Iowa law states that a property owner is not obligated to pay an original contractor until ninety (90) days from the completion of the building or improvement, unless the contractor provides waivers of lien signed by all parties who might claim a lien against the property.

Cedar Rapids Iowa Waiver of Lien by Corporation or LLC

Description

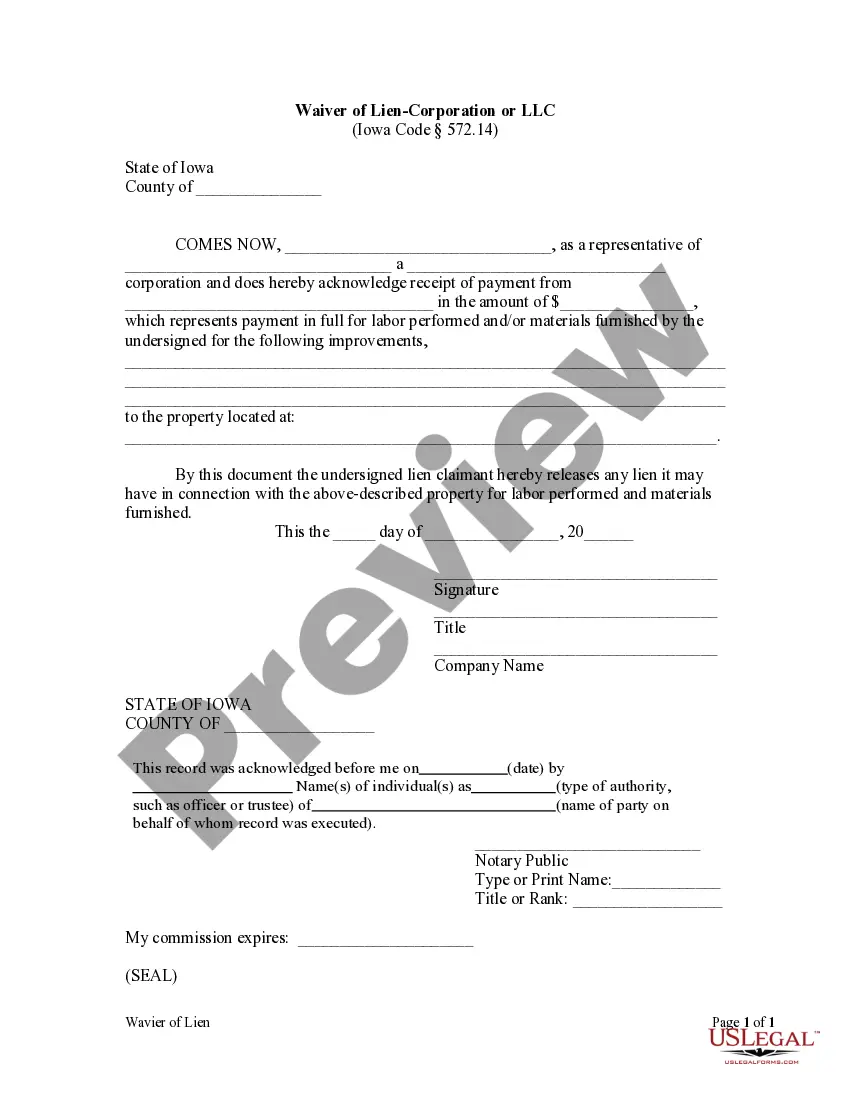

How to fill out Iowa Waiver Of Lien By Corporation Or LLC?

If you’ve previously utilized our service, Log In to your account and retrieve the Cedar Rapids Iowa Waiver of Lien by Corporation or LLC on your device by selecting the Download button. Ensure your subscription is current. If not, renew it based on your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You maintain continuous access to all documents you have purchased: you can locate them in your profile within the My documents section whenever you wish to reuse them. Utilize the US Legal Forms service to efficiently find and save any template for your personal or professional requirements!

- Ensure you’ve identified an appropriate document. Review the description and utilize the Preview feature, if accessible, to verify it aligns with your requirements. If it’s not suitable, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Retrieve your Cedar Rapids Iowa Waiver of Lien by Corporation or LLC. Choose the file format for your document and store it on your device.

- Fill out your sample. Print it or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

Unconditional lien waivers in Iowa typically do not need to be notarized; however, notarization can enhance the document's reliability. It's wise to consider having the waiver notarized to provide extra assurance during transactions. As with any Cedar Rapids Iowa Waiver of Lien by Corporation or LLC, consult with an expert to ensure proper compliance.

Filling out a conditional waiver of a lien involves a few key steps. First, you'll need your identifying information, the property owner's details, and a description of the work completed. Completing this accurately ensures that your Cedar Rapids Iowa Waiver of Lien by Corporation or LLC is valid and enforceable, so take your time to include all necessary information.

Yes, in Iowa, lien waivers can generally be signed electronically, but it's important to check specific regulations that may apply to your situation. Using electronic signatures can streamline the process and make it more convenient for all parties involved. Ensure that the electronic signature platform you choose meets legal standards to secure your Cedar Rapids Iowa Waiver of Lien by Corporation or LLC.

In Iowa, lien waivers do not typically require notarization to be valid. However, having the document notarized can add an extra layer of authenticity and help prevent disputes in the future. When dealing with a Cedar Rapids Iowa Waiver of Lien by Corporation or LLC, it's wise to consult with a legal expert to confirm the best practice.

A lien in Iowa generally remains in effect for a period of two years. During this time, the lien claimant can enforce their rights if payment is not received for services rendered or materials supplied. However, filing for an extension may be necessary if the situation requires additional time beyond the original two-year period.

To fill out a conditional waiver of lien in Cedar Rapids, Iowa, start by entering your name, the name of the property owner, and project details. You should clearly specify the amount being waived and indicate that the waiver is conditional upon receiving payment. It's essential to double-check all entered information to ensure accuracy before submitting the document.

In the context of a Cedar Rapids Iowa Waiver of Lien by Corporation or LLC, the claimant is typically the individual or entity that has provided labor or materials for a construction project. This person or company is seeking payment, and by executing a conditional waiver, they agree to relinquish their lien rights once they receive full payment. It is crucial to ensure that all details are clear to avoid any misunderstandings.

In Cedar Rapids, Iowa, the contractor or subcontractor who receives payment fills out the lien waiver. This individual provides details about the work performed and confirms that payment has occurred, effectively relinquishing their right to file a lien. Ensuring that the lien waiver is correctly filled out and signed can save you from future disputes. Utilizing the Cedar Rapids Iowa Waiver of Lien by Corporation or LLC makes the process straightforward and efficient.

Yes, in Cedar Rapids, Iowa, a mortgage lien must be recorded to be valid against third parties. Recording ensures that other creditors or potential buyers are aware of the mortgage claim on the property. Failure to record can lead to disputes and complications down the line. Understanding the Cedar Rapids Iowa Waiver of Lien by Corporation or LLC ensures you have the necessary documents to protect your interests.

In Cedar Rapids, Iowa, lien waivers typically do not need to be recorded to be effective, but doing so can provide an extra layer of protection. Recording your waiver can publicly document that a lien was waived, which helps prevent future claims against the property. This practice is especially important when dealing with multiple contractors or suppliers. Using the Cedar Rapids Iowa Waiver of Lien by Corporation or LLC can be a smart move for your business.