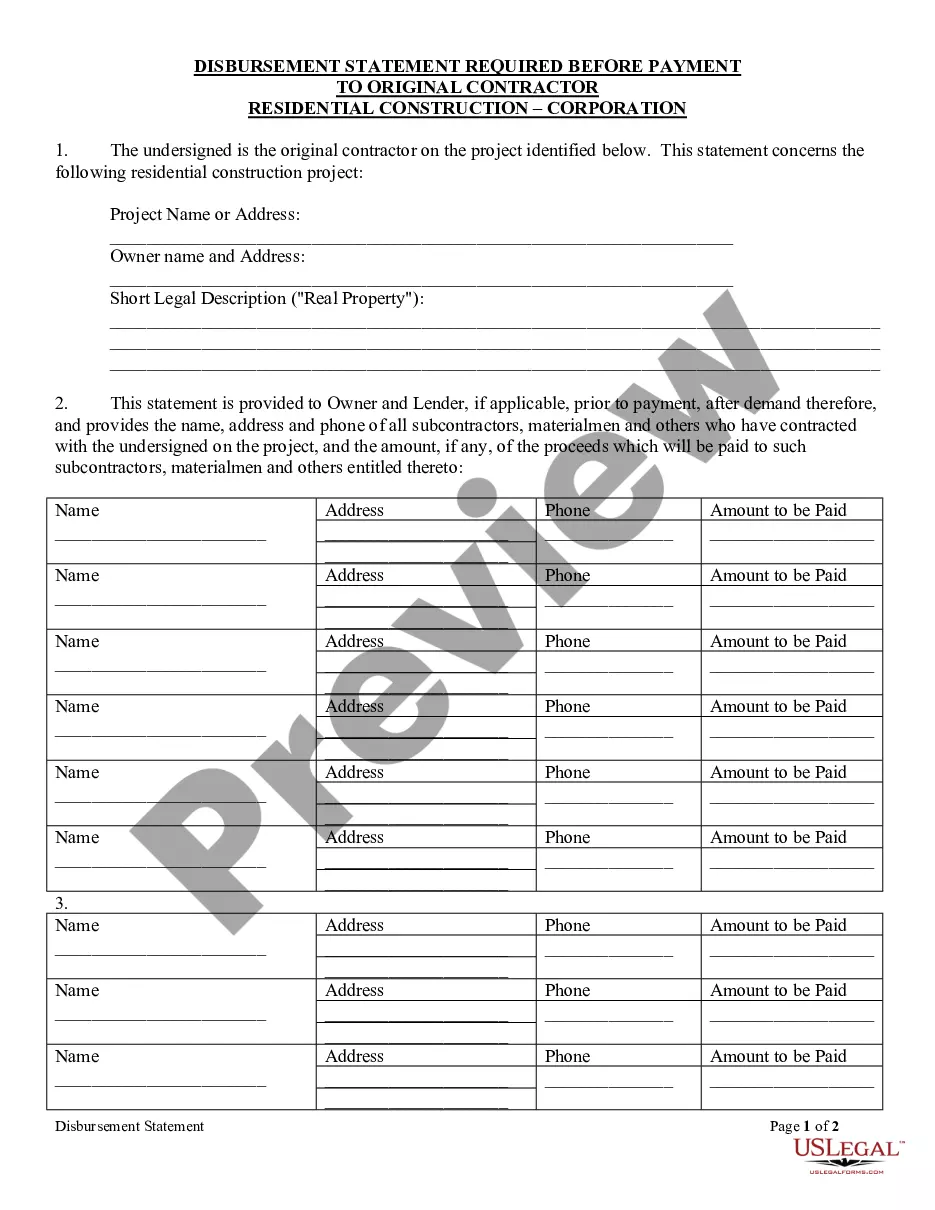

How to fill out Illinois Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you have previously engaged our service, Log In to your account and retrieve the Cook Illinois Final Notice of Default for Past Due Payments related to Contract for Deed on your device by clicking the Download button. Ensure your subscription remains active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have ongoing access to all documents you have purchased: they can be found in your profile under the My documents section whenever you wish to use them again. Utilize the US Legal Forms service to efficiently locate and store any template for your personal or business requirements!

- Ensure you’ve found the suitable document. Review the description and utilize the Preview option, if available, to determine if it satisfies your requirements. If it doesn’t fit your needs, use the Search tab above to locate the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and proceed with payment. Enter your credit card information or utilize the PayPal option to finalize the transaction.

- Obtain your Cook Illinois Final Notice of Default for Past Due Payments related to Contract for Deed. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or use online editing tools for filling it out and signing it digitally.

Form popularity

FAQ

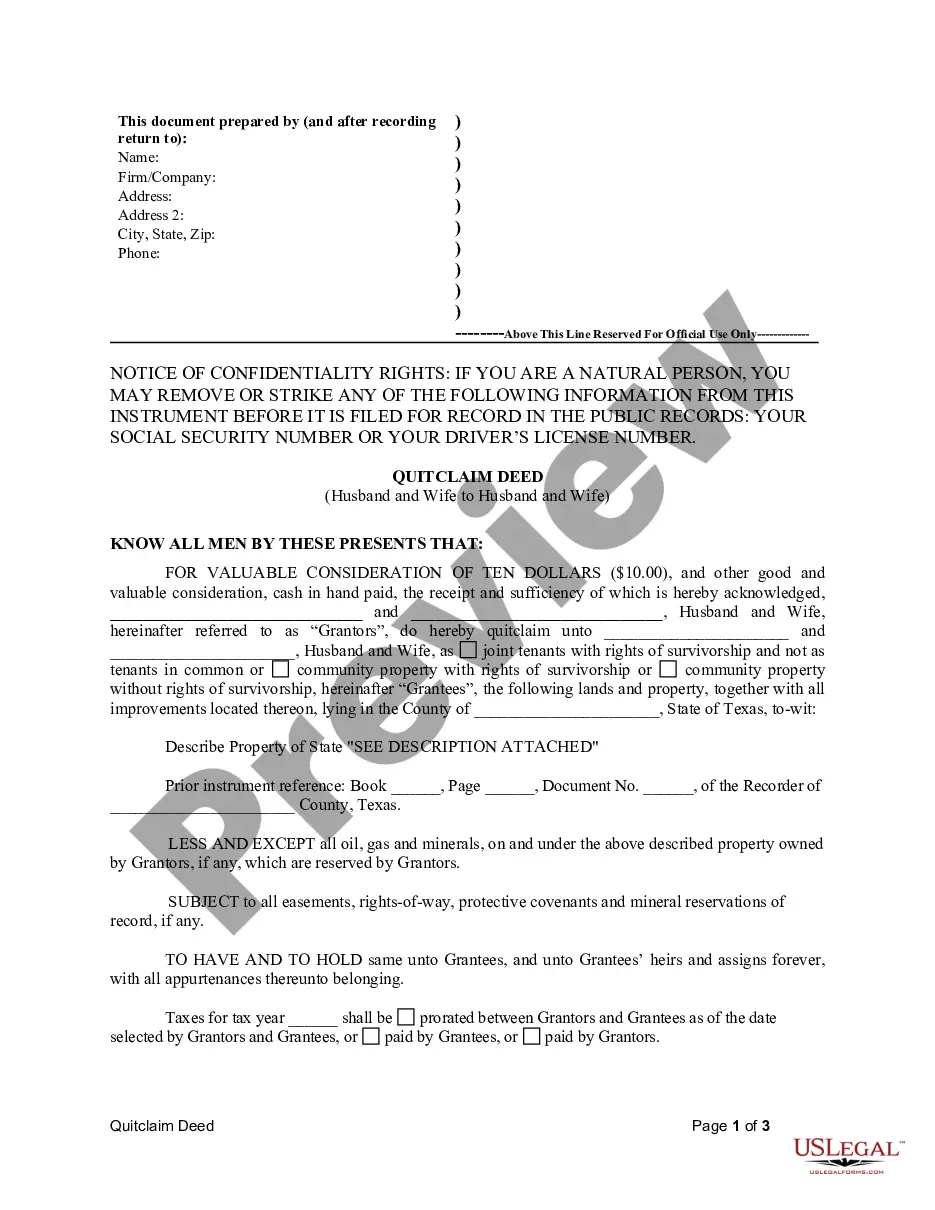

Canceling a contract for deed in Illinois involves delivering a written notice to the buyer, stating your intent to cancel due to default or another valid reason. It is advisable to include a Cook Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed within this notice. Ensuring compliance with Illinois laws on contracts for deed helps prevent potential disputes, and resources like UsLegalForms provide valuable templates and guidance.

To terminate a land contract, you must provide written notice to the other party, outlining the reasons for your termination. This process can include the delivery of a Cook Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed if applicable. Understanding the terms of your contract and local laws is crucial, and leveraging platforms like UsLegalForms can help navigate this process smoothly.

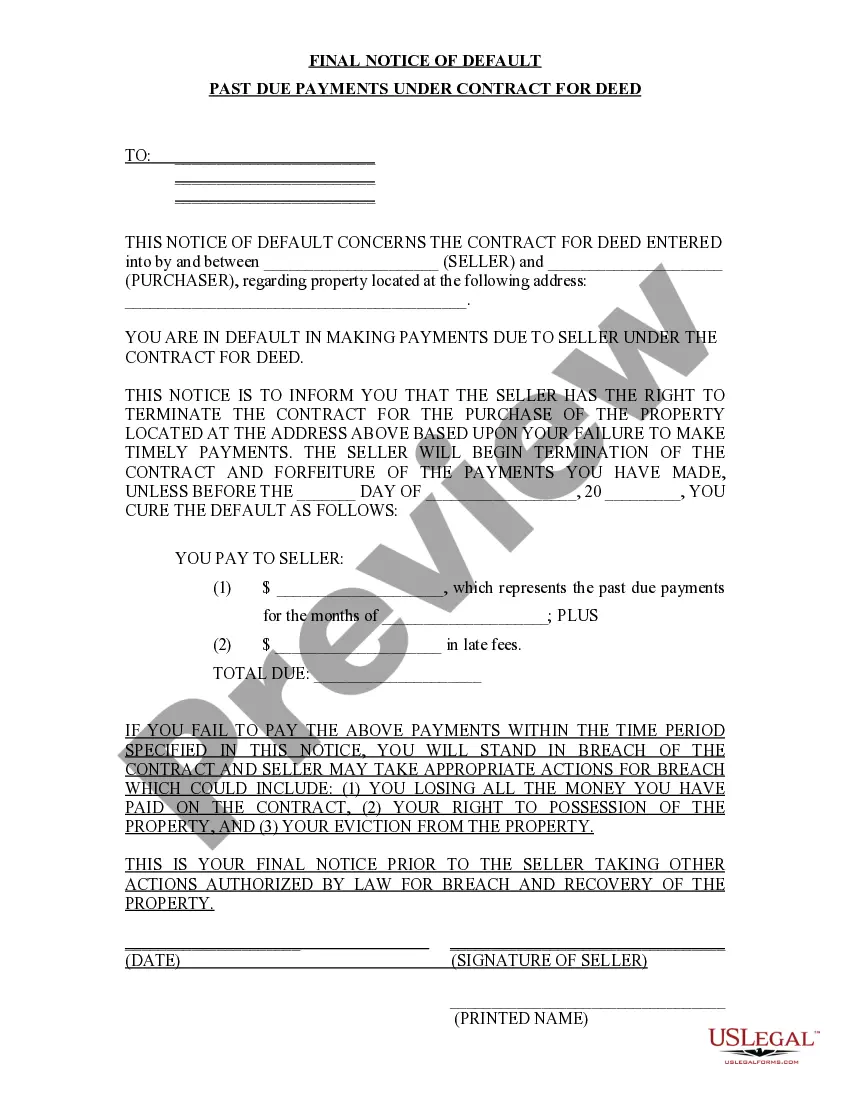

When a contract for deed is in default, the seller typically must send a Cook Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed to the buyer. This notice serves as a formal warning about the default. If the buyer does not remedy the situation, the seller may need to initiate legal proceedings to regain possession and equitable title to the property, which often requires adhering to specific state laws.

A deed of termination is a formal document that cancels a contract for deed, releasing both parties from their obligations. It indicates that the ownership and rights regarding the property are being reverted back to the seller. To ensure clarity and legality, the deed should be properly executed and recorded. Utilizing resources like UsLegalForms can assist you in drafting an effective deed of termination.

Contracts for deed can present several issues, including potential misunderstanding of terms, risks of forfeiture, and unclear property rights until the contract is fulfilled. Buyers may find themselves facing unexpected fees or changes in payment obligations. It's important to review your contract carefully and consider consulting with legal experts, such as those available on the UsLegalForms platform, to navigate these challenges.

To terminate a contract for deed in Illinois, ensure you follow the legal process outlined in your agreement. Typically, you must provide written notice to the buyer detailing the reasons for termination. This includes the delivery of a Cook Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed, which notifies the buyer of their failure to comply with payment terms.

Defaulting on a real estate contract can prompt various actions depending on the contract's terms. Typically, the seller will send a Cook Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed to inform the buyer of their default. This notice allows the buyer an opportunity to cure the default. If not addressed, the seller may initiate foreclosure or other legal proceedings to recover the property, making it essential to understand your obligations.

If a seller fails to comply with a contract, it may lead to serious legal consequences. The buyer can issue a Cook Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed to address the seller's non-compliance. This notice outlines the seller’s obligations and provides them a chance to remedy the situation. If unresolved, the buyer may pursue legal remedies, which could result in losing their investment or other penalties.

An unrecorded deed can be valid in Illinois; however, it may present various challenges. While the deed may technically transfer ownership between parties, the absence of record can leave it open to claims from others. In situations involving a Cook Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed, having a recorded deed is crucial for asserting one's claims effectively. Therefore, ensure proper documentation to protect your interests.

In Illinois, while it is not mandatory to record a contract for deed, it is highly advisable. Recording the contract helps to protect the seller’s rights, especially if the buyer defaults and a Cook Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed is necessary. An unrecorded contract may be vulnerable to disputes and challenges from third parties, which can complicate the seller's position. Therefore, recording offers essential legal security.