Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

If you are looking for a suitable form template, it's difficult to discover a superior platform than the US Legal Forms site – one of the largest online repositories.

With this repository, you can access a vast array of form samples for business and personal uses categorized by types and states, or keywords.

With our enhanced search capability, locating the most current Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual is as simple as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and save it to your device.

- Additionally, the applicability of each document is validated by a group of proficient attorneys who routinely review the templates on our platform and update them in line with the latest state and county laws.

- If you are already familiar with our system and possess a registered account, all you need to acquire the Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual is to Log In to your profile and press the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have accessed the form you require. Review its description and use the Preview feature (if available) to assess its contents. If it doesn't meet your requirements, utilize the Search bar at the top of the page to find the necessary document.

- Confirm your choice. Click the Buy now button. Afterward, select your desired subscription package and enter your details to create an account.

Form popularity

FAQ

Lenders in Florida generally do not have a specific timeframe mandated by law to make a decision regarding a mortgage application. However, it is ideal for borrowers to expect a response within a few weeks. Prompt communication from lenders is essential for a smooth experience, especially when you aim for Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual. Utilizing platforms like uslegalforms can assist in expediting this process.

A lender in Florida must record a satisfaction of mortgage within 60 days after receiving a payment in full. This timeframe is crucial for ensuring that public records accurately reflect the status of the mortgage. Timely recording protects the homeowner's rights and facilitates the process of Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual. Remember, you can easily streamline this process with the help of uslegalforms.

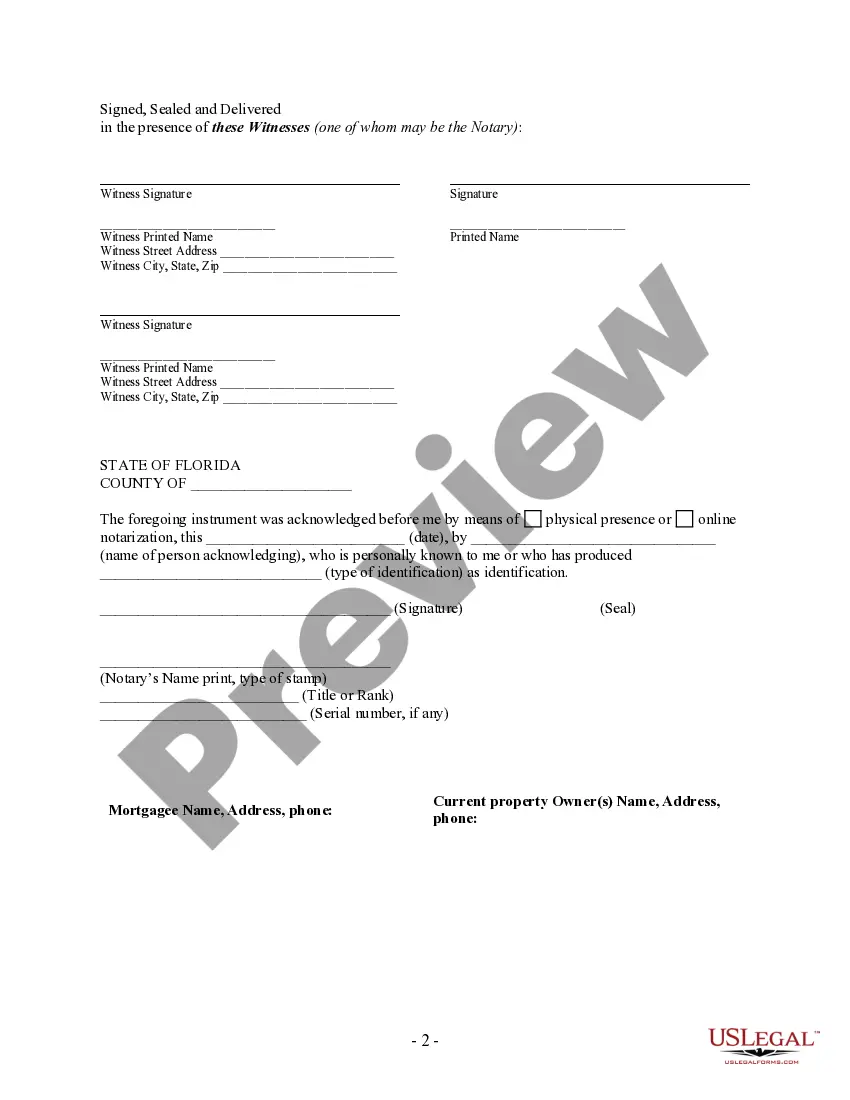

Yes, in Florida, a satisfaction of mortgage typically requires notarization. This step is important as it helps verify the authenticity of the satisfaction document. A notarized satisfaction of mortgage can be more readily accepted and appreciated by all parties involved, ensuring clarity in Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual. Always consult a professional to ensure compliance with local laws.

In Florida, it is essential to record a mortgage to protect your interests. Recording a mortgage provides public notice of the creditor's claim against the property. If the mortgage is not recorded, potential buyers may not be aware of existing liens or claims. To ensure your rights are secured in Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual, it is advisable to record the mortgage promptly.

In Florida, the Office of Financial Regulation is responsible for overseeing mortgage lenders. This agency ensures that lenders comply with state laws and regulations. As part of their duties, they protect borrowers, making sure the Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual is handled appropriately and fairly.

In Florida, the statute of limitations for a mortgage foreclosure is five years. This period begins from the date of the last payment made on the mortgage. Knowing this timeframe can help you understand your rights, especially if you are facing difficulties with payments related to the Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

To file a complaint against a mortgage company in Florida, begin by gathering all necessary documentation, such as your mortgage agreement and any correspondence. Next, contact the Florida Department of Financial Services or the Consumer Financial Protection Bureau. These organizations can guide you through the complaint process, ensuring your rights are protected under the Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual.

In Florida, a satisfaction of mortgage does not require witnesses to be valid, although it should be notarized. Having it notarized adds credibility to the document, which is beneficial for maintaining accurate property records. For those navigating the Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual, utilizing platforms like uslegalforms can simplify the process and ensure compliance with state requirements.

Yes, in Florida, a mortgage must be notarized to be legally valid. This process ensures that the identities of the parties involved are confirmed, providing an added layer of security. Notarization serves as a safeguard against fraud, making it a necessary step in the Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual process.

In Florida, a lender is required to record a satisfaction of mortgage within 60 days after full payment is made. If they fail to do so, this may result in penalties. Therefore, it is essential to follow up and ensure that the satisfaction document is filed promptly. This step is crucial for achieving a seamless Cape Coral Florida Satisfaction, Release or Cancellation of Mortgage by Individual.