The dissolution of a corporation package contains all forms to dissolve a corporation in Connecticut, step by step instructions, addresses, transmittal letters, and other information.

Stamford Connecticut Dissolution Package to Dissolve Corporation

Description

How to fill out Connecticut Dissolution Package To Dissolve Corporation?

If you are looking for a legitimate form, it’s impossible to select a more suitable platform than the US Legal Forms website – one of the largest online collections.

Here you can find a vast selection of templates for business and personal needs by categories and regions, or keywords.

Utilizing our top-notch search feature, acquiring the most up-to-date Stamford Connecticut Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration.

Obtain the form. Select the format and save it to your device.

- Furthermore, the validity of each document is verified by a team of experienced attorneys who constantly evaluate the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to obtain the Stamford Connecticut Dissolution Package to Dissolve Corporation is to Log In to your profile and click the Download button.

- If you're using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have accessed the sample you need. Review its description and use the Preview function (if available) to inspect its content. If it doesn’t suit your requirements, use the Search box at the top of the page to find the correct document.

- Verify your choice. Click the Buy now button. Then, choose your desired subscription plan and provide information to register for an account.

Form popularity

FAQ

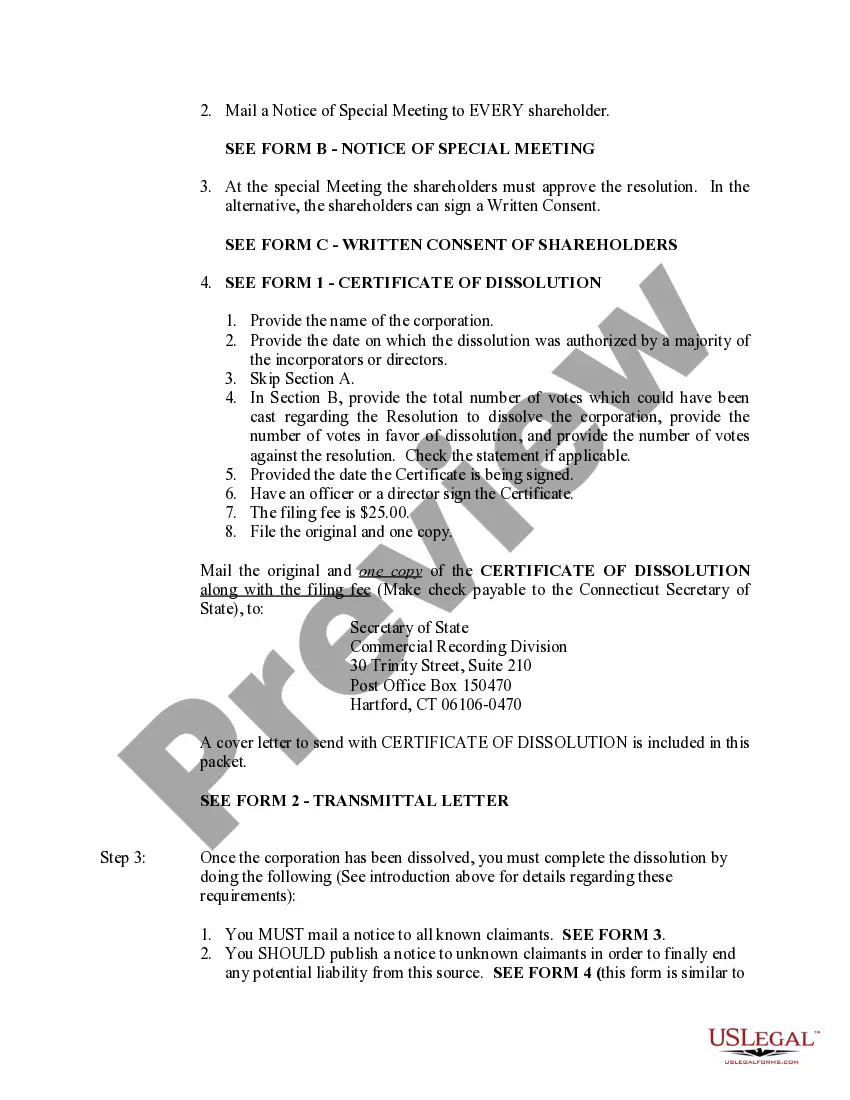

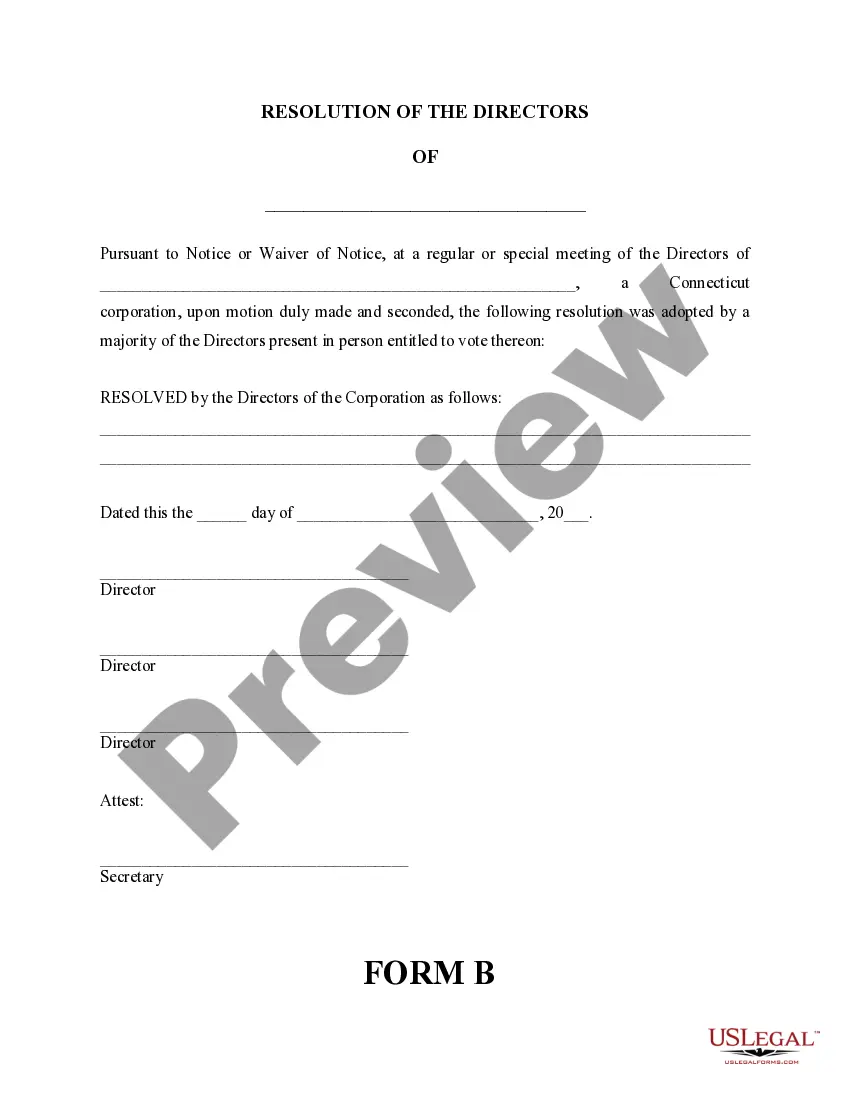

The first step to terminate a corporation involves holding a meeting with the board of directors to pass a resolution for dissolution. After obtaining the necessary approvals, you should document this decision. It's advisable to consult resources, like the Stamford Connecticut Dissolution Package to Dissolve Corporation, to guide you through the necessary steps.

To terminate a corporation with the IRS, first file your final corporate tax return and indicate that it is the last return. Then, notify the IRS of the dissolution by submitting Form 966, which notifies them of your decision to dissolve. It’s crucial to tie up all loose ends, and using the Stamford Connecticut Dissolution Package to Dissolve Corporation can help ensure all steps are followed efficiently.

To notify the IRS that your business is closed, you must file your final tax return. On the return, you should indicate that it is your last return by checking the appropriate box. Additionally, if your business was an S corporation or a partnership, make sure to provide a letter to the IRS stating your intent to dissolve. Utilizing the Stamford Connecticut Dissolution Package to Dissolve Corporation can simplify this process for you.

To complete a corporation's dissolution, you must follow several steps, including obtaining shareholder approval, filing articles of dissolution with the state, and notifying the IRS. This requires thorough documentation and awareness of state-specific rules. The Stamford Connecticut Dissolution Package to Dissolve Corporation offers resources and templates to ensure your dissolution is handled correctly and efficiently.

If you dissolve a company, it ceases to exist as a legal entity. This means the company can no longer conduct business, but it also puts a process in motion to settle outstanding debts and liabilities. Using the Stamford Connecticut Dissolution Package to Dissolve Corporation can help you understand the implications and ensure a smooth transition to dissolution.

Dissolving a company means that you are taking legal steps to formally end its existence as a business entity. This involves settling all debts, addressing liabilities, and filing dissolution papers with the state. The Stamford Connecticut Dissolution Package to Dissolve Corporation simplifies this process, providing the necessary tools to manage your dissolution appropriately.

Dissolving a company and closing it are related but distinct actions. Closing a company refers to ceasing operations, while dissolving it involves legally ending the business entity with state authorities. The Stamford Connecticut Dissolution Package to Dissolve Corporation assists you in navigating both processes effectively, helping you close and dissolve your business seamlessly.

Dissolving a corporation with the IRS requires you to formally notify them using IRS Form 966. This document indicates your decision to dissolve the corporation, and it must be filed within 30 days of the dissolution. Utilizing the Stamford Connecticut Dissolution Package to Dissolve Corporation can help ensure this step is correctly completed and documented.

When an LLC is dissolved, it means the business entity is officially terminated and recognized as no longer existing under state law. This process involves settling debts, liquidating assets, and filing necessary paperwork. The Stamford Connecticut Dissolution Package to Dissolve Corporation streamlines this process, ensuring all legal obligations are met promptly.

Dissolving an LLC can seem daunting but is manageable with the right guidance. The complexity often depends on the specific requirements set by your state, such as notifying members and filing the necessary documents. By using resources like the Stamford Connecticut Dissolution Package to Dissolve Corporation, you can simplify the process and ensure you follow all steps properly, making it less overwhelming.