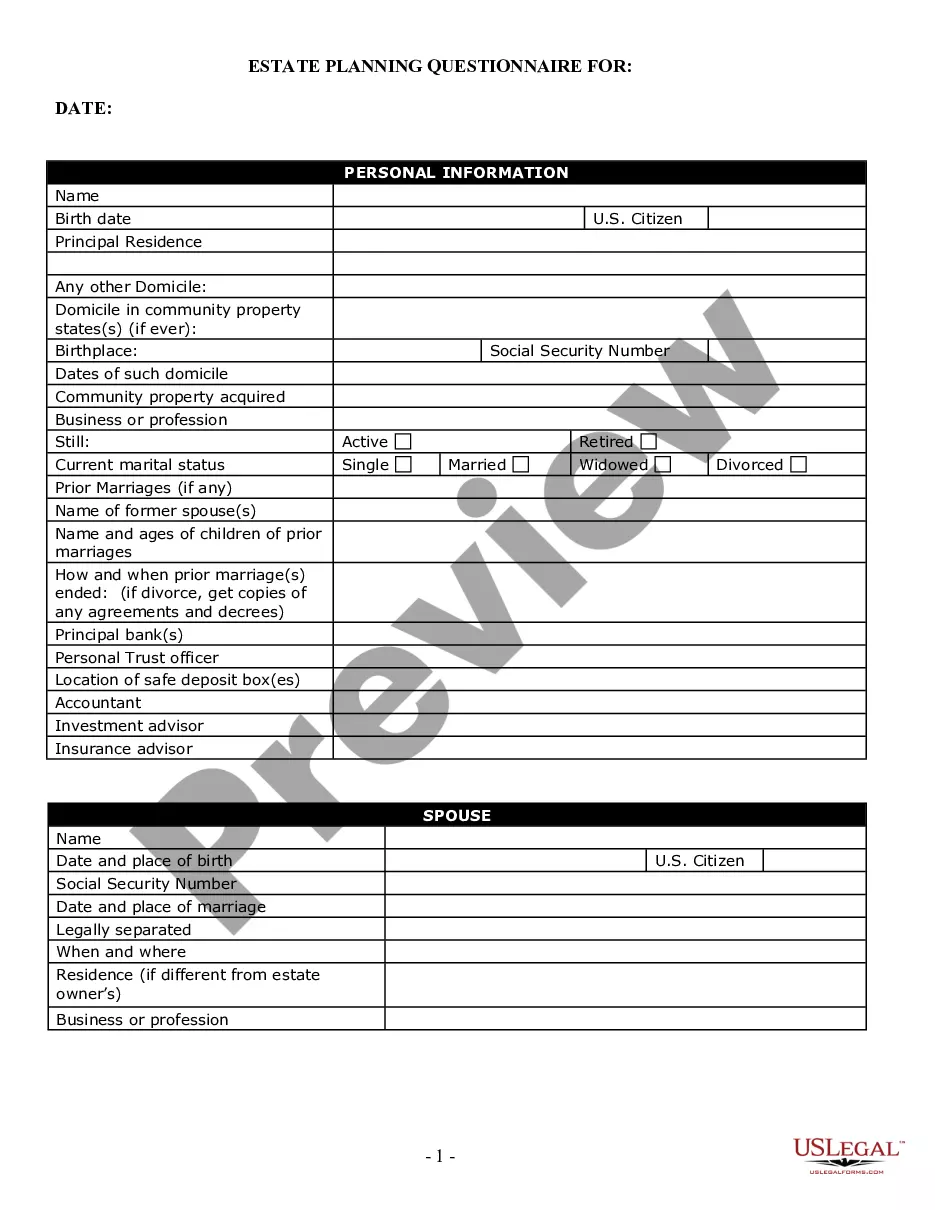

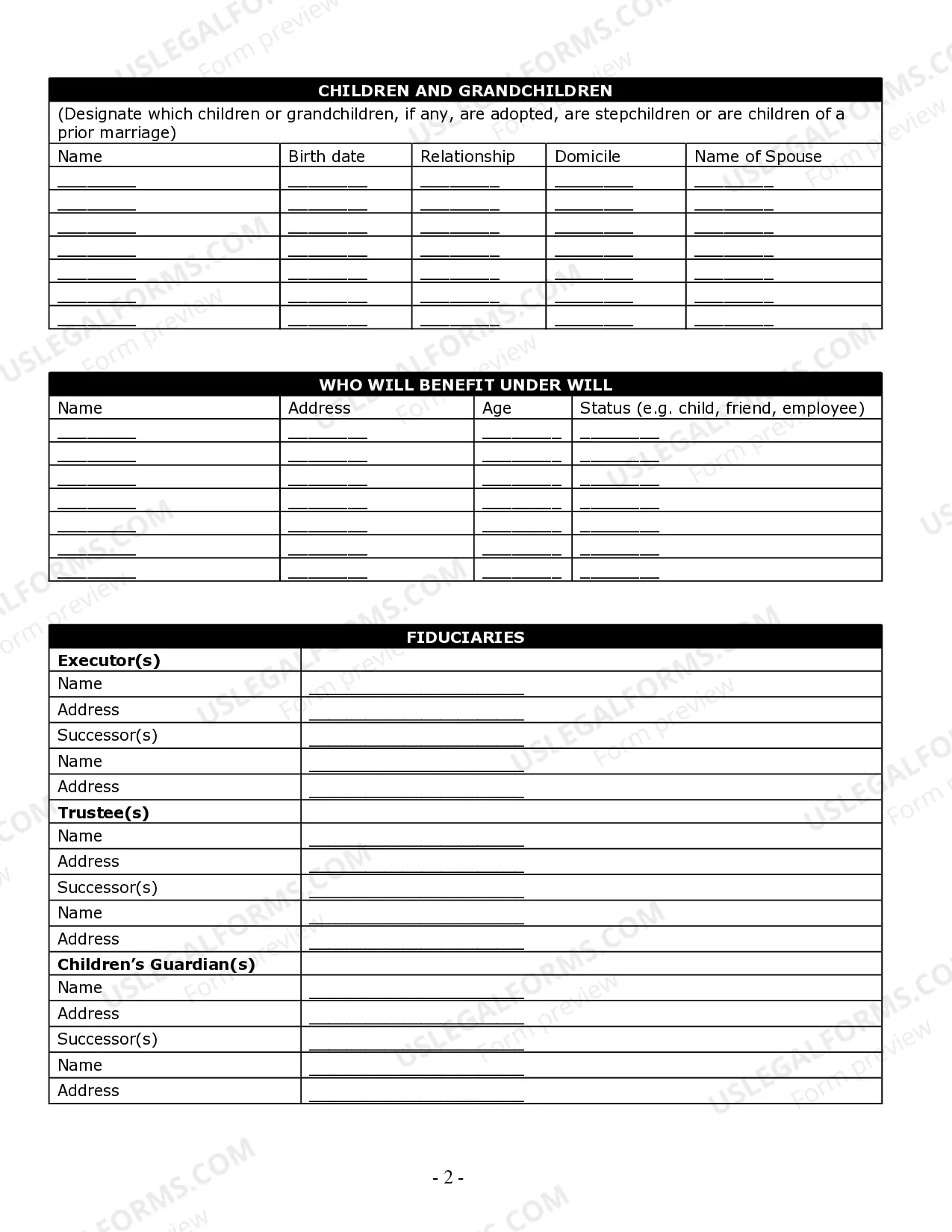

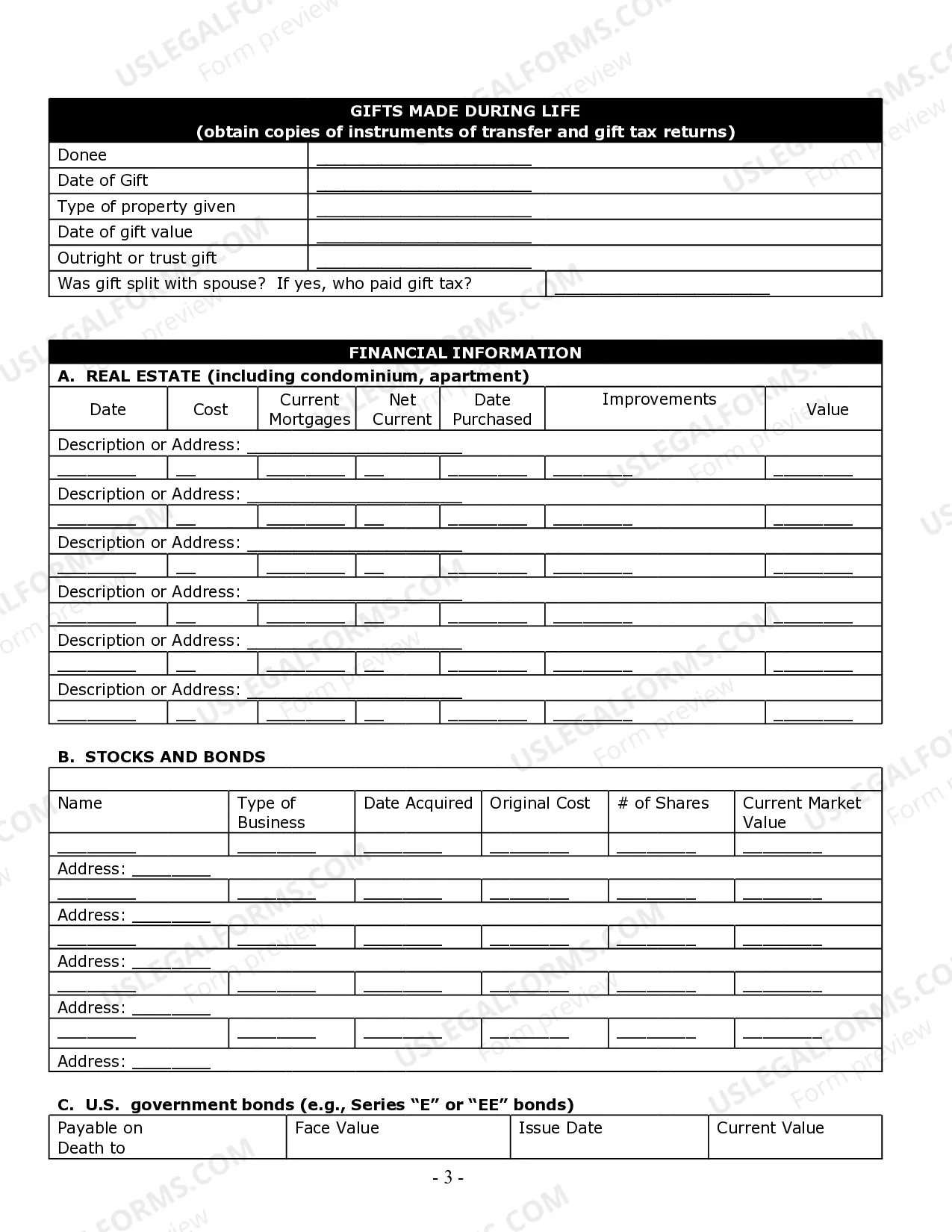

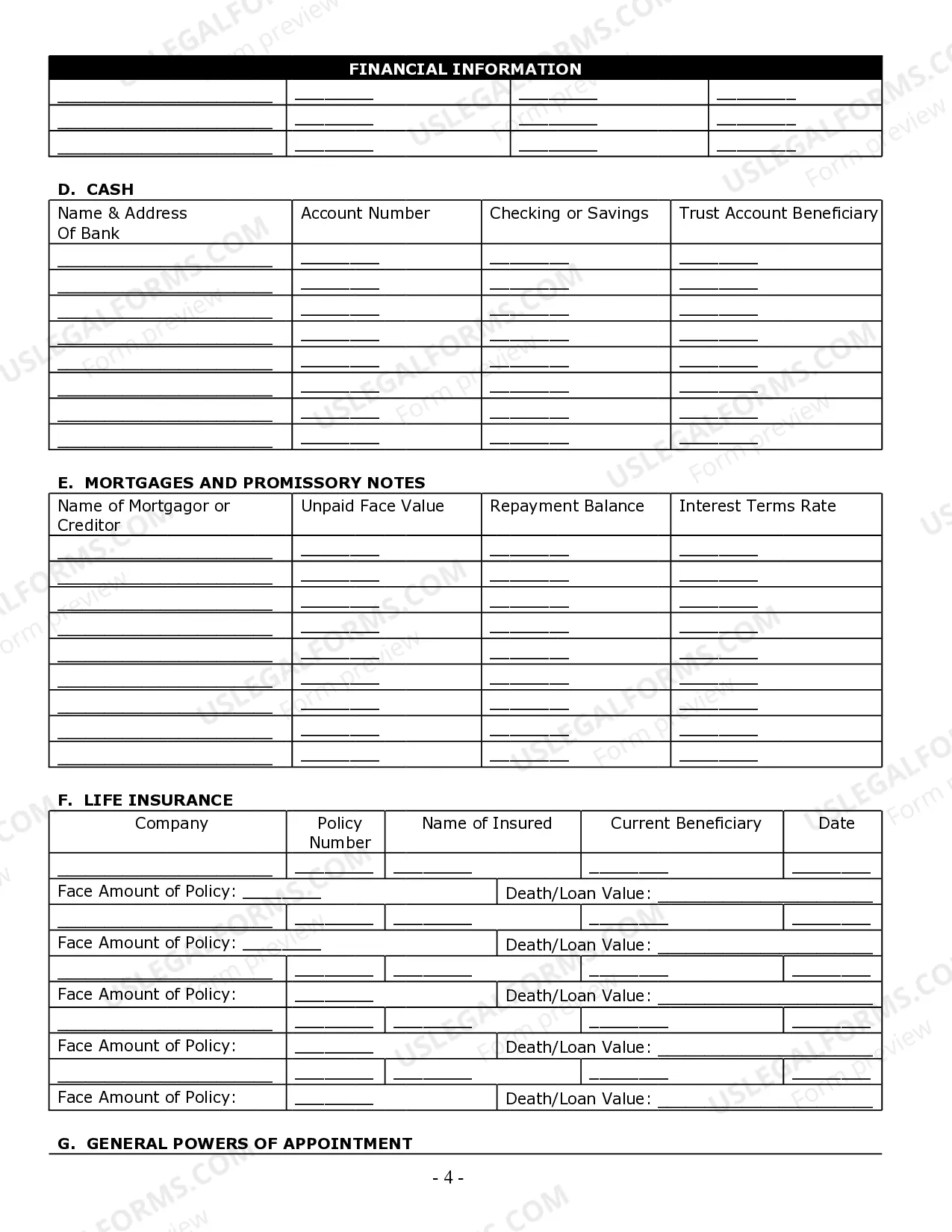

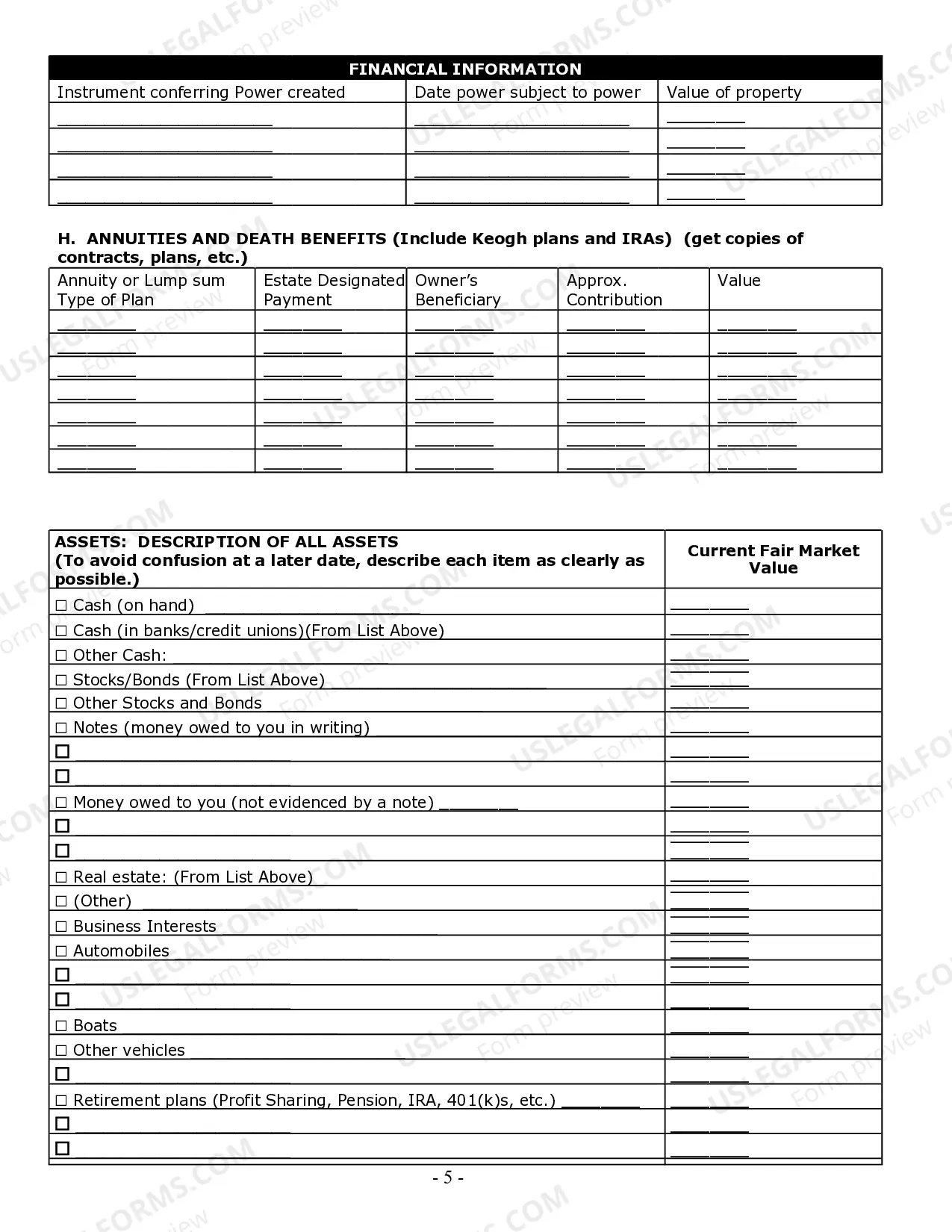

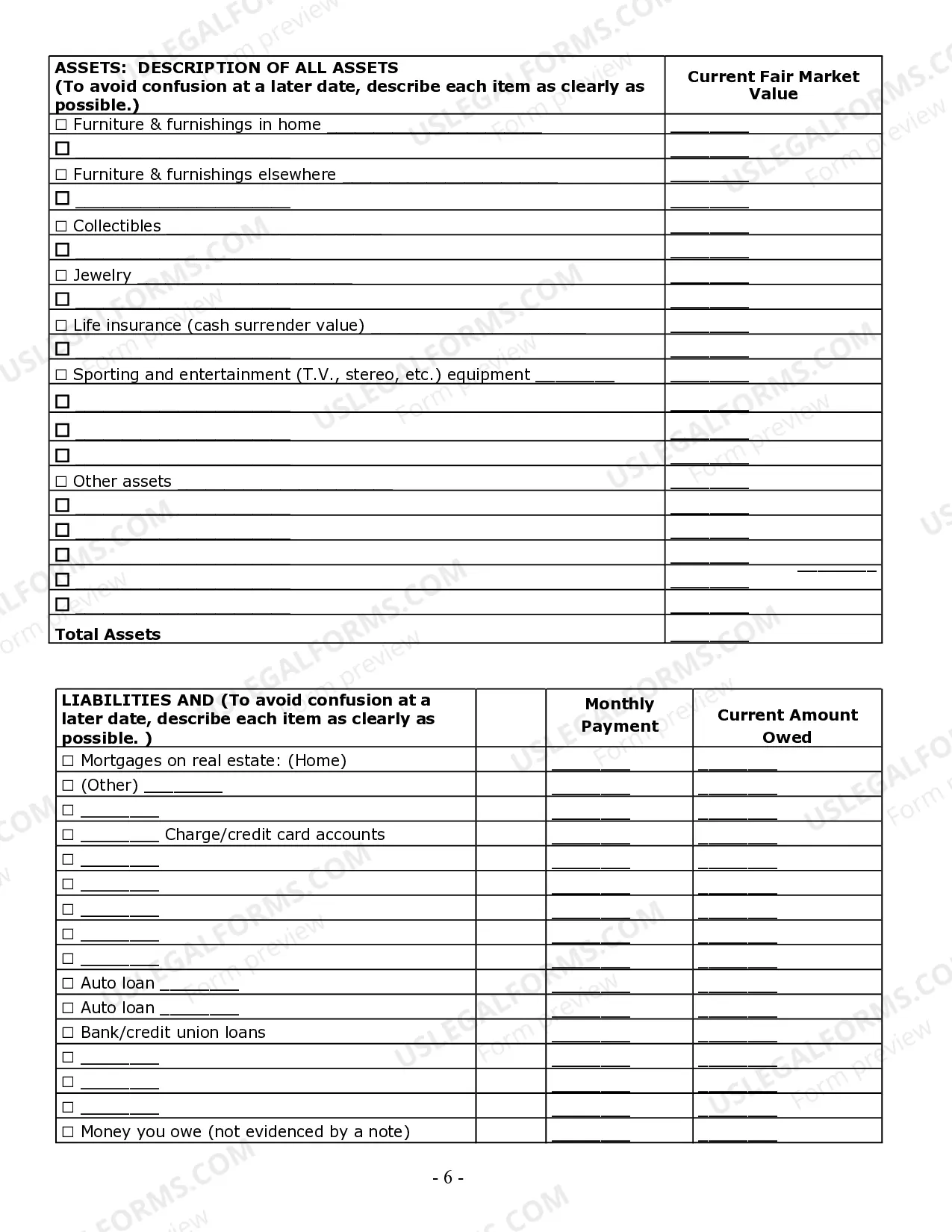

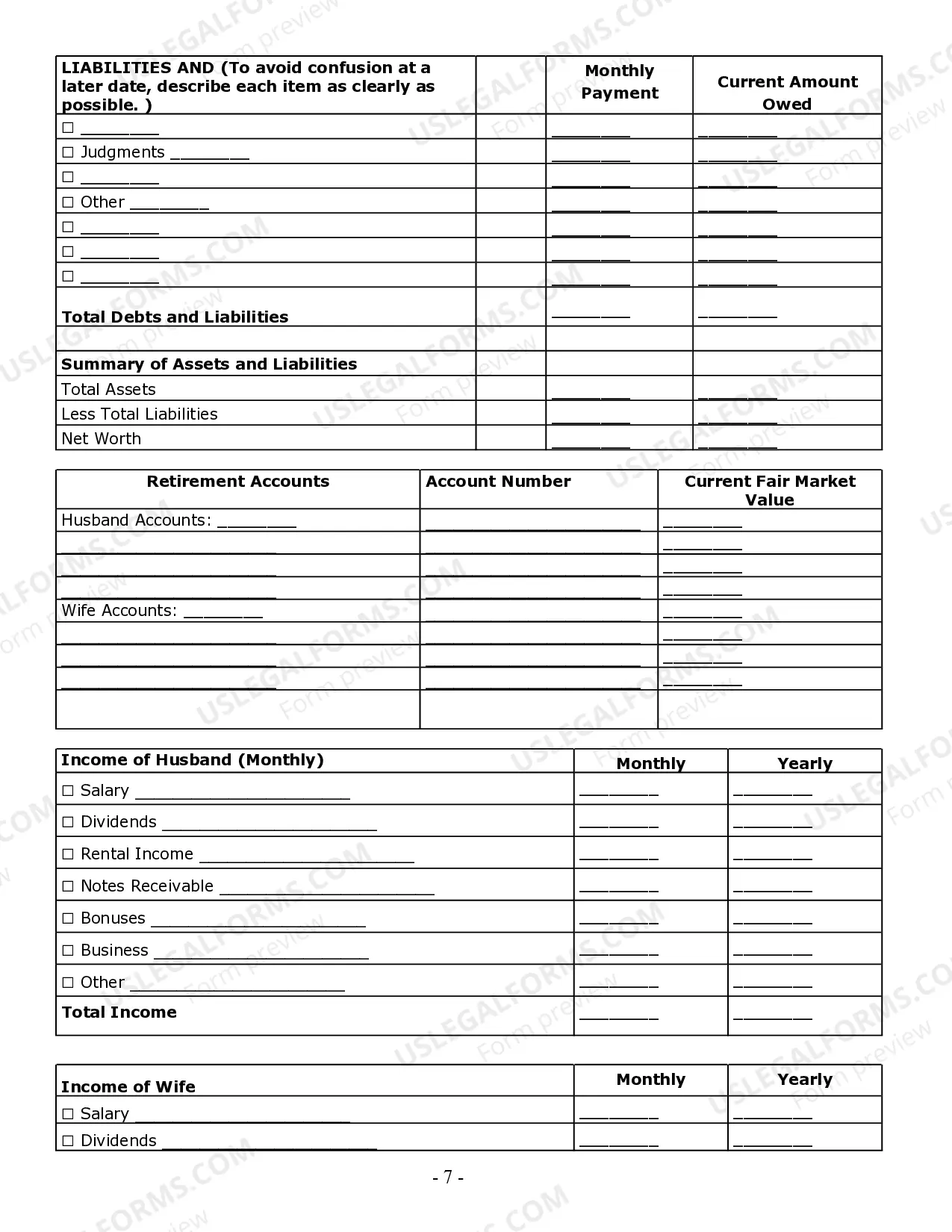

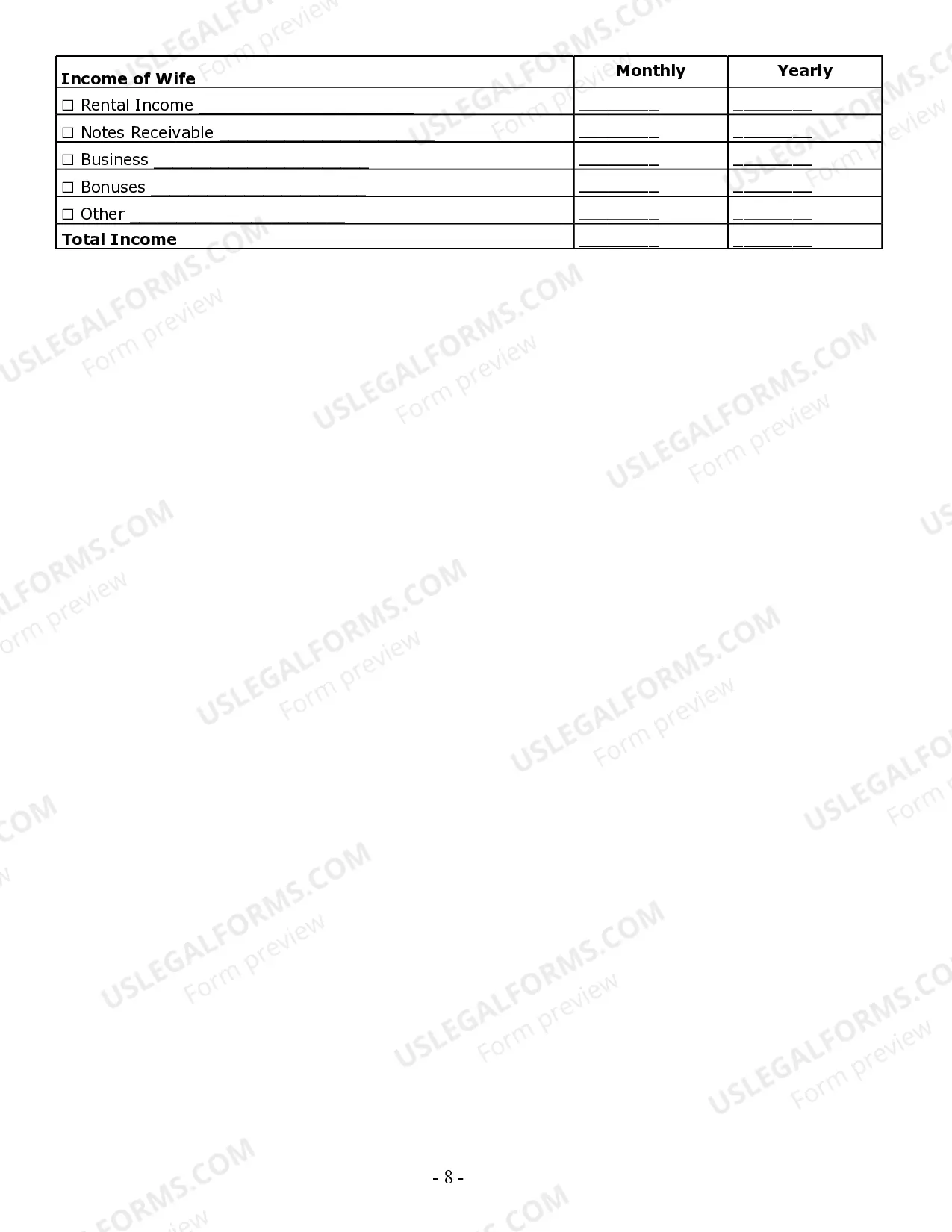

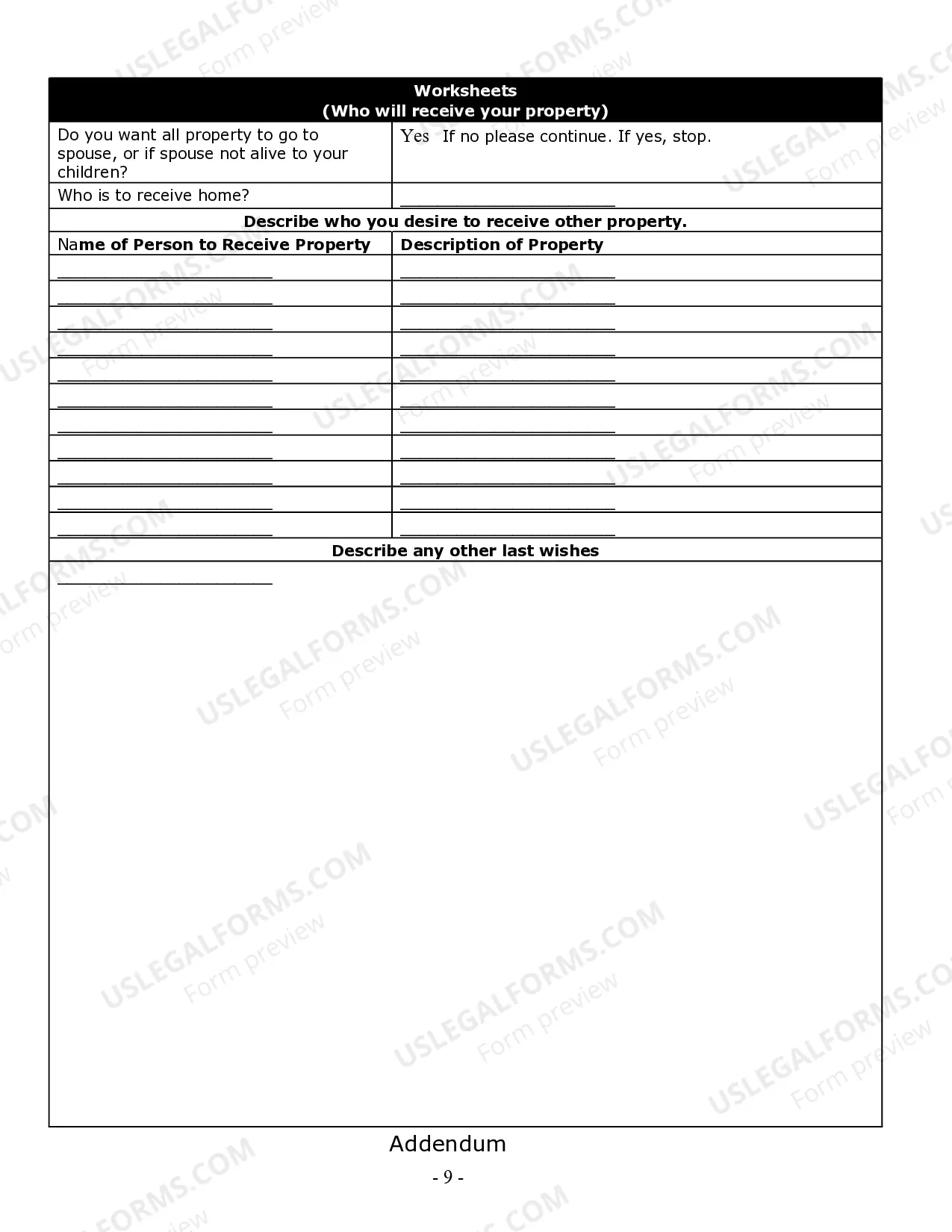

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets

Description

How to fill out Iowa Estate Planning Questionnaire And Worksheets?

Obtaining verified templates tailored to your local regulations can be tricky unless you access the US Legal Forms library.

This is an online repository containing over 85,000 legal documents catering to personal and professional requirements, as well as various real-life situations.

All the forms are accurately organized by area of application and jurisdiction, making it quick and easy to find the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets.

Download the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets. Save the document on your device to proceed with filling it out, and access it anytime from the My documents menu in your profile whenever needed.

- Examine the Preview mode and document description.

- Ensure you’ve selected the correct one that fulfills your needs and aligns completely with your local jurisdiction standards.

- Search for another template if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it fits your requirements, proceed to the next step.

- Purchase the document.

- Click on the Buy Now button and select the subscription plan that best suits you. You will need to create an account to access the library's resources.

Form popularity

FAQ

The biggest mistake parents make when setting up a trust fund is failing to communicate their intentions clearly to their children and beneficiaries. Transparency about the trust’s purpose, rules, and expectations is crucial for avoiding misunderstandings in the future. Additionally, using the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets can help you define these aspects upfront. By planning thoroughly, you can ensure that your loved ones understand the trust and its significance.

The 5 or 5 rule in estate planning refers to a tax strategy regarding gift exclusion. This rule allows individuals to give away up to $15,000 per recipient each year without risking gift taxes, and it can also apply to certain trusts. Understanding the 5 or 5 rule can play a significant role in your Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets, as it helps you effectively manage your wealth transfer strategies while minimizing tax implications. For detailed guidance, consider reaching out to a financial advisor.

Some assets cannot be included in a will, such as jointly owned properties with rights of survivorship, assets in a living trust, and certain financial accounts with designated beneficiaries. Understanding these exceptions is essential when completing your Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets. Ensuring you categorize your assets correctly will help streamline the estate planning process. If you have questions about specific assets, consulting with a legal expert can provide clarity.

An important document needed for estate planning is the last will and testament. This document allows you to express your final wishes regarding asset distribution and guardianship of dependents. To streamline the creation of this and other documents, the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets provide convenient templates and instructions that ensure you cover all necessary details.

The two key documents used in preparing an estate plan are the will and the power of attorney. The will specifies how your assets should be divided, while the power of attorney grants someone the authority to make decisions on your behalf if you become incapacitated. By completing the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets, you will have a structured approach to creating and managing these essential documents.

An estate plan document is a legal framework that outlines how your assets will be managed and distributed upon your passing. This document typically includes your will, trusts, and instructions for healthcare decisions. To ensure all necessary elements are covered, the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets serve as a valuable tool, guiding you through the essential documentation process.

Estate planning typically involves two main components: asset distribution and selecting an executor or trustee. Asset distribution ensures your belongings are passed on according to your wishes, while choosing the right executor or trustee ensures your plan is executed smoothly. By utilizing the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets, you can clarify these components and make informed decisions that align with your goals.

To effectively organize documents for estate planning, you can start by gathering all relevant financial and personal information, such as bank statements, property deeds, and insurance policies. Next, categorize these documents into sections, such as assets, liabilities, and wishes for your estate. Using the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets can greatly assist in this process by providing clear prompts to ensure you do not overlook any important details.

You should consider estate planning as soon as you acquire significant assets or start a family. Life changes, such as marriage, having children, or significant financial shifts, are ideal times to initiate your planning. Using the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets can simplify the process and prompt valuable discussions about your future wishes and responsibilities.

The 5 by 5 rule in estate planning allows a beneficiary of a trust to withdraw up to $5,000 each year without tax consequences. This strategy can help provide financial flexibility while keeping the primary estate intact. Understanding this rule is essential, and tools like the Cedar Rapids Iowa Estate Planning Questionnaire and Worksheets can help you incorporate such considerations into your estate planning effectively.