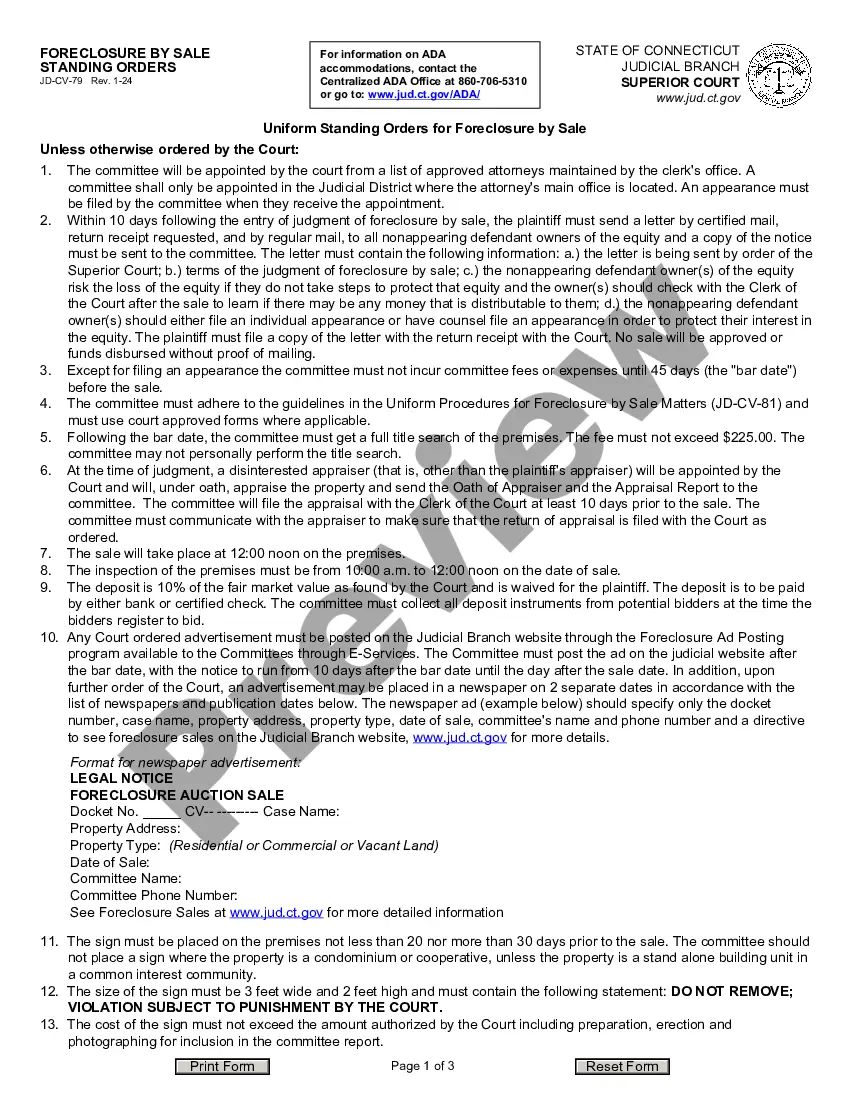

This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders

Description

How to fill out Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders?

If you are looking for an appropriate form template, it’s hard to discover a more accessible service than the US Legal Forms website – one of the largest collections on the internet.

With this collection, you can locate a vast number of document examples for business and personal uses by categories and states, or keywords.

With the excellent search functionality, obtaining the latest Waterbury Connecticut Foreclosure by Sale Fact Sheet - Notice to Bidders is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Receive the form. Specify the format and download it to your device. Edit. Fill out, modify, print, and sign the acquired Waterbury Connecticut Foreclosure by Sale Fact Sheet - Notice to Bidders.

- Additionally, the pertinence of each document is validated by a team of experienced attorneys who frequently review the templates on our site and update them according to the most recent state and county standards.

- If you are already familiar with our platform and have an active account, all you need to do to acquire the Waterbury Connecticut Foreclosure by Sale Fact Sheet - Notice to Bidders is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have located the example you desire. Review its description and use the Preview feature to examine its content. If it doesn’t fulfill your needs, utilize the Search box at the top of the page to find the required document.

- Verify your selection. Click on the Buy now button. After that, choose your preferred subscription plan and enter your details to create an account.

Form popularity

FAQ

Typically, missing three to six consecutive mortgage payments can lead to foreclosure proceedings in Connecticut. However, this can vary based on individual lender policies. Knowing your rights and understanding the process is essential, and you can find helpful information in the Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders.

The five stages of a foreclosure action in Connecticut include pre-foreclosure, foreclosure complaint filing, judgment, sale, and redemption period. Each stage has its own timeline and legal implications for homeowners. Understanding these stages can help you navigate the process more effectively, and the Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders can be an excellent resource.

In Connecticut, lenders often start the foreclosure process after homeowners miss three consecutive mortgage payments. However, homeowners should be aware that lenders may begin to initiate actions earlier, depending on their specific policies. It is advisable to refer to the Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders for detailed information on this process.

In Connecticut, buying a foreclosure involves participating in a public auction or negotiating directly with the lender. You will need to conduct due diligence on the property, including inspections and evaluating its market value. Understanding the process is essential, and the Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders provides useful information for prospective buyers.

The 120-day rule in Connecticut requires lenders to wait for 120 days after a missed payment before initiating foreclosure proceedings. This rule gives homeowners time to address missed payments or explore alternatives. Understanding this timeframe is essential, and the Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders can clarify your rights during this period.

Foreclosure in Connecticut generally takes between three to twelve months, depending on the complexity of the case and whether it goes to court. The process can be drawn out if homeowners choose to contest the foreclosure. To stay updated, you can refer to the Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders to understand the timelines better.

In Connecticut, lenders typically begin foreclosure proceedings after homeowners have missed three to six months of mortgage payments. It is crucial to understand that even one missed payment can lead to fees and penalties. Staying informed about your mortgage status helps you avoid falling into foreclosure. The Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders provides important details for those facing difficulty.

A judgment of foreclosure by sale in Connecticut is a legal order that directs the sale of a mortgaged property through a public auction. This judgment occurs after the lender has initiated the foreclosure process, and it allows the property to be sold to the highest bidder. Understanding this judgment is essential for anyone interested in bidding on properties, as it lays the groundwork for the auction process outlined in the Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders.

Yes, a debtor can bid on their own property at a foreclosure sale in Connecticut. This can be a strategic move if the debtor intends to reclaim their property and has the necessary funds. However, it’s crucial to understand the auction process and any outstanding amounts before participating. For assistance and resources, explore the Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders.

The primary difference between Strict Foreclosure and foreclosure by sale in Connecticut lies in the outcomes for the borrower. In Strict Foreclosure, the court awards the lender the property directly after the judgment, leaving little room for the homeowner to recover their property. Conversely, foreclosure by sale involves auctioning the property to the highest bidder, often allowing the homeowner a chance to redeem the property within a specified time. For more details, consult the Waterbury Connecticut Foreclosure By Sale, Fact Sheet - Notice To Bidders.