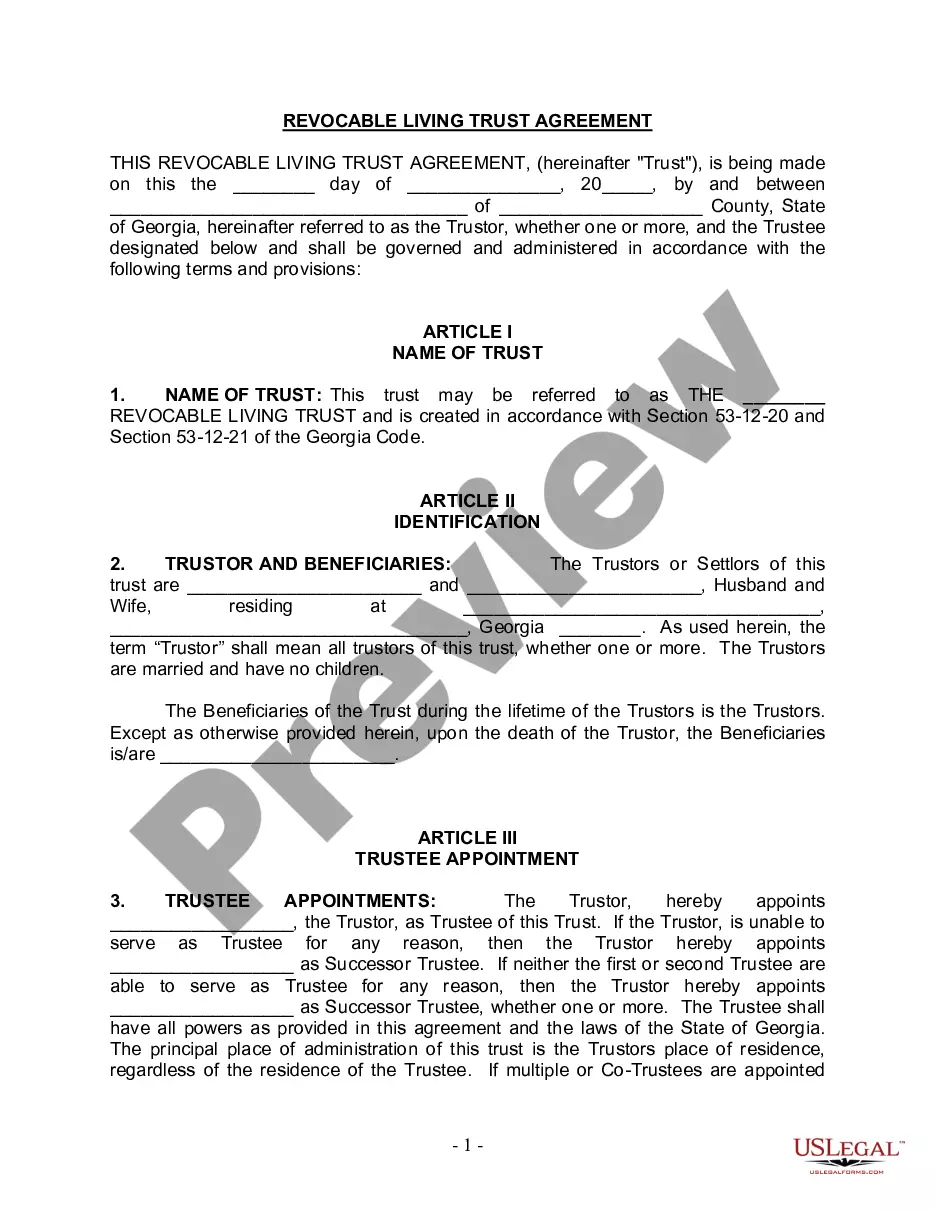

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Savannah Georgia Living Trust for Husband and Wife with No Children

Description

How to fill out Georgia Living Trust For Husband And Wife With No Children?

Regardless of social or professional standing, completing legal-related documents is an unfortunate requirement in today’s society.

Frequently, it’s nearly impossible for someone without a legal foundation to create such documents from the ground up, primarily due to the complicated language and legal nuances they entail.

This is where US Legal Forms comes into play.

However, if you are a newcomer to our library, make sure to follow these instructions before downloading the Savannah Georgia Living Trust for Husband and Wife with No Children.

Ensure the template you have selected is appropriate for your region since the regulations of one state or locality do not apply to another state or locality.

- Our platform provides a vast catalog with over 85,000 ready-to-use state-specific forms that are applicable for almost any legal situation.

- US Legal Forms also functions as an outstanding resource for associates or legal advisors who wish to improve their efficiency by using our DIY documents.

- No matter if you need the Savannah Georgia Living Trust for Husband and Wife with No Children or any other documents that will be enforceable in your jurisdiction, with US Legal Forms, everything is easily accessible.

- Here’s how you can obtain the Savannah Georgia Living Trust for Husband and Wife with No Children in minutes using our dependable platform.

- If you are already a customer, you can proceed to Log In to your account to retrieve the necessary form.

Form popularity

FAQ

One downside of a Savannah Georgia Living Trust for Husband and Wife with No Children is that it may not provide the same level of asset protection as a will. Living trusts require some initial setup costs and can be more complex to manage than a simple will. Additionally, transferring assets into the trust can be time-consuming, which might be a consideration for couples with existing properties. Despite these drawbacks, many couples find that the benefits of establishing a living trust far outweigh any challenges.

Deciding whether to create separate living trusts or one joint trust often depends on individual circumstances. A Savannah Georgia Living Trust for Husband and Wife with No Children could typically streamline asset management and distribution, as it consolidates resources. However, there may be situations where separate trusts offer benefits, especially in terms of personal assets. Consulting with an expert can provide clarity and help determine the best approach for your specific needs.

One of the biggest mistakes parents make when creating a trust is failing to properly fund it. Without transferring assets into the trust, it cannot operate effectively, leaving it meaningless. Additionally, parents often overlook discussing their wishes clearly with their loved ones, which can lead to confusion later. Taking time to understand all aspects of the Savannah Georgia Living Trust for Husband and Wife with No Children can prevent these common pitfalls.

Establishing a trust can involve certain risks. For example, mismanagement of the trust assets may lead to financial losses, impacting your overall financial goals. Moreover, if the trust is not set up correctly, it may not offer the desired tax benefits or protections. To mitigate these risks, consulting with a knowledgeable advisor, like those at US Legal Forms, can help ensure your Savannah Georgia Living Trust for Husband and Wife with No Children meets your needs.

Setting up a Savannah Georgia Living Trust for Husband and Wife with No Children can be an excellent choice for your parents. It helps ensure that their assets are managed according to their wishes, making the transition smoother during difficult times. Furthermore, a trust can help avoid the lengthy probate process, leading to less stress for your family. Encourage them to consider this option with a professional to understand its benefits.

The best trust for a married couple often depends on their unique situation, but they may find that a Savannah Georgia Living Trust for Husband and Wife with No Children suits their needs well. This trust type offers flexibility, tax advantages, and an efficient distribution plan for assets. It’s essential for couples to consult with estate planning professionals to determine the best strategy that fits their financial goals.

A separate trust provides distinct advantages, such as independent control over assets and more tailored estate planning. By utilizing a Savannah Georgia Living Trust for Husband and Wife with No Children, each spouse can create specific instructions that reflect their personal values and wishes. Additionally, separate trusts can enhance privacy, reduce potential conflicts, and ensure that both partners' interests are effectively protected.

Joint trusts can complicate the estate planning process, especially when there are changes in circumstances or if one spouse passes away. A Savannah Georgia Living Trust for Husband and Wife with No Children might limit flexibility and control over individual assets, as both must agree on any changes. This can create challenges in decision-making and asset management during a time that may already be stressful.

Husbands and wives may choose to establish separate trusts for various reasons, including individual asset management and differing estate planning goals. With a Savannah Georgia Living Trust for Husband and Wife with No Children, separate trusts can allow each spouse to specify their wishes regarding asset distribution. This approach also simplifies tax planning and helps protect assets from creditors or unforeseen circumstances.

Yes, a Savannah Georgia Living Trust for Husband and Wife with No Children can provide valuable estate planning benefits, even without children. This type of trust helps ensure your assets are transferred smoothly to your surviving spouse, avoiding probate, and maintaining privacy. Creating a trust can also offer flexibility in managing your assets during your lifetime and beyond.