This form is an Executor's Deed where the Grantor is the executor of an estate and the Grantee is a Trust as purchaser of the property. Grantor conveys the described property to the Grantee. This deed complies with all state statutory laws.

Fulton Georgia Executor's Deed to a Trust

Description

How to fill out Georgia Executor's Deed To A Trust?

Utilize the US Legal Forms and gain instant access to any template sample you require.

Our convenient website with a vast array of templates enables you to discover and acquire nearly any document sample you desire.

You can download, fill out, and authenticate the Fulton Georgia Executor's Deed to a Trust in just a few minutes instead of spending hours online searching for the correct template.

Using our catalog is an excellent method to enhance the security of your document submissions.

If you do not have an account yet, follow the steps outlined below.

Open the webpage with the form you require. Ensure that it is the form you were aiming to find: verify its title and description, and use the Preview option if it is available. If not, utilize the Search field to locate the suitable one.

- Our skilled legal experts frequently review all documents to verify that the templates are applicable for a specific region and compliant with the latest laws and regulations.

- How can you obtain the Fulton Georgia Executor's Deed to a Trust.

- If you hold a subscription, simply Log In to your account.

- The Download button will appear on every sample you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

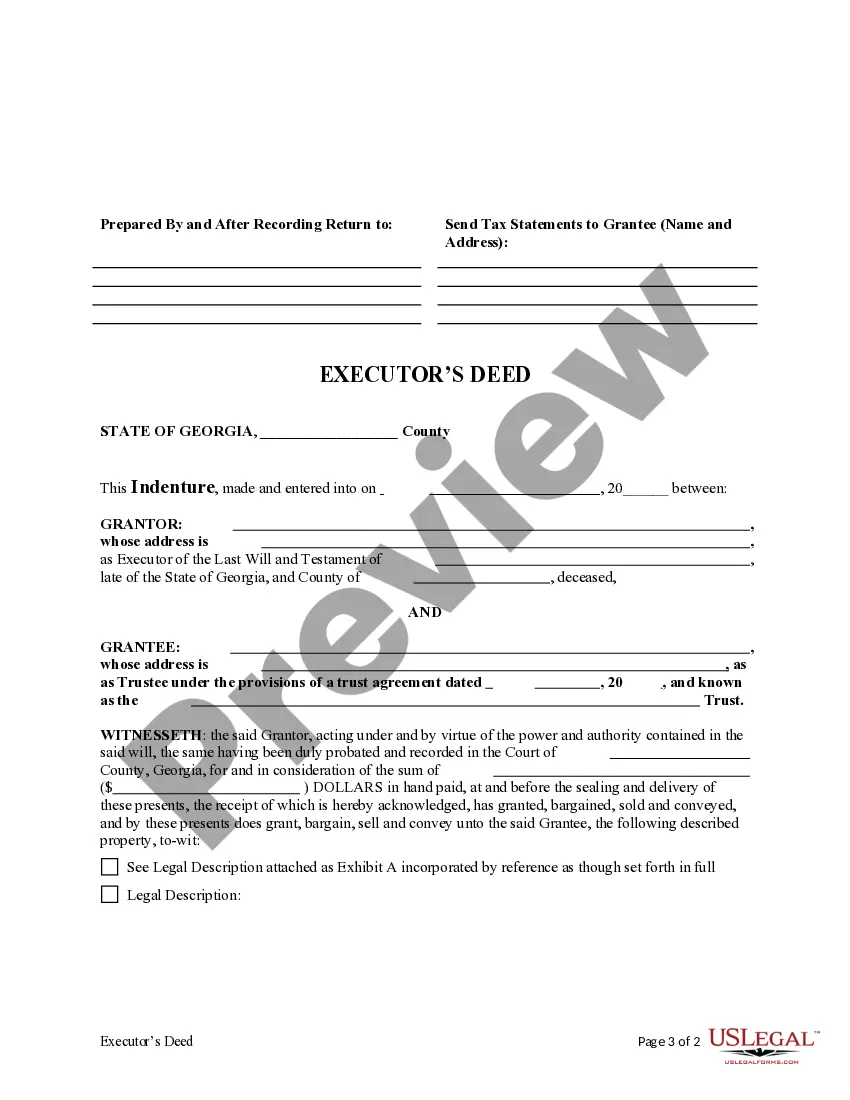

An executor's deed is used when a personal representative or administrator appointed by the Probate Court transfers property from the decedent's estate. For example, the court may instruct the estate's personal representative to sell the property to pay the estate's debts.

Georgia law governs estate property transfers after someone dies. A court-approved executor holds a probated estate's assets and transfers them by executor's deed to beneficiaries named in the decedent's will.

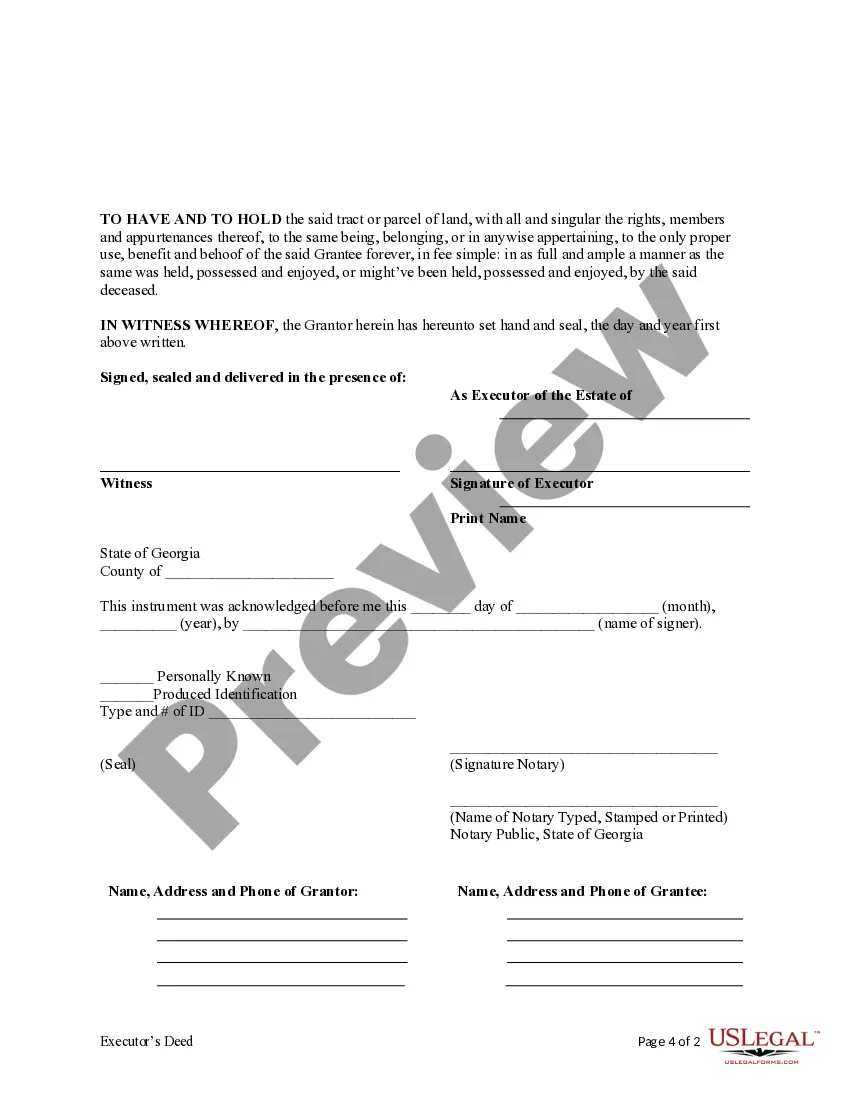

Complete the lien release section on the title, or complete and sign a Form T-4 Lien or Security Interest Release on behalf of the deceased. Attach a certified copy of the deceased death certificate. Complete Form T-20 Affidavit of Inheritance.

In this case, it is the responsibility of the executor or administrator to fill in and submit a Deceased Joint Proprietor form, along with a death certificate, to the Land Registry. This removes the deceased's name from the deed so that the living tenant owns the property in its entirety.

The Letters Testamentary gives the executor the duty and authority to collect and inventory the deceased person's assets, have those assets appraised, and sell any assets if necessary. An executor may sell items from the estate to pay off debts or to get rid of assets that are declining in value.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

The beneficiary needs to submit a copy of the deed to a probate court to receive the funds. The designated beneficiary must fill out a claim form and supply a copy of the death certificate to the bank to receive the funds in the account.