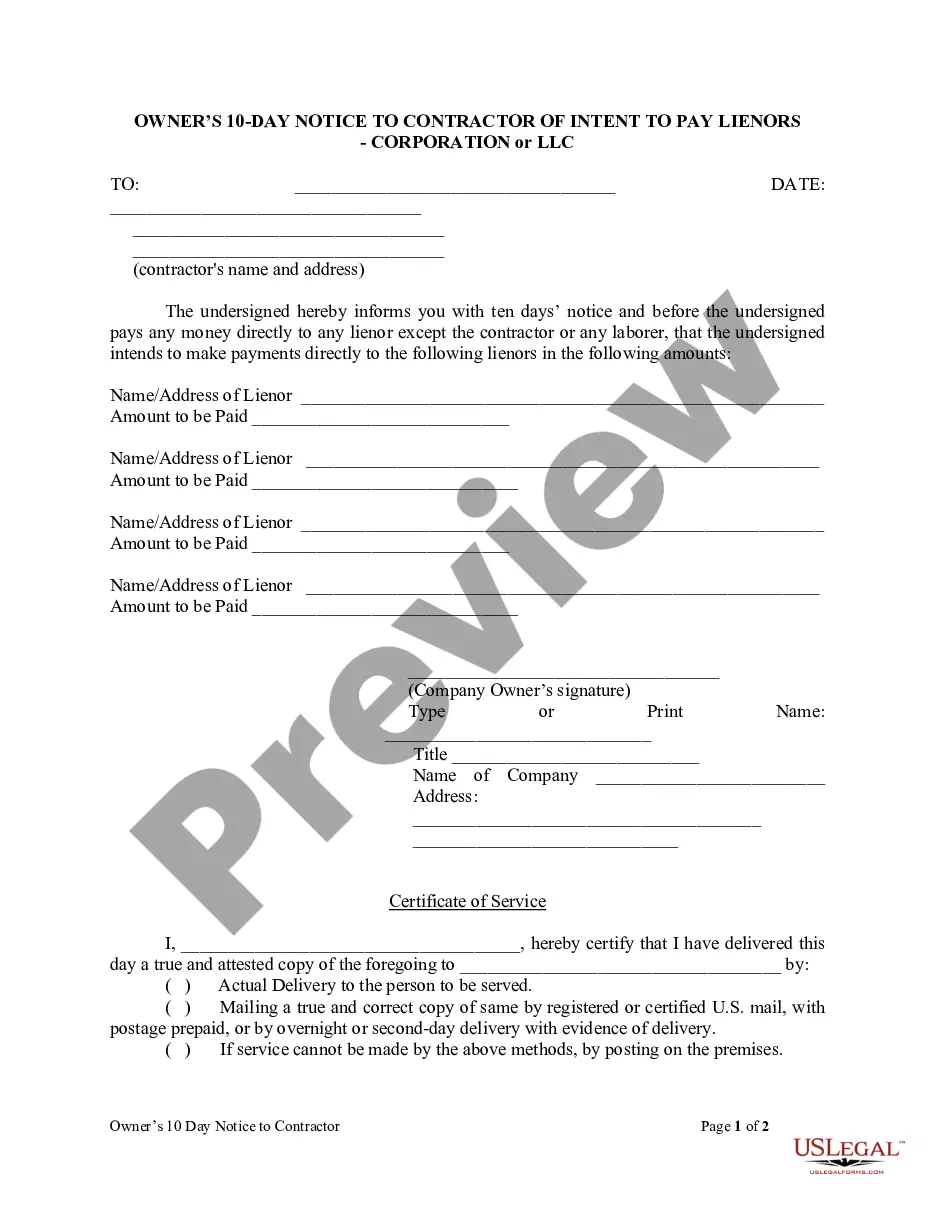

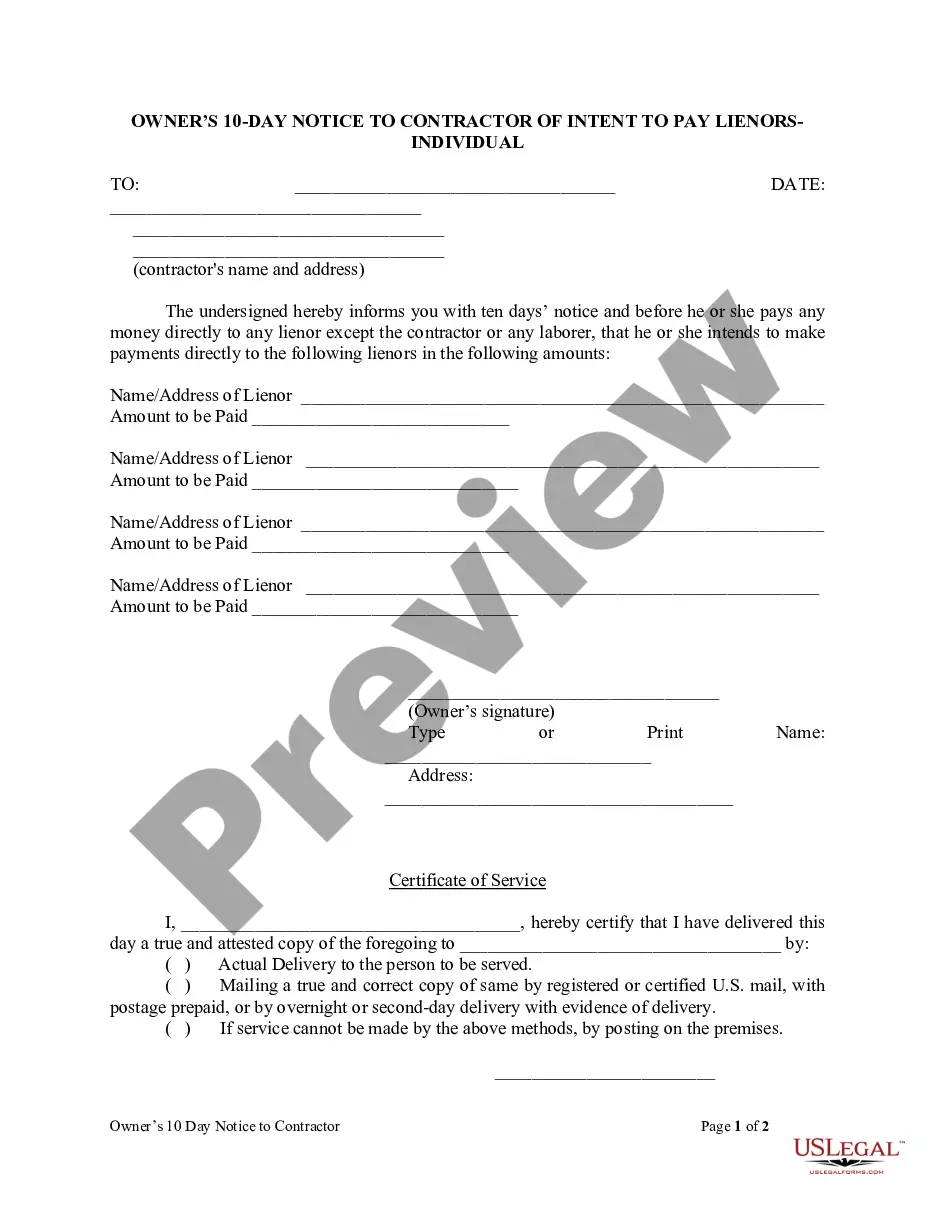

Orlando Florida Owner's 10-Day Notice to Contractor of Intent to Pay Lienors - Corporation or LLC

Description

How to fill out Florida Owner's 10-Day Notice To Contractor Of Intent To Pay Lienors - Corporation Or LLC?

Take advantage of the US Legal Forms and gain immediate access to any template you desire. Our helpful website, packed with a variety of documents, streamlines the process of locating and obtaining virtually any document example you may need.

You can save, complete, and validate the Orlando Florida Owner's 10-Day Notice to Contractor of Intent to Pay Lienors - Corporation or LLC in just a few moments instead of spending hours online searching for a suitable template.

Utilizing our collection is an excellent approach to enhance the security of your document submissions. Our experienced attorneys consistently review all materials to ensure that the templates are pertinent to a specific area and comply with current laws and regulations.

How do you acquire the Orlando Florida Owner's 10-Day Notice to Contractor of Intent to Pay Lienors - Corporation or LLC? If you have a membership, simply Log In to your account. The Download option will be displayed on all the samples you view. Moreover, you can access all your previously saved documents in the My documents section.

US Legal Forms is one of the largest and most reliable document libraries available online. Our organization is always prepared to assist you in any legal matter, even if it is merely downloading the Orlando Florida Owner's 10-Day Notice to Contractor of Intent to Pay Lienors - Corporation or LLC.

Feel free to take full advantage of our form catalog and make your document experience as effortless as possible!

- Access the page with the form you need. Ensure that it is the form you intended to locate: confirm its title and description, and use the Preview function if it is available. Otherwise, use the Search box to find the appropriate one.

- Begin the downloading procedure. Click Buy Now and select the pricing plan that fits you best. Then, create an account and complete your order using a credit card or PayPal.

- Download the document. Choose the format to receive the Orlando Florida Owner's 10-Day Notice to Contractor of Intent to Pay Lienors - Corporation or LLC and modify and complete, or sign it according to your requirements.

Form popularity

FAQ

In Florida, your Notice to Owner needs to be mailed within 45 days of when you completed your service or when you last received a payment. The notice must be served on the owner before filing the lien or within 15 days after you have filed the lien.

Even though sending a Notice of Intent to Lien is an optional (not required) step in the state of Florida, they are frequently successful at producing payment (without having to take the next step of filing a lien).

In Florida, your Notice to Owner needs to be mailed within 45 days of when you completed your service or when you last received a payment. The notice must be served on the owner before filing the lien or within 15 days after you have filed the lien.

FLORIDA'S CONSTRUCTION LIEN LAW ALLOWS SOME UNPAID CONTRACTORS, SUBCONTRACTORS, AND MATERIAL SUPPLIERS TO FILE LIENS AGAINST YOUR PROPERTY EVEN IF YOU HAVE MADE PAYMENT IN FULL. UNDER FLORIDA LAW, YOUR FAILURE TO MAKE SURE THAT WE ARE PAID MAY RESULT IN A LIEN AGAINST YOUR PROPERTY AND YOUR PAYING TWICE.

Prior to filing a lien, a lienor who does not have a direct contract with the owner, must serve the owner with a Notice to Owner. The Notice to Owner must state the lienor's name and address, and a description of the real property and the nature of the services or materials being furnished.

A Notice to Owner (also known as an NTO) is one of the most powerful collection tools in the construction industry. Its function is to secure your lien and bond claim rights in the event that whoever hired you is unable or unwilling to pay you. People often get the details wrong when sending their Florida NTOs.

Your Florida NTO is not considered valid unless it is received by the 45th day, which means you must leave time for the NTO to reach not only the owner, but all required recipients.

Here's the short answer: In Florida, all contractors, subcontractors, material suppliers, and vendors who did not contract directly with the property owner must send a Notice to Owner.