This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Centennial Colorado Living Trust Property Record

Description

How to fill out Colorado Living Trust Property Record?

If you have previously utilized our service, sign in to your account and retrieve the Centennial Colorado Living Trust Property Record on your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it according to your payment plan.

If this is your inaugural interaction with our service, follow these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can locate it in your profile within the My documents section whenever you need to reuse it. Utilize the US Legal Forms service to swiftly find and secure any template for your personal or professional requirements!

- Ensure you have identified the correct document. Review the description and utilize the Preview option, if available, to determine if it satisfies your needs. If it does not suit you, make use of the Search tab above to locate the correct one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and make a payment. Enter your credit card information or select the PayPal option to finalize the acquisition.

- Obtain your Centennial Colorado Living Trust Property Record. Choose the file format for your document and save it to your device.

- Complete your sample. Print it or use online professional editors to fill it out and sign it electronically.

Form popularity

FAQ

To transfer ownership of property in Colorado, you generally need to prepare a deed and sign it in front of a notary. Afterwards, you can file the deed with the county clerk and recorder. This process is important for updating your Centennial Colorado Living Trust Property Record and ensuring all ownership rights are clearly established. For a smoother experience, consider using uslegalforms for document preparation and guidance.

Yes, a deed must be notarized in Colorado to be legally effective. This means that the grantor must sign the deed in front of a notary public, who will authenticate the signature. Proper notarization supports the integrity of your Centennial Colorado Living Trust Property Record, providing assurance that the transfer is legitimate and recognized by the state.

Yes, you can transfer a deed without an attorney in Colorado, as long as you understand the requirements. However, it remains advisable to consult a professional to avoid mistakes that could complicate your Centennial Colorado Living Trust Property Record. By utilizing user-friendly platforms like uslegalforms, you can simplify the process and ensure that all legal documentation is correctly handled.

Recording a deed in Colorado requires several key steps. First, the deed must be signed and acknowledged in front of a notary. Then, you must file the deed with the county clerk and recorder's office in the county where the property is located. This recording is crucial for updating your Centennial Colorado Living Trust Property Record and ensuring the public recognizes your ownership.

To obtain a marriage certificate in Arapahoe County, you need to contact the County Clerk's office. They offer options for ordering copies online, by mail, or in person. If you also need information relating to a Centennial Colorado Living Trust Property Record that involves marital property, these offices can guide you through that process.

To find out who owns a property in Colorado, you can access the county assessor's website or visit their office directly. Here, you will find tools to search by address or parcel number for information related to property ownership. A Centennial Colorado Living Trust Property Record can provide specific details on ownership and any associated trusts.

Yes, Colorado is an open records state. This policy allows the public to access various government documents, including property records. If you are interested in a Centennial Colorado Living Trust Property Record, you can utilize the resources available in your county's website or speak with local officials for assistance.

Yes, property records are public in Colorado. This means anyone can access these records to learn about property ownership, sales history, and other related details. To find information about a Centennial Colorado Living Trust Property Record, you can visit local government offices or online databases that specialize in property records.

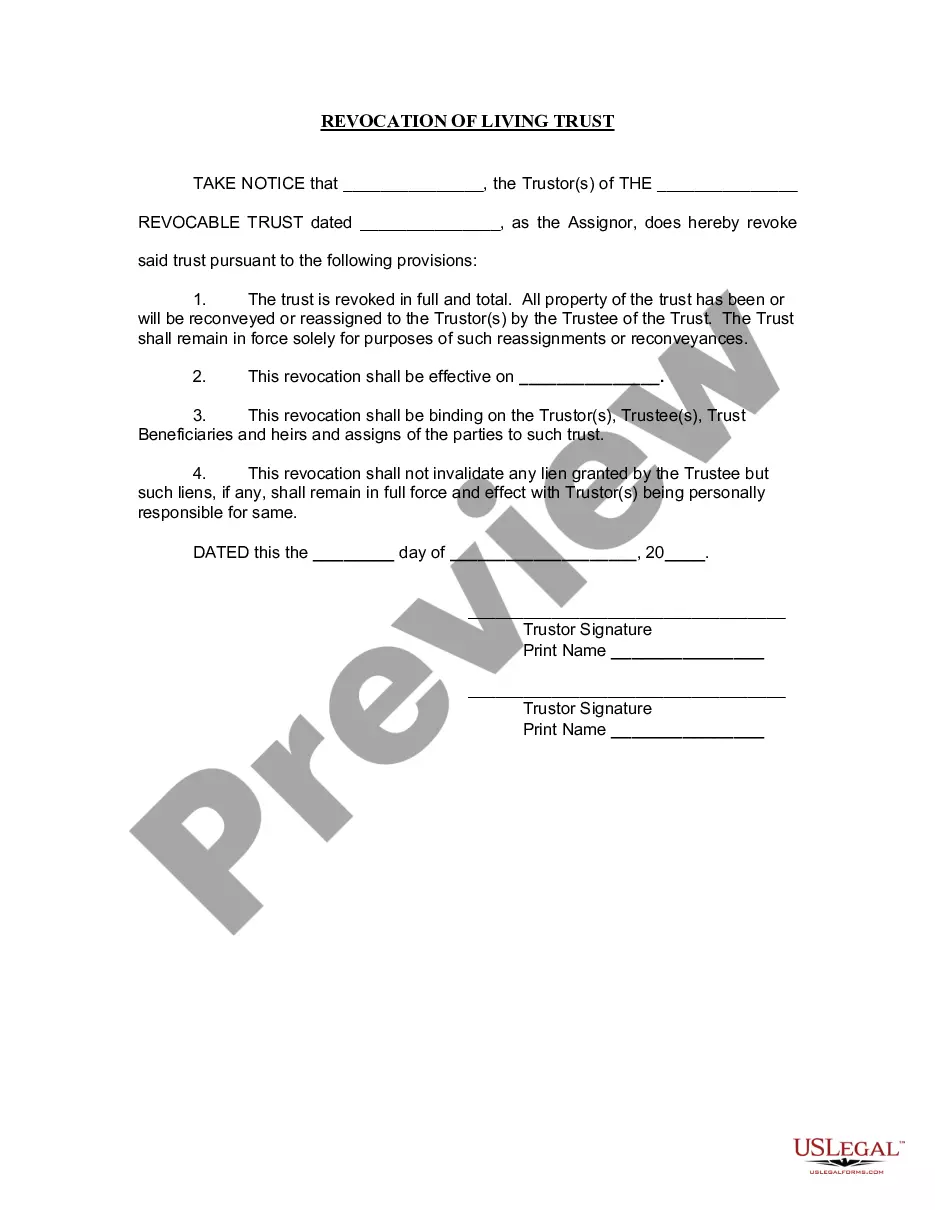

Filling out a trust form requires careful attention to detail. First, gather all necessary information about the assets you wish to include in the trust and your chosen beneficiaries. You can find user-friendly trust forms on platforms like uslegalforms that guide you through each section, ensuring you complete your Centennial Colorado Living Trust Property Record correctly. Taking your time with these forms ensures that your wishes are followed precisely.

A trust does not need to be formally recorded in Colorado to be valid; however, certain assets, like real estate, should have their ownership documented in the Centennial Colorado Living Trust Property Record. Keeping detailed records helps avoid confusion and ensures clarity when managing your assets. Additionally, some people prefer to record their trusts to provide added protection and recognition of their terms.