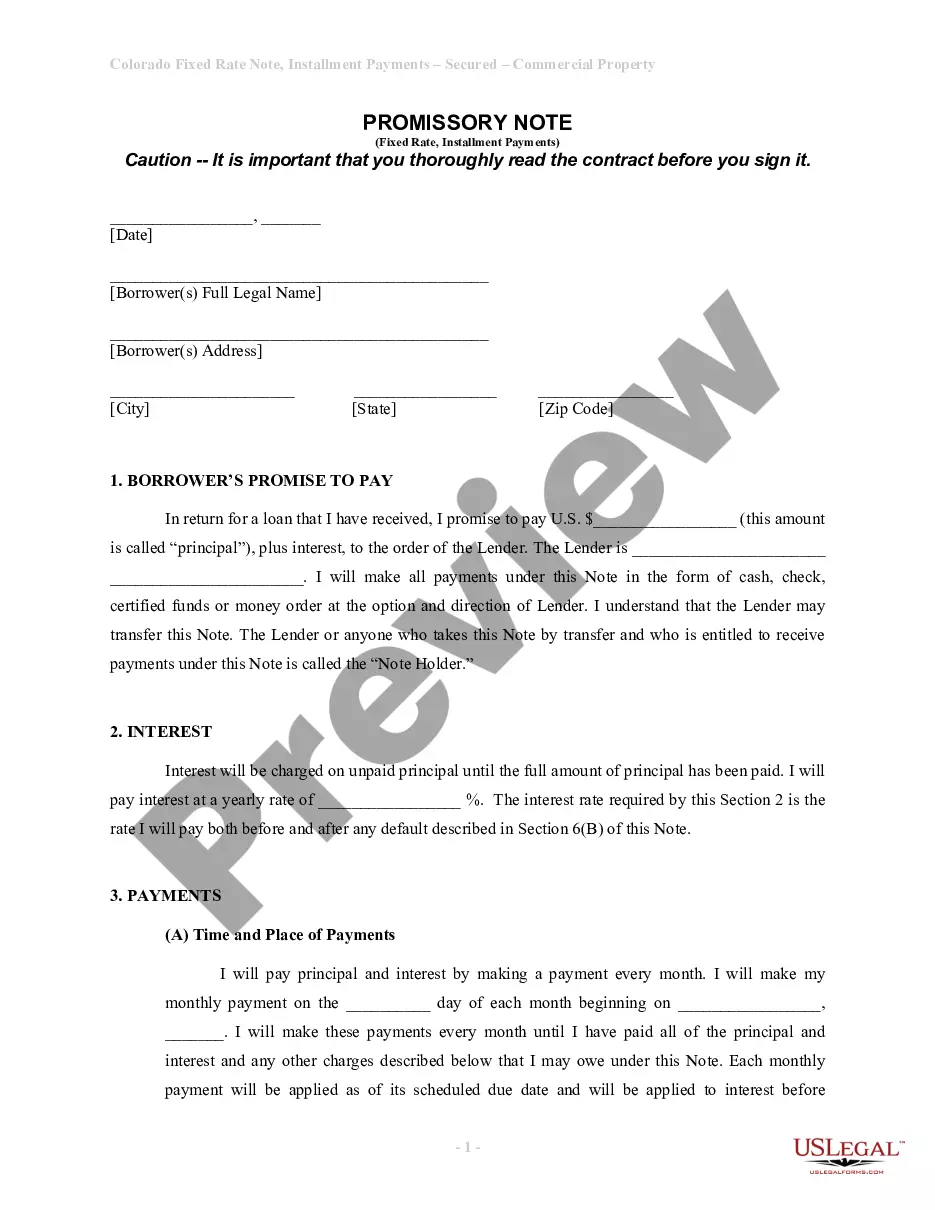

Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

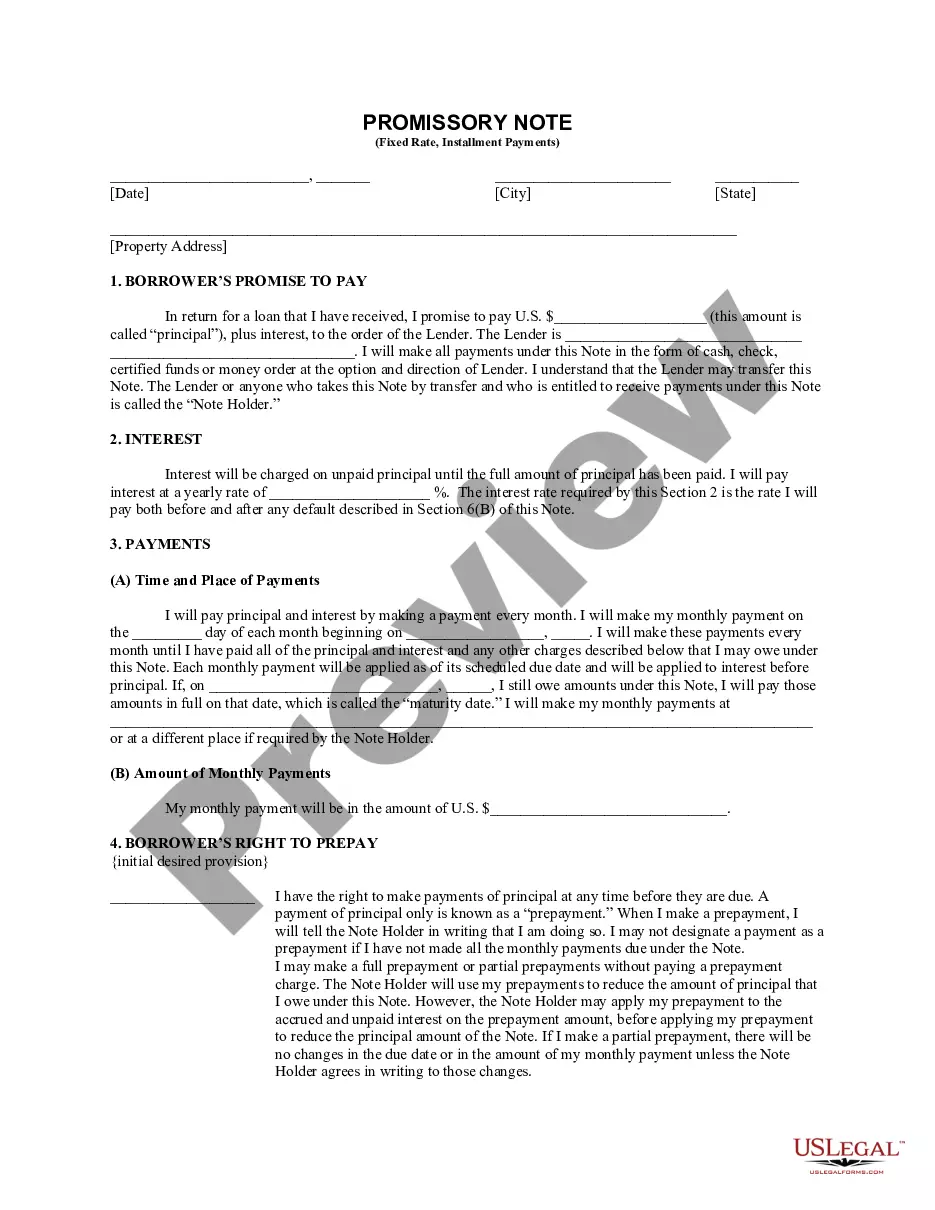

How to fill out Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Are you in search of a dependable and cost-effective provider of legal forms to purchase the Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate? US Legal Forms is your preferred choice.

Whether you need a straightforward contract to establish guidelines for living with your partner or a compilation of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and commercial use. All templates we provide are not generic and are tailored to meet the specifications of individual states and jurisdictions.

To acquire the form, you must Log In to your account, locate the required form, and click the Download button alongside it. Kindly remember that you can re-download your previously acquired document templates at any time from the My documents section.

Are you unfamiliar with our website? No problem. You can easily create an account, but beforehand, ensure to do the following.

You can now set up your account. Next, select the subscription option and proceed to payment. After the transaction is completed, download the Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate in any offered file type. You can revisit the website at any time and redownload the form at no cost.

Locating current legal documentation has never been simpler. Try US Legal Forms today, and say goodbye to spending hours combing through legal paperwork online for good.

- Verify if the Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate adheres to the laws of your state and locality.

- Review the details of the form (if available) to understand who and what the form is suitable for.

- Initiate the search again if the form does not suit your particular needs.

Form popularity

FAQ

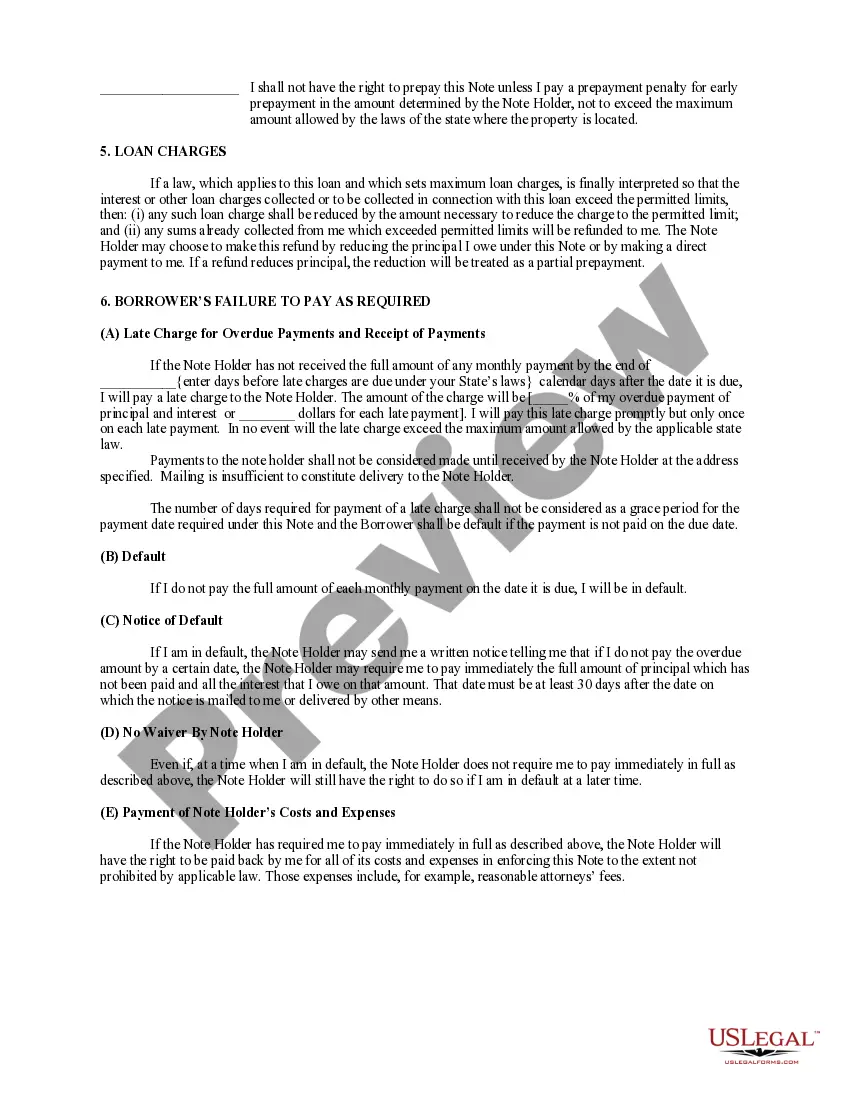

Yes, a promissory note can still be valid even if it is not notarized in Colorado. However, non-notarized notes may face challenges in enforcement. For an Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, notarization is advisable as it can strengthen your position in legal proceedings and clarify the intent of both parties.

You can obtain a promissory note for your mortgage from various sources, including banks, mortgage lenders, and online platforms like USLegalForms. Using a reliable service can ensure that you receive an Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate that meets state requirements. Make sure to review any terms carefully before signing.

In Colorado, a promissory note does not need to be notarized to be valid. However, notarization can add an extra layer of validity and help avoid disputes. If you are creating an Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, choosing to have it notarized can enhance its acceptance in legal matters.

To secure a promissory note with real property, you need to draft a mortgage or deed of trust that accompanies the promissory note. This document should clearly outline the property being used as collateral and the terms of repayment. When using the Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, both the note and security document must be executed properly to protect all parties involved.

The document that secures the Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate is known as a mortgage or deed of trust. This legal instrument links the promissory note to the real property, providing the lender with a claim to the property in case of default. Understanding this connection is crucial for both borrowers and lenders.

To report a promissory note on your taxes, you typically need to consider the interest income received. If your Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate generates interest, you’ll report this as income on your tax return. It’s wise to keep accurate records of payments received throughout the year. Consult a tax professional to ensure you meet all reporting requirements based on your specific situation.

You generally do not file a promissory note with any state authority, but you should keep it in a safe location for your records. If it is secured by real estate, you will need to record it with the county clerk or recorder's office. That's especially relevant for those using the Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Storing your note securely ensures that you have easy access to it when needed.

Yes, a secured promissory note should be recorded to protect your rights. By recording the Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, you assert your lien against the property. This step is essential for establishing your claim legally and prevents future disputes. Not recording the note could leave you vulnerable in a foreclosure or sale situation.

A promissory note itself typically does not appear on your credit record unless you default on it. However, if the note is secured by real estate, it may be recorded in property records. For an Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this means that anyone searching county records will see your legal claim. Make sure to manage your repayment responsibly to maintain a clean record.

You can record a promissory note at the county clerk or recorder’s office in the jurisdiction where the property is located. For those using the Aurora Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this office is typically where real estate transactions are documented. Recording your note establishes public notice of your secured interest. It also helps protect your rights should future legal matters arise.