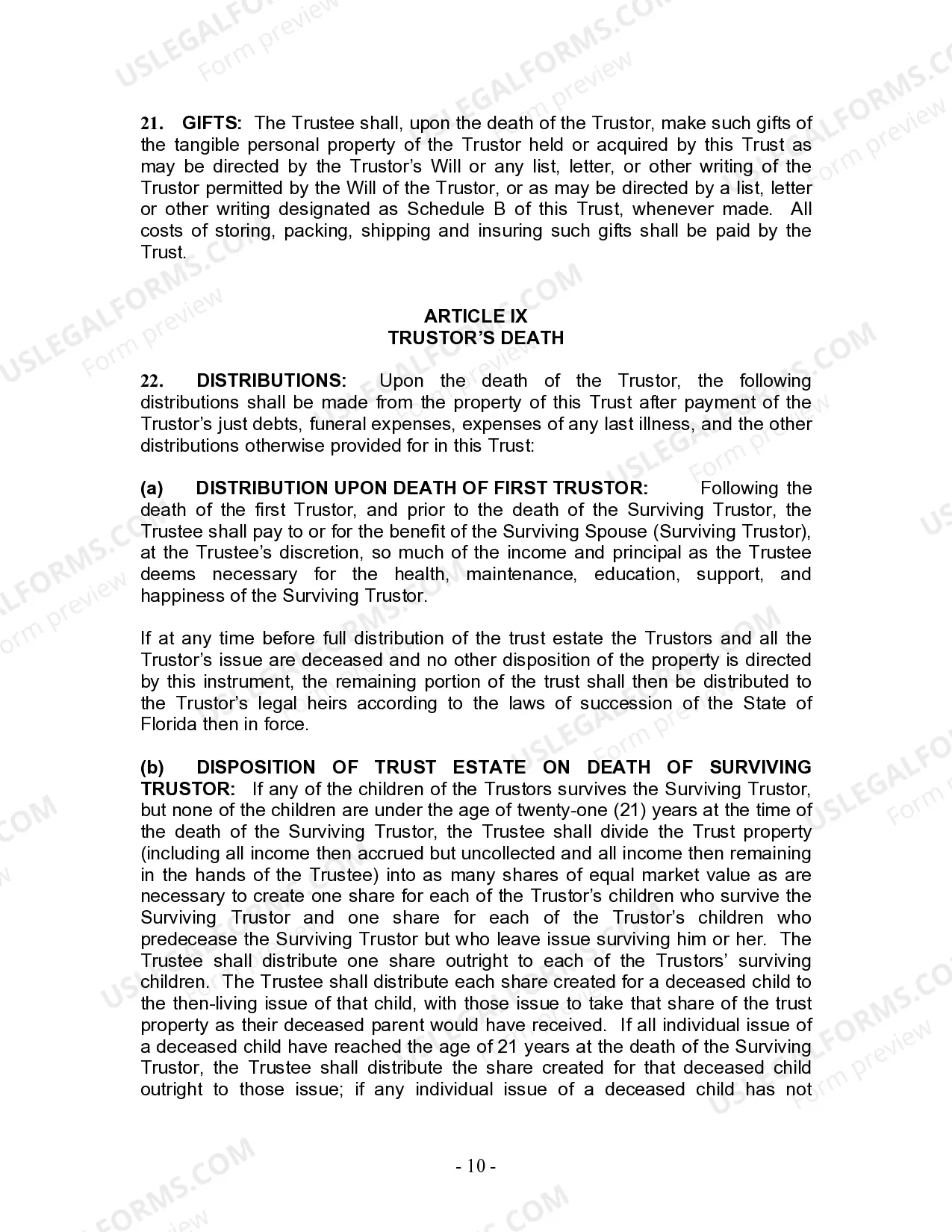

Palm Beach Florida Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Florida Living Trust For Husband And Wife With Minor And Or Adult Children?

Regardless of one's social or professional position, completing legal forms is a regrettable requirement in today's society.

Often, it is nearly impossible for an individual without legal training to create such documents from the ground up, mainly because of the complex terminology and legal subtleties they include.

This is the point at which US Legal Forms proves to be useful.

Verify that the form you selected is appropriate for your location since the laws of one state may not apply to another.

Review the form and check a brief description (if available) of the situations for which the document can be utilized.

- Our platform offers a vast collection of over 85,000 state-specific forms that are suitable for virtually any legal situation.

- US Legal Forms serves as a fantastic tool for associates or legal advisors seeking to enhance their efficiency using our DIY forms.

- Whether you're in need of the Palm Beach Florida Living Trust for Husband and Wife with Minor and/or Adult Children or any other documentation valid in your state or region, US Legal Forms has everything readily available.

- To quickly obtain the Palm Beach Florida Living Trust for Husband and Wife with Minor and/or Adult Children using our trustworthy platform, follow these steps.

- If you are already a subscriber, simply Log In to your account to download the required form.

- However, if you are new to our library, make sure to adhere to the following instructions before acquiring the Palm Beach Florida Living Trust for Husband and Wife with Minor and/or Adult Children.

Form popularity

FAQ

Creating a living trust without a lawyer in Florida is possible with the right resources. Start by outlining your assets and beneficiaries who will benefit from your Palm Beach Florida Living Trust for Husband and Wife with Minor and or Adult Children. Using a reliable service like uslegalforms can provide you with easy-to-use templates and step-by-step instructions, making the process straightforward and effective.

One of the biggest mistakes parents often make is failing to update their Palm Beach Florida Living Trust for Husband and Wife with Minor and or Adult Children. Life changes such as the birth of new children, changes in financial status, or divorce can affect how trust assets are distributed. Keeping your trust current ensures it reflects your family's needs and wishes. Regular reviews with platforms like uslegalforms can help ensure your trust remains effective.

You certainly can set up your own trust in Florida. Many residents successfully create their own Palm Beach Florida Living Trust for Husband and Wife with Minor and or Adult Children to manage their assets. However, bear in mind that improper setups can lead to complications in the future. Utilizing resources from uslegalforms can simplify the process by providing templates and expert insights.

Yes, you can write your own living trust in Florida. However, it’s important to ensure that your Palm Beach Florida Living Trust for Husband and Wife with Minor and or Adult Children adheres to state laws. If drafted incorrectly, the trust may not serve its intended purpose. By using a platform like uslegalforms, you can create a compliant trust with helpful guidance.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

A trust allows you to be very specific about how, when and to whom your assets are distributed. On top of that, there are dozens of special-use trusts that could be established to meet various estate planning goals, such as charitable giving, tax reduction, and more.

How much does it cost to set up a living trust in Florida? A typical cost for an attorney to prepare a revocable living trust in Florida is between $2,000 and $3,000, depending on the attorney's experience.

A will gives you the ability to name a guardian for your minor children. A trust allows you to avoid the probate process, which can potentially be time-consuming and expensive. Moreover, everything will remain private and your successor trustee will manage it after your death.

Does a Will Supersede a Trust? Wills control the estate. Trusts control the trust estate, the assets that are placed within their ownership. They do not overlap and therefore cannot supersede each other.

What assets cannot be placed in a trust? Retirement assets. While you can transfer ownership of your retirement accounts into your trust, estate planning experts usually don't recommend it.Health savings accounts (HSAs)Assets held in other countries.Vehicles.Cash.