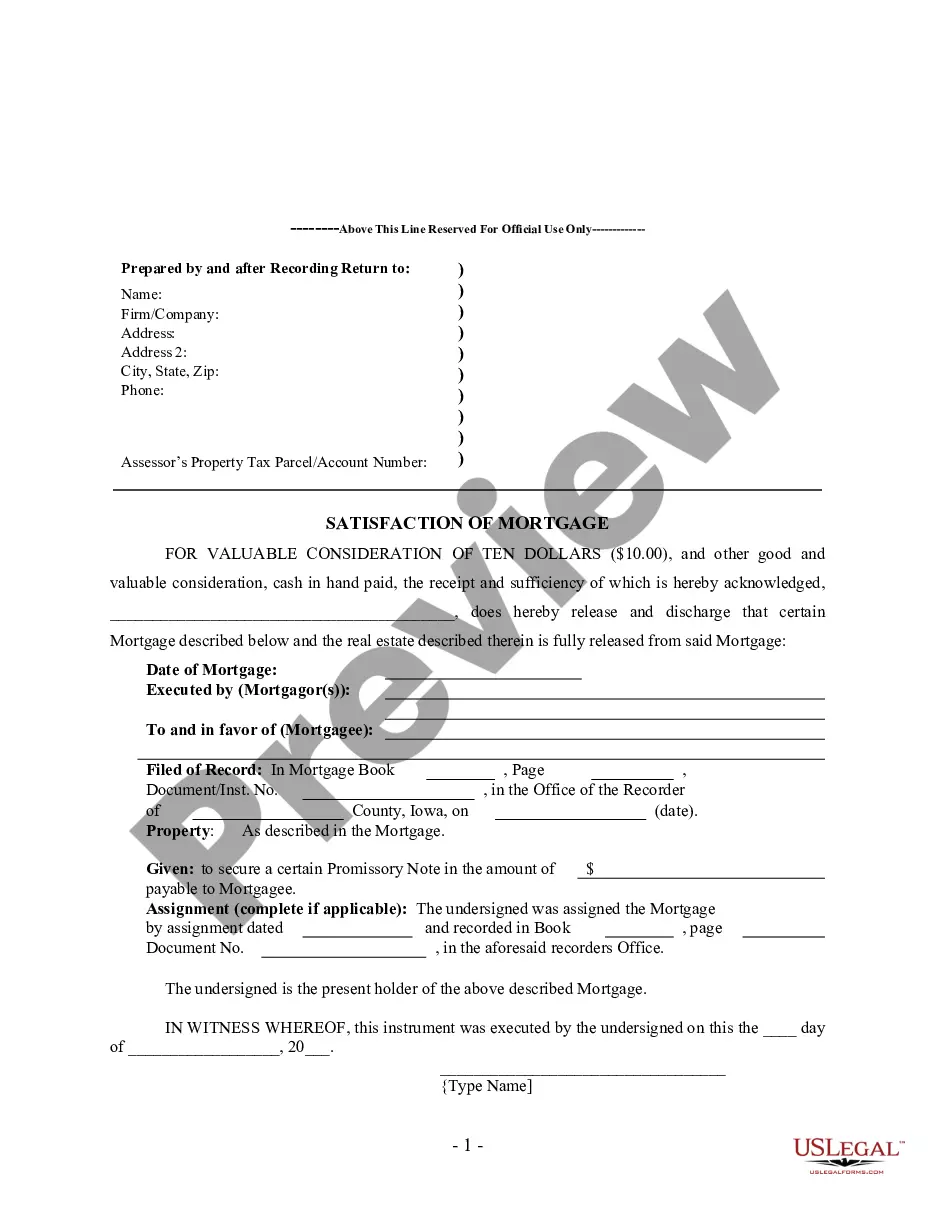

This form is for the satisfaction or release of a mortgage for the state of Iowa by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Cedar Rapids Iowa Satisfaction, Release, or Cancellation of Mortgage by Individual: Explained Introduction: In Cedar Rapids, Iowa, property owners who have fully repaid their mortgage have the option to obtain a Satisfaction, Release, or Cancellation of Mortgage by Individual. This legal process ensures that the lien on the property is officially released, providing a clear title for the homeowner. In this article, we will delve into the various types and requirements related to Cedar Rapids Iowa Satisfaction, Release, or Cancellation of Mortgage by Individual. Types of Cedar Rapids Iowa Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Full Satisfaction of Mortgage: This type of release occurs when the borrower has successfully fulfilled all financial obligations stated in the mortgage agreement. Upon complete repayment of the loan, the lender provides a satisfaction document that confirms the mortgage has been discharged. Once recorded, this document eliminates any encumbrances associated with the mortgage. 2. Release of Mortgage: Occasionally, a mortgage may be partially satisfied, where a portion of the loan has been repaid, freeing a specific property or parcel from the mortgage's reach. This type of release enables the homeowner to retain ownership of the released portion while continuing payments on the remaining balance. Key Steps Involved in Cedar Rapids Iowa Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Repayment Confirmation: The borrower is responsible for ensuring that the entire mortgage amount, including principal and interest, has been successfully paid according to the agreed-upon terms and conditions. 2. Obtain Satisfaction Release Document: Once the mortgage is paid off, the borrower must contact the lender to request a Satisfaction, Release, or Cancellation of Mortgage document. This document will discharge the lien against the property. 3. Document Recording: The released mortgage document must be recorded with the Line County Recorder's Office or applicable county office. This step ensures that the release is officially documented and protects the homeowner's property rights. 4. Title Search: To ensure the property's marketability, it is crucial to perform a title search to confirm that all encumbrances associated with the mortgage have been released. This step involves examining public records for any remaining liens or judgments that could impede the clear title transfer. 5. Title Insurance: Obtaining title insurance is highly recommended safeguarding against any potential title defects or undiscovered issues that may arise in the future. Title insurance provides reassurance to both the homeowner and prospective buyers, protecting against any financial loss. Conclusion: Cedar Rapids, Iowa, offers property owners a well-defined process known as Satisfaction, Release, or Cancellation of Mortgage by Individual to release the lien upon full or partial mortgage satisfaction. By meticulously following the steps outlined in this article, homeowners can secure a clear title and enjoy complete ownership of their property. If you are considering pursuing this legal process, consult with a qualified real estate attorney or title company for personalized guidance tailored to your specific situation.