This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are two Trusts. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Orlando Florida Quitclaim Deed

Description

How to fill out Florida Quitclaim Deed?

If you have previously availed yourself of our service, Log In to your account and retrieve the Orlando Florida Quitclaim Deed onto your device by selecting the Download button. Confirm that your subscription is active. If it is not, renew it according to your payment arrangement.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to all the documents you have purchased: you can find it in your profile under the My documents section whenever you need to retrieve it again. Utilize the US Legal Forms service to swiftly find and store any template for your personal or professional requirements!

- Make sure you’ve located a suitable document. Review the details and utilize the Preview feature, if provided, to verify if it fulfills your criteria. If it does not, use the Search tab above to discover the right one.

- Buy the template. Hit the Buy Now button and select either a monthly or yearly subscription option.

- Set up an account and process payment. Enter your credit card information or select the PayPal option to finalize the purchase.

- Get your Orlando Florida Quitclaim Deed. Choose the file format for your document and save it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

You can obtain a copy of a quitclaim deed through the county clerk's office where the property is located in Orlando, Florida. Many counties also offer online access to public records, making it easier to find the documents you need. If you prefer, using resources from USLegalForms can help you secure the correct form and streamline your process of retrieving necessary information.

You do not necessarily need a lawyer to file a quitclaim deed in Florida. Many individuals successfully file these deeds themselves using templates provided by platforms like USLegalForms that guide you through the process. However, consulting with a lawyer can be beneficial if you have any questions or concerns about property rights or specific legal requirements.

You absolutely can perform a quitclaim deed yourself in Florida. It's essential, however, to make sure the deed complies with local laws, including signature and notarization requirements. Using services like USLegalForms can simplify your task by providing the necessary forms and detailed instructions. This way, you ensure a smooth transfer of property.

Yes, you can prepare your own quitclaim deed. With the right information and resources, such as the Orlando Florida Quitclaim Deed templates from USLegalForms, you can efficiently create the document. While it is straightforward, you should understand the implications of transferring property rights, so take your time to learn about the process.

Yes, you can file a quitclaim deed yourself in Florida. The process involves filling out the necessary forms accurately and ensuring that all required details about the property and parties involved are included. Additionally, after completing the paperwork, you will need to sign the deed in front of a notary public. If you seek a straightforward way to manage this, consider using US Legal Forms for guidance and ready-to-use templates tailored for the Orlando Florida Quitclaim Deed.

Quitclaim deeds are particularly beneficial for individuals looking to transfer property quickly without the complexities of traditional sales, such as family members or business partners in Orlando Florida. They are often used in situations involving divorce settlements, estate planning, or transferring property into trusts. These transactions require transparency and mutual understanding to protect all parties involved. Platforms like USLegalForms can provide valuable resources to facilitate these transfers smoothly.

In general, quitclaim deeds, including those executed in Orlando Florida, are not automatically reported to the IRS as income. However, transfer of property ownership can have tax implications, especially if it involves a sale or a gift. It's important to maintain proper records and consult a tax professional to understand how your specific circumstances may affect your tax situation. This approach can provide clarity and peace of mind.

The main disadvantage of an Orlando Florida quitclaim deed is its unilateral nature; it does not provide warranties about the property's title. This means you may inherit hidden problems, such as unresolved legal disputes or unresolved debts. Furthermore, quit claim deeds offer limited legal protection should disputes arise, making it essential to approach this deed with caution. Always consider legal advice for a clearer understanding of your rights.

A quit claim deed transfers ownership without guarantee, which means the buyer may not receive clear title. This lack of assurance can create future issues, especially if other parties claim ownership rights. Additionally, using an Orlando Florida quitclaim deed can be risky if you are unaware of existing liens or property encumbrances. Therefore, it's crucial to understand these risks before proceeding.

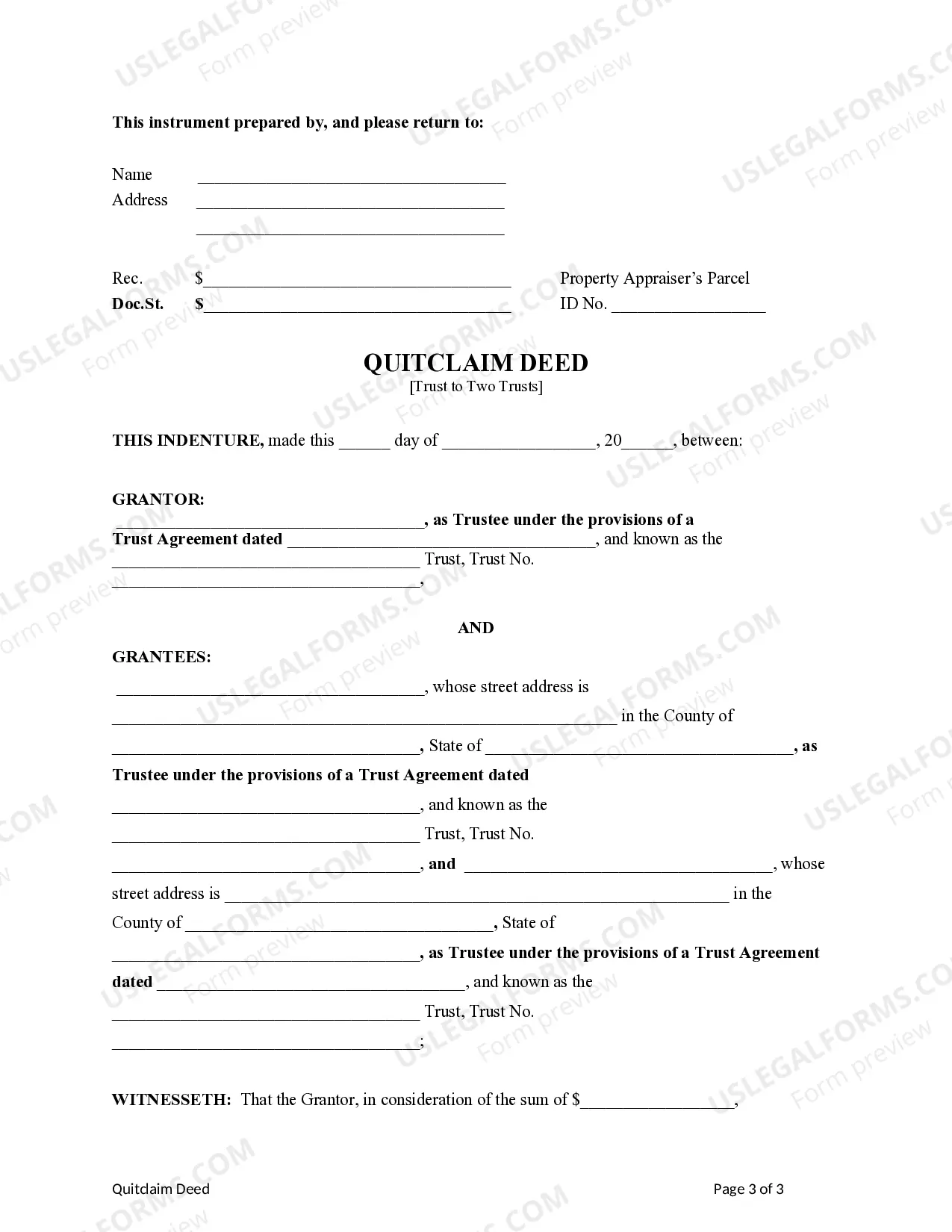

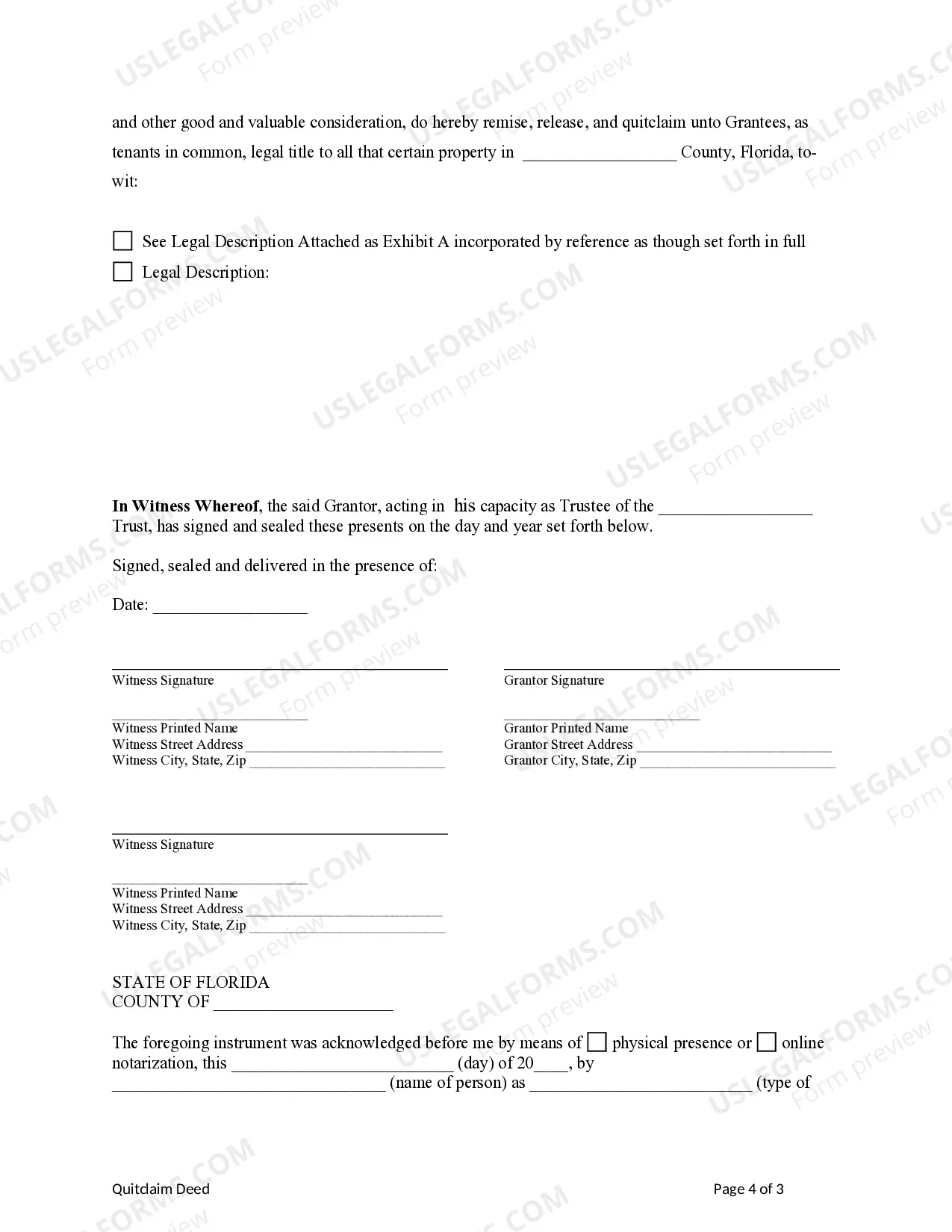

Filling out a quitclaim deed in Florida involves providing specific details such as the full names of all parties and an accurate description of the property. Ensure that you include the county where the property is located and the date of the transaction. If you're looking for a straightforward way to complete this form, consider using US Legal Forms, which offers user-friendly templates tailored for Florida's laws.