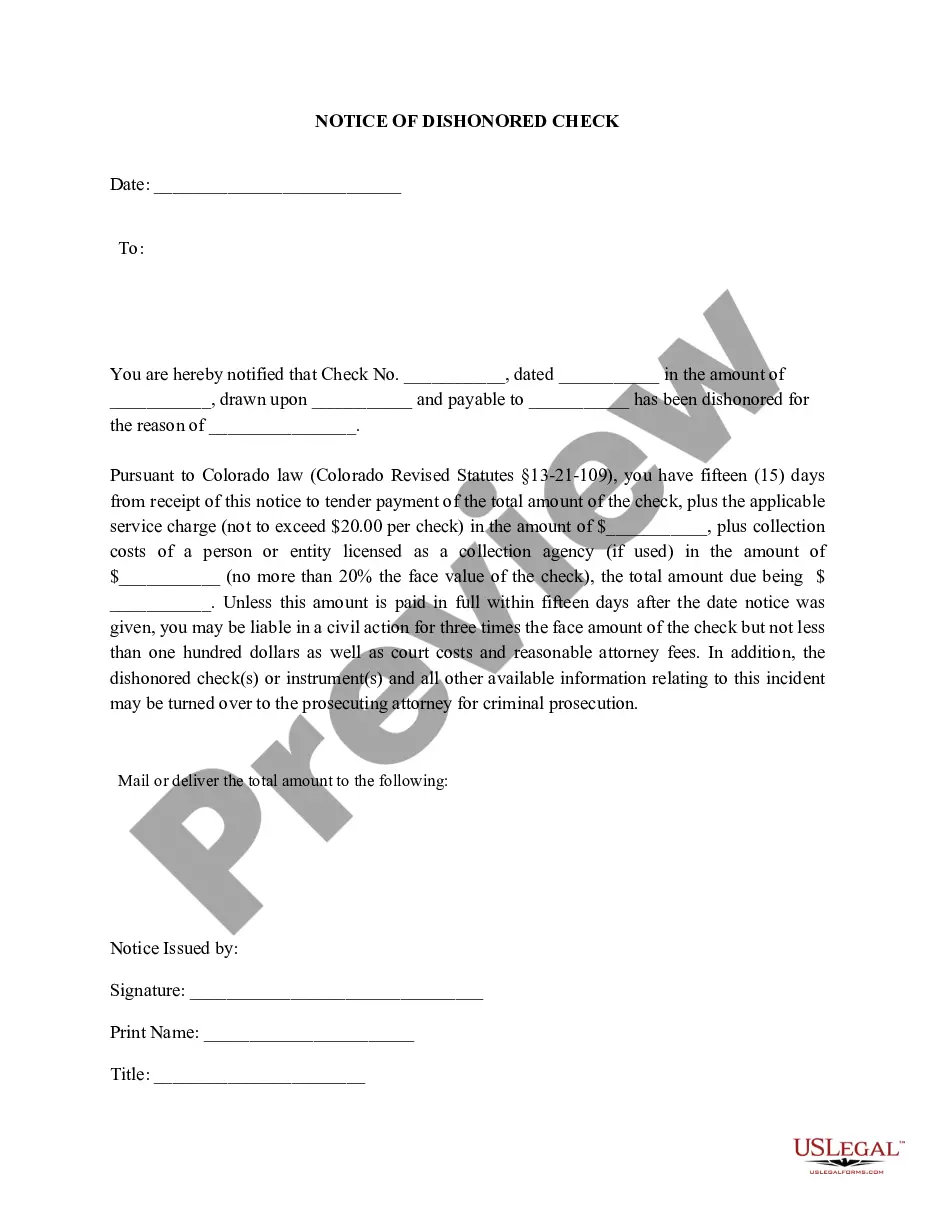

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Thornton Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Colorado Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

If you are looking for a pertinent form, it’s incredibly difficult to discover a more user-friendly service than the US Legal Forms website – likely the most comprehensive libraries on the web.

Here you can locate thousands of form examples for organizational and personal purposes categorized by types and regions, or keywords.

Utilizing our sophisticated search feature, discovering the latest Thornton Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check is as simple as 1-2-3.

Every form you add to your account does not have an expiration date and remains yours indefinitely. You can conveniently access them via the My documents menu, so if you require another copy for editing or printing, feel free to return and download it again at any time.

Utilize the US Legal Forms professional collection to obtain the Thornton Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check you were in search of along with thousands of other professional and state-specific templates in one location!

- Ensure you have located the sample you need.

- Review its description and utilize the Preview option to examine its content. If it doesn’t meet your requirements, employ the Search field at the top of the page to find the appropriate file.

- Confirm your selection. Click the Buy now button. Then, choose your desired subscription plan and provide the necessary details to register for an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

- Obtain the form. Select the file format and download it to your device.

- Make alterations. Fill in, modify, print, and sign the acquired Thornton Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check.

Form popularity

FAQ

The terms bounced check and returned check are often used interchangeably; however, there can be slight nuances. A bounced check specifically refers to the action of the check being rejected due to insufficient funds, while a returned check can also denote checks that are rejected for other reasons, such as wrong signatures. Understanding these distinctions can assist you in navigating banking and legal processes, especially when dealing with a Thornton Colorado Notice of Dishonored Check.

Yes, writing a check that bounces can lead to legal trouble for the issuer. Depending on local laws, it may be considered fraud, especially if there is intent to deceive. It’s important to be aware of the implications, as this could lead to a criminal record or financial liability. If you find yourself in this situation, consider seeking guidance through the Thornton Colorado Notice of Dishonored Check.

Yes, a bounced cheque and a dishonoured cheque are essentially the same. Both terms describe a situation where a check is not accepted by the bank for payment due to insufficient funds or other reasons. Recognizing the equivalence of these terms can assist you in addressing issues related to bounced checks effectively, potentially guiding you to file a Thornton Colorado Notice of Dishonored Check when necessary.

The term 'bounced check' originates from the imagery of a basketball bouncing back after a failed shot. Similarly, when a check cannot be processed, it is 'bounced' back to the issuer by the bank. This terminology makes the process easy to visualize and comprehend, especially when you must take steps like filing a Thornton Colorado Notice of Dishonored Check. Being aware of these terms can help you communicate effectively about financial matters.

Another common name for a dishonored check is a returned check. It reflects the check's status when the bank cannot process it due to the issuer's insufficient funds. Understanding this term is helpful when dealing with issues related to bounced checks, especially in situations requiring the Thornton Colorado Notice of Dishonored Check. Clarifying these terms ensures all parties understand the legal and financial implications.

A person who writes a bad check may face several consequences, including financial penalties and potentially criminal charges. The severity of the situation often depends on the amount involved and whether it is deemed intentional. In many cases, the recipient of the bounced check can pursue action through a Thornton Colorado Notice of Dishonored Check. It’s crucial to understand your responsibilities to avoid legal issues.

If a company writes you a bad check, start by contacting them to resolve the issue amicably. Inform them about the returned check, and allow them a chance to rectify the situation. Should the company fail to make good on the bad check, you may need to consider filing a claim via the Thornton Colorado Notice of Dishonored Check. Utilizing a legal service platform like Uslegalforms can facilitate the necessary steps to recover your funds.

A dishonored check is often referred to as a bounced check because it 'bounces' back to the issuer due to insufficient funds in the account. When a bank cannot process the check, it returns it to the payee, indicating the check cannot be honored. This term vividly describes the action of the check being rejected and the financial inconvenience it causes. Understanding the terminology can help you better navigate issues related to the Thornton Colorado Notice of Dishonored Check.

A bank can dishonor a check for several reasons. This includes scenarios such as insufficient funds in the payer's account, the check being stale-dated, or a stop payment order in place. Knowing when a bank may refuse to honor a check helps you stay informed and cautious when issuing payments. To learn more about handling these situations, the Thornton Colorado Notice of Dishonored Check - Civil is a useful resource.

A dishonored bank check refers to a check that the bank will not process. This can occur for various reasons, including a lack of funds or an invalid account. It essentially means that the financial transaction cannot be completed as intended. If you have received such a check, consider seeking assistance from US Legal Forms to understand your rights and responsibilities.