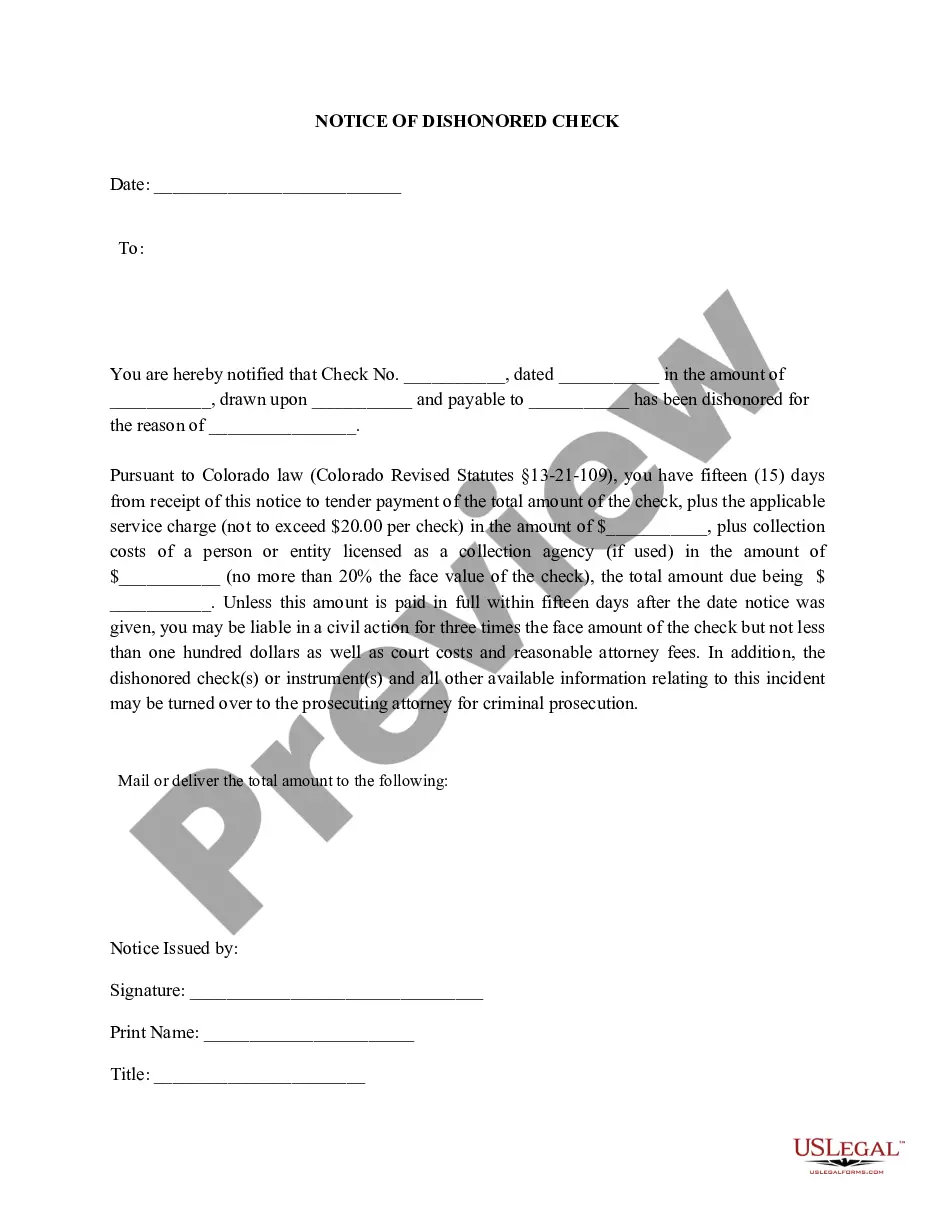

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Colorado Springs Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Colorado Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Are you in search of a reliable and affordable provider of legal forms to purchase the Colorado Springs Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check? US Legal Forms is your ideal choice.

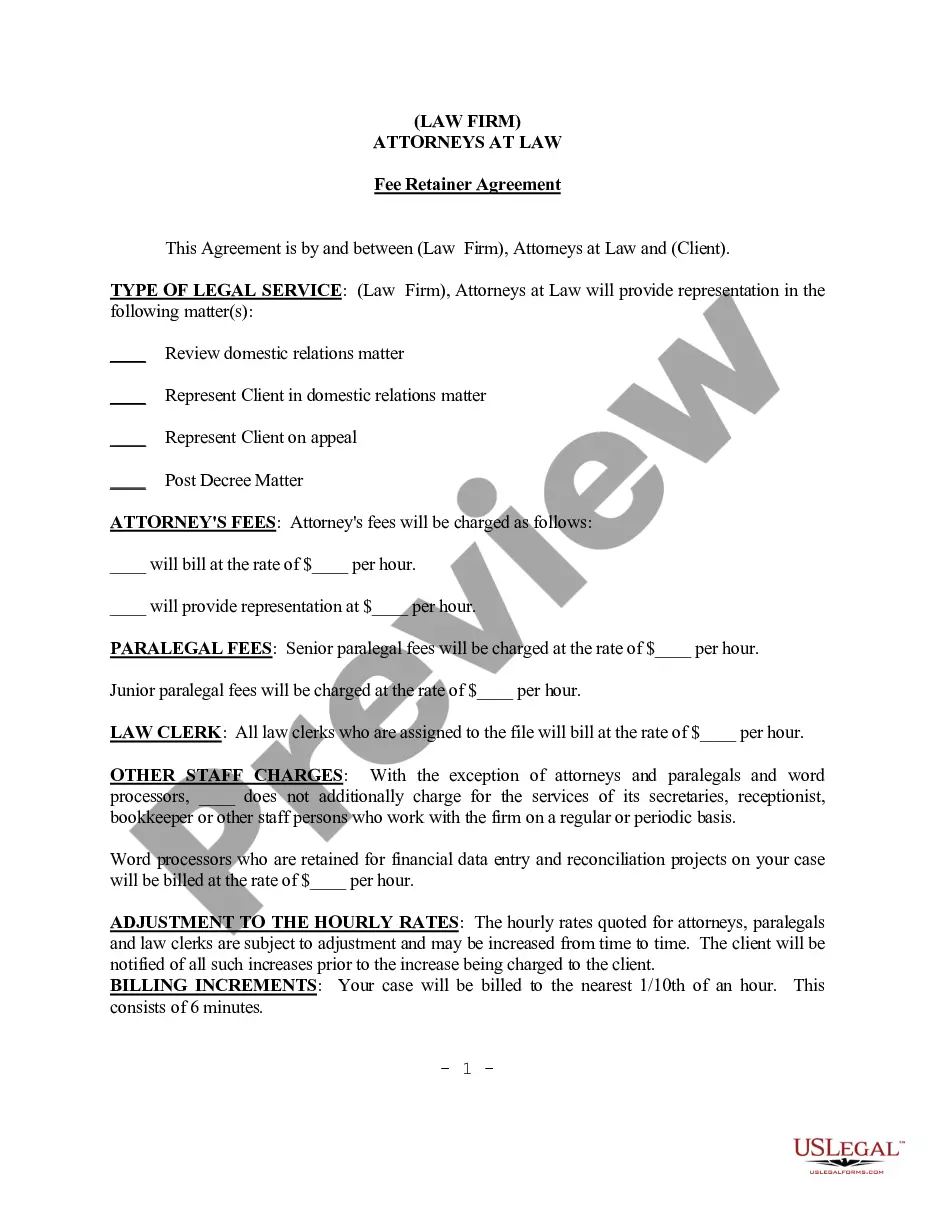

Whether you require a fundamental agreement to establish guidelines for living together with your partner or a collection of forms to facilitate your separation or divorce through the court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business needs. All templates that we provide access to are tailored and structured according to the regulations of specific states and regions.

To obtain the document, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates anytime from the My documents section.

Is this your first visit to our site? No problem. You can establish an account in just a few minutes, but first, ensure you do the following.

Now you can create your account. Then select the subscription plan and proceed to the payment process. Once the payment is completed, download the Colorado Springs Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in any available format. You can revisit the website when necessary and redownload the document without any additional fees.

Obtaining up-to-date legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time trying to understand legal documents online.

- Verify if the Colorado Springs Colorado Notice of Dishonored Check - Civil - Keywords: bad check, bounced check adheres to the laws of your state and locality.

- Review the form’s details (if available) to determine who and what the document is suitable for.

- Restart your search if the template does not meet your specific needs.

Form popularity

FAQ

If your check bounces, you may be charged a returned check fee. This fee will be charged by the recipient of the check as a penalty for trying to distribute money that you don't have.

Bouncing a check can result in overdraft, NSF and merchant fees ? and even criminal charges.

Generally, a bank may attempt to deposit the check two or three times when there are insufficient funds in your account. However, there are no laws that determine how many times a check may be resubmitted, and there is no guarantee that the check will be resubmitted at all.

When you write a bad one, the bank will bounce it because there are insufficient funds in your account. Bad checks are often written inadvertently by people who are simply unaware that their bank balances were too low.

If a cheque is bounced citing insufficient funds in bank account, it is a criminal offence and the payee - the person or the bank - can file a complaint under Section 138 of the Negotiable Instruments Act.

For example, a check might be drawn on a non-existent bank account, or the account on which the check is drawn does not contain sufficient funds, or the check was not signed, or the check was not endorsed.

The reports also show whether your negative balances have been paid. The Fair Credit Reporting Act allows checking-account reporting agencies like ChexSystems to report certain negative information for up to seven years.

A bad check refers to a check that cannot be negotiated because it is drawn on a nonexistent account or one that has insufficient funds. Writing a bad check, also known as a hot check, is illegal.

If you wrote a check that bounced, your bank may charge you a nonsufficient funds fee or overdraft fee. In addition, the company you were trying to pay may charge you a late fee if the bounced check means your payment is now overdue. Failure to pay outstanding fees can result in your account being sent to collections.

(v) a felony of the third degree if the check or order is $75,000 or more.