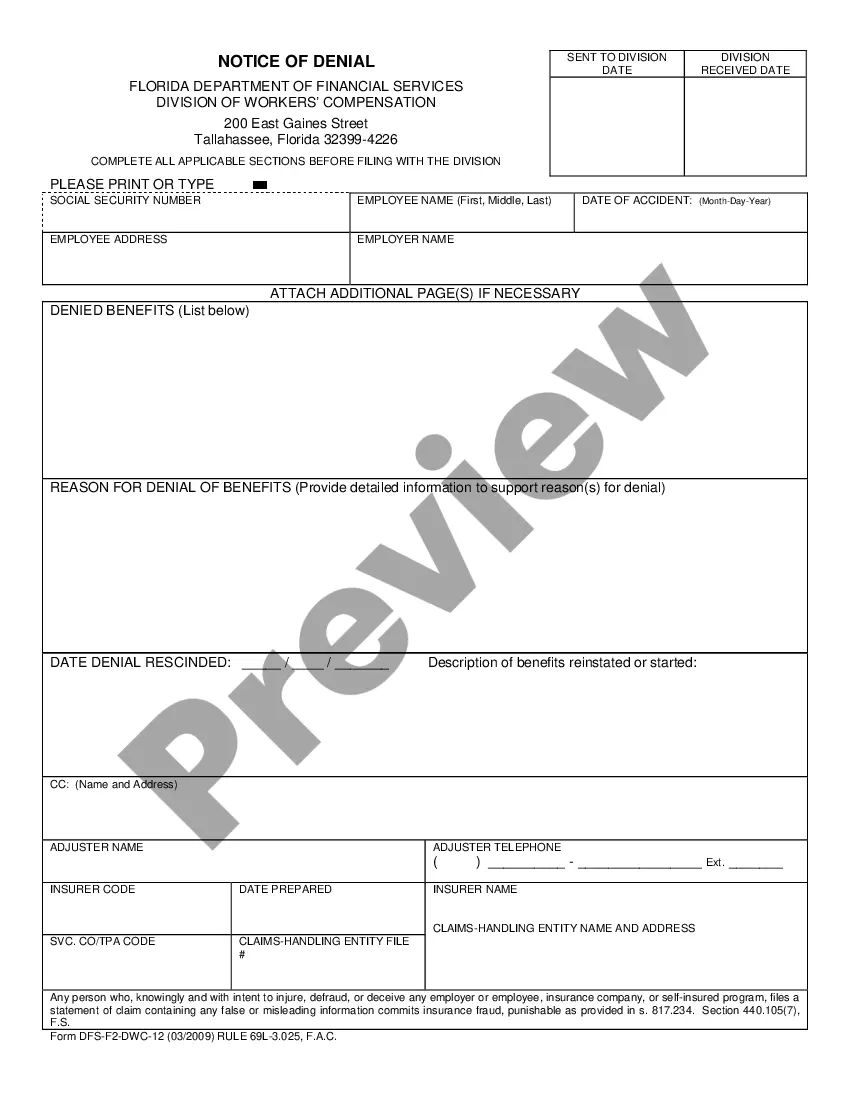

Orlando Florida Notice of Revocation of Election to be Exempt

Description

How to fill out Florida Notice Of Revocation Of Election To Be Exempt?

If you have previously utilized our service, Log In to your account and download the Orlando Florida Notice of Revocation of Election to be Exempt onto your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it in line with your payment arrangement.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have indefinite access to all documents you have bought: you can find them in your profile within the My documents section whenever you wish to reuse them. Utilize the US Legal Forms service to conveniently search for and save any template for your personal or professional requirements!

- Ensure you've located a suitable document. Browse through the description and utilize the Preview option, if accessible, to verify if it meets your needs. If it doesn’t fit, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or yearly subscription option.

- Create an account and process the payment. Enter your credit card information or select the PayPal option to finalize the purchase.

- Acquire your Orlando Florida Notice of Revocation of Election to be Exempt. Opt for the file format of your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Generally speaking, any business with fewer than four employees is exempt from workers' compensation insurance. Businesses with four or more employees, whether those employees work part-time or full-time, must carry workers' compensation insurance that covers all employees.

It's required. According to Florida law, there is no way for regular employees to waive workers' compensation coverage legally.

The exemption takes 30 days to be effective. Workers' compensation exemptions allow business owners and officers to exclude themselves from receiving workers' compensation benefits ? keeping their salaries out of the total payroll when insurance companies calculate their premiums.

Reminder: Your Florida Workers Compensation Exemption Has to be Renewed Every Two Years.

Employers conducting work in the State of Florida are required to provide workers' compensation insurance for their employees. Specific employer coverage requirements are based on the type of industry, number of employees and entity organization.

Sole proprietors and Partners are not considered ?employees? and are automatically excluded from workers' compensation coverage by law; they do not have to file for an exemption.

The purpose of filing an exemption is for an officer of a corporation or member of a limited liability company to exclude themselves from the workers' compensation laws. Upon issuance of a Certificate of Election to be Exempt, the officer or member is not an employee and may not recover workers' compensation benefits.

Construction industry employers hiring subcontractors must ensure that a subcontractor has workers' compensation coverage or a valid exemption. If the subcontractor has employees, the subcontractor must have a workers' compensation policy, even if the owner is exempt.

Workers' compensation exemptions must be renewed each year. The exemption takes 30 days to be effective.

In order to apply for a workers' compensation exemption, the applicant must complete and submit a Notice of Election to be Exempt online via the Florida Division of Workers' Compensation. The exemption application process is fairly straightforward once you determine that you have met the qualifications.