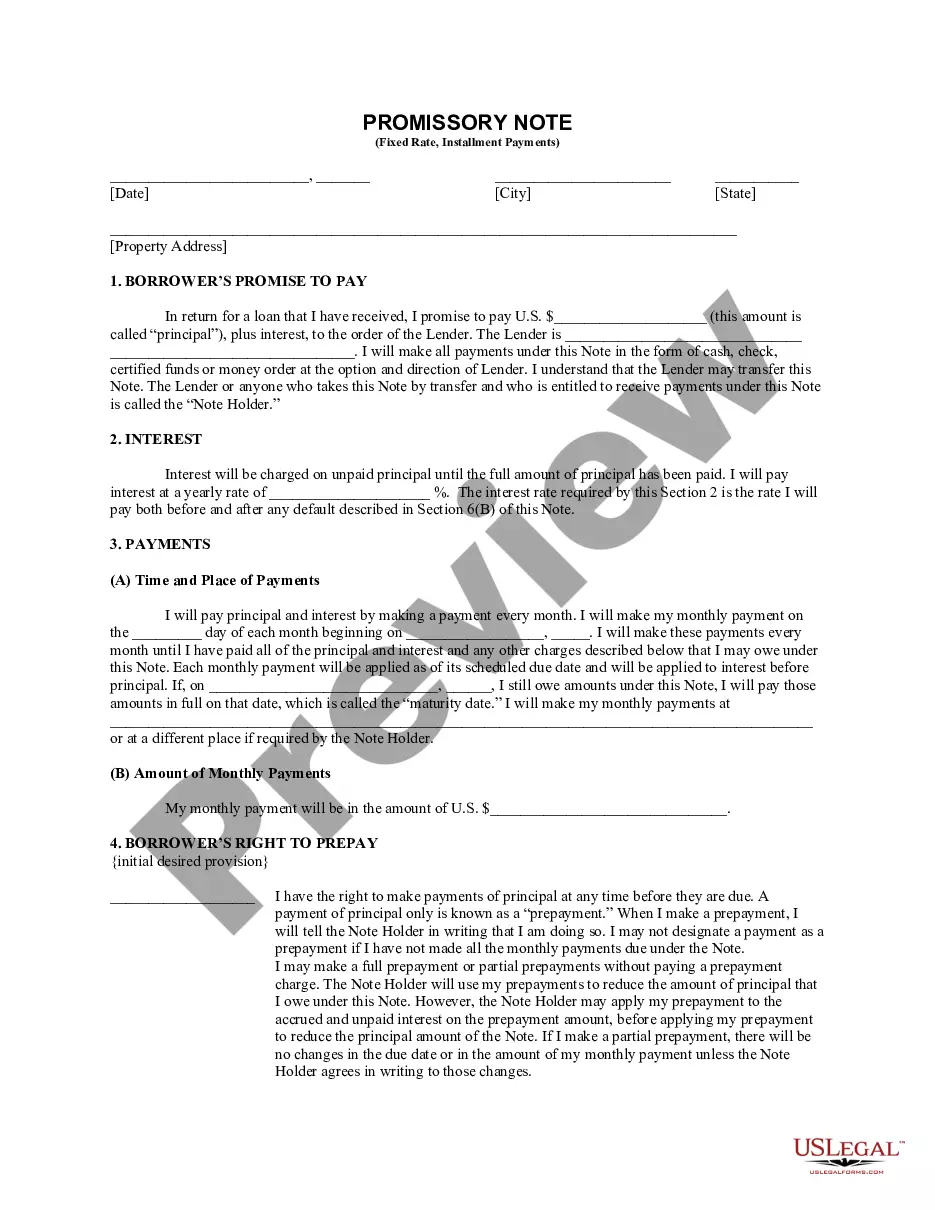

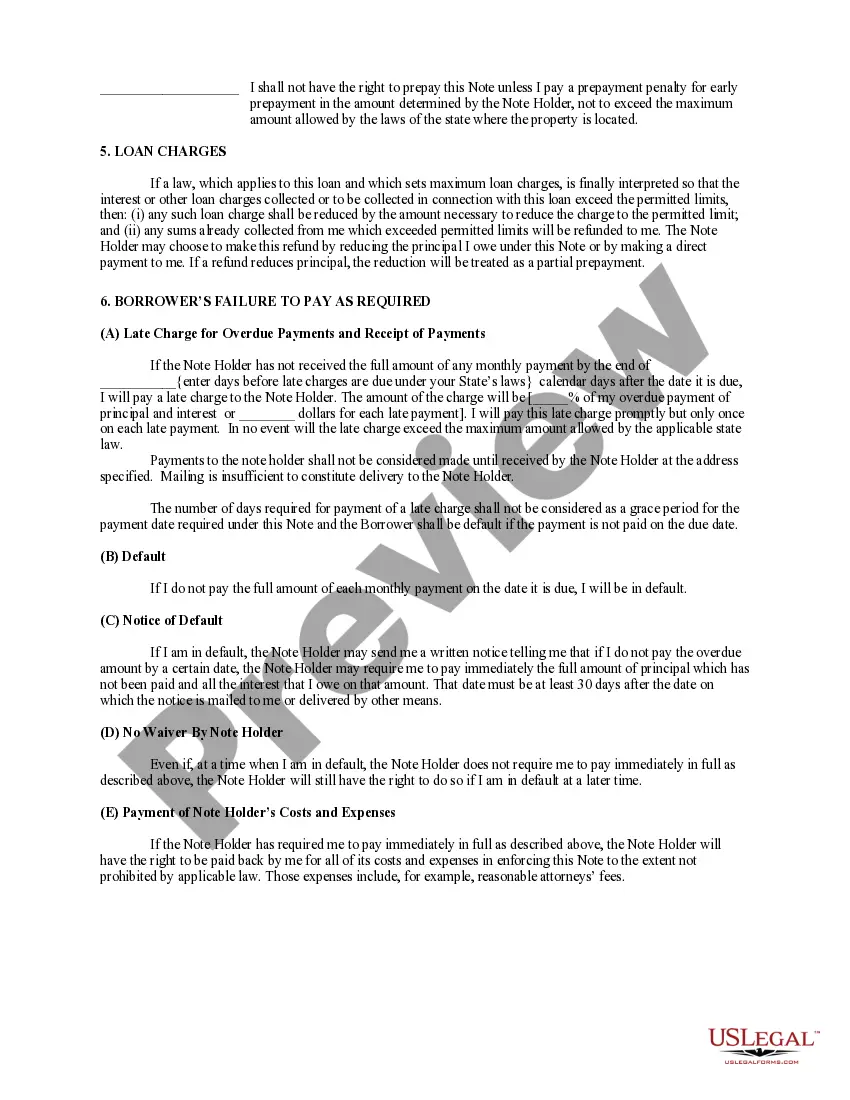

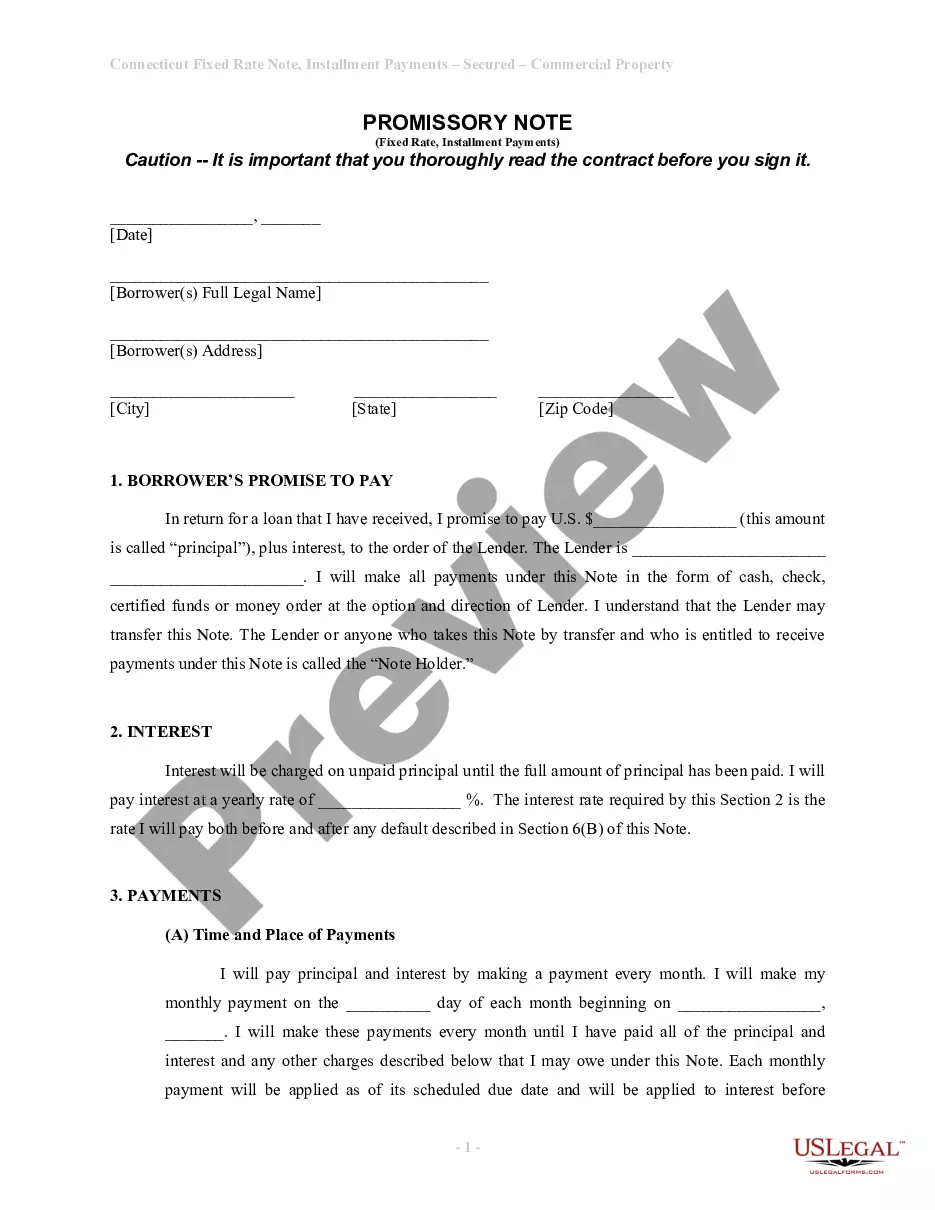

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Connecticut Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Finding validated templates relevant to your regional laws can be challenging unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents for both personal and professional purposes and various real-world situations.

All the files are accurately categorized by area of application and jurisdictional regions, making the search for the Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate as simple as ABC.

Utilize the US Legal Forms library to maintain your documentation organized and compliant with legal standards.

- If you are already familiar with our service and have utilized it previously, acquiring the Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate only requires a few clicks.

- Simply Log In to your account, select the document, and click Download to store it on your device.

- This method will involve a few extra steps for new users.

- Follow the instructions below to begin with the largest online form library.

- Review the Preview mode and form summary. Ensure you’ve picked the appropriate one that meets your needs and fully aligns with your local jurisdictional requirements.

Form popularity

FAQ

When your car is repossessed in Connecticut, the lender takes back the vehicle because of missed payments. You generally have the right to reclaim your vehicle by paying the total amount due, including any fees, before the car is sold. If the lender re-sells your vehicle, they may seek to recover any remaining balance on your Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Knowing your rights can help you make better decisions during this process.

When writing a promissory note for payment, first define the borrower and the lender, followed by the precise amount due. State the repayment terms, including when payments will occur and what happens in case of default. For a Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, highlighting any security features is essential, as it assures the lender of the asset backing the note.

To write a simple promissory note, start by clearly stating the borrower's name, the amount borrowed, and the repayment terms. Include the interest rate, payment schedule, and any collateral involved, especially if you are considering a Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate. It's crucial to have both parties sign the note, as this adds to its legality and ensures clarity in the agreement.

Yes, a judgment typically falls off your credit report after seven years. However, this does not mean the lien is automatically removed from your property. If you are considering alternatives like a Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, be aware of how these timelines can affect your financial health. With uslegalforms, you can explore detailed guidance on managing judgments and liens effectively.

Judgment liens in Connecticut generally last for 20 years from the date they are placed on your property. They can be renewed, extending their effect beyond the original period. If you're evaluating financial strategies such as a Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it's vital to understand how these liens may influence your financial decisions. Our platform provides supportive tools and information for your legal needs.

A judgment lien typically remains on your credit report for seven years. It can impact your credit score, making it harder for you to secure loans or credit. If you're considering options like a Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it's important to manage these liens effectively. Working with uslegalforms can provide resources to navigate these complexities.

You can procure a promissory note from legal document websites, banks, or through legal counsel. For a Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, online platforms like USLegalForms offer templates that are easy to follow and compliant with local regulations.

Yes, a promissory note can absolutely be secured by real property, enhancing its security for the lender. In the case of a Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the property acts as collateral, providing peace of mind for both parties involved. Using a service like USLegalForms can aid you in drafting an effective agreement.

Yes, you can create your own promissory note, but it is crucial to ensure that it covers all legal bases. Specifically, for a Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the terms must meet state requirements. Fortunately, USLegalForms provides templates that can help you craft a legally robust document.

You can obtain a promissory note through several channels, including legal software, financial institutions, or by consulting with an attorney. Online platforms like USLegalForms offer ready-made templates for a Waterbury Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, making the process straightforward and accessible.