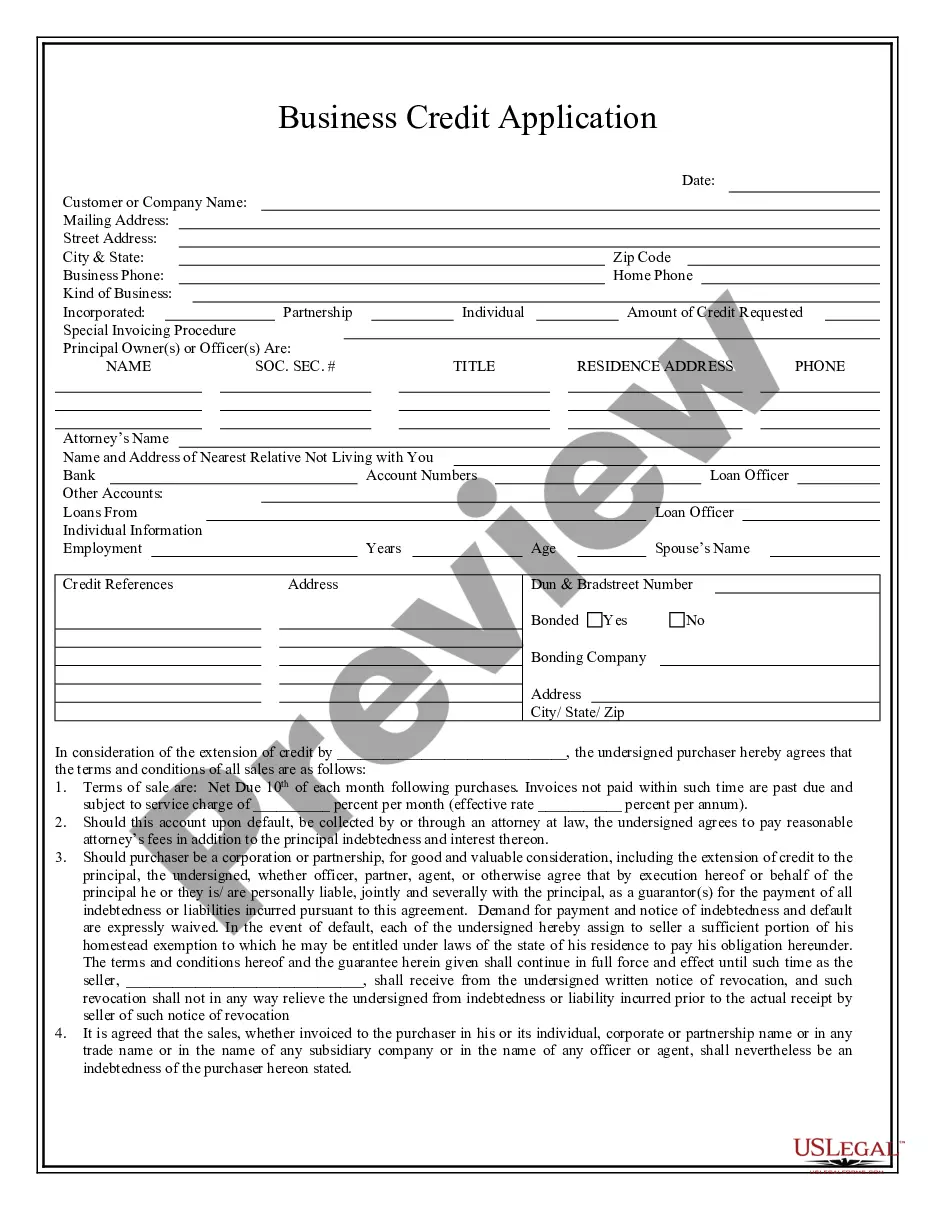

Westminster Colorado Business Credit Application

Description

How to fill out Colorado Business Credit Application?

Do you require a dependable and economical provider of legal forms to acquire the Westminster Colorado Business Credit Application? US Legal Forms is your preferred choice.

Whether you need a simple agreement to establish guidelines for cohabitation with your partner or a collection of documents to facilitate your separation or divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business use.

All templates that we provide are not generic and are crafted in accordance with the requirements of individual states and counties.

To obtain the document, you need to Log In to your account, find the necessary template, and click the Download button beside it. Please remember that you can retrieve your previously purchased form templates at any time in the My documents section.

Now you can set up your account. After that, choose the subscription plan and proceed with payment. Once the payment is finalized, download the Westminster Colorado Business Credit Application in any available format. You can revisit the website at any point to re-download the document free of charge.

Locating current legal documents has never been simpler. Give US Legal Forms a try today, and stop wasting your precious time trying to understand legal paperwork online once and for all.

- Are you unfamiliar with our platform? No problem.

- You can create an account in just a few minutes, but first, ensure you do the following.

- Determine if the Westminster Colorado Business Credit Application complies with the regulations of your state and local jurisdiction.

- Review the form’s description (if available) to understand who and what the document is for.

- Restart the search if the template does not meet your particular needs.

Form popularity

FAQ

In Colorado, a small business typically has fewer than 100 employees and generates less than $5 million in annual revenue. These businesses often play a crucial role in the local economy. If you're looking to secure funding, understanding this definition can help you with the Westminster Colorado Business Credit Application. US Legal Forms offers streamlined resources to support small business owners throughout Colorado in navigating the application process effectively.

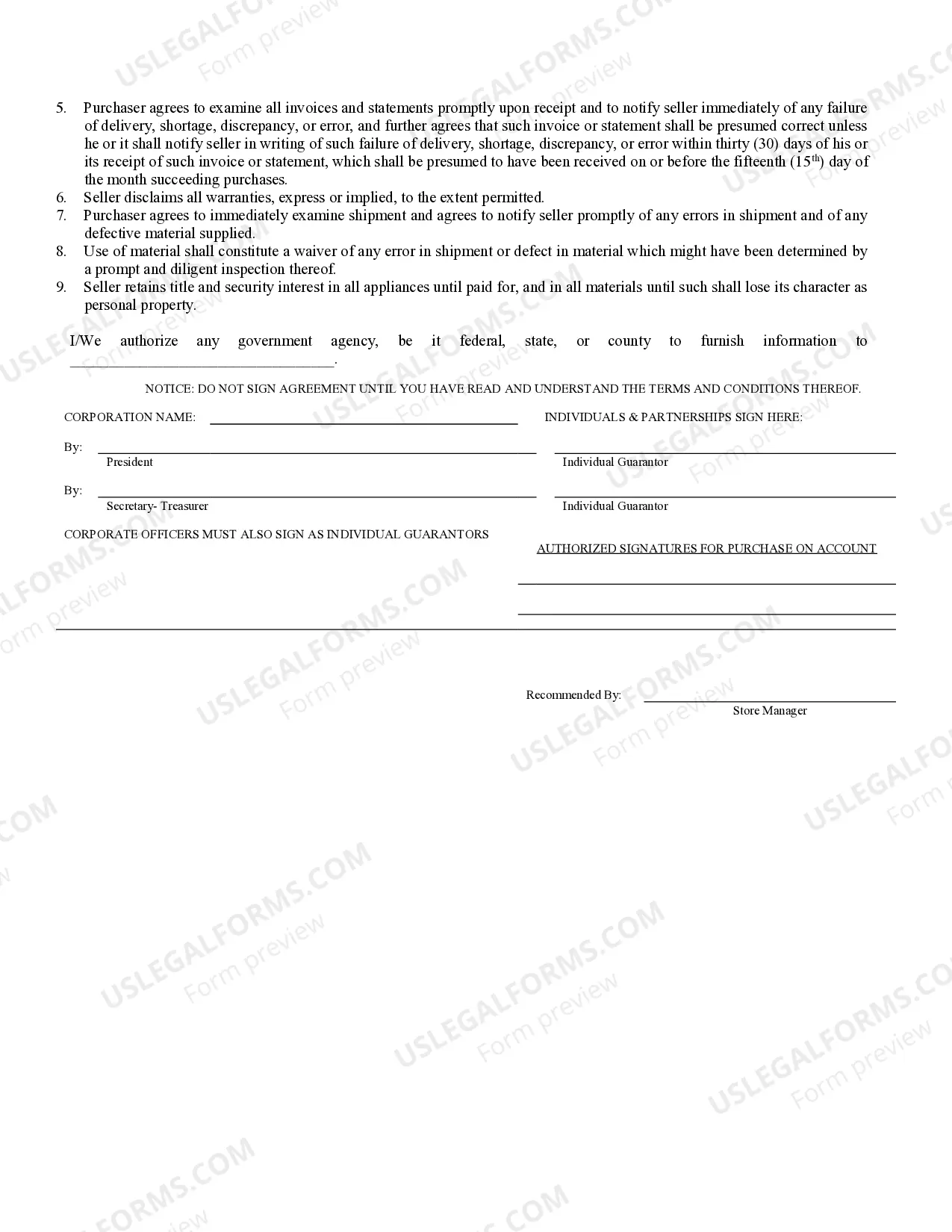

To fill out a business credit card application, start by providing detailed information about your business, including its name, address, and type of structure. You will also need to include your annual revenue and time in business. When filling out the Westminster Colorado Business Credit Application, ensure all information is accurate and up-to-date to enhance your chances of approval. Don’t forget to check if you meet the eligibility requirements set by the lender.

The purpose of a business credit score is to evaluate the creditworthiness of your business. This score influences lenders' decisions and determines the terms of loans you may receive. A solid credit score can open doors to better financing options. Thus, maintaining a strong score through timely payments and responsible credit use is essential for your business growth.

A credit application for a business is a formal request for credit or financing. It typically asks for information about your business operations, financial health, and credit history. By completing a Westminster Colorado Business Credit Application, lenders assess your ability to repay loans. This information helps them make informed decisions about granting credit.

Oregon does not have a state business license, but many cities and counties require local business licenses. Be sure to check the regulations in your specific area to ensure compliance. Staying informed will help you avoid potential fines. If you intend to grow your business in Oregon, utilizing a Westminster Colorado Business Credit Application can provide necessary funding to get started.

The best license for your small business largely depends on your industry and location. Common options include general business licenses, professional licenses, and specific trade licenses. Research the licenses required in your state and city. By having a solid understanding of these requirements, you can streamline your business setup and apply for a Westminster Colorado Business Credit Application if you need financial support.

In Iowa, whether you need a business license depends on the type of business you plan to operate. Some local municipalities in Iowa may require licenses or permits for specific businesses. Always check with your local government for the most accurate information. If you are considering expanding your operations, completing a Westminster Colorado Business Credit Application can help facilitate that growth.

Yes, you can run a small business from home. Many entrepreneurs start their ventures in a home office to save on costs. However, ensure you understand local zoning laws and obtain any necessary permits. If you're seeking financing, consider completing a Westminster Colorado Business Credit Application to secure the funds you need for your home-based business.