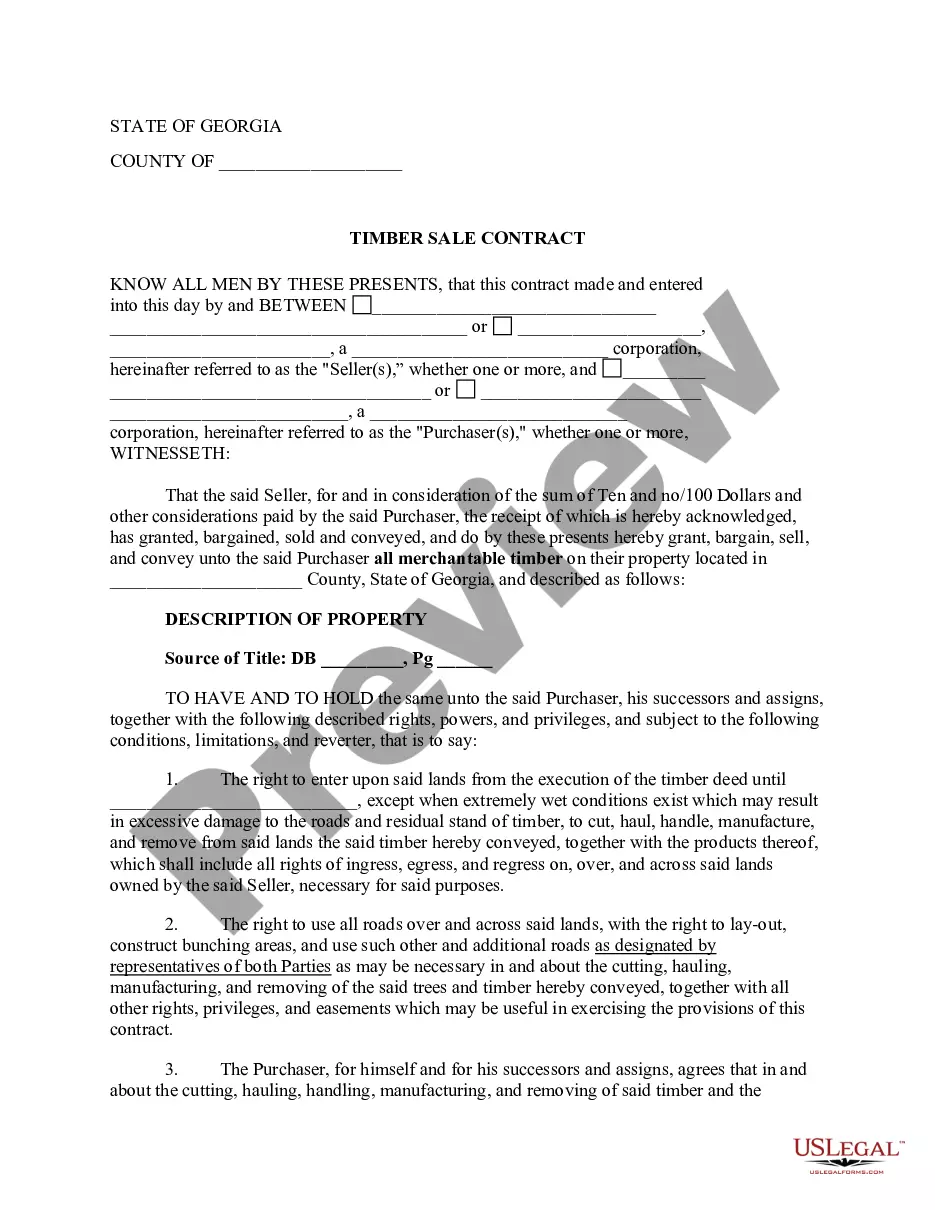

This is a contract whereby the buyer agrees to purchase all timber as designated for removal by the seller. Seller will also grant the buyer the right of ingress and egress to remove the timber from seller's land.

Sandy Springs Georgia Forest Products Timber Sale Contract

Description

How to fill out Georgia Forest Products Timber Sale Contract?

If you have previously utilized our service, sign in to your account and fetch the Sandy Springs Georgia Forest Products Timber Sale Agreement on your device by pressing the Download button. Ensure your subscription is active. If not, renew it as per your payment arrangement.

If this is your inaugural encounter with our service, adhere to these straightforward steps to obtain your document.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to swiftly locate and save any template for your personal or business requirements!

- Ensure you have found an appropriate document. Review the description and utilize the Preview option, if available, to ascertain if it fulfills your needs. If it doesn't meet your criteria, use the Search tab above to discover the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription option.

- Create an account and process a payment. Enter your credit card information or select the PayPal option to finalize the transaction.

- Obtain your Sandy Springs Georgia Forest Products Timber Sale Agreement. Choose the file format for your document and store it on your device.

- Complete your form. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

To record a sale of timber, start by creating a document that outlines the transaction details, including information from your Sandy Springs Georgia Forest Products Timber Sale Contract. Include the date of sale, amount received, and any expenses incurred in the process. This record will serve as a crucial reference for your tax reporting and will help you maintain clear financial records going forward.

To report timber sales on your taxes, you will need to categorize the income as 'Other Income' on your tax return. Your Sandy Springs Georgia Forest Products Timber Sale Contract will have essential details to ensure accurate reporting. You must keep track of all income received from the sale, as well as any associated costs to potentially offset that income. Proper documentation can save you time and effort during tax season.

Yes, selling timber does count as income. The revenue generated from the sale, as outlined in your Sandy Springs Georgia Forest Products Timber Sale Contract, must be reported on your tax return. It is considered taxable income, so maintaining detailed records of the sale and any related expenses is essential for accurate reporting.

Handling timber sales on a tax return involves careful documentation and reporting. Start by reviewing the Sandy Springs Georgia Forest Products Timber Sale Contract, as it outlines the terms of your sale. You will need to report the sale as income and consider any eligible deductions, such as costs associated with the sale. Accurate reporting ensures compliance and helps you avoid penalties.

When reporting timber royalties on your Form 1040, you typically list this income as 'Other Income'. Make sure to keep a record of your Sandy Springs Georgia Forest Products Timber Sale Contract, as it provides important details for your entries. It is crucial to maintain accurate records, ensuring that you report the correct amounts to avoid any issues with the IRS.

To report the sale of timber using TurboTax, begin by gathering all relevant documentation related to the transaction. You should have information about the Sandy Springs Georgia Forest Products Timber Sale Contract handy. Open TurboTax, navigate to the income section, and enter the details under 'Other Income'. This ensures that your timber sale is accurately reflected in your tax return.

Timber rights refer to the legal rights that allow an individual or company to harvest and sell timber from a specific piece of land. These rights can be sold or leased, allowing landowners to benefit financially from their forest resources. When drafting a Sandy Springs Georgia Forest Products Timber Sale Contract, it is essential to clearly define these rights to prevent misunderstandings. This ensures that all parties are aware of their legal obligations and entitlements regarding the timber on the property.

Timber can expand and contract due to changes in humidity and temperature, often leading to dimensional changes in the wood. Generally, hardwoods might experience minimal expansion, while softwoods can be more significantly affected. Understanding these factors is crucial in a Sandy Springs Georgia Forest Products Timber Sale Contract, as it can impact the timber's value and usability. Proper seasoning and storage of timber can mitigate issues related to expansion and contraction.

Timber leases allow a landowner to grant someone else the right to harvest timber in exchange for payment. Typically, these leases last for a specific duration, and payments can be based on the volume of timber cut. Utilizing a Sandy Springs Georgia Forest Products Timber Sale Contract helps formalize this agreement, ensuring that both parties meet their obligations. This method allows landowners to benefit without handling the logging process themselves.

A logging contract outlines the agreement between a landowner and a logging company for the harvesting of timber. Typically, it specifies the types of trees being harvested, the method of logging, and the payment terms. By using a Sandy Springs Georgia Forest Products Timber Sale Contract, you can ensure that all parties understand their rights and responsibilities. This clarity helps prevent disputes and secures a fair transaction.