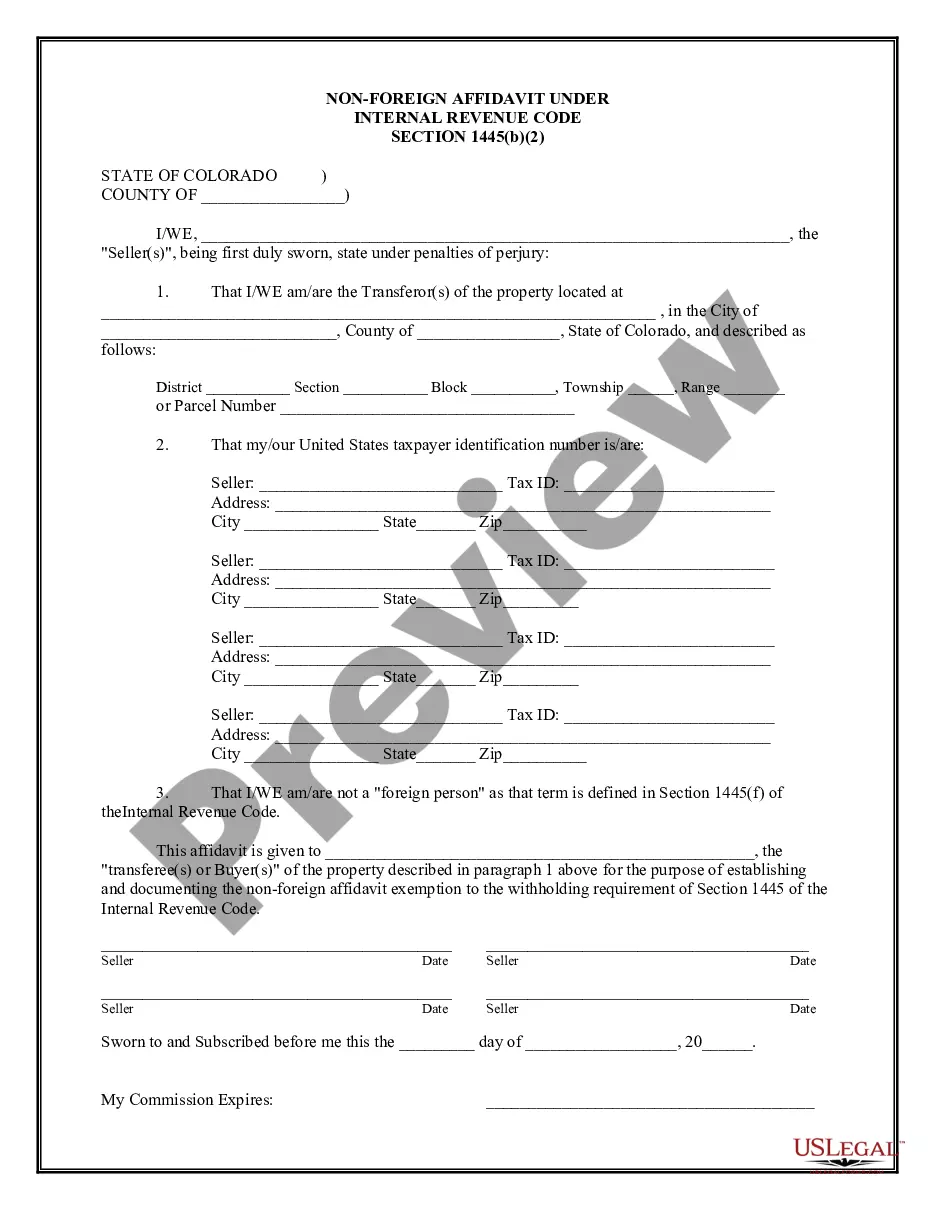

Colorado Springs Colorado Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Colorado Non-Foreign Affidavit Under IRC 1445?

We consistently aim to reduce or evade legal complications when engaging with intricate legal or financial issues.

To achieve this, we enlist legal services that are typically quite costly.

However, not all legal issues are equally intricate; many can be handled independently.

US Legal Forms is a digital library of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Just Log In to your account and click the Get button beside it. Should you misplace the document, you can always re-download it from the My documents section. The process remains equally straightforward if you're a newcomer! You can set up your account within minutes. Ensure that the Colorado Springs Colorado Non-Foreign Affidavit Under IRC 1445 complies with your state and local laws. Additionally, it's crucial to review the form's outline (if available); if you notice any inconsistencies with your initial requirements, look for an alternative template. Once you've confirmed that the Colorado Springs Colorado Non-Foreign Affidavit Under IRC 1445 fits your needs, you can select a subscription plan and make your payment. You can then download the document in any offered format. With over 24 years in the industry, we have assisted millions by providing customizable and current legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- Our repository enables you to manage your affairs without needing a lawyer's services.

- We offer access to legal document templates that are not always readily available.

- Our templates are specific to states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you need to easily and securely find and download the Colorado Springs Colorado Non-Foreign Affidavit Under IRC 1445 or any other form.

Form popularity

FAQ

FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests. A disposition means ?disposition? for any purpose of the Internal Revenue Code. This includes but is not limited to a sale or exchange, liquidation, redemption, gift, transfers, etc.

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

In order to potentially avoid FIRPTA withholding, the foreign seller, the Form 8288-B and a contract for the purchase of the replacement property, must be submitted to the IRS on or before the replacement property's closing following the procedures discussed in Rev. Rroc.

If you're buying property, you should make sure the seller signs a FIRPTA Affidavit to protect yourself. You shouldn't take the seller's word for it ? or you could face serious penalties for not abiding by FIRPTA rules if they apply. A buyer can be penalized for not determining or disclosing a foreign seller.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

A citizen or resident of the United States, ? A domestic partnership, or ? A domestic corporation, or ? An estate or trust (other than a foreign estate of foreign trust as those terms are defined in Section 7701 (a) (31) of the Code.

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an authorized officer of Borrower, stating (a) that Borrower is not a ?foreign corporation,? ?foreign partnership,? ?foreign trust,? or ?foreign estate,? as those terms are defined in the Code and the regulations promulgated

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.