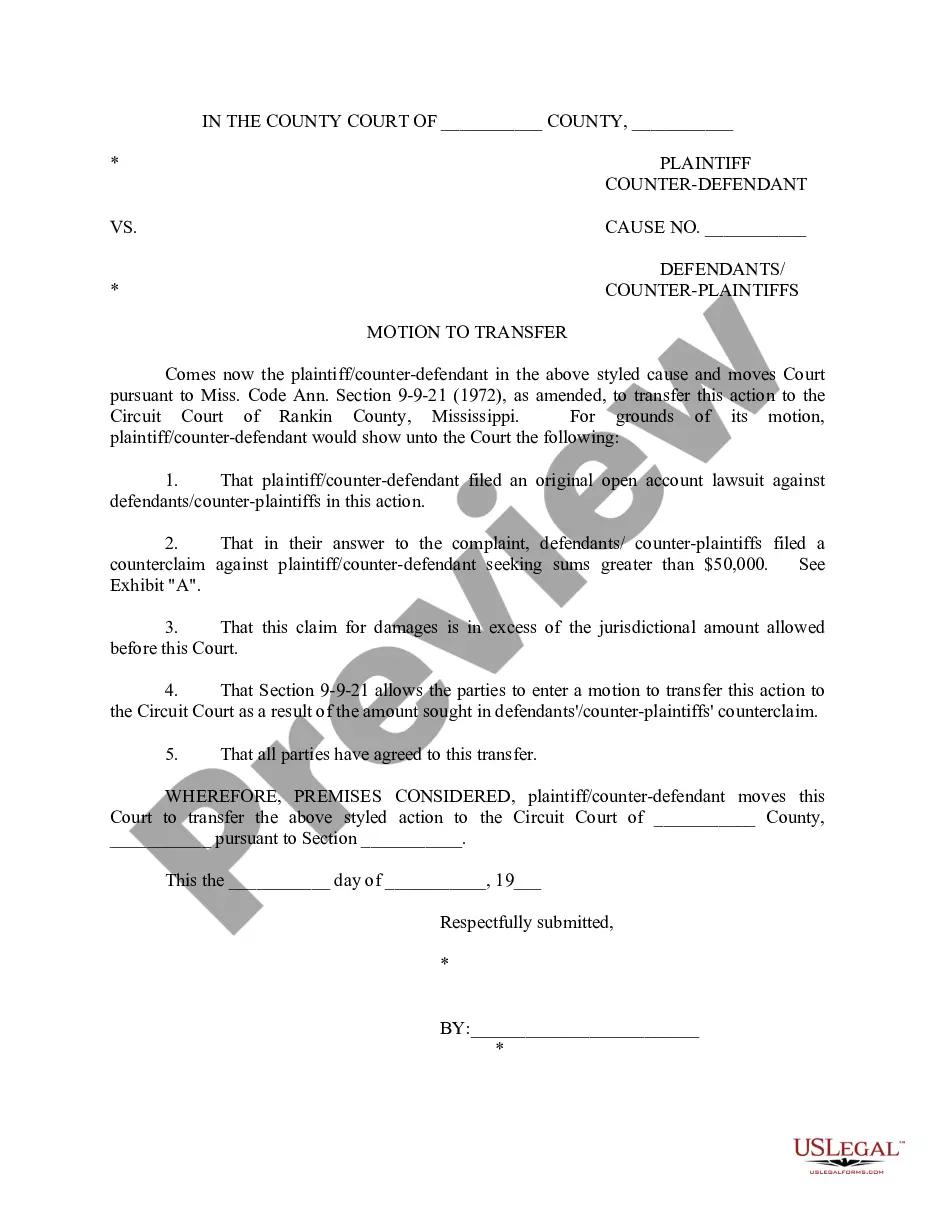

This form is a Personal Representative's Deed of Distribution where the Grantor is an Individual appointed as personal representative of the estate and the Grantee is the beneficiary entitled to receive the property from the estate. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Lakeland Florida Personal Representative's Deed of Distribution

Description

How to fill out Florida Personal Representative's Deed Of Distribution?

If you’ve already used our service previously, Log In to your account and store the Lakeland Florida Personal Representative's Deed of Distribution on your device by pressing the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continual access to every document you’ve purchased: you can locate it in your profile within the My documents menu anytime you wish to reuse it. Utilize the US Legal Forms service to promptly find and store any template for your personal or professional requirements!

- Confirm you’ve located the correct document. Browse through the description and utilize the Preview option, if available, to determine if it satisfies your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Purchase the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Input your credit card information or use the PayPal option to finalize the transaction.

- Obtain your Lakeland Florida Personal Representative's Deed of Distribution. Select the file format for your document and save it to your device.

- Complete your template. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Thus, fee simple means the maximum interest in the property, being unqualified, of indefinite duration, freely transferable and inheritable. When the certified appraisers of the assessor's office value property for property tax purposes, the law requires that we use the ?unencumbered fee simple? value of the property.

(2) A commission computed on the compensable value of the estate is presumed to be reasonable compensation for a personal representative in formal administration as follows: (a) At the rate of 3 percent for the first $1 million. (b) At the rate of 2.5 percent for all above $1 million and not exceeding $5 million.

The Duties of the Personal Representative in Florida Notifying all heirs and other interested parties that the will is being submitted to probate. Identifying and taking control of any estate assets. Filing tax returns and paying taxes. Paying creditors claims.

What is the Utah Personal Representative Deed? A personal representative's deed is a fiduciary instrument used in probate proceedings. Probate is the process of settling and distributing a decedent's estate. The Utah Uniform Probate Code is codified at Title 75 of the Utah Code.

Florida Personal Representative's Distributive Deed (intestate) This form is for use by the personal representative of an individual who died without a will. Wills, or last wills and testaments, are estate planning documents used to organize and record how people wish to distribute their assets after death.

The three most common types of deeds are: Grant Deeds. Quitclaim Deed. Warranty Deed.

According to Florida Probate Code 733.612, ?a personal representative, acting reasonably for the benefit of the interested persons, may properly sell, mortgage, or lease any personal property of the estate or any interest in it for cash, credit, or for part cash or part credit, and with or without security for the

Yes. A personal representative can also be a named beneficiary in the decedent's will. For example, in a family with four siblings, one of the siblings or even the spouse may act as a personal representative. There is no law against it as long as the individual is mentally and physically fit to perform the duties.

?Fee simple? means full and complete ownership of property which can be inherited by the owner's heirs or devised by the owner's will or trust to the owner's beneficiaries.

A Personal Representative's Deed is the form of deed commonly used in connection with the sale of real property owned by an estate.