Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will

Description

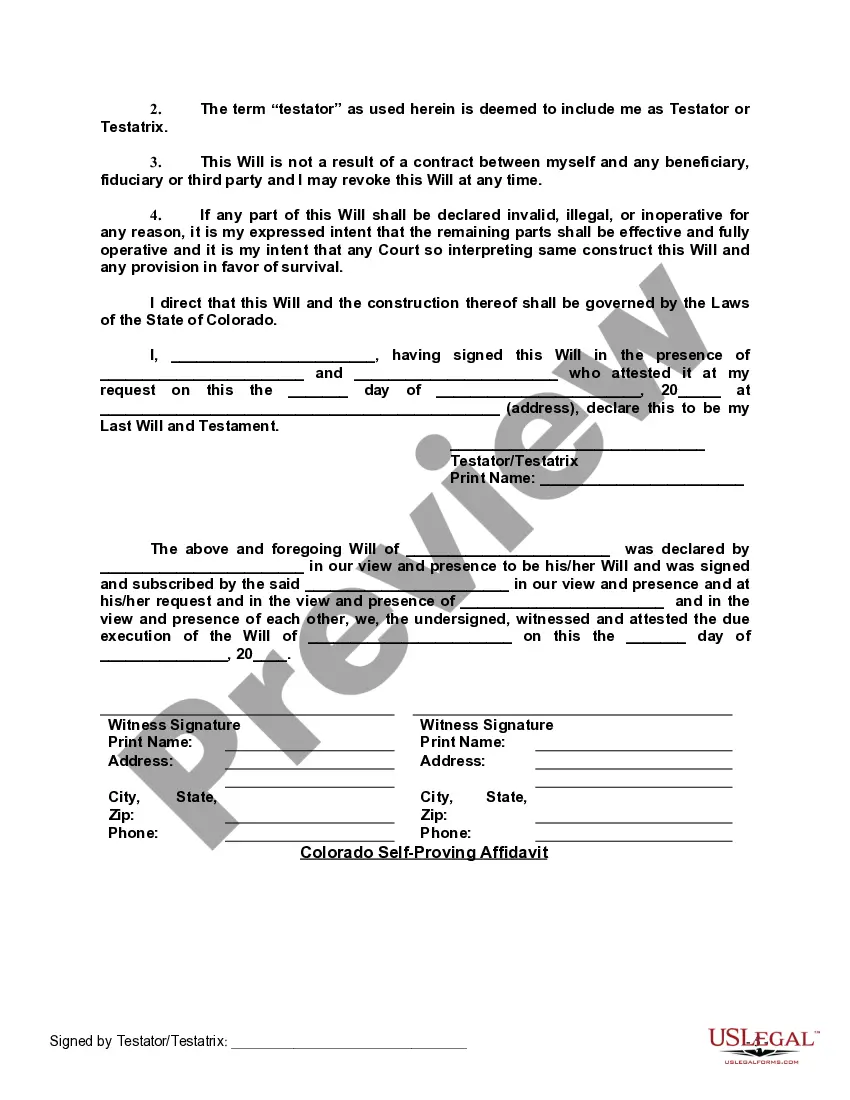

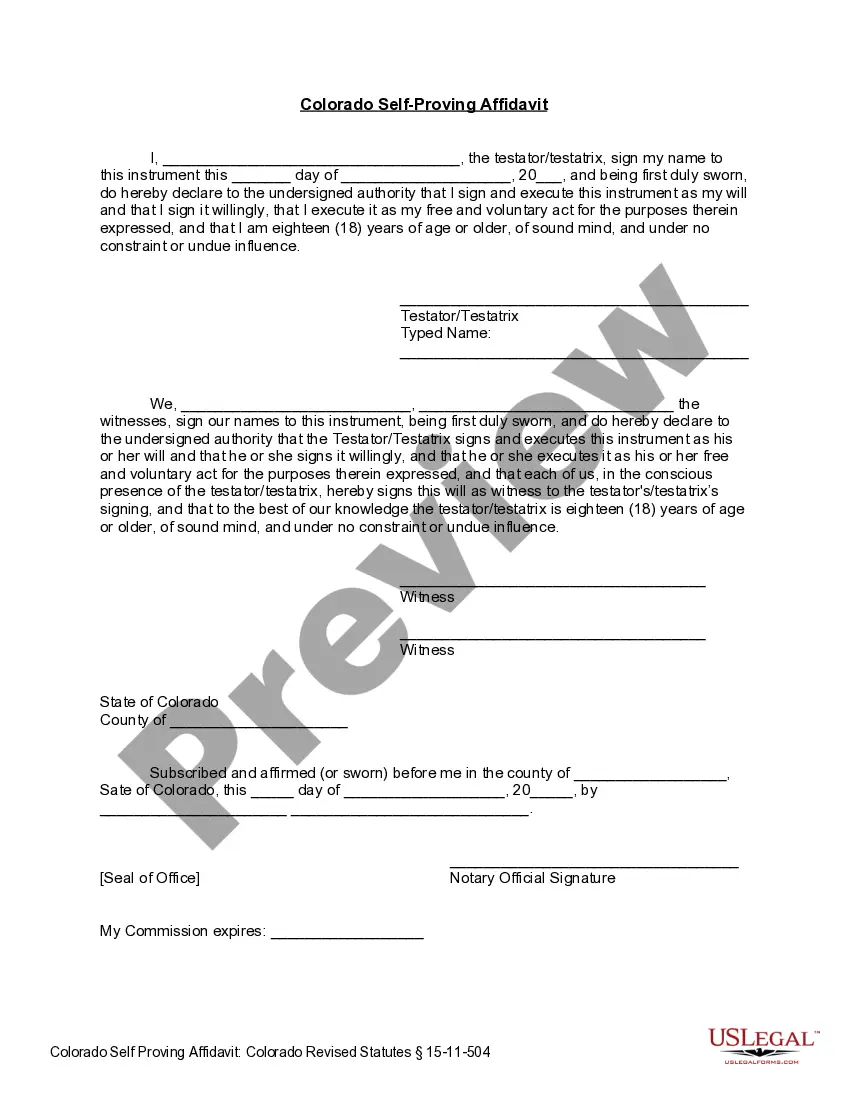

How to fill out Colorado Last Will And Testament With All Property To Trust Called A Pour Over Will?

If you are looking for an authentic document, it’s challenging to discover a superior platform than the US Legal Forms site – one of the most extensive collections on the internet.

Here you can obtain countless templates for both corporate and personal use categorized by types and states, or keywords. Utilizing our premium search functionality, finding the latest Centennial Colorado Legal Last Will and Testament Form with All Property to Trust, referred to as a Pour Over Will, is as simple as 1-2-3.

Additionally, the pertinence of each file is verified by a team of expert lawyers who routinely examine the templates on our system and update them in accordance with the most current state and county regulations.

Obtain the document. Select the file format and save it on your gadget.

Edit. Complete, modify, print, and sign the acquired Centennial Colorado Legal Last Will and Testament Form with All Property to Trust, known as a Pour Over Will. Each template you save in your user account has no expiration date and belongs to you indefinitely. You can effortlessly access them via the My documents section, so if you wish to obtain an additional copy for editing or creating a physical version, you can revisit and save it again at any time. Take advantage of the US Legal Forms professional collection to access the Centennial Colorado Legal Last Will and Testament Form with All Property to Trust you were searching for and thousands of other specialized and state-specific samples in one location!

- If you are familiar with our platform and possess a registered account, all you need to obtain the Centennial Colorado Legal Last Will and Testament Form with All Property to Trust, known as a Pour Over Will, is to Log In to your user profile and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the steps below.

- Ensure you have selected the form you need. Review its details and utilize the Preview option to view its contents. If it doesn’t satisfy your requirements, employ the Search function at the top of the page to locate the desired document.

- Validate your choice. Click on the Buy now button. Subsequently, choose the desired subscription plan and provide the information needed to create an account.

- Complete the payment process. Use your credit card or PayPal account to finalize the account registration.

Form popularity

FAQ

Having a will alone does not avoid probate in Colorado. When you create a Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will, the probate process is still necessary for assets not included in your trust. However, this will simplifies the distribution of your assets and guides how they should be managed after your death. Understanding this process ensures that your estate is settled efficiently and according to your wishes.

over will functions in conjunction with your trust by transferring any remaining assets into the trust after your passing. When you outline your Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will, it ensures that any assets not included in your trust at the time of your death will still be placed into it. This automation simplifies the estate's transition and minimizes the potential for disputes among heirs. Consequently, your trust remains the central vehicle for asset management.

Certain assets do not go through probate, including those held in a trust, joint accounts, and life insurance policies with named beneficiaries. In fact, when you have a Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will, your trust can hold various assets that bypass probate. This means your heirs can access these assets more quickly and without the need for court intervention. Streamlining the process offers peace of mind for both you and your loved ones.

over will does not completely avoid probate in Colorado, but it simplifies the process for assets not already in the trust. When the pourover will is executed, it ensures that any assets not placed in your trust will be added to it upon your passing. This features the Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will, designed to ease the transition of your estate. Thus, it helps reduce complications during probate, streamlining asset distribution.

Yes, a trust generally overrides a Last Will and Testament. When you create a trust and transfer your assets into it, those assets do not go through probate, unlike those specified in your will. Therefore, the Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will will only distribute assets that are not already placed in your trust. This ensures a smooth transition of your assets according to your wishes.

One major mistake parents make when establishing a trust fund is failing to communicate their intentions to their children. This lack of clarity can lead to misunderstandings and conflicts down the line. It's vital to clearly outline your wishes in the Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will, providing guidance on asset distribution. Platforms like uslegalforms can offer templates and advice to help avoid these pitfalls.

Distributing trust assets to beneficiaries involves the trustee following the guidelines set in the Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will. Initially, the trustee inventories the trust assets and then divides them according to the will's provisions. It's important for the trustee to maintain transparency and keep beneficiaries informed throughout the distribution process. Consider using tools from uslegalforms to ensure accuracy and legal compliance in this process.

To distribute trust property to beneficiaries after establishing a Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will, the trustee manages the trust according to the terms specified in the will. The trustee identifies the assets within the trust and ensures they are allocated according to the beneficiaries' interests. Clear communication with beneficiaries about their shares is key, helping prevent disputes. Using a legal platform like uslegalforms can simplify this process with their resources.

One significant disadvantage of a will compared to a trust is the requirement for probate. The Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will must go through this legal process before your beneficiaries can access their inheritance. Probate can be time-consuming and may incur legal fees that diminish the estate's value. In contrast, trusts can expedite the distribution of assets, making them a more efficient option.

In most cases, a trust takes precedence over a will in terms of asset distribution. The Centennial Colorado Last Will and Testament with All Property to Trust called a Pour Over Will acts to consolidate any remaining assets into the trust. Thus, if there is any disagreement or overlap, the terms of the trust usually prevail. This ensures that your estate is managed according to your wishes without unnecessary complications.