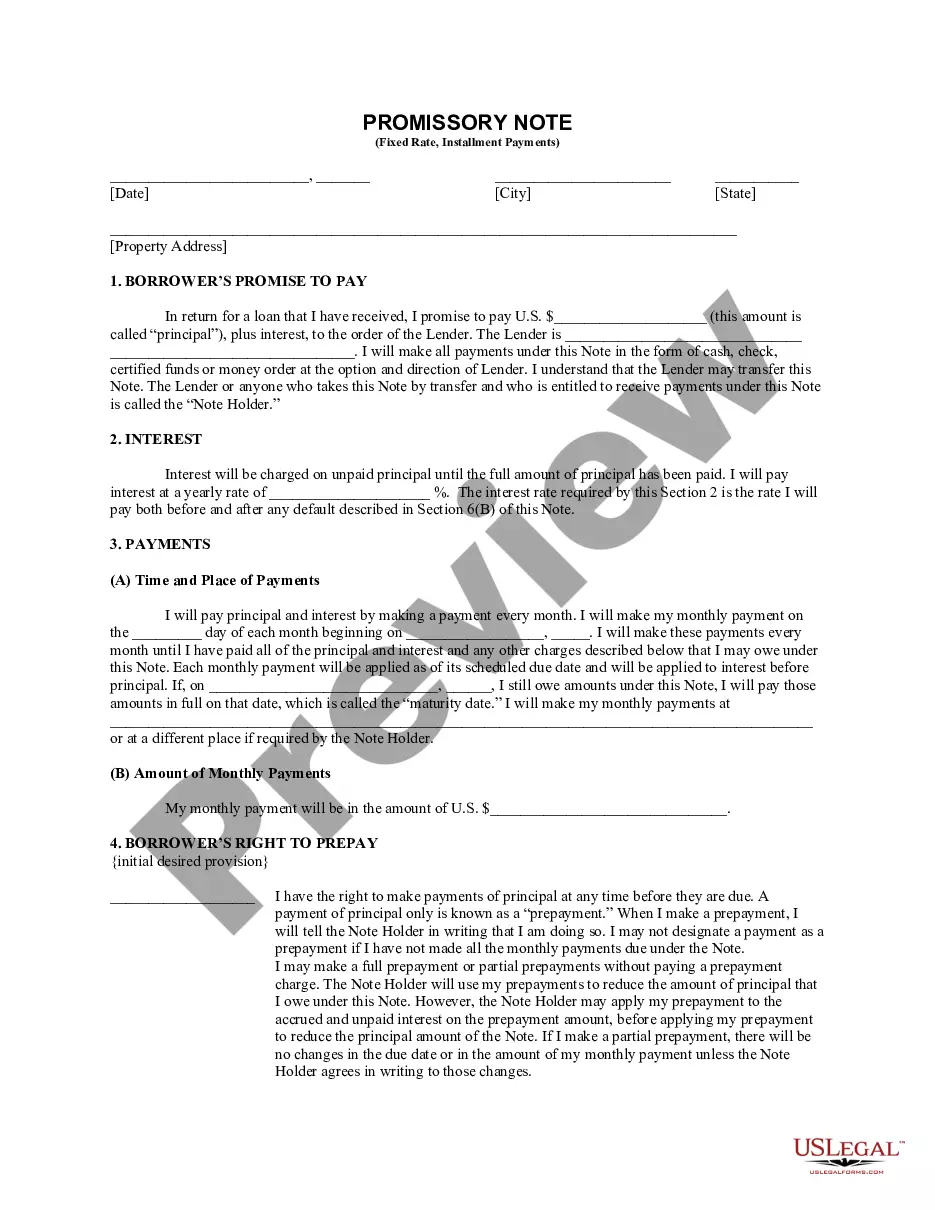

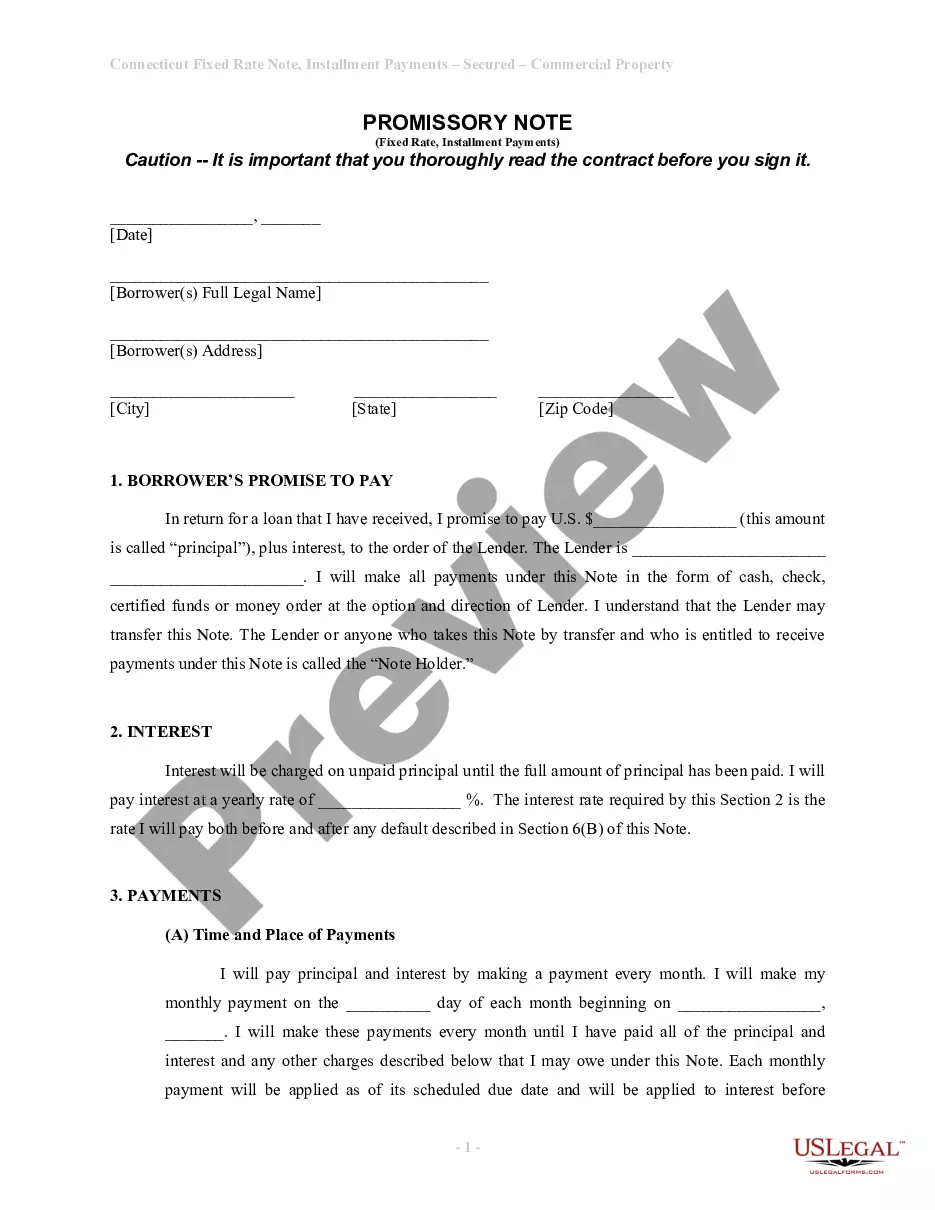

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Connecticut Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We consistently aim to reduce or avert legal complications when handling intricate legal or financial issues.

To achieve this, we seek legal remedies that are typically very expensive.

However, not all legal issues are equally complicated. Many of them can be addressed on our own.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button adjacent to it. Should you misplace the document, you can always re-download it from the My documents section. The procedure is equally simple if you are not familiar with the platform! You can create your account in just a few minutes. Ensure to verify if the Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate adheres to the laws and regulations of your state and locality. Additionally, it is essential to review the form’s description (if applicable), and if you identify any inconsistencies with what you initially sought, look for an alternative template. Once you confirm that the Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate is suitable for your situation, you can select the subscription plan and complete the payment process. Following that, you may download the form in any available format. For over 24 years in the industry, we’ve assisted millions by providing ready-to-customize and current legal forms. Maximize your benefits with US Legal Forms now to save time and resources!

- Our platform empowers you to manage your affairs independently without the necessity of consulting a lawyer.

- We offer access to legal document templates that are not always accessible to the public.

- Our templates are tailored to specific states and regions, making the search process significantly easier.

- Utilize US Legal Forms whenever you need to locate and download the Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other document securely and effortlessly.

Form popularity

FAQ

You can obtain a promissory note for your mortgage through various legal services or online platforms, such as uslegalforms. They offer templates tailored for different situations, including Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate. It’s important to select a trustworthy source to ensure your document meets legal standards.

For a promissory note to be valid, it must specify the principal amount, payment terms, and be signed by the borrower. It's also important to include the date and other necessary details that outline obligations. If you are drafting a Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, meeting these requirements ensures the document stands legal and enforceable.

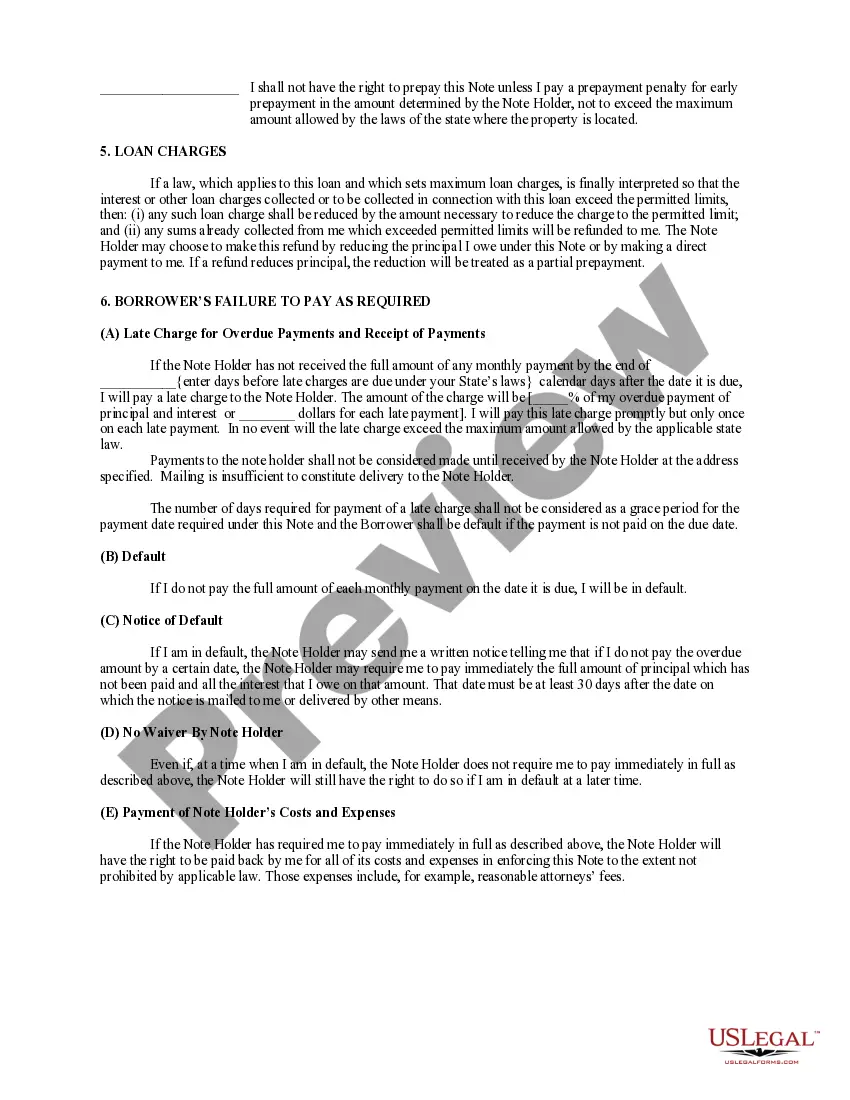

Conditions for a promissory note often include the repayment schedule, interest rates, and consequences of late payments. Clear documentation of these conditions prevents misunderstandings between borrower and lender. When using a Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensure that the terms are outlined distinctly to facilitate smooth transactions.

To secure a promissory note, you typically back it with collateral, such as residential real estate. This means if the borrower defaults, the lender can claim the collateral to recover the owed amount. Using a Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate provides an extra layer of security for lenders and peace of mind for borrowers.

You can record a promissory note at your local county clerk's office or land registry office. When dealing with a Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, recording the note solidifies your claim against the property. This process provides additional security and transparency for both parties involved in the transaction.

You generally do not file a promissory note with the court, as it's a private agreement between parties. However, for a Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you may want to record it in the county land records if it is secured by property. This helps ensure that your rights regarding the residential real estate are protected and publicly acknowledged.

A promissory note should be kept in a safe location to ensure it is accessible when needed. After creating your Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you should store it in a secure environment, such as a locked file cabinet or a safe. This ensures that both the lender and borrower can refer back to the document at any time.

Yes, promissory notes typically hold up in court, especially if they are well-drafted and meet the legal requirements. A Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate is enforceable if it clearly outlines the terms of repayment and has the required signatures. Courts often uphold these agreements as binding contracts, giving you the leverage needed in case of a dispute.

Yes, you can foreclose on a promissory note, particularly when it is secured by residential real estate. If the borrower defaults on the payment terms outlined in a Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the lender has the right to initiate foreclosure proceedings. This process allows the lender to reclaim the property and recover the amount owed. Understanding your rights and the detailed terms in the promissory note is crucial.

Yes, a promissory note can be secured by real property, which is a common practice in real estate financing. This type of arrangement provides security for the lender and creates a legally enforceable claim on the property. When structured as a Bridgeport Connecticut Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it offers peace of mind for both parties.