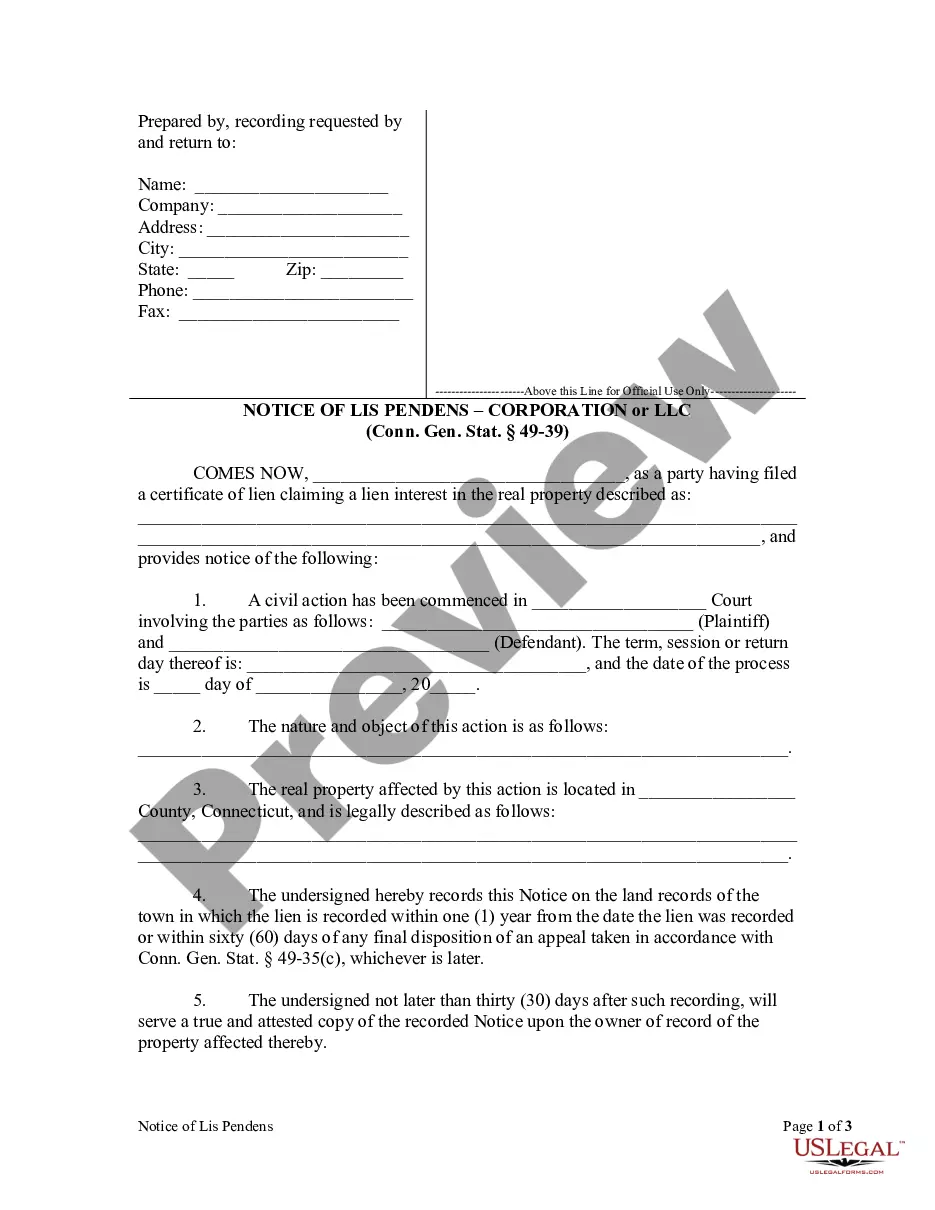

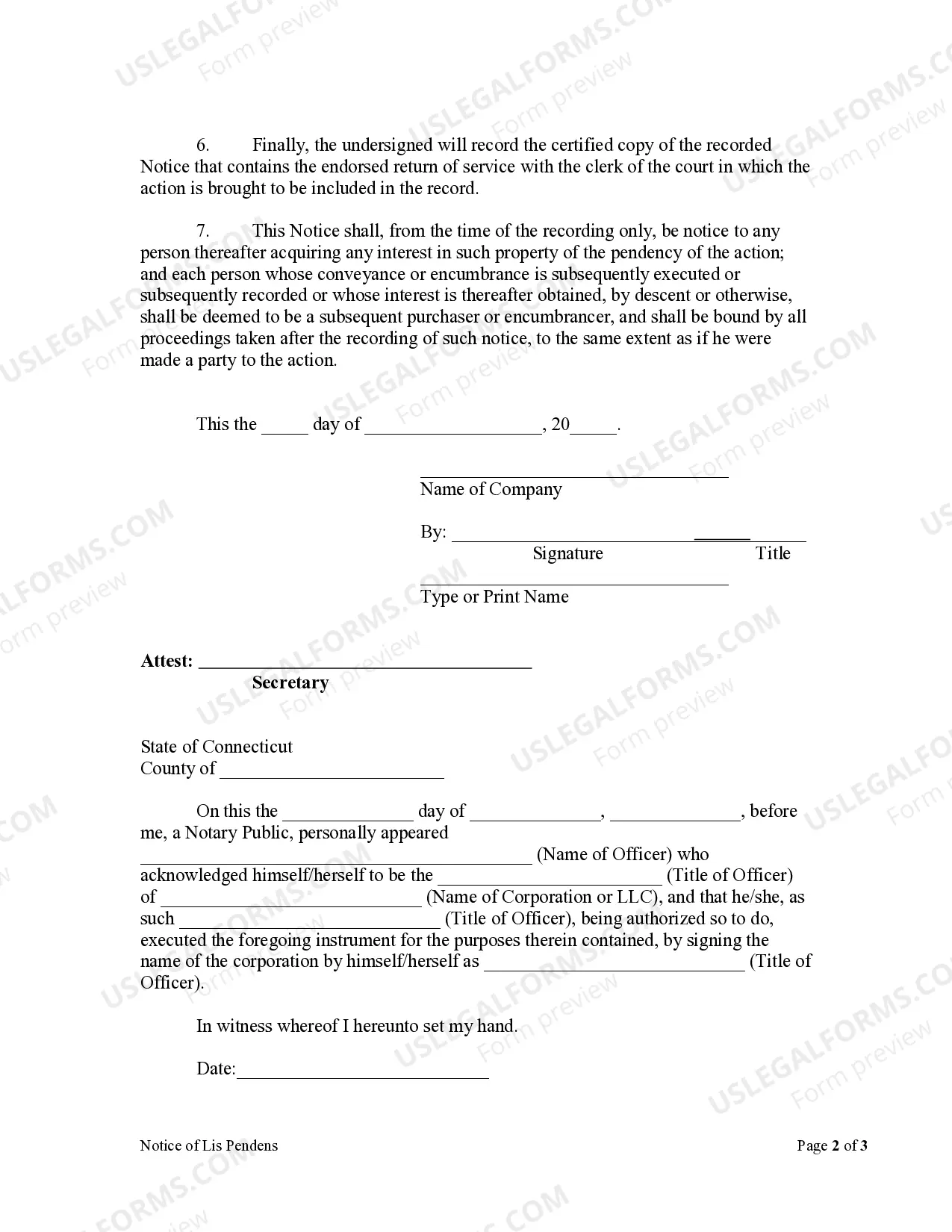

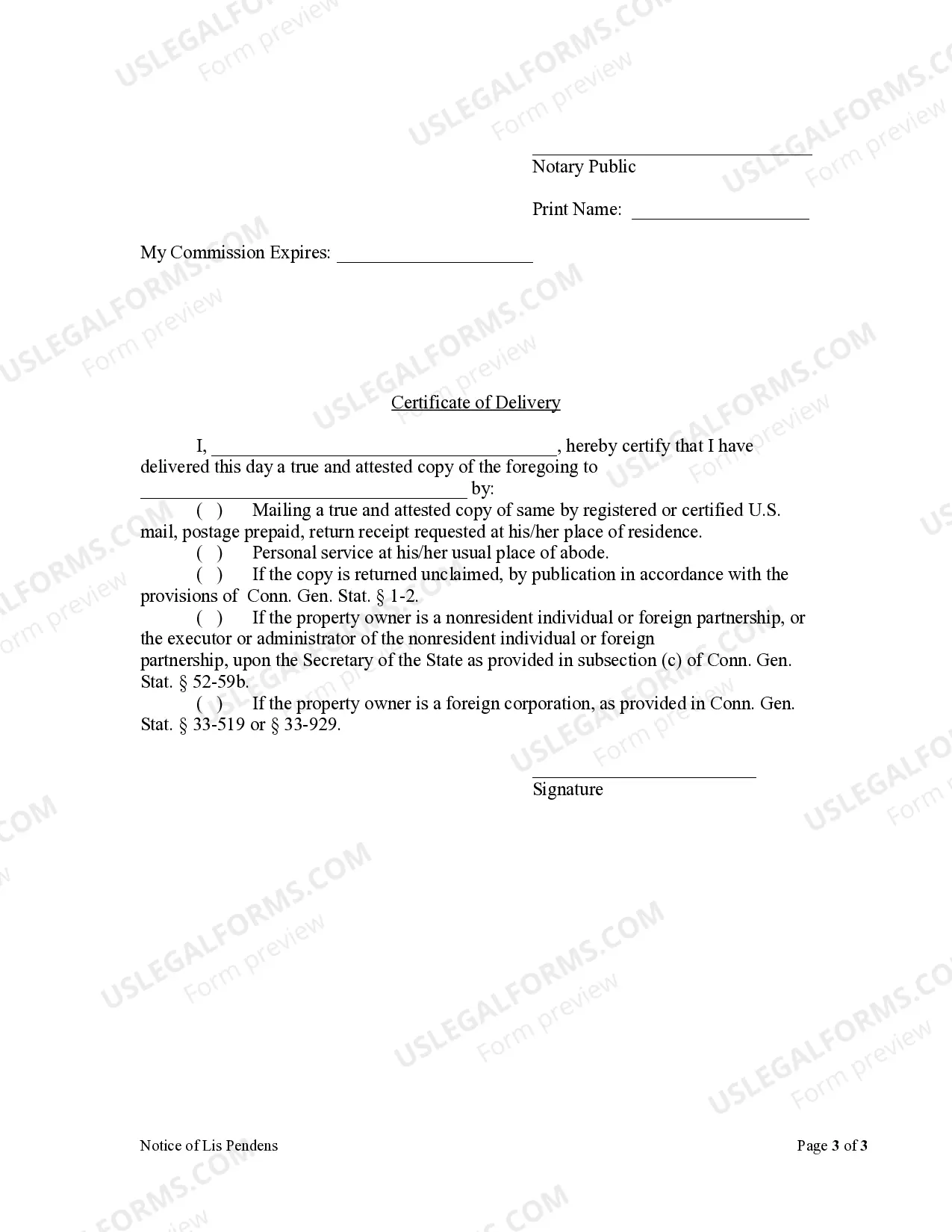

This Notice of Lis Pendens form is for use by a corporate or LLC party who has filed a certificate of lien claiming a lien interest in real property to provide notice of a civil action. The notice includes the name of the court where the action has been filed, the name of the parties to the action, the nature and object of the action, and the location and legal description of the property affected by the action. The notice must be recorded on the land records of the town in which the lien is recorded within one year from the date the lien was recorded or within 60 days of any final disposition of an appeal taken in accordance with Conn. Gen. Stat. § 49-35(c), whichever is later. The recorded notice must not later than 30 days after such recording, be served upon the owner of record of the property affected thereby. The certified copy of the recorded notice that contains the endorsed return of service must also be recorded with the clerk of the court in which the action is brought to be included in the record.

Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC

Description

How to fill out Connecticut Notice Of Lis Pendens - Corporation Or LLC?

No matter your societal or occupational standing, filling out legal documents is a regrettable requirement in the modern world.

Frequently, it’s nearly impossible for an individual without legal training to create such papers from the ground up, primarily due to the complex language and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Confirm that the document you have selected is appropriate for your area since the regulations of one state do not apply to another.

Review the form and glance at a brief outline (if provided) of the scenarios for which the document can be utilized. If the form you selected does not fulfill your requirements, you can start anew and search for the correct document.

- Our service provides a vast library with over 85,000 ready-to-use forms specific to different states that cater to virtually any legal circumstance.

- US Legal Forms also acts as an outstanding resource for associates or legal advisors wishing to conserve time by utilizing our DIY documents.

- Whether you require the Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC or any other documentation valid in your locality, US Legal Forms has everything readily available.

- Here’s how to acquire the Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC in minutes through our dependable service.

- If you are currently a returning customer, you can proceed to Log In to your account to download the correct form.

- However, if you are not accustomed to our platform, ensure you follow these steps before obtaining the Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC.

Form popularity

FAQ

To put a lien on another person's property in Connecticut, you must file a court case against them and obtain a judgment. After securing the judgment, you will need to complete a Notice of Lien and submit it to the town clerk's office. Make sure to adhere to the proper filing requirements to protect your interests. Understanding the implications of a Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC can aid in this process.

To place a lien on a property in Connecticut, first secure a judgment from the court. Once you have the judgment, file a Notice of Lien with the town clerk's office where the property is located. Be sure to include proper documentation and payment of any required fees. This process is vital for ensuring your legal rights in matters related to the Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC.

You can look up liens in Connecticut by accessing the online database provided by the Connecticut Secretary of the State. Use the lien search feature to enter relevant information such as the property address or the name of the lienholder. This tool will present you with a list of recorded liens, helping you understand any claims against real estate. This knowledge is crucial when dealing with the Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC.

To look up an LLC in Connecticut, you can visit the Connecticut Secretary of the State's website. There, you will find a business entity search tool that allows you to enter the name of the LLC. This search will provide you with essential details such as the status, formation date, and registered agent. Utilizing this resource can help you access important information related to the Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC.

Yes, a lis pendens does affect the title of a property. When a notice is filed, it serves as a warning that there is an ongoing legal dispute regarding the property, which potential buyers and lenders must consider. This is particularly relevant for those dealing with a Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC, as it indicates that legal actions may impact ownership rights. Ensure you understand your rights in these situations with the help of US Legal Forms.

A lis pendens in Connecticut typically remains valid as long as the underlying lawsuit is active or until dismissed by the court. Once the case concludes or if the plaintiff decides to withdraw the claim, the notice can be removed. This means that having a Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC can significantly impact your property until the legal matter is resolved. For further assistance, consider using US Legal Forms to streamline your legal processes.

A notice of lis pendens is a legal document that signals an ongoing lawsuit involving a specific property. It informs potential buyers or lenders that there is a claim against the property, which may affect their interests. If you receive a Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC, it indicates that your property is involved in legal proceedings, and you should consult a legal professional. US Legal Forms offers tools to help you navigate legal matters effectively.

In Connecticut, a lien can remain valid for a maximum of 20 years. However, if you do not take action to enforce the lien, it may become unenforceable after a certain period. Keep in mind that a Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC can help alert interested parties about any pending legal claims, which may impact the property during this timeframe. If you need assistance managing liens, consider exploring the resources on US Legal Forms.

In Connecticut, you generally have a limited timeframe to file a lien, often dictated by the type of claim and the underlying agreement. It is crucial to act promptly to protect your interests. Understanding the implications of the Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC will be useful in ensuring timely and effective filing.

In Connecticut, a lis pendens typically remains effective until the resolution of the legal dispute it addresses or until a court order dismisses it. This notice can significantly impact potential property transactions during that period. Familiarizing yourself with the Bridgeport Connecticut Notice of Lis Pendens - Corporation or LLC process can help in managing your legal rights.