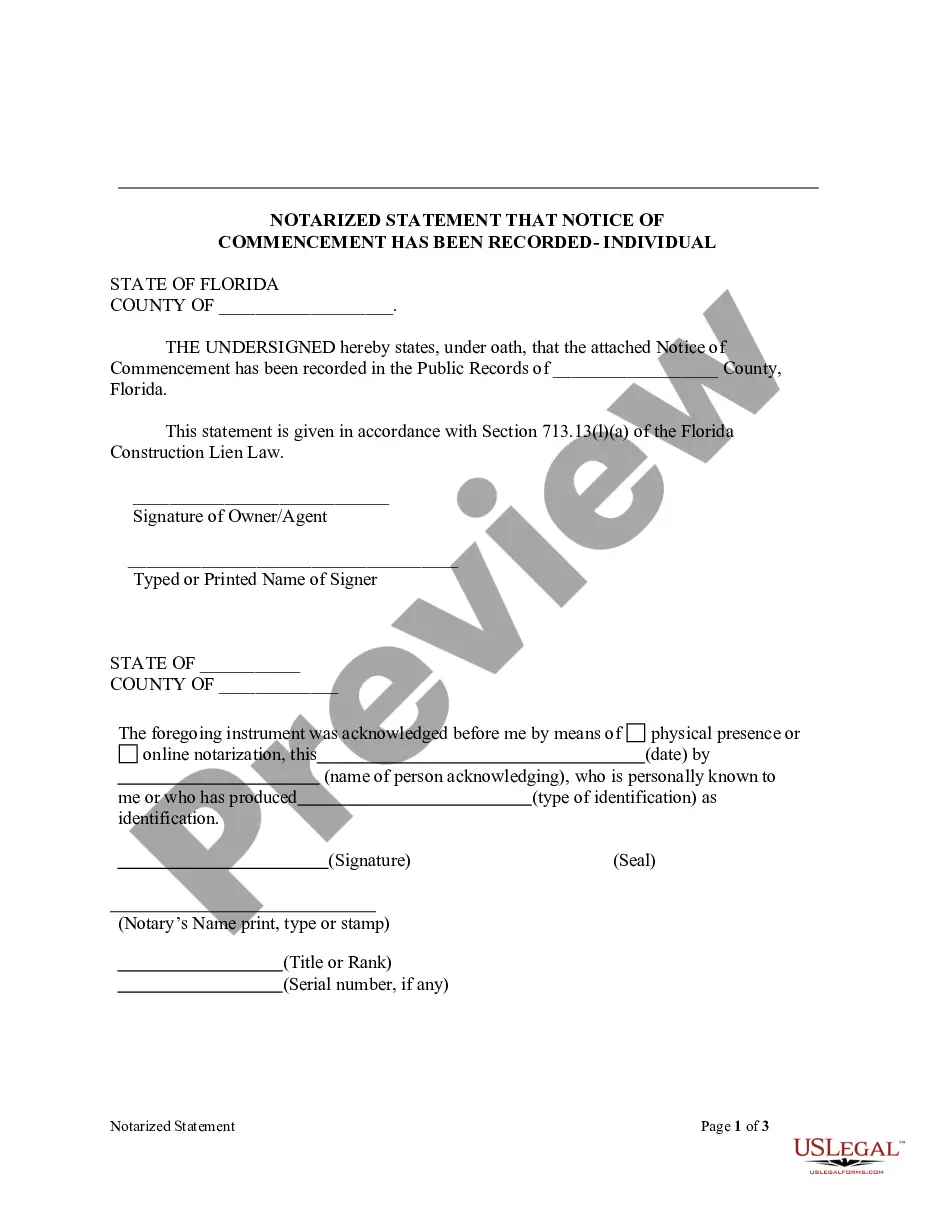

Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual

Description

How to fill out Florida Notarized Statement Regarding Notice Of Commencement Form - Construction - Mechanic Liens - Individual?

If you are looking for a suitable form template, it’s hard to find a more advantageous location than the US Legal Forms website – undoubtedly one of the most extensive online collections.

Here, you can discover thousands of templates for both business and personal use, categorized by type and region, or specific phrases.

With the efficient search feature, locating the most recent Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to conclude the registration process.

Obtain the template. Choose the file format and download it to your device.

- Moreover, the validity of each document is ensured by a team of skilled attorneys who consistently evaluate the templates on our site and refresh them according to the latest state and county requirements.

- If you are already acquainted with our platform and have an account, all you need to do to obtain the Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual is to Log In to your account and select the Download option.

- For first-time users of US Legal Forms, simply adhere to the instructions below.

- Ensure you have located the sample you need. Review its description and utilize the Preview function (if accessible) to inspect its content. If it does not fulfill your needs, use the Search feature at the top of the page to find the required document.

- Validate your choice. Click the Buy now button. Next, select the desired subscription plan and enter your information to create an account.

Form popularity

FAQ

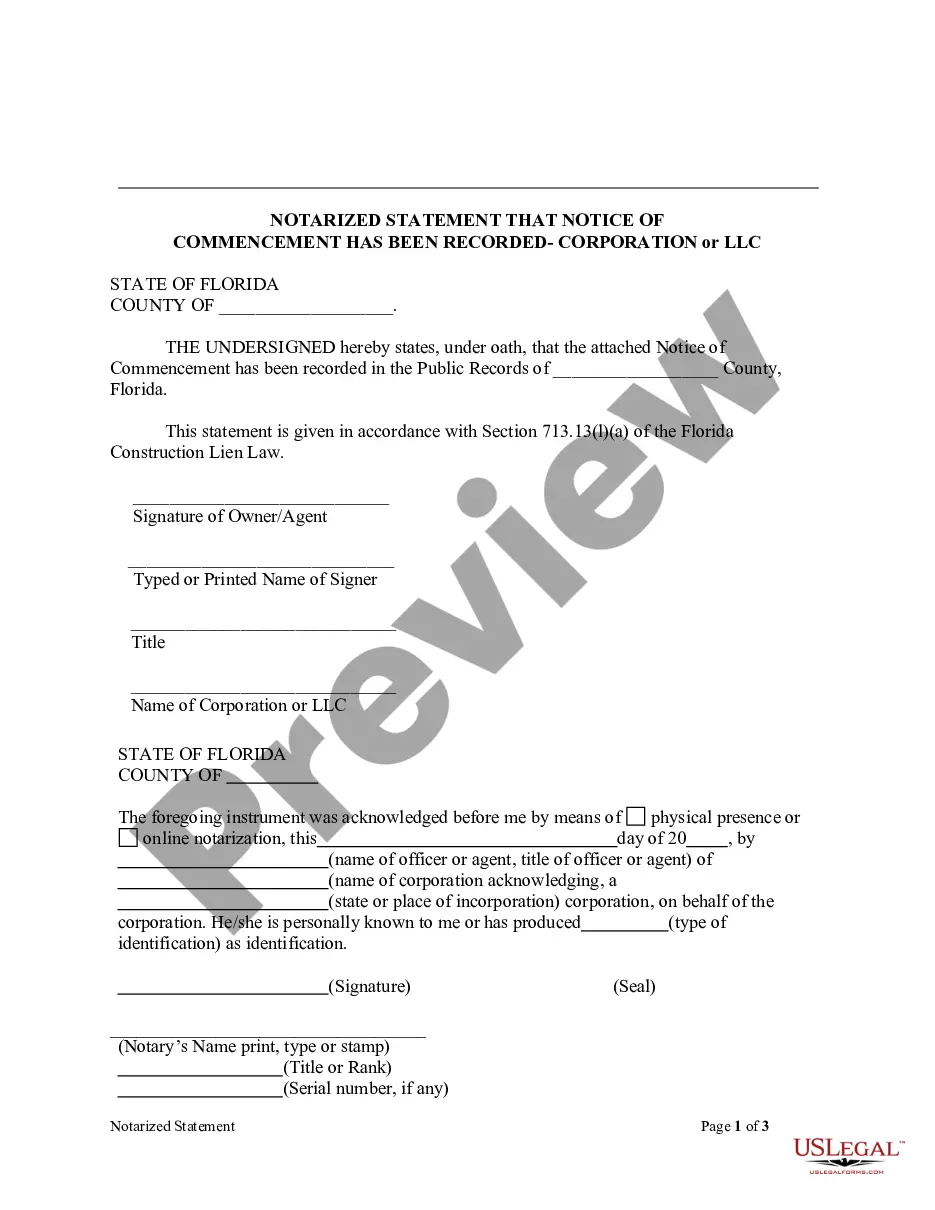

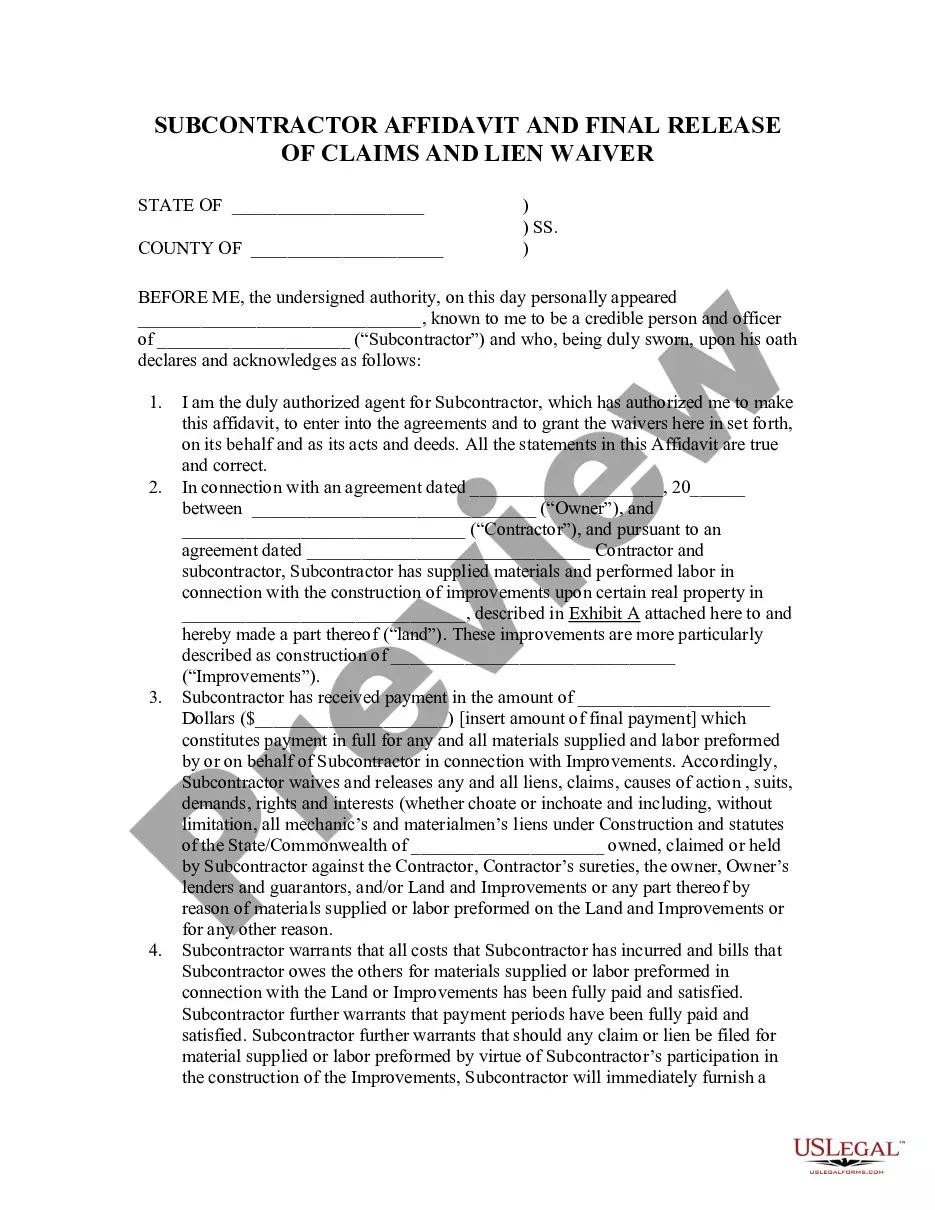

In Florida, notarization is generally required for lien waivers to ensure their validity. This requirement strengthens the enforceability of the documents involved in construction projects, particularly with respect to the Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual. Notarization provides an additional level of verification, which benefits all parties by preventing disputes. If you need assistance, USLegalForms offers resources and templates that simplify the notarization process.

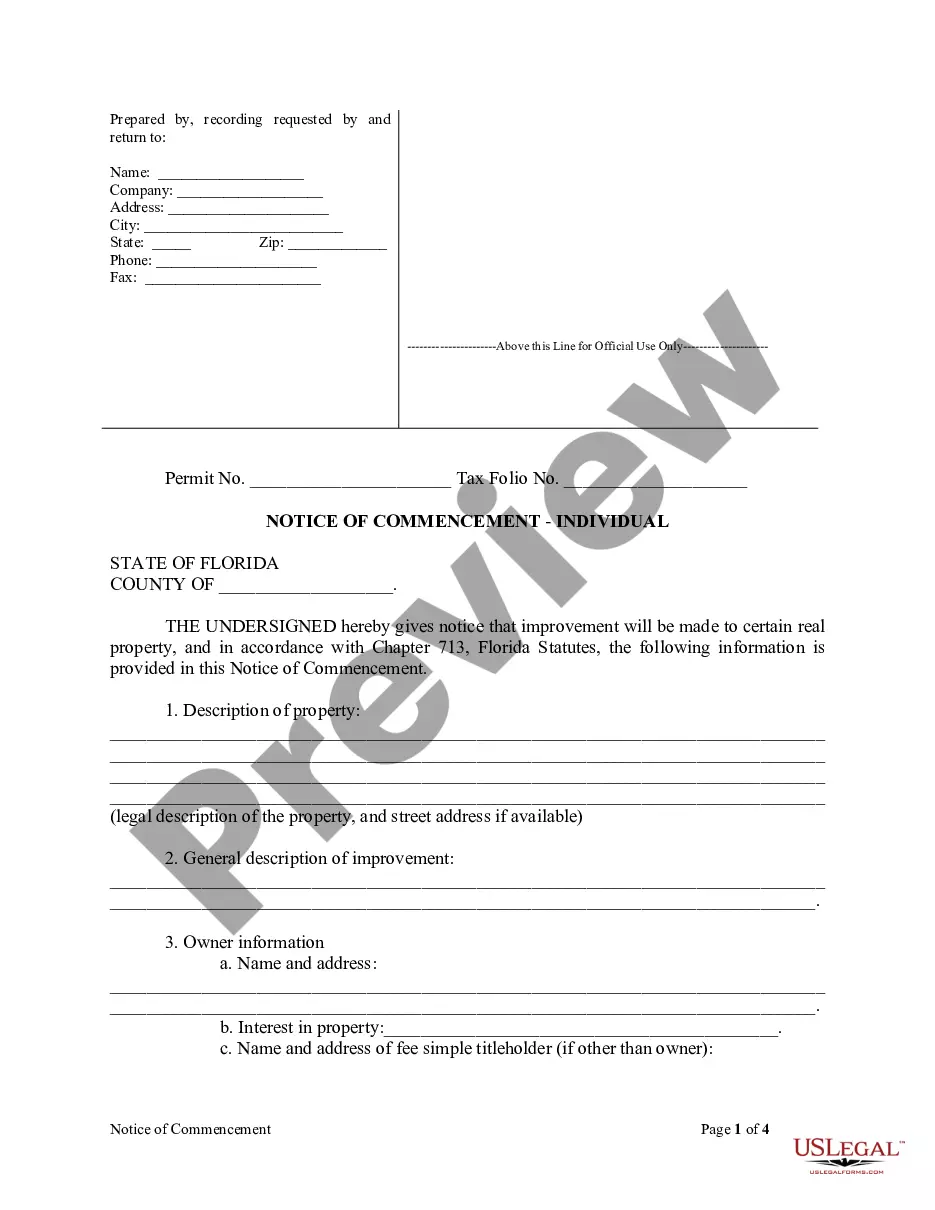

To obtain a copy of a notice of commencement in Florida, you can contact the clerk of court in the county where the property is located. Many counties offer online access to public records, making it easy to request copies electronically. For an efficient and reliable solution, consider using the Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual through uslegalforms, which can help you navigate the process.

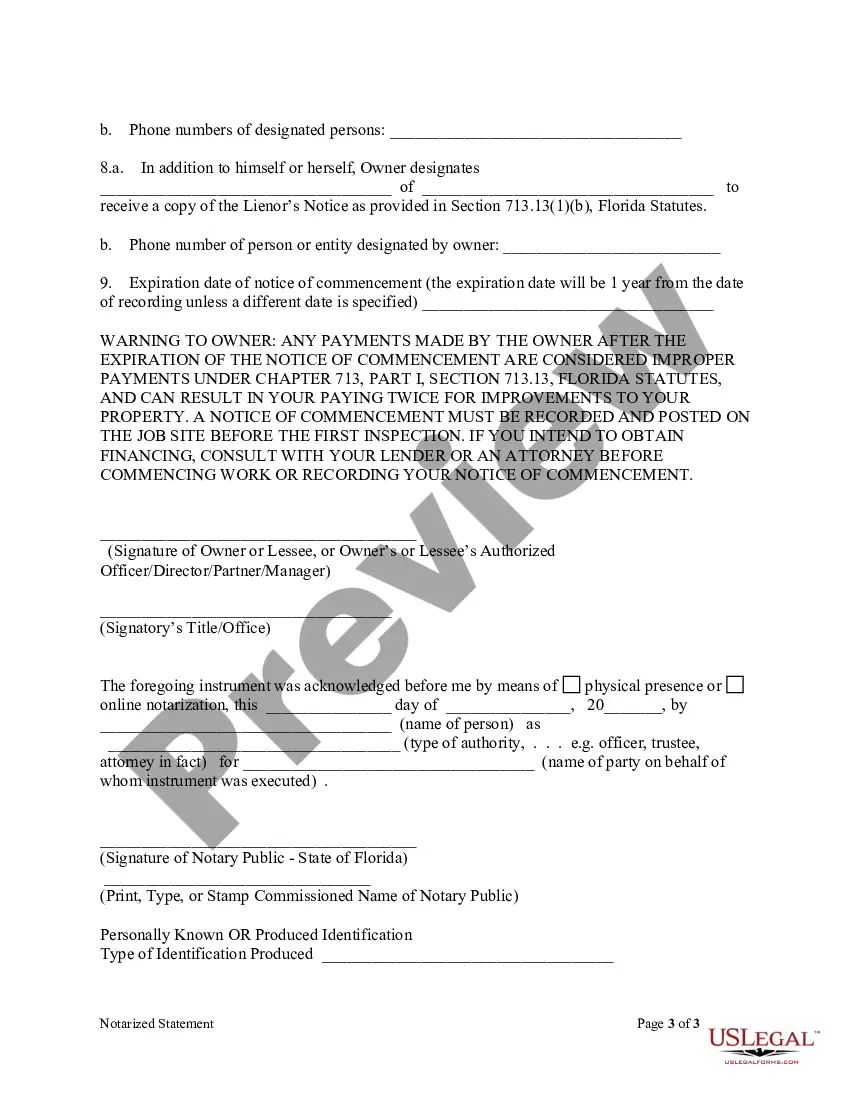

Yes, a notice of commencement in Florida must be notarized to be valid. Notarization helps verify the identities of the parties involved and confirms that the required information is true and accurate. By using the Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual, you simplify the notarization process and add an extra layer of security to your construction project.

To certify a notice of commencement in Florida, the owner or contractor must sign the document in the presence of a notary public. This certification verifies the authenticity of the document, making it legally binding. Using the Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual ensures you meet all certification requirements effectively and provides protection against potential disputes.

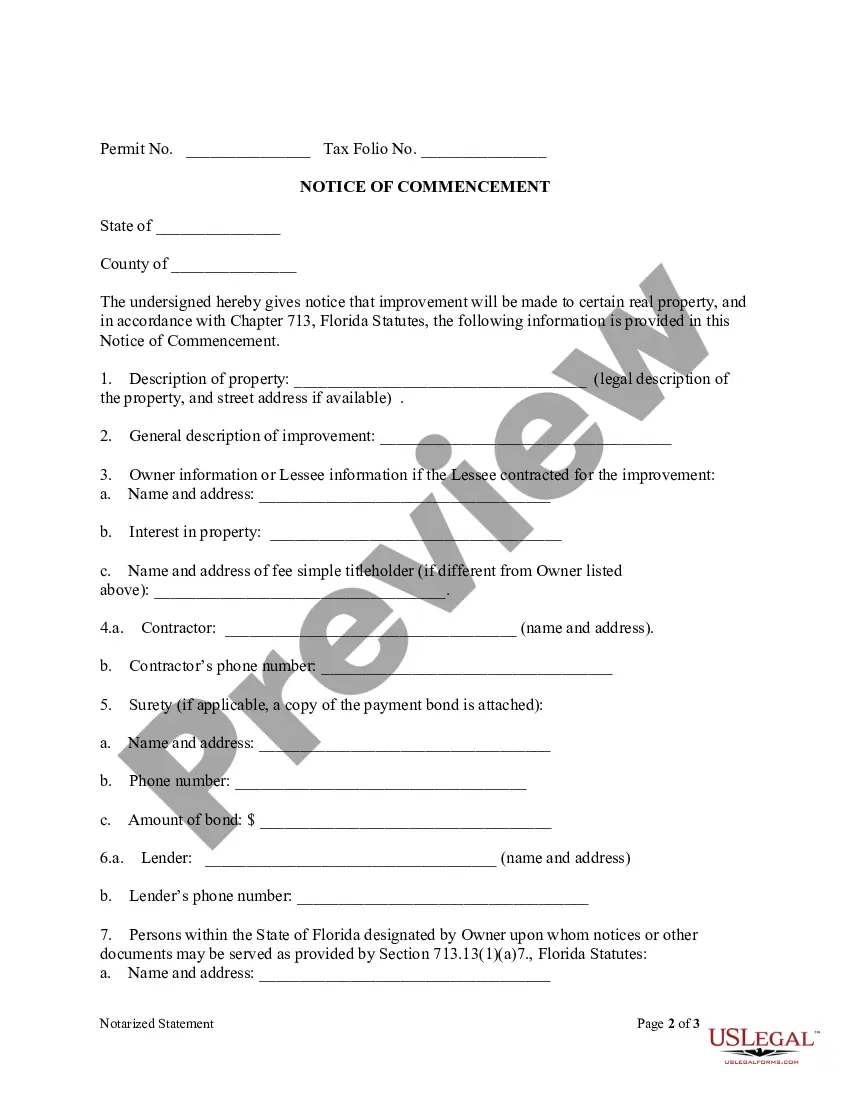

In Florida, the notice of commencement informs all parties involved in a construction project about the contract and the potential for mechanic liens. It must be filed with the clerk of court before work begins and include key details like the property owner's name, the contractor's information, and a description of the improvement. The Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual is essential to ensure compliance with these rules and protect your rights.

No, a Notice of Commencement is not a lien document, but it is essential for establishing lien rights. This document serves as public notice of the beginning of construction and informs all parties of the project. To protect your interests effectively, consider using the Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual as part of your project documentation.

Filing a Notice of Commencement in Orange County, Florida, involves completing the required form and taking it to the Orange County Clerk of the Circuit Court. Remember to have the document notarized prior to filing. The Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual streamlines your submission and ensures all necessary details are included.

In Orange County, Florida, you should file your notice of commencement with the Orange County Clerk of the Circuit Court. This office handles the official recording of these documents. By using the Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual, you can expedite the filing process.

To submit a notice of commencement, you must file the document with the local clerk of court in the respective Florida county. Make sure to obtain the necessary notarization prior to submission. The Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual makes this process easy and reliable.

Indeed, a notice of commencement (NOC) must be notarized in Florida. This requirement helps protect the rights of all parties involved in a construction project. By utilizing the Orlando Florida Notarized Statement Regarding Notice of Commencement Form - Construction - Mechanic Liens - Individual, you can ensure compliance with legal standards.