St. Petersburg Florida Wage Statement

Description

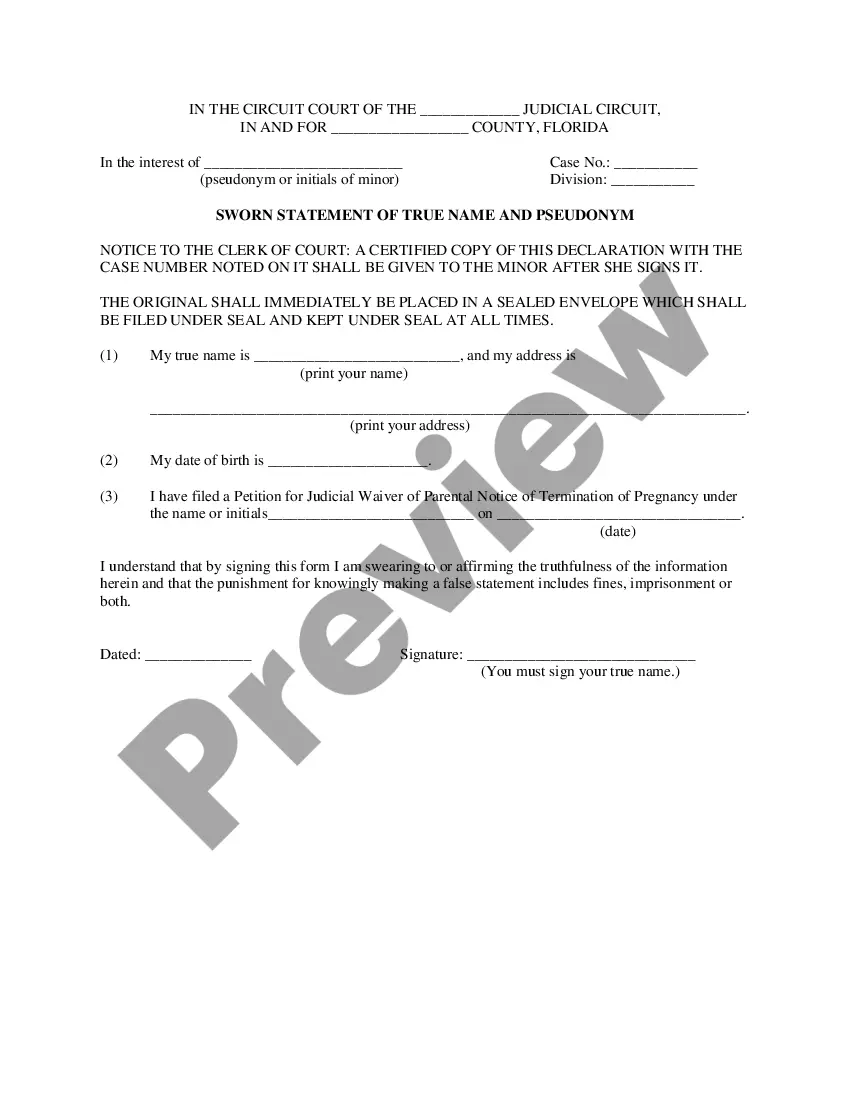

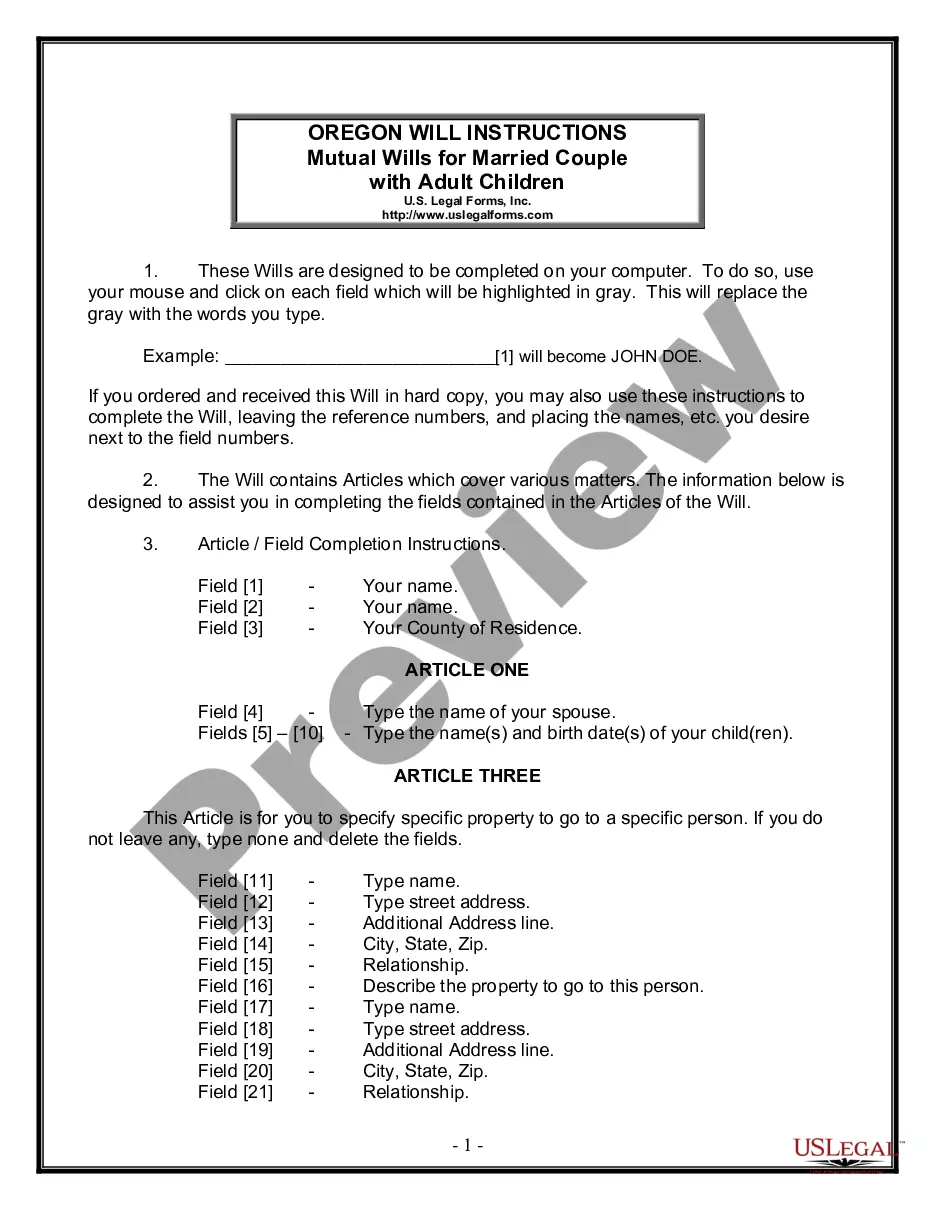

How to fill out Florida Wage Statement?

If you are looking for a pertinent form template, it’s incredibly challenging to discover a superior location than the US Legal Forms website – arguably the most extensive libraries available on the web.

Through this collection, you can locate a vast assortment of document samples for commercial and personal use categorized by types and regions, or relevant keywords.

With the high-grade search capability, locating the most up-to-date St. Petersburg Florida Wage Statement is as simple as 1-2-3.

Execute the payment transaction. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the form. Select the format and download it to your device. Make alterations. Complete, edit, print, and sign the retrieved St. Petersburg Florida Wage Statement.

- Moreover, the significance of each document is validated by a group of experienced attorneys who routinely examine the templates on our site and update them in accordance with the latest state and county requirements.

- If you are already acquainted with our platform and possess an account, all you have to do to obtain the St. Petersburg Florida Wage Statement is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions outlined below.

- Ensure you have accessed the sample you need. Review its details and utilize the Preview feature to inspect its contents. If it fails to satisfy your requirements, use the Search option located at the top of the screen to find the appropriate document.

- Confirm your selection. Click the Buy now button. After that, select your desired subscription plan and enter your information to register for an account.

Form popularity

FAQ

Employee theft in Florida is governed by laws that define theft as the unlawful taking of another's property. Specifically, Florida Statute 812.014 outlines various offenses related to theft, including penalties for violations. If you suspect employee theft may affect your St. Petersburg Florida Wage Statement, it is essential to consult legal resources or professionals to understand your rights.

In Florida, wage theft is defined under several laws meant to protect workers from unfair treatment. Employees have the right to file a complaint if they believe they are victims of wage theft. The enforcement of wage laws is essential, making it important to address any discrepancies noted on your St. Petersburg Florida Wage Statement promptly.

Wage theft occurs when employees do not receive their due earnings, and it can take various forms. Common examples include unpaid overtime, denying breaks during shifts, and misclassifying employees to avoid paying benefits. Recognizing these scenarios can help you better understand your St. Petersburg Florida Wage Statement and ensure you receive fair compensation.

The minimum wage in St. Petersburg, Florida, aligns with Florida's state law, which is currently $11.00 per hour as of 2022. This rate is set to increase annually until it reaches $15.00 per hour by 2026. Understanding the minimum wage is crucial for employees and employers alike, especially when reviewing your St. Petersburg Florida Wage Statement.

Substantially the whole of 13 weeks refers to a significant portion of a 13-week period, generally implying at least 9 to 10 weeks of continuous employment or wages. This concept often comes into play when assessing wage loss under workers' compensation. Understanding how this relates to your St. Petersburg Florida Wage Statement can help clarify your compensation expectations.

In Florida, employees must report work-related injuries to their employer within 30 days. Employers are then required to file claims with their workers' compensation insurance. Tracking your St. Petersburg Florida Wage Statement can give you insights into how your earnings might be impacted during this time.

In Tennessee, workers' compensation provides medical care and compensation for lost wages due to job-related injuries. Employers fund the program, and employees must report injuries promptly. If you are transitioning from other states, keep in mind how your St. Petersburg Florida Wage Statement reflects your earnings during this process.

Many workers' comp lawyers might not disclose all potential pitfalls in your claim process. They may omit details about how different states handle wage statements, like in St. Petersburg, Florida. Being aware of your rights and the importance of accurate wage statements can empower you in negotiations with insurers.

Filing an unpaid wage claim in Florida involves a few steps. Start by completing the necessary forms, which you can find on the Florida Department of Economic Opportunity website or by using US Legal Forms for a straightforward process. Remember to include your St. Petersburg Florida Wage Statement along with any evidence that backs up your claim, ensuring that you follow all guidelines and submit your claim timely.

To report unpaid wages in Florida, first contact the Florida Department of Economic Opportunity. They handle wage disputes and can provide support on how to proceed with your claim. It’s also beneficial to have your St. Petersburg Florida Wage Statement and any related information on hand when you make the call to streamline the process.