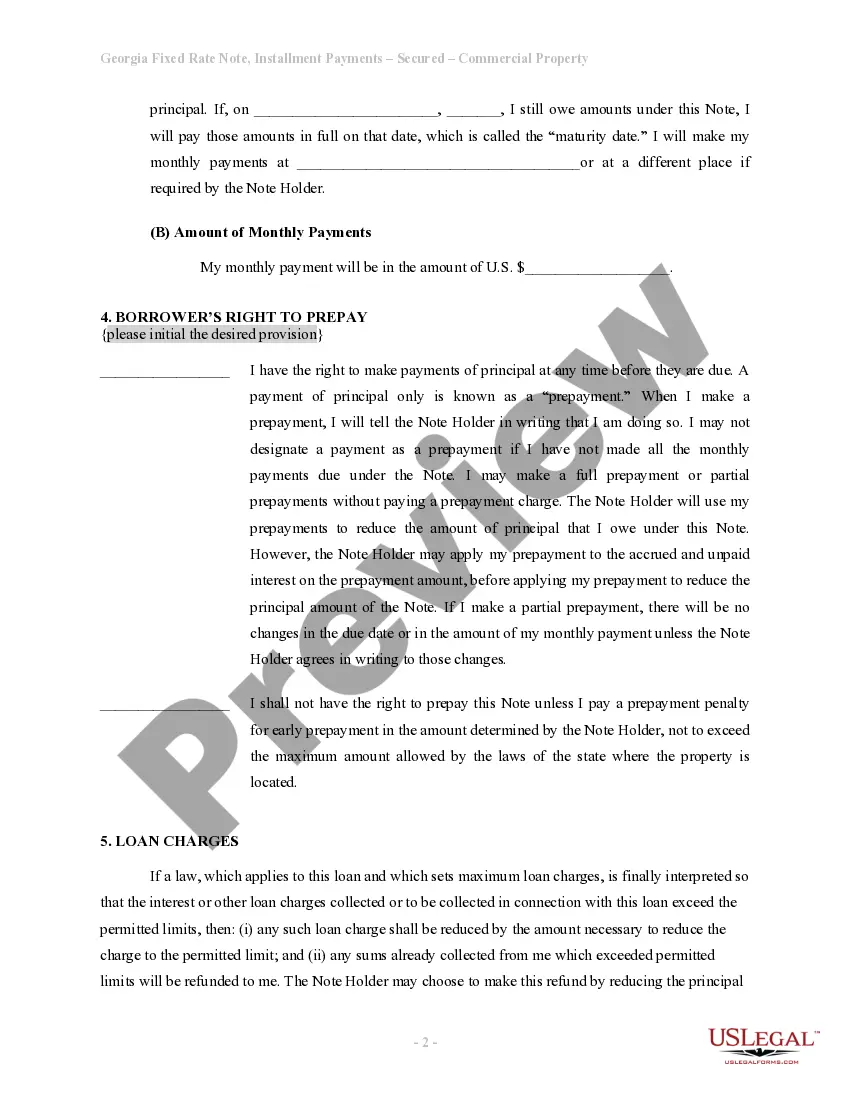

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Fulton Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Georgia Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Take advantage of the US Legal Forms and obtain immediate access to any document you desire.

Our advantageous platform with a vast selection of templates simplifies the process of locating and acquiring nearly any document sample you may require.

You can save, complete, and validate the Fulton Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate in just a few moments instead of spending countless hours online searching for the appropriate template.

Leveraging our assortment is an excellent approach to enhance the security of your document filing.

Access the page with the template you need. Ensure that it is the document you were looking for: verify its title and description, and utilize the Preview feature when available. If not, use the Search field to find the correct one.

Initiate the saving process. Click Buy Now and select the pricing plan that best fits your needs. Then, set up an account and finalize your order using a credit card or PayPal.

- Our experienced attorneys frequently assess all records to ensure that the templates are suitable for a specific state and comply with current laws and regulations.

- How can you obtain the Fulton Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

- If you already have a subscription, simply Log In to your account. The Download option will be available on all documents you view.

- Additionally, all previously saved documents can be found in the My documents section.

- If you haven’t created an account yet, follow the steps below.

Form popularity

FAQ

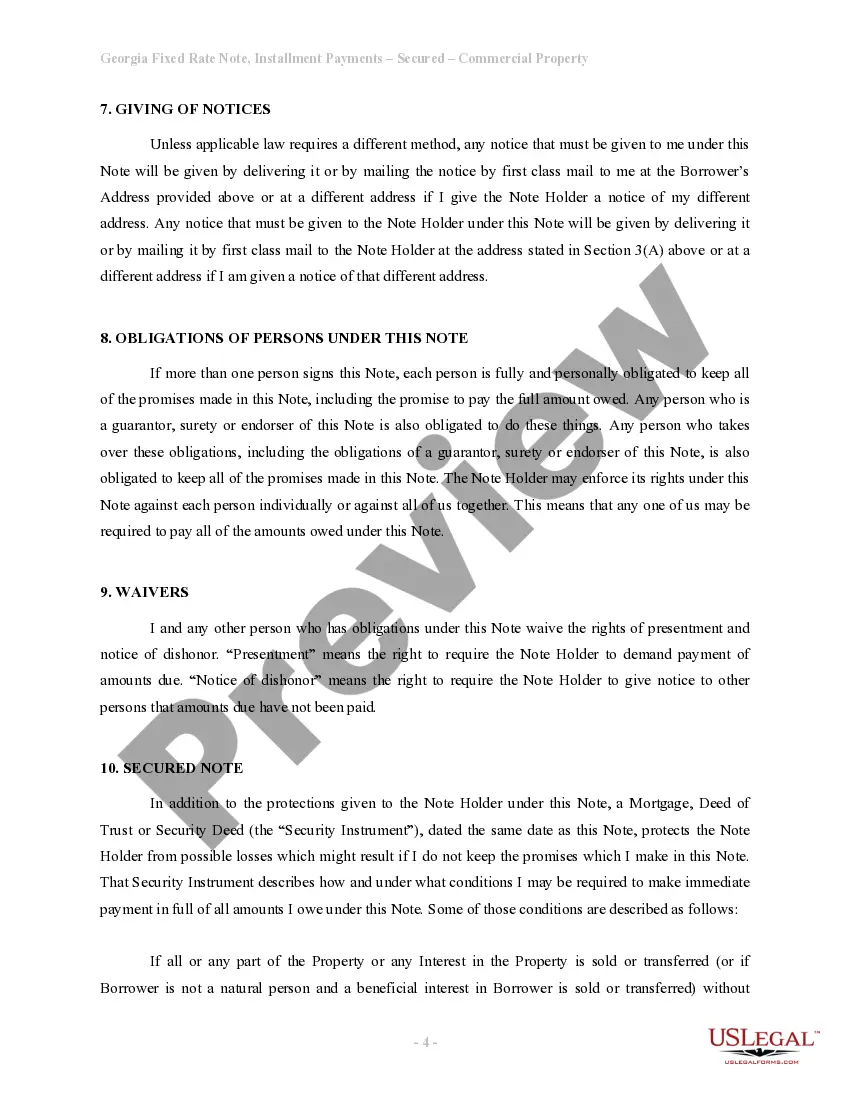

Yes, a promissory note can indeed be secured by real property. This practice enhances the lender's security, ensuring that they have a claim to the asset if repayment does not occur. In the context of Fulton Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, securing the note with real estate offers a reliable means of protection for both the borrower and the lender.

Securing a promissory note with real property involves creating a lien against the property in question. This method provides assurance to the lender, as they can claim the property if the borrower defaults. By structuring a Fulton Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate with proper legal documentation, lenders can ensure their investment remains protected.

To complete a promissory note, start with accurate information, including the date, borrower's name, and lender's details. Next, state the principal amount, interest rate, and payment schedule clearly. In the case of the Fulton Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, ensure the secured property's description is precise to safeguard both parties.

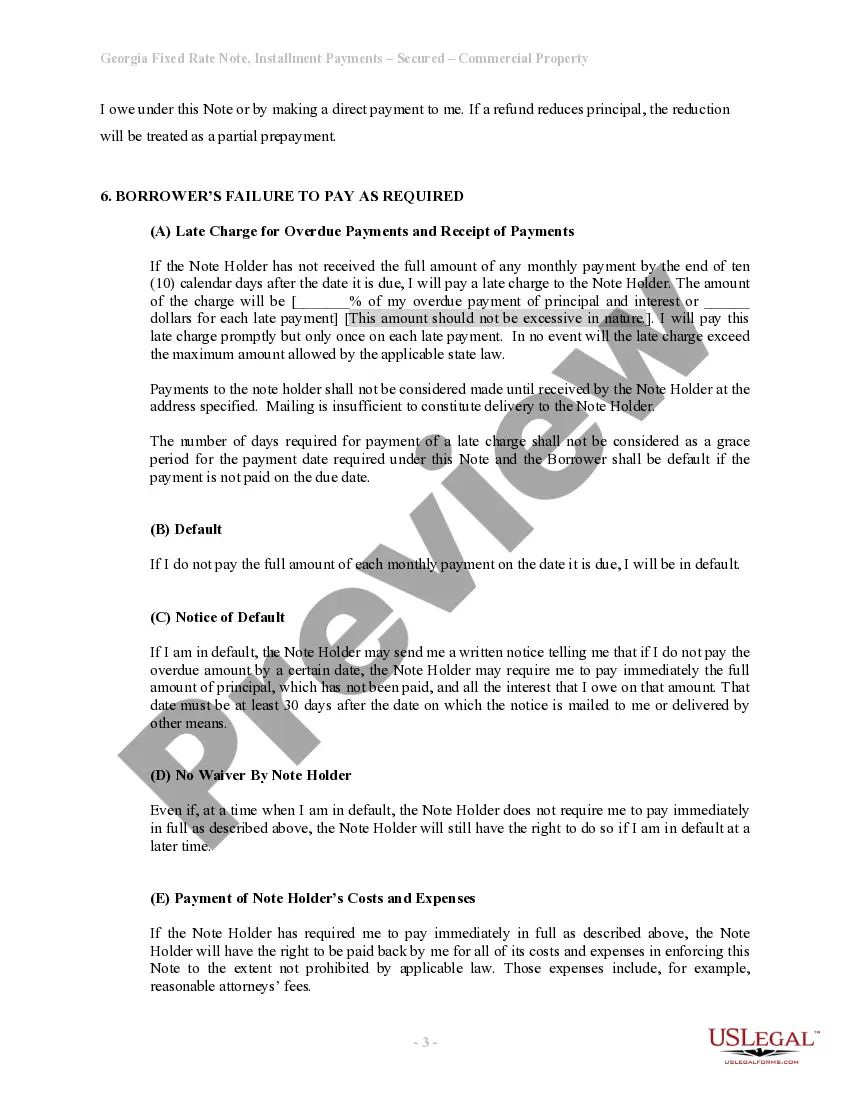

One disadvantage of a promissory note is its potential lack of enforceability if not properly documented. In the context of the Fulton Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, failure to adhere to legal standards may jeopardize your rights. Additionally, if the borrower defaults, recovering the owed amounts can become complicated without additional security.

In Georgia, promissory notes do not require notarization to be legally binding. However, obtaining a notarized Fulton Georgia Installments Fixed Rate Promissory Note Secured by Commercial Real Estate can provide added security and credibility. Notarization helps verify the identities of the parties involved and can assist in preventing disputes. For tailored legal documents or further insights, consider using the U.S. Legal Forms platform.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A secured promissory note should carefully outline its repayment, and default terms. For example, it should spell out the steps required for seizing collateral. It should also state if there are any grace periods for late payments, and name who shall pay for costs, and legal fees if there is a default.

Take the original signed and notarized Deed of Trust and Promissory Note to the County Recorder's Office for the county where the property is located.

As you repay the loan, you'll record notes payable as a debit journal entry, while crediting the cash account. This is recorded on the balance sheet as a liability. But you must also work out the interest percentage after making a payment, recording this figure in the interest expense and interest payable accounts.