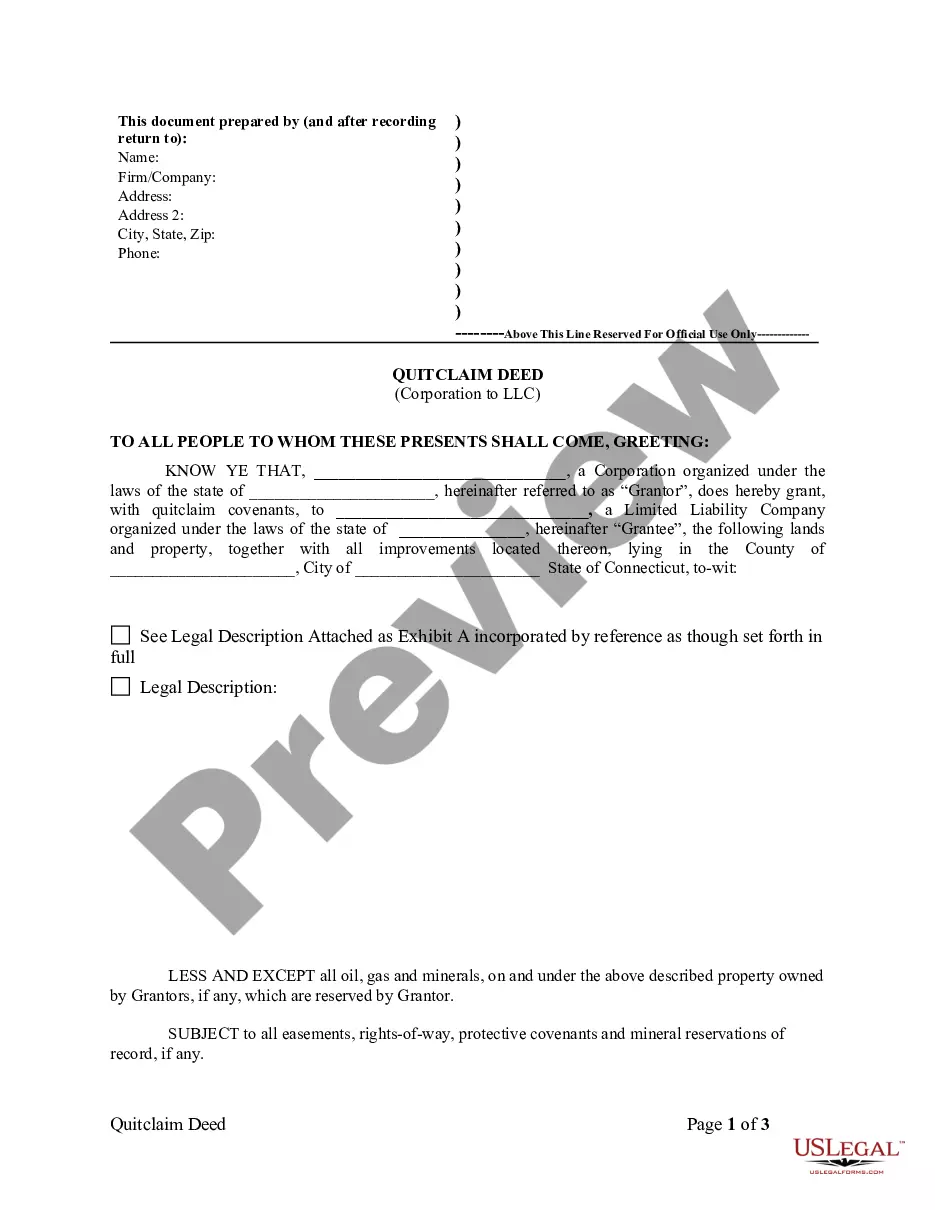

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Waterbury Connecticut Quitclaim Deed from Corporation to LLC

Description

How to fill out Connecticut Quitclaim Deed From Corporation To LLC?

Utilize the US Legal Forms and gain instant access to any form sample you need.

Our valuable platform with a vast collection of documents streamlines the process of locating and acquiring almost any document sample you require.

You can download, complete, and certify the Waterbury Connecticut Quitclaim Deed from Corporation to LLC in just a few minutes, rather than searching the Internet for hours looking for an appropriate template.

Using our catalog is an excellent method to enhance the security of your document submissions.

Locate the template you need. Verify that it is the form you were looking for: review its title and description, and utilize the Preview option if it is available. Alternatively, use the Search field to find the correct one.

Begin the download process. Select Buy Now and choose the payment plan you prefer. Then, register for an account and complete your purchase using a credit card or PayPal.

- Our skilled attorneys routinely examine all the records to ensure that the forms are applicable for a specific region and comply with new legislation and regulations.

- How can you acquire the Waterbury Connecticut Quitclaim Deed from Corporation to LLC.

- If you have an account, simply Log In to your account. The Download option will be activated on all the documents you view.

- Additionally, you can find all your previously saved records in the My documents section.

- If you haven't created an account yet, follow the steps below.

Form popularity

FAQ

In Connecticut, a quitclaim deed essentially allows a property owner to transfer their interest in the property without affirming ownership or title issues. This practice is commonly used for simple transactions like a Waterbury Connecticut quitclaim deed from corporation to LLC. After signing, the deed must be filed with the town clerk to officialize the transfer. This straightforward process is attractive for those looking to quickly change ownership.

In general, a Waterbury Connecticut quitclaim deed from corporation to LLC may not trigger tax implications for the transfer itself. However, it's vital to check specific local regulations and consult with a tax professional. Depending on the circumstances of the transfer and any associated liabilities, there could be other tax consequences to consider. Being informed helps ensure compliance with tax laws.

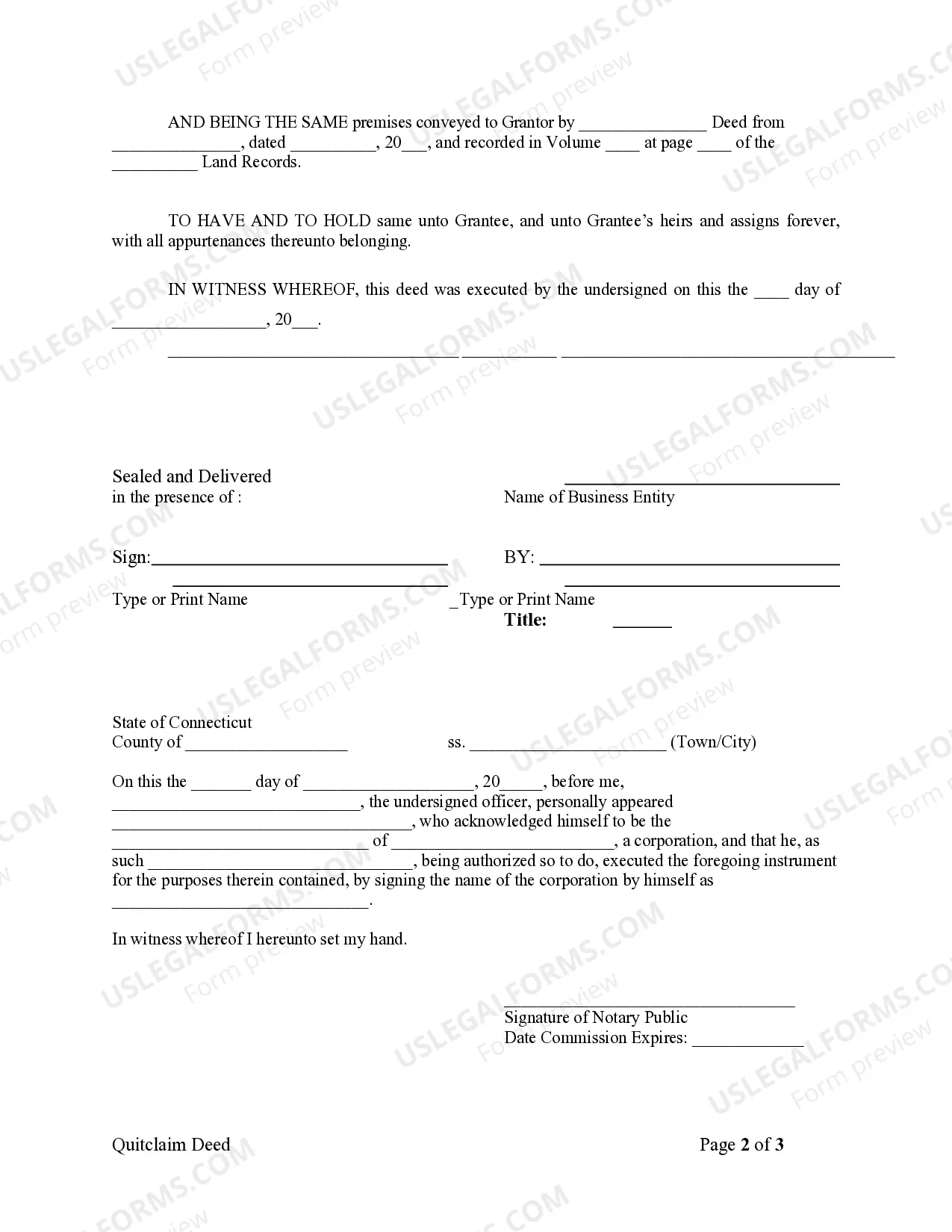

Once you file a quit claim deed in Waterbury, Connecticut, the property ownership officially transfers from the corporation to the LLC. It's crucial to ensure that the deed is filed with the appropriate local registry of deeds. After filing, you'll receive a stamped copy of the deed which serves as proof of the ownership change. This document is important for future reference and any potential legal matters.

To file a quit claim deed in Connecticut, first, make sure you have a properly prepared deed that delineates the transfer of property. Next, the deed must be signed by the grantor in front of a notary public. Once signed, submit the Waterbury Connecticut Quitclaim Deed from Corporation to LLC to your local town clerk for recording, which solidifies the ownership change and provides a legal record of the transaction.

Filing a quitclaim deed in Connecticut involves preparing the deed, including accurate property descriptions and the names of grantors and grantees. You will then need to sign the deed in the presence of a notary public. After completion, file the Waterbury Connecticut Quitclaim Deed from Corporation to LLC with your local town clerk’s office to make the transfer official and ensure public record.

To change ownership of an LLC in Connecticut, you need to update your operating agreement and make necessary amendments with the Secretary of State. Once the updates are made, you may also need to execute a quitclaim deed if the transfer involves real property. By utilizing the Waterbury Connecticut Quitclaim Deed from Corporation to LLC, you can smoothly transfer ownership interests while ensuring compliance with state regulations.

Filling out a quitclaim deed form involves several essential steps. First, accurately enter the names of both the grantor and grantee, making sure to specify the LLC if applicable. Next, describe the property clearly, and include any necessary terms for the transfer. It's beneficial to use a Waterbury Connecticut Quitclaim Deed from Corporation to LLC template available on the UsLegalForms platform to ensure compliance with local laws and streamline the process.

To transfer a deed to your LLC, you start with the current deed for the property in question. Use a Waterbury Connecticut Quitclaim Deed from Corporation to LLC to formally document the transfer. This deed must include key details, such as the property description, the LLC’s information, and the signatures of involved parties. Once completed, file the deed with the local county recorder's office to make it official.

Transferring personal assets to your LLC requires a clearly defined process. Begin by identifying the assets you wish to transfer and ensuring they are in good standing. You will need to document the transfer using a Waterbury Connecticut Quitclaim Deed from Corporation to LLC. This deed will serve as evidence of the transfer and help maintain your LLC's legal protections.

The process for a quitclaim deed in Connecticut involves preparing the deed, signing it in front of a notary, and filing it with your local town clerk. It's crucial to include all required details to ensure validity. If you're navigating a Waterbury Connecticut Quitclaim Deed from Corporation to LLC, consider using legal forms or consulting a professional to help you through the complexities.