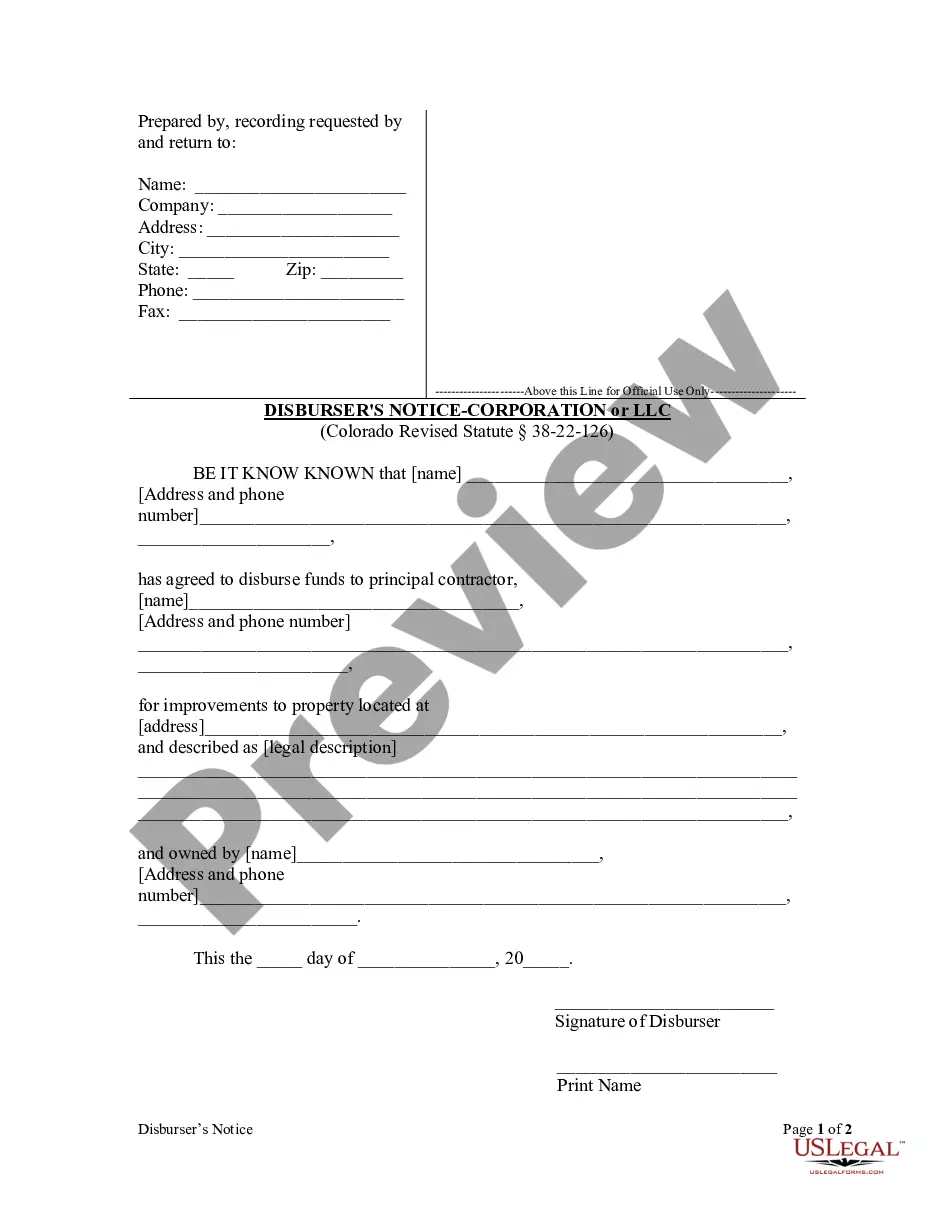

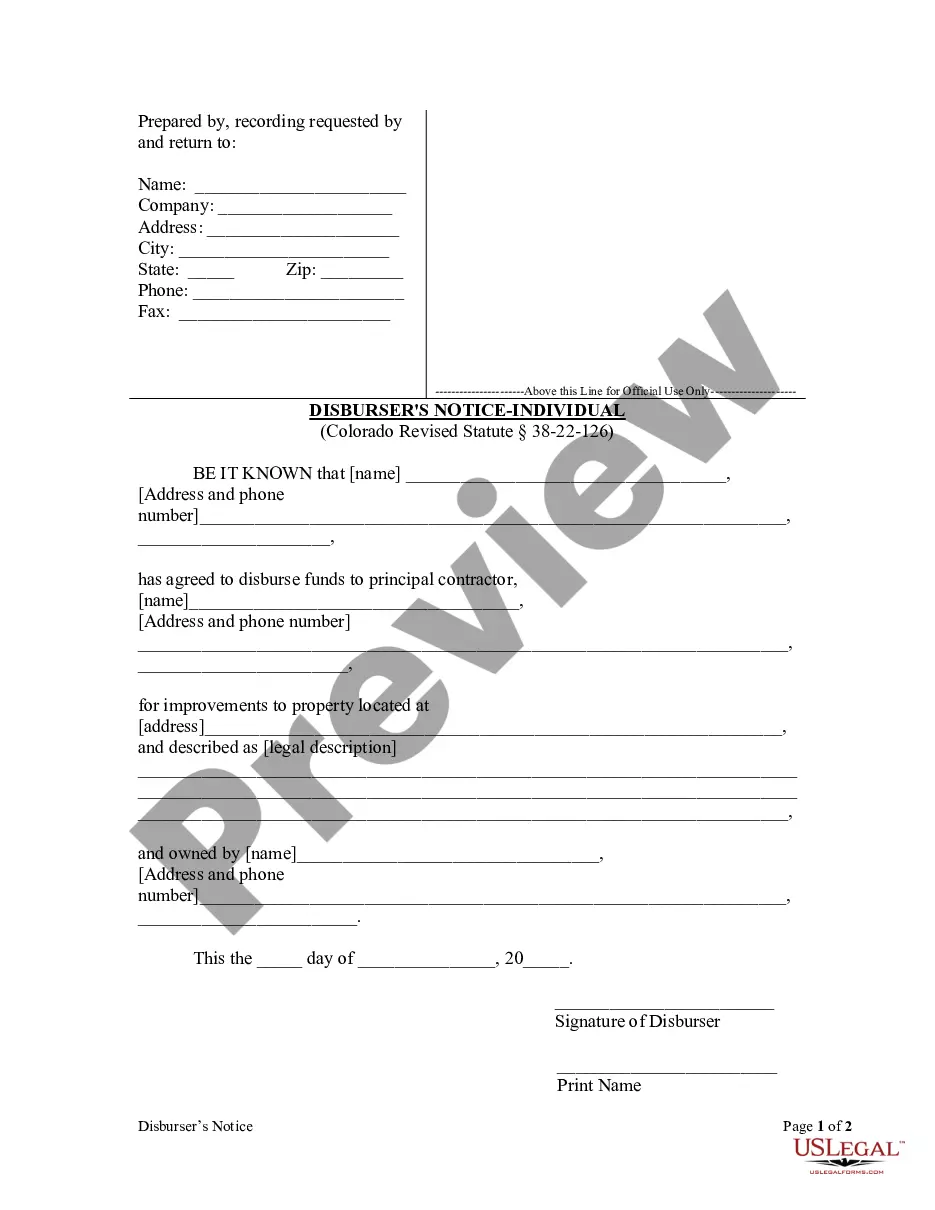

Colorado Revised Statute section 38-22-126 requires lenders who have agreed to make any loan to a contractor to file notice of the disbursement prior to the first disbursement.

Westminster Colorado Disburser's Notice - Corporation

Description

How to fill out Colorado Disburser's Notice - Corporation?

Regardless of social or professional rank, finalizing legal-related documents is an unfortunate requirement in today’s society.

Frequently, it is nearly impossible for an individual lacking legal knowledge to draft such documents from the beginning, primarily due to the complex terminology and legal subtleties involved.

This is where US Legal Forms steps in to help.

Verify that the template you have located is appropriate for your region because the regulations of one state or area do not apply to another.

Preview the document and read a brief description (if available) of the circumstances the document can be utilized for.

- Our platform features an extensive library with over 85,000 ready-to-use state-specific documents applicable for virtually any legal situation.

- US Legal Forms additionally acts as a valuable resource for associates or legal advisors aiming to conserve time by utilizing our DIY documents.

- Whether you are in need of the Westminster Colorado Disburser's Notice - Corporation or LLC or any other document that will be valid in your jurisdiction, everything is readily accessible with US Legal Forms.

- Here’s how to quickly obtain the Westminster Colorado Disburser's Notice - Corporation or LLC using our reliable platform.

- If you are currently a subscriber, you can proceed to Log In to your account to download the correct form.

- However, if you are new to our platform, ensure to follow these steps before acquiring the Westminster Colorado Disburser's Notice - Corporation or LLC.

Form popularity

FAQ

Does your residential project require a building permit? Yes.

File Your Annual (Periodic) Report The State of Colorado requires you to file a periodic report annually for your SMLLC. You must file the report online at the SOS website. The report is due during the three-month period beginning with the first day of the anniversary month of your SMLLC's formation.

S corporations and partnerships can make a Colorado extension payment using Form 0158-N. Extension payments can also be made electronically via the ?Revenue Online? system. Colorado Tax Extension Tip: If your Colorado tax liability is zero, you do not need to file anything to get a state extension.

A permit is required when you construct, enlarge, alter, repair, move, demolish or change the occupancy of a building or structure, or to erect, install, enlarge, repair, remove, convert or replace any electrical, gas, mechanical or plumbing system or when you construct, place or modify a sign.

Any corporation, partnership, joint venture, common trust fund, limited association, pool or working agreement, limited liability company or any other combination of persons or interests, that is required to file a federal income tax return, must file a Colorado Income Tax Return.

The Colorado Account Number is listed on the Sales Tax License as the first eight (8) digits of the Use Account Number. The CAN is located on the upper left portion of the sales tax license.

Do I Need a Permit? All sheds require a zoning permit. Sheds that are over 8 feet tall or larger than 200 square feet also require building permits.

An S corporation must file Form 106 for any year it is doing business in Colorado. Doing business in a state is defined as having income arising from the activity of one or more employees located in the state; or arising from the fact that real or personal property is located in the state for business purposes.

All Colorado S corporations are required to file a tax return at the federal level. More specifically, as an S-Corp in the state of Colorado, you need to file Form 1120S. Your Colorado tax return will refer to your federal tax return, so it is important that you complete all federal paperwork first.

Any partnership, joint venture, common trust fund, limited asso- ciation, pool or working agreement, limited liability company or any other combination of persons or interests which is required to file a federal partnership return of income must file a Colorado Form 106 if any of the partnership income is from Colorado