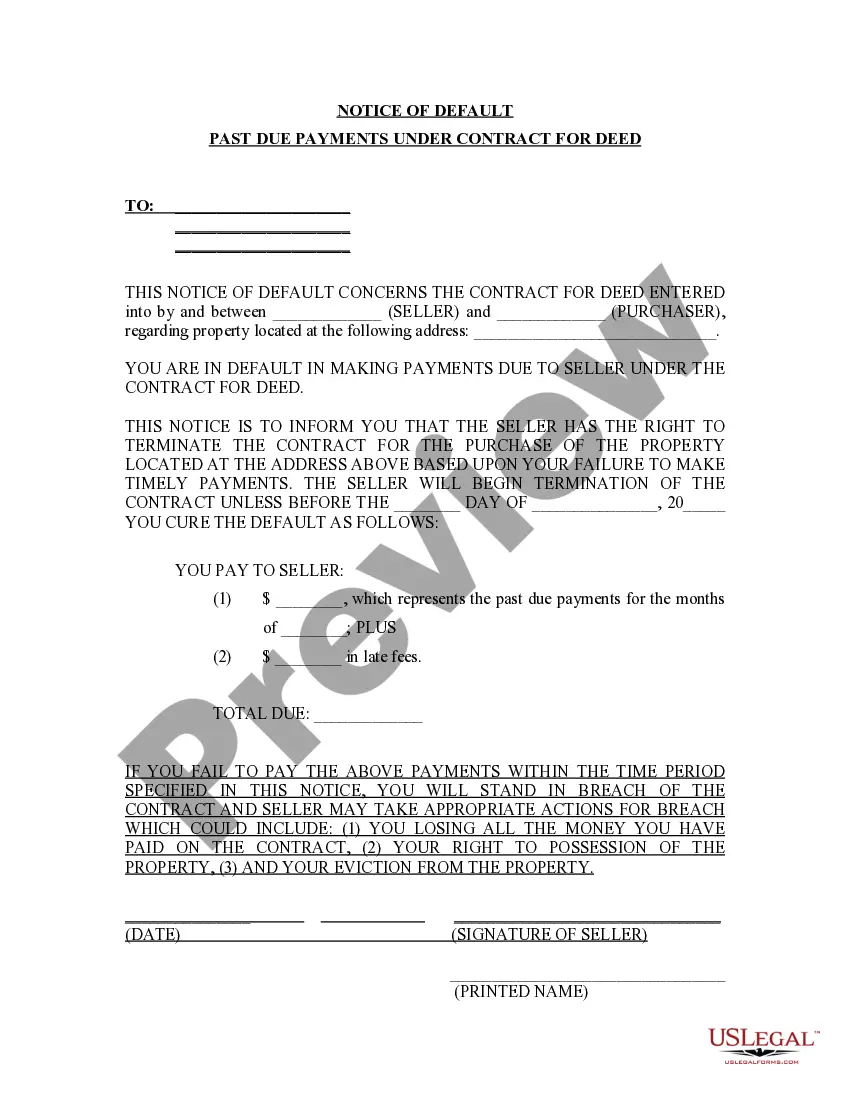

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Georgia Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Regardless of social or professional standing, finalizing legal documentation is an unfortunate obligation in today's society.

Too frequently, it's nearly unfeasible for someone lacking legal education to draft these kinds of documents from scratch, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms steps in to assist.

Confirm that the form you have located is appropriate for your area because the rules of one state or region do not apply to another.

Examine the form and read a concise summary (if available) of the cases the document may be used for.

- Our platform offers an extensive repository with over 85,000 ready-to-utilize state-specific documents that are suitable for nearly any legal situation.

- US Legal Forms is also an excellent tool for associates or legal advisors who wish to enhance their efficiency by using our DIY forms.

- Whether you need the Savannah Georgia Notice of Default for Past Due Payments related to Contract for Deed or any other document valid in your state or locality, with US Legal Forms, everything is accessible.

- Here's how you can obtain the Savannah Georgia Notice of Default for Past Due Payments related to Contract for Deed swiftly using our dependable platform.

- If you are already a registered user, you can proceed to Log In to your account to access the appropriate form.

- However, if you are new to our library, ensure that you follow these steps before acquiring the Savannah Georgia Notice of Default for Past Due Payments related to Contract for Deed.

Form popularity

FAQ

A request for notice of default means you are asking to be notified when a borrower falls behind on payments. This is particularly relevant in situations involving Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed. By requesting this notice, you gain timely information that can help you take necessary action. It’s an important tool for anyone holding interest in a property that may be at risk.

A request for notice of default is a formal document that a borrower or interested party submits to a lender. This request is important as it gives them official notification when a borrower defaults on their payments. In the context of Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed, this notice serves to keep all parties informed and protects creditor rights. Understanding this process can assist you in managing your obligations effectively.

Responding to a default notice promptly is crucial for protecting your interests. You can reach out to your lender to discuss payment options or possible arrangements. In situations involving Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed, consider consulting with a legal professional. This approach ensures you understand your rights and the steps you need to take.

Receiving a default notice indicates that the lender has formally acknowledged your missed payments. This notice is a serious document and signifies the need for immediate attention. In the context of Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed, you should review your options and possibly seek legal advice. Ignoring this notice can escalate to foreclosure proceedings.

When a property goes into default, it means the borrower has failed to meet the terms of the contract, usually due to missed payments. In the case of Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed, the lender may start the process of reclaiming the property. This can lead to foreclosure if the issues remain unresolved. It is important to act quickly to avoid losing your property.

In Georgia, the timeline for foreclosure can vary, but it generally takes about 90 to 120 days after receiving a notice of default. During this period, you have opportunities to address your missed payments and potentially avoid foreclosure. If you receive a Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed, be proactive in seeking solutions. Legal resources can assist you in finding the best course of action.

When you receive a notice of default, it means your lender has begun the foreclosure process due to missed payments. This document serves as a warning indicating the amount due and the consequences you may face if the issue is not resolved. The Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed is your signal to act swiftly to remedy the situation. Consulting with legal resources like uslegalforms can provide clarity and guidance on how to proceed.

Typically, you can miss three mortgage payments before foreclosure proceedings may begin in Georgia. However, receiving a Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed is a sign that your lender is serious about collecting what is owed. It is important to engage with your lender or explore options to address your payment situation. Don’t hesitate to seek resources to understand your rights and options.

In Georgia, lenders generally start the foreclosure process after three missed payments. However, this can vary based on the lender's policies and individual circumstances. Receiving a Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed usually occurs after one missed payment but sets a timeline in motion. Understanding these rules can help you avoid unexpected consequences.

The 120 day rule in Georgia states that lenders must wait at least 120 days after a borrower misses a payment before initiating foreclosure. This gives homeowners a chance to remedy their missed payments or negotiate alternatives. Therefore, it is crucial to address any Savannah Georgia Notice of Default for Past Due Payments in connection with Contract for Deed promptly. Utilizing platforms like uslegalforms can help you understand and navigate these crucial periods effectively.